Schedule a Form 8804 Penalty for Underpayment of Estimated Section 1446 Tax by Partnerships

Understanding the Penalty for Underpayment of Estimated Section 1446 Tax

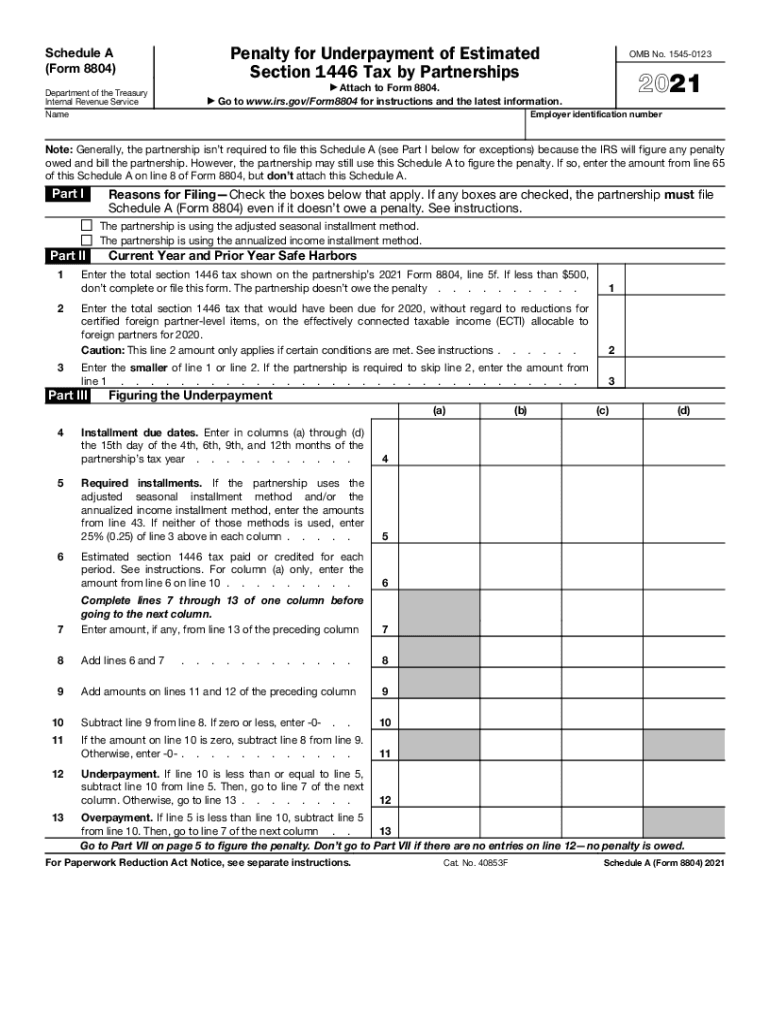

The Schedule A Form 8804 addresses penalties associated with the underpayment of estimated Section 1446 tax by partnerships. This penalty is imposed when a partnership fails to pay the required estimated tax amounts throughout the year. It is crucial for partnerships to understand these penalties to avoid unnecessary financial burdens. The penalty is calculated based on the amount of underpayment and the duration of the underpayment period. Partnerships should be aware that timely and accurate payments can prevent these penalties from accruing.

Steps to Complete the Schedule A Form 8804

Completing the Schedule A Form 8804 involves several key steps to ensure compliance with IRS regulations. First, partnerships must gather all relevant financial data, including income statements and prior tax returns. Next, calculate the estimated tax liability based on the partnership's income projections. After determining the estimated tax, fill out the form accurately, ensuring all figures reflect the partnership's financial situation. Finally, review the completed form for any errors before submission, as inaccuracies can lead to further penalties.

Filing Deadlines and Important Dates

Partnerships must adhere to specific filing deadlines when submitting the Schedule A Form 8804. Generally, the form is due on the 15th day of the third month following the end of the partnership’s tax year. For partnerships operating on a calendar year, this typically falls on March 15. It is essential for partnerships to mark these dates on their calendars to ensure timely submissions and avoid penalties for late filing.

IRS Guidelines for Schedule A Form 8804

The IRS provides comprehensive guidelines for completing and submitting the Schedule A Form 8804. These guidelines include instructions on how to calculate estimated tax payments, the necessary documentation to accompany the form, and the consequences of non-compliance. Partnerships should refer to the IRS guidelines to ensure they meet all requirements and avoid potential issues during the tax filing process.

Penalties for Non-Compliance with Schedule A Form 8804

Failure to comply with the requirements of the Schedule A Form 8804 can result in significant penalties. These penalties may include interest on unpaid taxes and additional fines for late filings. The IRS takes non-compliance seriously, and partnerships should be proactive in understanding their obligations to mitigate these risks. Regularly reviewing tax obligations and maintaining accurate records can help partnerships avoid these penalties.

Eligibility Criteria for Using Schedule A Form 8804

To utilize the Schedule A Form 8804, partnerships must meet specific eligibility criteria set by the IRS. Generally, this form is applicable to partnerships that are required to make estimated tax payments under Section 1446. Partnerships should evaluate their tax situation to determine if they fall under this category. Understanding these eligibility requirements can help partnerships navigate their tax responsibilities more effectively.

Quick guide on how to complete 2021 schedule a form 8804 penalty for underpayment of estimated section 1446 tax by partnerships

Complete Schedule A Form 8804 Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships effortlessly on any device

Managing documents online has become favored by organizations and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it digitally. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly without delays. Handle Schedule A Form 8804 Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest method to edit and eSign Schedule A Form 8804 Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships effortlessly

- Find Schedule A Form 8804 Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships and click on Get Form to initiate the process.

- Use the tools we offer to fill in your document.

- Highlight relevant parts of the documents or redact sensitive details with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Schedule A Form 8804 Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships and guarantee exceptional communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2021 schedule a form 8804 penalty for underpayment of estimated section 1446 tax by partnerships

How to make an electronic signature for a PDF document in the online mode

How to make an electronic signature for a PDF document in Chrome

The best way to generate an e-signature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your mobile device

The best way to generate an e-signature for a PDF document on iOS devices

The way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is the 8804 and how does it work?

The 8804 refers to a specific feature within the airSlate SignNow platform that allows users to manage and eSign documents efficiently. It streamlines the signing process, ensuring that all parties can quickly receive, review, and sign documents online. This eliminates the need for physical signatures and speeds up workflows.

-

How much does using the 8804 cost?

The pricing for the 8804 feature can vary depending on the specific plan you choose within airSlate SignNow. Each plan offers different levels of access to features including the 8804, so it's crucial to review their pricing page or contact customer support for the most accurate details. In general, airSlate SignNow offers competitive pricing tailored to meet diverse business needs.

-

What are the key features of the 8804?

The 8804 includes several key features designed to enhance document management and eSigning processes. These features typically consist of customizable templates, multi-party signing options, and secure cloud storage. By leveraging the 8804, businesses can improve efficiency and maintain compliance in their signing processes.

-

What are the benefits of using the 8804 for my business?

Using the 8804 can signNowly increase your business's operational efficiency by reducing the time spent on manual signing processes. It allows for faster document turnaround times and enhances overall productivity. Additionally, the 8804 supports remote work, making it easier for teams to collaborate from anywhere.

-

Can the 8804 integrate with other applications?

Yes, the 8804 is designed to integrate seamlessly with various applications, enhancing its functionality within your existing tech stack. Popular integrations include CRMs, project management tools, and office software, allowing for a more streamlined workflow across platforms. This connectivity can help you manage documents without switching between different systems.

-

Is the 8804 secure for sensitive documents?

Absolutely, the 8804 prioritizes security to ensure that sensitive documents are handled with care. It utilizes encryption and secure cloud storage to protect data during uploading and signing processes. By using the 8804, you can feel confident that your documents are safe from unauthorized access.

-

How do I get started with the 8804?

Getting started with the 8804 is easy and can be done by signing up for an airSlate SignNow account. Once your account is set up, you can explore the features of the 8804 and start uploading your documents for eSigning. Follow the user-friendly interface, and you'll be managing your documents in no time.

Get more for Schedule A Form 8804 Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships

Find out other Schedule A Form 8804 Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now