Schedule G Form 990 or 990 EZ Supplemental Information Regarding Fundraising or Gaming Activities

What is the Schedule G Form 990 or 990 EZ Supplemental Information Regarding Fundraising or Gaming Activities

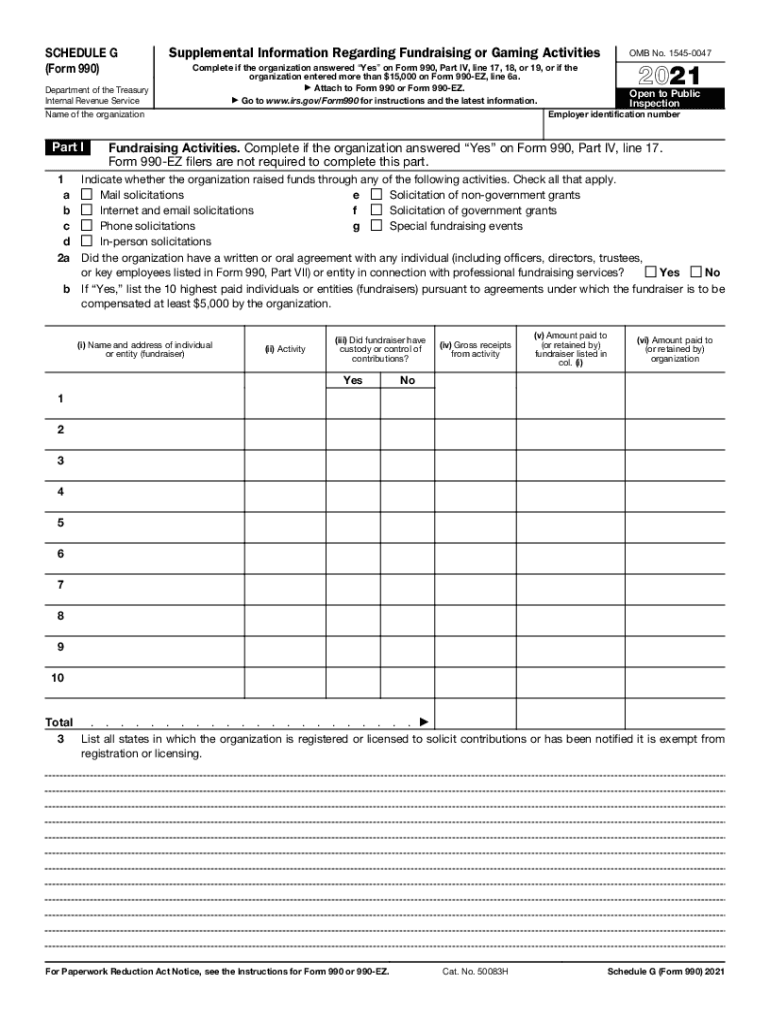

The Schedule G Form 990 or 990 EZ is a crucial document for organizations that engage in fundraising or gaming activities. This form provides supplemental information about the fundraising efforts of a nonprofit organization, allowing the IRS to assess how funds are raised and utilized. It includes details about various fundraising methods, such as events, donations, and gaming activities, ensuring transparency in financial reporting. Organizations must accurately complete this form to maintain compliance with IRS regulations and to inform stakeholders about their fundraising practices.

How to Use the Schedule G Form 990 or 990 EZ Supplemental Information Regarding Fundraising or Gaming Activities

Using the Schedule G Form involves several steps. First, organizations must determine if they meet the criteria for filing this form based on their fundraising activities. Once confirmed, they should gather relevant financial data related to their fundraising efforts. This includes information about events held, income generated, and expenses incurred. After compiling the necessary data, organizations can complete the form by following the provided instructions, ensuring all sections are filled out accurately. Finally, the completed form should be submitted along with the main Form 990 or 990 EZ during the filing process.

Steps to Complete the Schedule G Form 990 or 990 EZ Supplemental Information Regarding Fundraising or Gaming Activities

Completing the Schedule G Form requires a systematic approach. Follow these steps:

- Review the eligibility criteria to determine if your organization needs to file Schedule G.

- Collect financial records related to fundraising activities, including income and expenses.

- Fill out the form sections, providing detailed information about each fundraising method used.

- Ensure compliance with IRS guidelines by cross-referencing your entries with the instructions provided.

- Review the completed form for accuracy and completeness before submission.

Legal Use of the Schedule G Form 990 or 990 EZ Supplemental Information Regarding Fundraising or Gaming Activities

The Schedule G Form is legally binding and must be completed in accordance with IRS regulations. Organizations must provide truthful and accurate information to avoid penalties and maintain their tax-exempt status. The form serves as a record of compliance with federal laws governing nonprofit fundraising activities. Organizations should keep copies of their submitted forms for their records and be prepared to provide additional documentation if requested by the IRS.

Key Elements of the Schedule G Form 990 or 990 EZ Supplemental Information Regarding Fundraising or Gaming Activities

Several key elements are essential when completing the Schedule G Form. These include:

- Fundraising Methods: Detailed descriptions of the different methods used to raise funds, such as events, direct mail, and online campaigns.

- Income Reporting: Accurate reporting of total income generated from fundraising activities.

- Expense Breakdown: A clear outline of expenses associated with fundraising, including costs for events and marketing.

- Gaming Activities: Specific information regarding any gaming activities, including bingo, raffles, or lotteries, if applicable.

Filing Deadlines / Important Dates

Organizations must be aware of the filing deadlines for the Schedule G Form. Typically, the form is due on the fifteenth day of the fifth month after the end of the organization's fiscal year. For organizations operating on a calendar year, this means the form is due by May fifteenth. If additional time is needed, organizations can file for an extension, which allows for an additional six months to submit the form. It is crucial to meet these deadlines to avoid potential penalties and maintain compliance with IRS regulations.

Quick guide on how to complete 2021 schedule g form 990 or 990 ez supplemental information regarding fundraising or gaming activities

Effortlessly Prepare Schedule G Form 990 Or 990 EZ Supplemental Information Regarding Fundraising Or Gaming Activities on Any Device

Digital document management has become increasingly popular among organizations and individuals. It serves as an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents quickly without any delays. Manage Schedule G Form 990 Or 990 EZ Supplemental Information Regarding Fundraising Or Gaming Activities on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and eSign Schedule G Form 990 Or 990 EZ Supplemental Information Regarding Fundraising Or Gaming Activities with Ease

- Find Schedule G Form 990 Or 990 EZ Supplemental Information Regarding Fundraising Or Gaming Activities and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes just a few seconds and holds the same legal value as a traditional handwritten signature.

- Review all information and click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Schedule G Form 990 Or 990 EZ Supplemental Information Regarding Fundraising Or Gaming Activities and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2021 schedule g form 990 or 990 ez supplemental information regarding fundraising or gaming activities

How to generate an e-signature for your PDF file in the online mode

How to generate an e-signature for your PDF file in Chrome

How to make an e-signature for putting it on PDFs in Gmail

The way to make an electronic signature right from your smartphone

The best way to create an electronic signature for a PDF file on iOS devices

The way to make an electronic signature for a PDF on Android

People also ask

-

What is the Form 990 EZ Schedule G and how does it work?

The Form 990 EZ Schedule G is a required component for certain tax-exempt organizations reporting their fundraising activities. Using airSlate SignNow, you can easily complete and submit your Form 990 EZ Schedule G electronically. Our solution simplifies the process by allowing you to fill out, sign, and manage your documents efficiently and securely.

-

How can I prepare my Form 990 EZ Schedule G using airSlate SignNow?

Preparing your Form 990 EZ Schedule G with airSlate SignNow is straightforward. You can start by accessing our platform, selecting the form template, and entering the necessary information. Our user-friendly interface ensures that your completion of the Form 990 EZ Schedule G is hassle-free and compliant with IRS regulations.

-

What features does airSlate SignNow offer for handling Form 990 EZ Schedule G?

airSlate SignNow offers features tailored for the efficient management of your Form 990 EZ Schedule G, including e-signature capabilities, document tracking, and secure cloud storage. These features ensure that your documents are efficiently processed while maintaining compliance with tax regulations. You’ll have peace of mind knowing that your Form 990 EZ Schedule G is handled securely.

-

Is airSlate SignNow a cost-effective solution for managing Form 990 EZ Schedule G?

Yes, airSlate SignNow offers a cost-effective solution for managing your Form 990 EZ Schedule G. Our pricing plans are designed to fit various budgets, making it accessible for small and large organizations alike. With airSlate SignNow, you gain access to tools that streamline your workflow without overspending on document management.

-

Can I integrate airSlate SignNow with other software to assist with Form 990 EZ Schedule G?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your ability to manage your Form 990 EZ Schedule G. Whether it’s accounting software or CRM systems, our integrations can help you automate data flow and ensure all information is consistently updated, improving your operational efficiency.

-

What are the benefits of using airSlate SignNow for Form 990 EZ Schedule G?

Using airSlate SignNow for your Form 990 EZ Schedule G offers signNow benefits, including increased efficiency, reduced turnaround times, and enhanced document security. By digitizing your document workflow, you eliminate paperwork bottlenecks, allowing for quicker processing and filing. Additionally, our platform is designed to provide a compliant and user-friendly experience.

-

Is training required to use airSlate SignNow for Form 990 EZ Schedule G?

No, training is not required to use airSlate SignNow for your Form 990 EZ Schedule G. Our platform is designed with user experience in mind, making it intuitive and easy to navigate. However, we do provide helpful resources and customer support should you have any questions or need assistance while filling out the form.

Get more for Schedule G Form 990 Or 990 EZ Supplemental Information Regarding Fundraising Or Gaming Activities

Find out other Schedule G Form 990 Or 990 EZ Supplemental Information Regarding Fundraising Or Gaming Activities

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple

- eSign Idaho Healthcare / Medical Arbitration Agreement Later

- How To eSign Colorado High Tech Forbearance Agreement

- eSign Illinois Healthcare / Medical Resignation Letter Mobile

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free