April S 211 Wisconsin Sales and Use Tax Exemption Certificate and Instructions Fillable Form

What is the April S 211 Wisconsin Sales And Use Tax Exemption Certificate And Instructions fillable

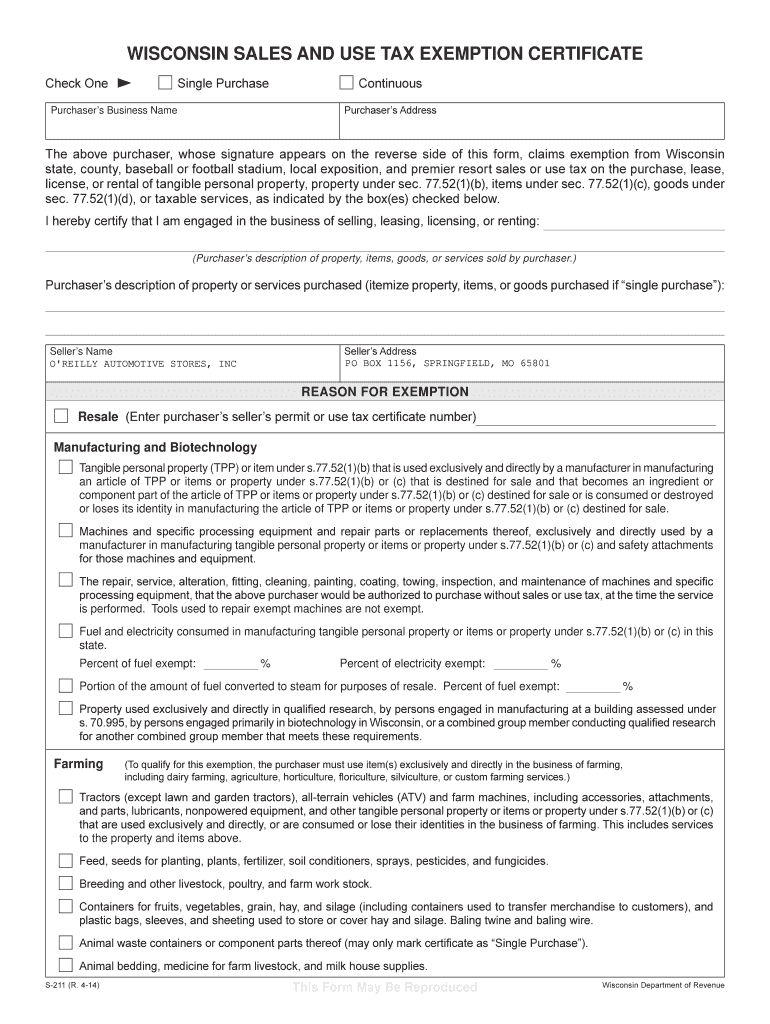

The April S 211 Wisconsin Sales And Use Tax Exemption Certificate is a legal document that allows eligible purchasers to claim exemption from sales and use tax on certain purchases. This certificate is particularly useful for organizations that qualify under specific categories, such as non-profit entities, government agencies, or educational institutions. By completing this form, buyers can avoid paying sales tax on items that are intended for exempt purposes, thus facilitating compliance with Wisconsin tax regulations.

How to use the April S 211 Wisconsin Sales And Use Tax Exemption Certificate And Instructions fillable

To utilize the April S 211 certificate, individuals or organizations must first ensure they meet the eligibility criteria outlined by the Wisconsin Department of Revenue. After confirming eligibility, the form can be filled out electronically or printed for manual completion. It is essential to provide accurate information, including the purchaser's name, address, and the reason for the exemption. Once completed, the certificate should be presented to the seller at the time of purchase to validate the tax exemption.

Steps to complete the April S 211 Wisconsin Sales And Use Tax Exemption Certificate And Instructions fillable

Completing the April S 211 form involves several key steps:

- Download the fillable form from a trusted source.

- Enter the purchaser's name and address in the designated fields.

- Indicate the type of exemption being claimed.

- Provide a description of the items being purchased.

- Sign and date the certificate to validate it.

After completing these steps, ensure that the certificate is given to the seller at the time of purchase to avoid any sales tax charges.

Key elements of the April S 211 Wisconsin Sales And Use Tax Exemption Certificate And Instructions fillable

The key elements of the April S 211 include:

- Purchaser Information: Name, address, and contact details of the purchaser.

- Exemption Type: Specific category under which the exemption is claimed.

- Item Description: Clear identification of the items being purchased tax-free.

- Signature: The purchaser's signature is required to authenticate the form.

Each of these elements must be accurately filled out to ensure the validity of the exemption claim.

Eligibility Criteria

Eligibility for using the April S 211 certificate typically includes:

- Non-profit organizations recognized under IRS regulations.

- Government entities, including federal, state, and local agencies.

- Educational institutions that meet specific criteria.

It is important for applicants to review the specific eligibility requirements set forth by the Wisconsin Department of Revenue to ensure compliance.

Form Submission Methods (Online / Mail / In-Person)

The completed April S 211 form can be submitted in various ways, depending on the seller's preference:

- In-Person: Present the completed certificate directly to the seller at the time of purchase.

- Mail: Some sellers may accept the certificate via postal service, but this should be confirmed beforehand.

- Online: If applicable, sellers may have options for electronic submission of the certificate.

Always verify the preferred submission method with the seller to ensure proper processing of the exemption.

Quick guide on how to complete april s 211 wisconsin sales and use tax exemption certificate and instructions fillable

Complete [SKS] effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest method to modify and eSign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Craft your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to share your form, via email, text (SMS), an invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses your needs in document management with just a few clicks from a device of your choice. Modify and eSign [SKS] to ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to April S 211 Wisconsin Sales And Use Tax Exemption Certificate And Instructions fillable

Create this form in 5 minutes!

How to create an eSignature for the april s 211 wisconsin sales and use tax exemption certificate and instructions fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the April S 211 Wisconsin Sales And Use Tax Exemption Certificate And Instructions fillable?

The April S 211 Wisconsin Sales And Use Tax Exemption Certificate And Instructions fillable is a document that allows eligible businesses to claim exemption from sales and use tax in Wisconsin. This fillable form simplifies the process of providing necessary information to vendors, ensuring compliance with state tax regulations.

-

How can I obtain the April S 211 Wisconsin Sales And Use Tax Exemption Certificate And Instructions fillable?

You can easily obtain the April S 211 Wisconsin Sales And Use Tax Exemption Certificate And Instructions fillable through the airSlate SignNow platform. Simply visit our website, navigate to the forms section, and download the fillable version of the certificate for your convenience.

-

Is there a cost associated with using the April S 211 Wisconsin Sales And Use Tax Exemption Certificate And Instructions fillable?

Using the April S 211 Wisconsin Sales And Use Tax Exemption Certificate And Instructions fillable through airSlate SignNow is part of our cost-effective solution for document management. While the form itself is free to download, our platform offers various pricing plans for additional features and services.

-

What features does the airSlate SignNow platform offer for the April S 211 Wisconsin Sales And Use Tax Exemption Certificate And Instructions fillable?

The airSlate SignNow platform provides features such as eSignature capabilities, document sharing, and secure storage for the April S 211 Wisconsin Sales And Use Tax Exemption Certificate And Instructions fillable. These features streamline the process of completing and submitting your exemption certificate efficiently.

-

How does the April S 211 Wisconsin Sales And Use Tax Exemption Certificate And Instructions fillable benefit my business?

Utilizing the April S 211 Wisconsin Sales And Use Tax Exemption Certificate And Instructions fillable can signNowly reduce your tax liabilities, allowing your business to save money. Additionally, it simplifies compliance with state tax laws, ensuring that you avoid potential penalties and audits.

-

Can I integrate the April S 211 Wisconsin Sales And Use Tax Exemption Certificate And Instructions fillable with other software?

Yes, airSlate SignNow allows for seamless integration with various business applications, enhancing the usability of the April S 211 Wisconsin Sales And Use Tax Exemption Certificate And Instructions fillable. This integration helps streamline your workflow and ensures that all your documents are easily accessible.

-

What should I do if I have questions while filling out the April S 211 Wisconsin Sales And Use Tax Exemption Certificate And Instructions fillable?

If you have questions while completing the April S 211 Wisconsin Sales And Use Tax Exemption Certificate And Instructions fillable, our customer support team is here to help. You can signNow out via our website or consult the detailed instructions provided with the form for guidance.

Get more for April S 211 Wisconsin Sales And Use Tax Exemption Certificate And Instructions fillable

- Carta de autorizacin para pasaporte de menor de edad form

- Battery declaration form 224653980

- Corporatellc record tickler blumberg excelsior inc form

- Payroll ledger template excel form

- Osh med intake requirements form

- Chase add beneficiary online form

- Iaft 6 form

- Personal assistant application form 30112985

Find out other April S 211 Wisconsin Sales And Use Tax Exemption Certificate And Instructions fillable

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast