14 Printable Form 990 Templates Fillable Samples in

What is the 990 interested form printable?

The 990 interested form printable is a crucial document used by tax-exempt organizations in the United States to report their financial information to the Internal Revenue Service (IRS). Specifically, this form is part of the Form 990 series, which includes various versions such as the 990, 990-EZ, and 990-N. Organizations must complete this form annually to maintain their tax-exempt status and provide transparency regarding their financial activities. The form captures essential details about the organization's revenue, expenses, and governance, ensuring compliance with federal regulations.

Steps to complete the 990 interested form printable

Completing the 990 interested form printable involves several key steps to ensure accuracy and compliance. Here is a structured approach:

- Gather necessary financial records, including income statements, balance sheets, and any relevant supporting documentation.

- Review the specific version of the form you need, as requirements may vary between the 990, 990-EZ, and 990-N.

- Fill out the form accurately, providing all requested information, including details about revenue sources and expenses.

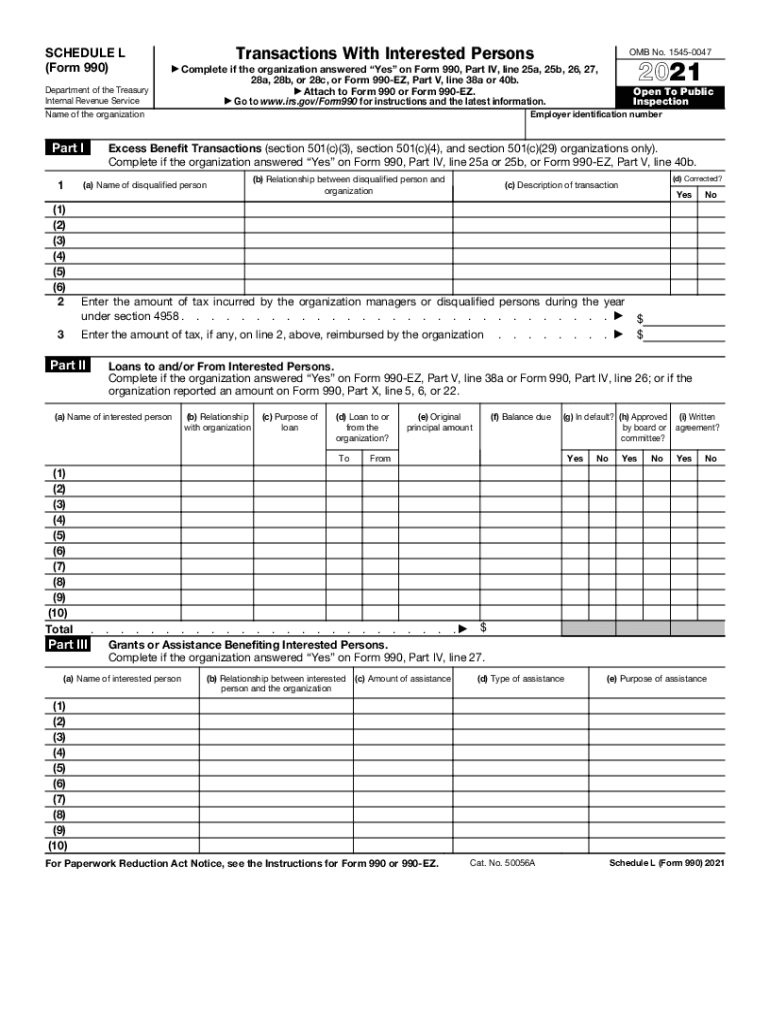

- Ensure that all required schedules, such as Schedule L for transactions with interested persons, are completed and attached.

- Review the completed form for errors or omissions before submission.

- File the form electronically or by mail, adhering to IRS guidelines regarding submission methods.

IRS Guidelines

The IRS provides specific guidelines for completing the 990 interested form printable. These guidelines include instructions on what information to report, how to report it, and deadlines for submission. Organizations must ensure they are familiar with these guidelines to avoid penalties. The IRS emphasizes the importance of transparency and accuracy in reporting, as this information is made publicly available. Additionally, organizations should be aware of any changes to the guidelines that may occur annually, as tax laws and reporting requirements can evolve.

Filing Deadlines / Important Dates

Filing deadlines for the 990 interested form printable are critical for compliance. Generally, organizations must submit their completed forms by the fifteenth day of the fifth month after the end of their fiscal year. For example, if an organization’s fiscal year ends on December 31, the form is due by May 15 of the following year. It is advisable to plan ahead and allow ample time for completion to avoid late filing penalties. Organizations may also apply for an extension if needed, but they must do so before the original deadline.

Required Documents

To complete the 990 interested form printable, organizations need to gather several required documents. These typically include:

- Financial statements, including income statements and balance sheets.

- Records of revenue sources, such as donations, grants, and program service revenue.

- Expense reports detailing operational costs, salaries, and other expenditures.

- Governance documents, including bylaws and board meeting minutes.

- Any additional schedules or attachments required by the specific version of Form 990 being filed.

Penalties for Non-Compliance

Failure to file the 990 interested form printable on time can result in significant penalties for organizations. The IRS imposes fines for late submissions, which can accumulate over time. Additionally, if an organization fails to file for three consecutive years, it may automatically lose its tax-exempt status. It is essential for organizations to prioritize compliance by adhering to filing deadlines and ensuring that all required information is accurately reported to avoid these penalties.

Quick guide on how to complete 14 printable 2016 form 990 templates fillable samples in

Effortlessly Prepare 14 Printable Form 990 Templates Fillable Samples In on Any Device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly without delays. Handle 14 Printable Form 990 Templates Fillable Samples In on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to Edit and eSign 14 Printable Form 990 Templates Fillable Samples In with Ease

- Find 14 Printable Form 990 Templates Fillable Samples In and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Select important parts of your documents or conceal sensitive information with the tools specially designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Decide how you want to send your form—via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign 14 Printable Form 990 Templates Fillable Samples In and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 14 printable 2016 form 990 templates fillable samples in

The best way to make an electronic signature for your PDF in the online mode

The best way to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to generate an e-signature right from your smart phone

How to generate an electronic signature for a PDF on iOS devices

The best way to generate an e-signature for a PDF on Android OS

People also ask

-

What is the 990 interested form printable?

The 990 interested form printable is a document used by nonprofits to express their interest in acquiring tax-exempt status. This form helps organizations streamline their application process. By utilizing the 990 interested form printable, you can ensure that all necessary information is correctly presented.

-

How can I download the 990 interested form printable?

You can easily download the 990 interested form printable from our website. Simply navigate to the resources section and find the form in PDF format. This allows for quick access and easy printing to get started.

-

Is the 990 interested form printable free to use?

Yes, the 990 interested form printable is available for free. Our goal is to assist nonprofits in their application process without incurring additional costs. Downloading and using the form helps you focus on what truly matters: your mission.

-

What features does airSlate SignNow offer for the 990 interested form printable?

With airSlate SignNow, you can easily upload, edit, and eSign the 990 interested form printable. Our platform provides a user-friendly interface that simplifies document management. Additional features like templates and automated workflows enhance your experience and efficiency.

-

Can I integrate the 990 interested form printable with other software?

Absolutely! AirSlate SignNow offers various integrations with popular software, allowing for seamless document management. Integrating the 990 interested form printable with your existing tools enhances workflow efficiency and keeps your processes streamlined.

-

What are the benefits of using airSlate SignNow for the 990 interested form printable?

Using airSlate SignNow for the 990 interested form printable minimizes paperwork and accelerates the signing process. Our platform enhances collaboration and provides secure storage for your important documents. Overall, it simplifies the process of obtaining necessary signatures.

-

Is it safe to use the 990 interested form printable on airSlate SignNow?

Yes, safety is a top priority at airSlate SignNow. The platform employs advanced encryption methods to protect your data while using the 990 interested form printable. With our secure system, you can feel confident about your sensitive information and document security.

Get more for 14 Printable Form 990 Templates Fillable Samples In

Find out other 14 Printable Form 990 Templates Fillable Samples In

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement