Form 1096 Internal Revenue ServiceAn Official

What is the Form 1096?

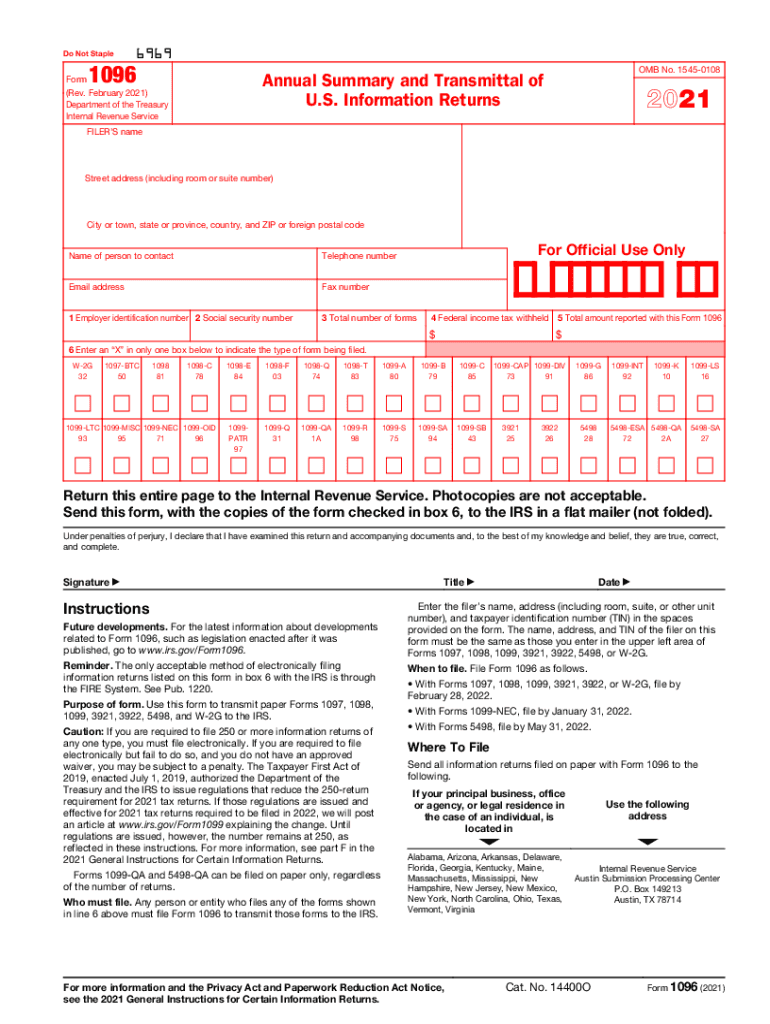

The Form 1096 is an official document used by the Internal Revenue Service (IRS) in the United States. It serves as a transmittal form for various information returns, including Forms 1099, 1098, and W-2G. Essentially, it summarizes the information being reported to the IRS and provides essential details about the filer and the forms being submitted. This form is crucial for businesses and individuals who are required to report certain types of payments made throughout the year.

Steps to Complete the Form 1096

Completing the 1096 form for 2021 involves several key steps:

- Gather necessary information: Collect all relevant data, including payer and recipient details, and the total amounts reported on the associated forms.

- Fill out the form: Enter your name, address, and taxpayer identification number (TIN) in the appropriate fields. Include the total number of forms being submitted and the total amount reported.

- Review for accuracy: Ensure all information is correct to avoid penalties or delays in processing.

- Sign and date the form: A signature is required to validate the submission.

- Submit the form: Send the completed 1096 form along with the related information returns to the IRS by the designated deadline.

Filing Deadlines / Important Dates

For the 2021 tax year, the deadline for filing the Form 1096 is typically the last day of February if filing by mail or March 31 if filing electronically. It is essential to stay informed about these deadlines to avoid penalties. Late submissions can result in fines, so timely filing is crucial for compliance.

Legal Use of the Form 1096

The Form 1096 is legally binding when completed correctly and submitted to the IRS. It must be filed by any entity that is reporting payments made to non-employees, such as independent contractors or freelancers. Compliance with IRS regulations ensures that the information reported is accurate and that the filer is protected from potential legal issues.

Key Elements of the Form 1096

Several key elements are essential when filling out the Form 1096:

- Payer Information: Includes the name, address, and TIN of the entity submitting the form.

- Recipient Information: Summarizes the total number of information returns and the total dollar amount reported.

- Signature: The form must be signed by an authorized person to validate the submission.

- Filing Method: Indicates whether the forms are being filed by mail or electronically.

How to Obtain the Form 1096

The Form 1096 can be obtained directly from the IRS website or through various tax preparation software. It is available in printable format, allowing users to fill it out manually or digitally. Ensure that you are using the correct version for the year you are filing, as forms may change from year to year.

Quick guide on how to complete 2021 form 1096 internal revenue servicean official

Effortlessly Prepare Form 1096 Internal Revenue ServiceAn Official on Any Device

Managing documents online has gained traction among businesses and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents promptly without any delays. Handle Form 1096 Internal Revenue ServiceAn Official on any device using airSlate SignNow's Android or iOS applications and enhance your document-related operations today.

How to Alter and Electronically Sign Form 1096 Internal Revenue ServiceAn Official with Ease

- Obtain Form 1096 Internal Revenue ServiceAn Official and then click Get Form to commence.

- Use the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information with specialized tools provided by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which takes just moments and holds equivalent legal standing to a conventional wet ink signature.

- Review all the information and then click on the Done button to preserve your changes.

- Decide how you want to share your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Form 1096 Internal Revenue ServiceAn Official to ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2021 form 1096 internal revenue servicean official

How to generate an electronic signature for a PDF file in the online mode

How to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature right from your smartphone

How to make an e-signature for a PDF file on iOS devices

How to generate an electronic signature for a PDF on Android

People also ask

-

What is the 1096 form 2021?

The 1096 form 2021 is a summary form used to transmit paper forms 1099 to the IRS. This form provides key information about the types of payments and the total amount paid to recipients. Completing the 1096 form accurately is essential for compliance with federal tax requirements.

-

How can airSlate SignNow assist with the 1096 form 2021?

AirSlate SignNow simplifies the process of signing and sending your 1096 form 2021 by providing an easy-to-use electronic signature platform. You can securely send the form to those who need to sign and receive it, which minimizes processing time and enhances organization. This feature helps ensure you meet tax deadlines efficiently.

-

Are there any costs associated with using airSlate SignNow for the 1096 form 2021?

AirSlate SignNow offers various pricing plans tailored to meet business needs, allowing you to choose one that fits your budget. Each plan includes features like document signing and tracking, which can streamline your workflow when dealing with the 1096 form 2021. Contact us for detailed pricing options that suit your specific requirements.

-

Can I integrate airSlate SignNow with other software for handling the 1096 form 2021?

Yes, airSlate SignNow integrates seamlessly with various CRM and accounting software, allowing you to manage your 1096 form 2021 alongside other essential business operations. This connectivity enhances data management and reduces the risk of errors. You can easily sync your documents and maintain a smooth workflow.

-

What are the benefits of using airSlate SignNow for my 1096 form 2021 submissions?

Using airSlate SignNow for your 1096 form 2021 submissions provides enhanced efficiency and compliance. The platform allows you to track your documents, ensuring that you always know the status of your submissions. Additionally, electronic signatures save time and resources compared to traditional paper methods.

-

Is airSlate SignNow secure for processing the 1096 form 2021?

Absolutely! AirSlate SignNow employs advanced encryption and security measures to protect sensitive information on the 1096 form 2021. Your data is safeguarded against unauthorized access, ensuring compliance with regulations while giving you peace of mind during the signing process.

-

How can I prepare my 1096 form 2021 for signing through airSlate SignNow?

Preparing your 1096 form 2021 for signing with airSlate SignNow is simple. You can upload your form directly to the platform, add fields for signatures, and specify the recipients. Once set up, you can send it electronically, ensuring a quick turnaround time.

Get more for Form 1096 Internal Revenue ServiceAn Official

- Hawaii income expense statement form

- Asset statement form 497304480

- Hawaii divorce decree 497304481 form

- Affidavit of plaintiff for uncontested divorce hawaii form

- Commercial sublease hawaii form

- Hi child support form

- Residential lease renewal agreement hawaii form

- Supplemental affidavit regarding direct payment child support hawaii form

Find out other Form 1096 Internal Revenue ServiceAn Official

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure