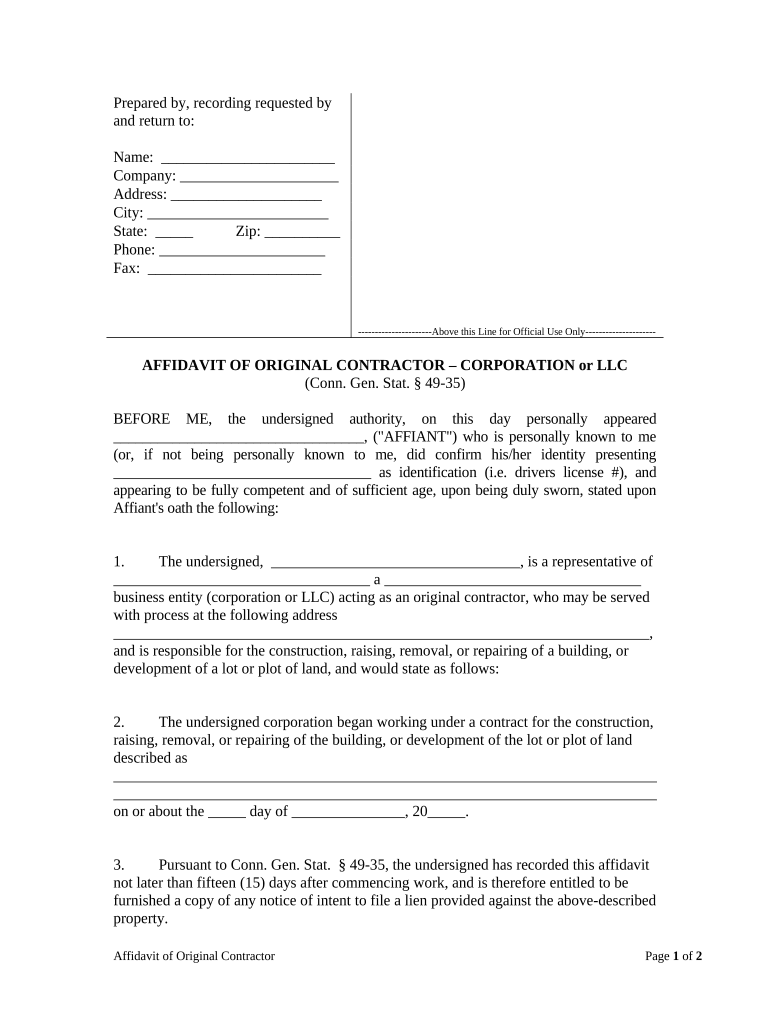

Ct Corporation Llc Form

What is the Connecticut Limited Company?

A Connecticut limited company, commonly known as a limited liability company (LLC), is a business structure that combines the benefits of both a corporation and a partnership. This entity type provides its owners, called members, with limited liability protection, meaning their personal assets are generally protected from business debts and liabilities. In Connecticut, forming an LLC offers flexibility in management and taxation, making it an attractive option for many entrepreneurs.

Steps to Complete the Connecticut Limited Company Formation

To form a Connecticut limited company, follow these essential steps:

- Choose a Name: Select a unique name for your LLC that complies with state regulations. The name must include "Limited Liability Company" or abbreviations like "LLC" or "L.L.C."

- Designate a Registered Agent: Appoint a registered agent who will be responsible for receiving legal documents on behalf of the LLC.

- File the Certificate of Organization: Submit the Certificate of Organization with the Connecticut Secretary of State, either online or by mail. This document includes essential information about your LLC.

- Create an Operating Agreement: Although not required by law, it is advisable to draft an operating agreement outlining the management structure and operating procedures of the LLC.

- Obtain an EIN: Apply for an Employer Identification Number (EIN) from the IRS, which is necessary for tax purposes and hiring employees.

Legal Use of the Connecticut Limited Company

The Connecticut limited company is legally recognized as a separate entity from its members, which means it can enter contracts, own property, and be held liable for its debts. To maintain this legal status, it is crucial to adhere to state laws and regulations, including filing annual reports and paying necessary fees. Additionally, members should avoid commingling personal and business finances to uphold the liability protection that an LLC provides.

Required Documents for Forming a Connecticut Limited Company

When forming a Connecticut limited company, several key documents are required:

- Certificate of Organization: This official document must be filed with the Secretary of State to legally establish the LLC.

- Operating Agreement: While not mandatory, this document outlines the internal rules and management structure of the LLC.

- Employer Identification Number (EIN): Required for tax purposes and employee hiring, this number can be obtained from the IRS.

State-Specific Rules for the Connecticut Limited Company

Connecticut has specific regulations governing limited companies that differ from other states. For instance, LLCs in Connecticut must file an annual report with the Secretary of State, which includes updated information about the business. Additionally, the state imposes a minimum tax on LLCs, which varies based on the company's revenue. Understanding these state-specific rules is essential for compliance and maintaining the LLC's good standing.

Form Submission Methods for Connecticut Limited Company

To submit the Certificate of Organization for your Connecticut limited company, you have multiple options:

- Online Submission: The fastest method is to file online through the Connecticut Secretary of State's website.

- Mail Submission: You can also print the form and send it via postal mail to the Secretary of State's office.

- In-Person Submission: If preferred, you may deliver the completed form in person at the Secretary of State's office.

Quick guide on how to complete ct corporation llc 497301008

Complete Ct Corporation Llc effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, enabling you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without interruptions. Handle Ct Corporation Llc on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign Ct Corporation Llc with ease

- Find Ct Corporation Llc and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and then click the Done button to save your modifications.

- Select your preferred method for submitting your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about missing or lost documents, tedious form navigation, or mistakes that necessitate printing new document versions. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Alter and eSign Ct Corporation Llc and ensure clear communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Connecticut limited company?

A Connecticut limited company, also known as a limited liability company (LLC), is a flexible business structure that combines the benefits of a corporation and a partnership. LLCs in Connecticut provide owners with limited liability protection while allowing for pass-through taxation. This structure is ideal for small businesses looking to minimize personal risk.

-

How do I form a Connecticut limited company?

To form a Connecticut limited company, you need to file a Certificate of Organization with the Connecticut Secretary of State. The process includes choosing a unique name for your company and paying the requisite filing fee. Once your Certificate is approved, you can begin operating your LLC in Connecticut.

-

What are the costs associated with establishing a Connecticut limited company?

Establishing a Connecticut limited company involves several costs, including the filing fee for the Certificate of Organization and ongoing annual report fees. While the initial filing fee is relatively low, it’s essential to budget for any legal assistance if needed, as well as accounting services to maintain compliance with state regulations.

-

What are the benefits of using airSlate SignNow for my Connecticut limited company?

airSlate SignNow offers several benefits for Connecticut limited companies, including the ability to easily send and eSign documents electronically. This streamlined process saves time and enhances efficiency, allowing businesses to focus on their operations. Additionally, SignNow provides robust security features to protect your sensitive information.

-

Can airSlate SignNow integrate with other software commonly used by Connecticut limited companies?

Yes, airSlate SignNow offers seamless integrations with various software tools that Connecticut limited companies commonly use, such as CRM systems and project management applications. These integrations enhance productivity by allowing you to manage documents directly within your preferred applications. It's easy to connect your workflows for a more efficient business operation.

-

Is airSlate SignNow suitable for startups and small businesses operating as a Connecticut limited company?

Absolutely! airSlate SignNow is a cost-effective solution designed for startups and small businesses, including those organized as Connecticut limited companies. With user-friendly features and competitive pricing, it's an ideal choice for businesses looking to streamline their document management and eSigning process.

-

What features does airSlate SignNow provide that are beneficial for a Connecticut limited company?

airSlate SignNow offers a variety of features beneficial for Connecticut limited companies, including customizable templates, automated reminders, and advanced security settings. These tools simplify the eSigning process, ensuring documents are executed efficiently and securely. You can also track the status of your documents in real-time.

Get more for Ct Corporation Llc

- Form mo pts 2022 property tax credit schedule

- Missouri form mo scc shared care tax credit taxformfinder

- Missouri form mo nri missouri nonresident income percentage 2021

- Form 1040 es otc easy to fill and downloadcocodoc

- 4569 crime inquiry and inspection reportauthorization to tow form

- Form 89 350 1 000 rev mississippi employees

- Montana request for informal review property tax

- Names of corporate officers rev 1605 formspublications

Find out other Ct Corporation Llc

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document