Cobb County Homestead 2020

What is the Cobb County Homestead?

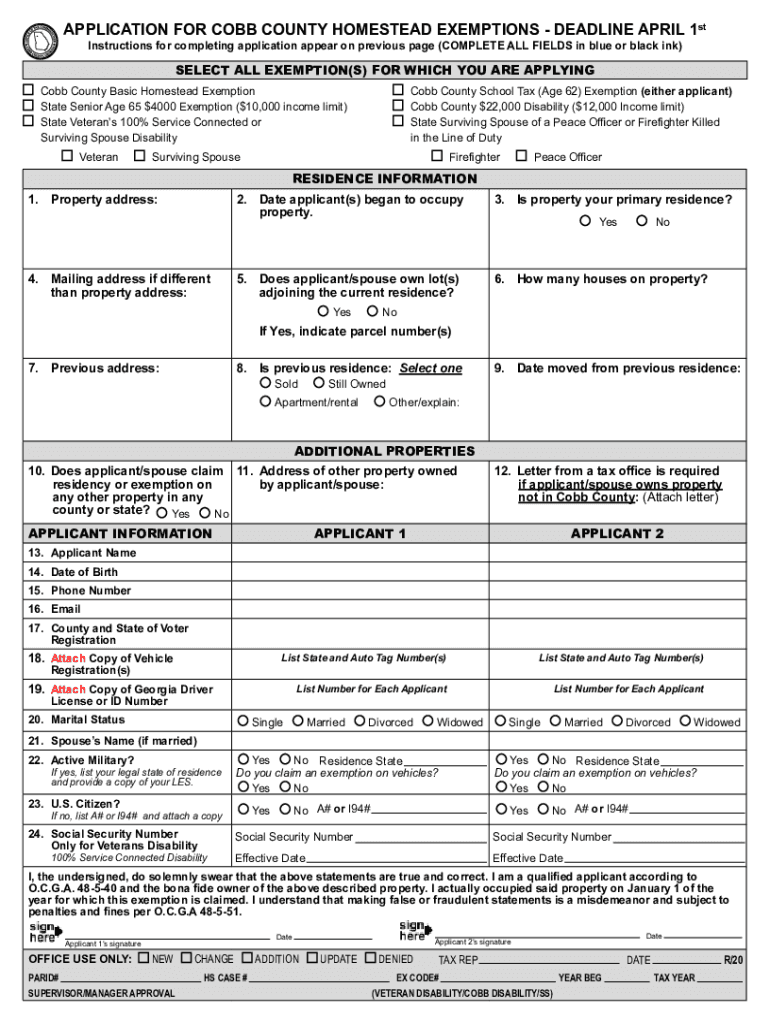

The Cobb County Homestead exemption is a property tax benefit designed to reduce the taxable value of a homeowner's primary residence. This exemption can significantly lower property taxes for eligible homeowners, making it a valuable financial resource. The homestead exemption applies to various categories, including general homestead, senior citizens, and disabled veterans, each with specific requirements and benefits.

Eligibility Criteria for the Cobb County Homestead

To qualify for the Cobb County Homestead exemption, homeowners must meet certain criteria. Primarily, the property must be the applicant's primary residence. Additional eligibility factors may include:

- Age of the homeowner (some exemptions are available for seniors).

- Disability status (for those who qualify as disabled).

- Income limitations (for specific exemption categories).

Homeowners must also provide proof of residency and ownership, typically through documentation such as a driver's license or property deed.

Steps to Complete the Cobb County Homestead Application

Filling out the Cobb County Homestead exemption form involves several steps to ensure accuracy and compliance. Here are the key steps:

- Gather necessary documents, including proof of residency and income.

- Obtain the Cobb County Homestead exemption form from the appropriate county office or online.

- Complete the form, ensuring all required fields are filled out accurately.

- Submit the completed form along with any supporting documents to the designated county office.

It is important to double-check all information to avoid delays in processing.

Required Documents for the Cobb County Homestead

When applying for the Cobb County Homestead exemption, certain documents are required to verify eligibility. Commonly required documents include:

- A copy of the applicant's driver's license or state-issued ID.

- Proof of residency, such as a utility bill or lease agreement.

- Income documentation, if applicable, for income-based exemptions.

Having these documents ready can streamline the application process and help ensure a successful submission.

Form Submission Methods for the Cobb County Homestead

Homeowners in Cobb County have several options for submitting their homestead exemption applications. The available methods include:

- Online submission through the county's official website.

- Mailing the completed form to the designated county office.

- In-person submission at the local tax assessor's office.

Choosing the most convenient method can help expedite the application process.

Legal Use of the Cobb County Homestead

The Cobb County Homestead exemption is legally binding once the application is approved. Homeowners must adhere to the terms of the exemption, including maintaining the property as their primary residence. Failure to comply with these requirements may result in penalties or the loss of the exemption. It is essential for homeowners to stay informed about any changes in eligibility or application procedures to maintain their benefits.

Quick guide on how to complete cobb county homestead

Prepare Cobb County Homestead effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, alter, and electronically sign your documents quickly and without delays. Handle Cobb County Homestead on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Cobb County Homestead effortlessly

- Find Cobb County Homestead and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to preserve your changes.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Cobb County Homestead to ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct cobb county homestead

Create this form in 5 minutes!

How to create an eSignature for the cobb county homestead

How to generate an eSignature for your PDF online

How to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The best way to make an eSignature straight from your smartphone

The best way to create an electronic signature for a PDF on iOS

The best way to make an eSignature for a PDF document on Android

People also ask

-

What is the Cobb County homestead exemption form?

The Cobb County homestead exemption form is a document that homeowners can submit to obtain property tax relief. This exemption reduces the assessed value of your home for tax purposes, potentially lowering your overall tax bill. Completing the Cobb County homestead exemption form is a straightforward way to maximize tax benefits for eligible homeowners.

-

How do I apply for the Cobb County homestead exemption?

To apply for the Cobb County homestead exemption, download the form from the official Cobb County website or in person at local offices. Ensure you meet the eligibility requirements before submission. Once you complete the Cobb County homestead exemption form, submit it by the stated deadline to qualify for the property tax exemption.

-

What are the benefits of the Cobb County homestead exemption?

The main benefit of the Cobb County homestead exemption is the reduction in property taxes, which can lead to signNow savings for homeowners. Furthermore, the exemption can protect you from tax increases on a portion of your property value, ensuring your tax burden remains manageable. The Cobb County homestead exemption promotes homeownership and financial stability for residents.

-

Can I file the Cobb County homestead exemption form online?

Yes, you can file the Cobb County homestead exemption form online through the Cobb County tax assessor's website. This online option provides a convenient way to complete your application without visiting local offices. Make sure to follow the instructions carefully to ensure your application is processed promptly.

-

Is there a fee to submit the Cobb County homestead exemption form?

No, there is no fee associated with submitting the Cobb County homestead exemption form. The process is designed to be accessible for all eligible homeowners seeking tax relief. It's important to remember that while filing the form is free, missing the application deadline could result in losing potential tax benefits.

-

What documents do I need to submit with the Cobb County homestead exemption form?

When submitting the Cobb County homestead exemption form, you typically need to provide proof of ownership, such as a deed or mortgage statement, along with a valid ID. Depending on the type of exemption you are applying for, additional documents may be required. Ensure you check the specific requirements outlined on the Cobb County website to prepare adequately.

-

When is the deadline to submit the Cobb County homestead exemption form?

The deadline to submit the Cobb County homestead exemption form is usually April 1st for the current tax year. It is crucial to meet this deadline to ensure you receive the exemption benefits for your property taxes. Always check Cobb County's official communication for the most accurate and up-to-date deadlines.

Get more for Cobb County Homestead

Find out other Cobb County Homestead

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors