Www Taxformfinder Orgfederalform 8879 PeFederal Form 8879 PE IRS E File Signature Authorization for

Understanding the IRS e-file signature authorization form 8879

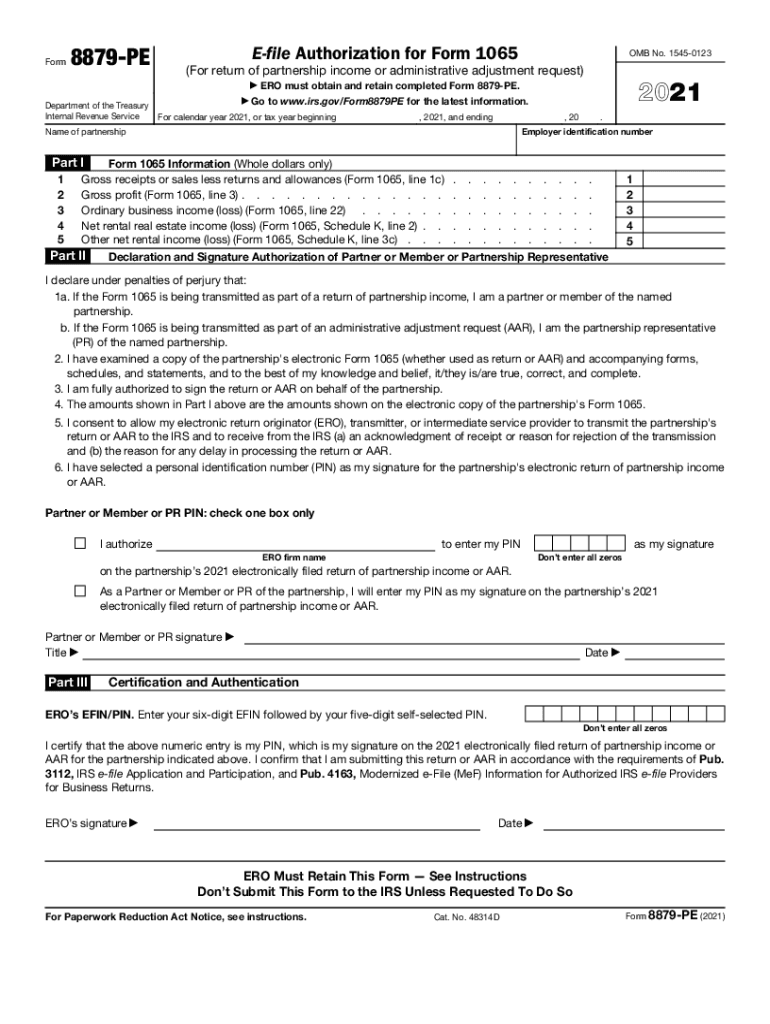

The IRS e-file signature authorization form 8879 is a crucial document for taxpayers who wish to e-file their federal tax returns. This form serves as a declaration that the taxpayer authorizes their tax preparer to electronically file their tax return on their behalf. It also provides the preparer with the necessary signature to validate the submission. The form is designed to ensure compliance with IRS regulations while simplifying the e-filing process.

Steps to complete the IRS e-file signature authorization form 8879

Completing the IRS e-file signature authorization form 8879 involves several straightforward steps:

- Obtain the form: You can download the IRS e-file signature authorization form 8879 PDF from the IRS website or request it from your tax preparer.

- Fill in your personal information: Enter your name, Social Security number, and any other required details accurately.

- Review your tax return: Ensure that all information on your tax return is correct before signing the authorization form.

- Sign the form: You must sign and date the form, confirming your authorization for e-filing.

- Submit the form: Return the completed form to your tax preparer, who will then file your tax return electronically.

Legal use of the IRS e-file signature authorization form 8879

The IRS e-file signature authorization form 8879 is legally binding when completed correctly. It meets the requirements set forth by the IRS for electronic signatures, ensuring that both the taxpayer and the tax preparer are protected under the law. The form must be signed by the taxpayer to validate the e-filing process, and it provides a record of consent for the tax preparer to act on the taxpayer's behalf.

Key elements of the IRS e-file signature authorization form 8879

Several key elements are essential for the IRS e-file signature authorization form 8879 to be valid:

- Taxpayer Information: Accurate personal details of the taxpayer, including name and Social Security number.

- Tax Preparer Information: Details of the tax preparer, including their name and identification number.

- Signature: The taxpayer's signature is required to authorize the e-filing.

- Date: The date of the signature must be included to validate the authorization.

IRS guidelines for using form 8879

The IRS provides specific guidelines for the use of the e-file signature authorization form 8879. Taxpayers should ensure that they fully understand the implications of signing the form, including the responsibilities it entails. The IRS mandates that the form must be retained for three years from the date the tax return is filed, and it should be made available for review upon request.

Filing deadlines and important dates for form 8879

It is essential to be aware of the filing deadlines associated with the IRS e-file signature authorization form 8879. Typically, the deadline for submitting your federal tax return is April 15. However, if you are unable to file by this date, you may apply for an extension. In such cases, the form 8879 must be submitted along with the tax return by the extended deadline to ensure compliance with IRS regulations.

Quick guide on how to complete wwwtaxformfinderorgfederalform 8879 pefederal form 8879 pe irs e file signature authorization for

Complete Www taxformfinder orgfederalform 8879 peFederal Form 8879 PE IRS E file Signature Authorization For easily on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the accurate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without complications. Manage Www taxformfinder orgfederalform 8879 peFederal Form 8879 PE IRS E file Signature Authorization For on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to edit and eSign Www taxformfinder orgfederalform 8879 peFederal Form 8879 PE IRS E file Signature Authorization For effortlessly

- Locate Www taxformfinder orgfederalform 8879 peFederal Form 8879 PE IRS E file Signature Authorization For and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive content with specific tools that airSlate SignNow offers for that purpose.

- Generate your signature with the Sign feature, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to preserve your modifications.

- Select how you want to send your form: by email, text message (SMS), invitation link, or download it to your computer.

Eliminate issues with lost or misplaced documents, tedious form navigation, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any selected device. Modify and eSign Www taxformfinder orgfederalform 8879 peFederal Form 8879 PE IRS E file Signature Authorization For and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wwwtaxformfinderorgfederalform 8879 pefederal form 8879 pe irs e file signature authorization for

How to make an electronic signature for a PDF file online

How to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The way to make an electronic signature from your mobile device

The best way to generate an e-signature for a PDF file on iOS

The way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is the IRS e-file signature authorization form 8879 PDF?

The IRS e-file signature authorization form 8879 PDF is a crucial document used in the e-filing process to authenticate the electronic submission of tax returns. By utilizing this form, taxpayers can authorize their tax preparer to file their federal tax returns electronically on their behalf.

-

How does airSlate SignNow facilitate the completion of the IRS e-file signature authorization form 8879 PDF?

airSlate SignNow simplifies the process by allowing users to easily fill out and eSign the IRS e-file signature authorization form 8879 PDF online. With our intuitive platform, you can complete this form quickly, ensuring you're ready to e-file your tax returns without hassle.

-

Is airSlate SignNow a cost-effective solution for handling IRS e-file signature authorization forms?

Yes, airSlate SignNow offers a cost-effective solution for managing your IRS e-file signature authorization form 8879 PDF and other documents. Our pricing plans are designed to accommodate both individual users and businesses, allowing you to save time and money on document management.

-

Are there any integrations available for airSlate SignNow with tax preparation software?

Absolutely! airSlate SignNow integrates seamlessly with various tax preparation software, allowing you to link your IRS e-file signature authorization form 8879 PDF directly to your preferred tools. This feature streamlines your workflow and enhances efficiency in managing tax documents.

-

What are the key features of airSlate SignNow for eSigning documents like the IRS form 8879 PDF?

airSlate SignNow provides features like customizable templates, secure cloud storage, and instant notifications when the IRS e-file signature authorization form 8879 PDF is signed. These advantages ensure you have full control over the eSigning process while keeping your documents secure.

-

Can I track the status of my IRS e-file signature authorization form 8879 PDF once sent through airSlate SignNow?

Yes, with airSlate SignNow, you can easily track the status of your IRS e-file signature authorization form 8879 PDF after sending it for signature. Our platform provides real-time updates, so you always know where your document stands in the signing process.

-

How does eSigning the IRS e-file signature authorization form 8879 PDF help with tax filing?

E-signing the IRS e-file signature authorization form 8879 PDF streamlines the tax filing process, allowing you to quickly authorize your tax preparer to file your return electronically. This not only saves time but also ensures your tax return is filed accurately and on time.

Get more for Www taxformfinder orgfederalform 8879 peFederal Form 8879 PE IRS E file Signature Authorization For

- Deed husband wife florida form

- Florida quitclaim deed 497302879 form

- Florida special warranty form

- Deed husband wife florida 497302881 form

- Deed from trust form

- Quitclaim deed by two individuals to corporation florida form

- Warranty deed from two individuals to corporation florida form

- Enhanced life estate or lady bird deed quitclaim individual to three individuals florida form

Find out other Www taxformfinder orgfederalform 8879 peFederal Form 8879 PE IRS E file Signature Authorization For

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free