Cobb County Georgia Homestead Exemption Form 2021-2026

What is the Cobb County Georgia Homestead Exemption Form

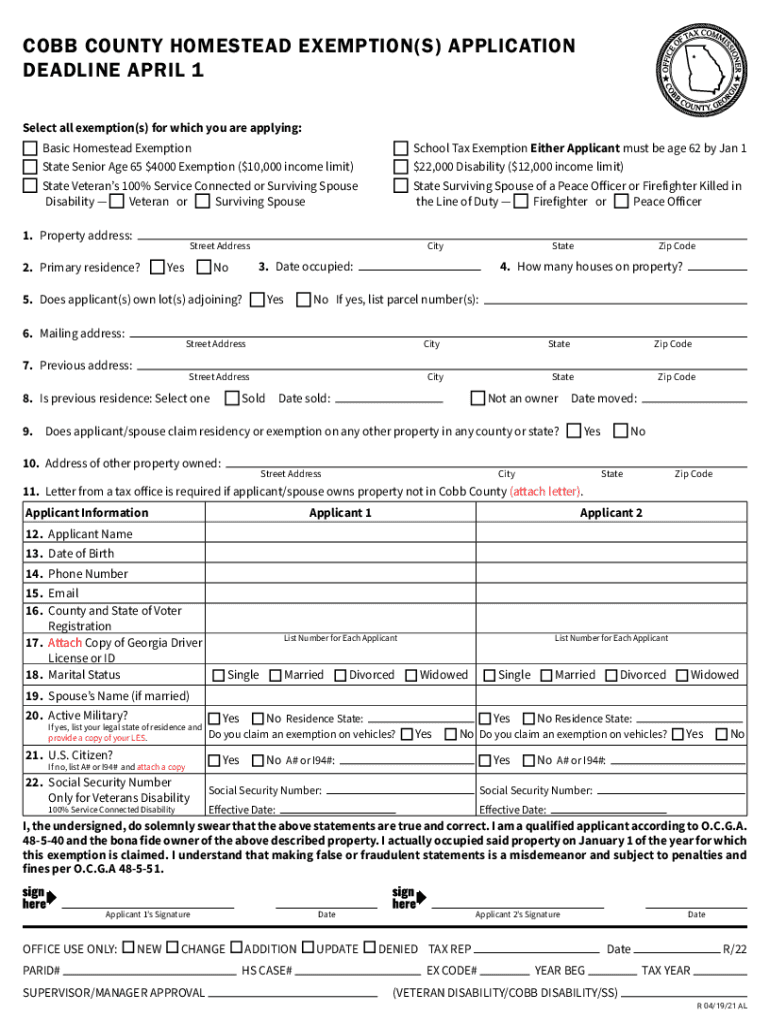

The Cobb County Georgia Homestead Exemption Form is a crucial document that allows homeowners to apply for property tax exemptions. This form is designed to reduce the taxable value of a primary residence, thereby lowering the overall property tax burden. The exemptions can vary based on specific criteria, including age, income, and disability status. Understanding this form is essential for homeowners looking to take advantage of potential savings on their property taxes.

Eligibility Criteria for the Cobb County Georgia Homestead Exemption

To qualify for the Cobb County homestead exemption, applicants must meet certain eligibility requirements. Generally, applicants must:

- Be the owner of the property and occupy it as their primary residence.

- Provide proof of residency, such as a driver’s license or utility bill.

- Meet income limitations if applying for specific exemptions aimed at seniors or disabled individuals.

It is important to review the specific criteria for each exemption type, as they may differ based on local regulations.

Steps to Complete the Cobb County Georgia Homestead Exemption Form

Completing the Cobb County homestead exemption form involves several steps to ensure accuracy and compliance. Here are the main steps:

- Gather necessary documentation, including proof of residency and income statements.

- Fill out the application form with accurate personal and property information.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline, either online, by mail, or in person.

Following these steps carefully will help streamline the application process and improve the chances of approval.

Form Submission Methods for the Cobb County Georgia Homestead Exemption

Homeowners can submit the Cobb County homestead exemption form through various methods to accommodate different preferences. The available submission methods include:

- Online Submission: Applicants can fill out and submit the form electronically via the Cobb County website.

- Mail: The completed form can be printed and mailed to the appropriate county office.

- In-Person: Homeowners may also choose to deliver the form in person at the designated county office.

Selecting the most convenient method can help ensure that the application is processed in a timely manner.

Required Documents for the Cobb County Georgia Homestead Exemption Form

When applying for the Cobb County homestead exemption, certain documents are required to support the application. These typically include:

- Proof of ownership, such as a deed or property tax bill.

- Identification, like a driver's license or state ID.

- Income documentation, if applicable, to verify eligibility for income-based exemptions.

Having these documents ready will facilitate a smoother application process and help avoid delays.

Legal Use of the Cobb County Georgia Homestead Exemption Form

The legal use of the Cobb County homestead exemption form is governed by state and local laws. It is important for applicants to ensure that they are using the most current version of the form and that all information provided is truthful and accurate. Misrepresentation on the form can lead to penalties, including the loss of the exemption and potential fines. Understanding the legal implications of the form is essential for compliance and to protect one’s property tax benefits.

Quick guide on how to complete cobb county georgia homestead exemption form

Effortlessly Prepare Cobb County Georgia Homestead Exemption Form on Any Device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal environmentally-friendly substitute for conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Manage Cobb County Georgia Homestead Exemption Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Modify and Electronically Sign Cobb County Georgia Homestead Exemption Form with Ease

- Find Cobb County Georgia Homestead Exemption Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or hide sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your changes.

- Choose your preferred method to submit your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that require reprinting copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you select. Modify and electronically sign Cobb County Georgia Homestead Exemption Form to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct cobb county georgia homestead exemption form

Create this form in 5 minutes!

How to create an eSignature for the cobb county georgia homestead exemption form

The best way to generate an e-signature for your PDF in the online mode

The best way to generate an e-signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The best way to create an e-signature straight from your smart phone

How to create an electronic signature for a PDF on iOS devices

The best way to create an e-signature for a PDF document on Android OS

People also ask

-

What are Cobb homestead exemptions?

Cobb homestead exemptions are property tax reductions available to eligible homeowners in Cobb County, Georgia. These exemptions can lower the taxable value of a home, ultimately reducing the amount of property taxes due. Understanding Cobb homestead exemptions can help you save money and benefit from the local government's support for residents.

-

Who qualifies for Cobb homestead exemptions?

To qualify for Cobb homestead exemptions, you must be a legal resident of Cobb County and occupy the home as your primary residence. Additionally, certain exemptions may have age, income, or disability requirements. It's important to review the specific criteria for each type of exemption to ensure you meet the qualifications.

-

How can I apply for Cobb homestead exemptions?

You can apply for Cobb homestead exemptions through the Cobb County Tax Assessor's Office. The application form is typically available online on their official website, where you can submit the required documents electronically. Make sure to adhere to the annual filing deadlines to take full advantage of the exemptions available.

-

Are there different types of Cobb homestead exemptions?

Yes, there are several types of Cobb homestead exemptions, each designed to support specific groups such as senior citizens, disabled individuals, and veterans. Each exemption has unique eligibility requirements and benefits. Reviewing these options can help you determine which Cobb homestead exemptions you may qualify for.

-

How much money can I save with Cobb homestead exemptions?

The amount you can save with Cobb homestead exemptions varies depending on the type of exemption you qualify for and the value of your property. In general, these exemptions can signNowly reduce your tax bill, helping you save hundreds or even thousands of dollars annually. Calculating your potential savings beforehand can provide insights into the value of applying.

-

Do Cobb homestead exemptions affect property value?

Cobb homestead exemptions do not reduce the market value of your property; rather, they lower the taxable value, which decreases your property tax liability. This distinction is important as it maintains your home’s equity while providing financial relief. Homeowners can benefit from the reduction in taxes without impacting their property's market standing.

-

Can I combine different Cobb homestead exemptions?

In some cases, eligible homeowners can combine various Cobb homestead exemptions to maximize their tax benefits. However, it's essential to verify the compatibility of each exemption by consulting with the Cobb County Tax Assessor's Office. This guidance ensures you fully leverage the available Cobb homestead exemptions without running into conflicts.

Get more for Cobb County Georgia Homestead Exemption Form

Find out other Cobb County Georgia Homestead Exemption Form

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship