Hawaii Income Expense Statement Form

What is the Hawaii Income Expense Statement

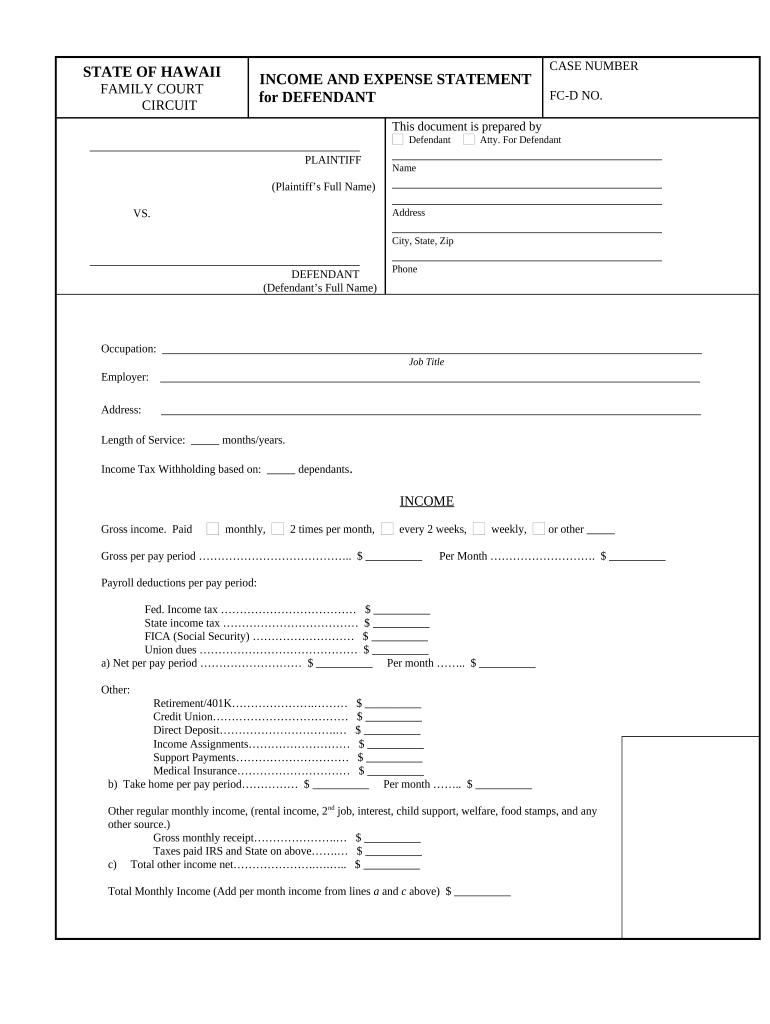

The Hawaii Income Expense Statement is a financial document used to outline the income and expenses of individuals or businesses operating in Hawaii. This statement is essential for various purposes, including tax filings, financial assessments, and loan applications. It provides a clear overview of financial performance over a specific period, typically a year. By detailing all sources of income and categorizing expenses, the statement helps users understand their financial situation and make informed decisions.

How to use the Hawaii Income Expense Statement

Using the Hawaii Income Expense Statement involves several steps to ensure accuracy and compliance. First, gather all relevant financial documents, such as bank statements, receipts, and invoices. Next, categorize your income sources, which may include wages, rental income, and business revenue. After that, list all expenses, including utilities, rent, and operational costs. Once all information is compiled, fill out the statement accurately, ensuring that totals are calculated correctly. This document can then be used for filing taxes or applying for loans.

Key elements of the Hawaii Income Expense Statement

The Hawaii Income Expense Statement includes several key elements that are crucial for its effectiveness. These elements typically consist of:

- Income Sources: A detailed list of all income received during the reporting period.

- Expense Categories: Breakdown of expenses into categories such as fixed and variable costs.

- Total Income: The sum of all income sources.

- Total Expenses: The sum of all expenses incurred.

- Net Income: The difference between total income and total expenses, indicating profitability.

Steps to complete the Hawaii Income Expense Statement

Completing the Hawaii Income Expense Statement requires careful attention to detail. Follow these steps for accurate completion:

- Collect all financial records, including income statements and receipts.

- Organize income sources and categorize them appropriately.

- List all expenses, ensuring to categorize them for clarity.

- Calculate total income and total expenses.

- Determine net income by subtracting total expenses from total income.

- Review the statement for accuracy before submission.

Legal use of the Hawaii Income Expense Statement

The Hawaii Income Expense Statement holds legal significance, especially when used for tax purposes or financial disclosures. It must be completed accurately to comply with state and federal regulations. The statement can be requested by financial institutions, tax authorities, or during legal proceedings. Ensuring that this document is filled out correctly not only supports legal compliance but also enhances credibility when seeking financial assistance or negotiating contracts.

Who Issues the Form

The Hawaii Income Expense Statement is typically issued by the state’s tax authority or financial regulatory body. Individuals and businesses may also create their own versions of the statement for internal use or specific financial assessments. It is important to ensure that any version used complies with state guidelines and includes all necessary information for legal and financial purposes.

Quick guide on how to complete hawaii income expense statement

Manage Hawaii Income Expense Statement effortlessly on any device

Web-based document management has become increasingly favored by organizations and individuals. It offers an excellent environmentally friendly substitute to conventional printed and signed papers, as you can easily locate the needed form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents promptly without holdups. Handle Hawaii Income Expense Statement on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven procedure today.

Steps to modify and eSign Hawaii Income Expense Statement with ease

- Find Hawaii Income Expense Statement and click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, arduous form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any preferred device. Modify and eSign Hawaii Income Expense Statement and ensure exceptional communication at any point of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Hawaii income expense statement?

A Hawaii income expense statement is a financial document that provides a detailed breakdown of income and expenses for businesses operating in Hawaii. This statement is essential for tax filing, budgeting, and financial planning. Accurate documentation can help you maximize deductions and comply with local regulations.

-

How can airSlate SignNow assist in creating a Hawaii income expense statement?

airSlate SignNow simplifies the process of creating a Hawaii income expense statement by allowing you to digitize and eSign documents with ease. You can easily upload templates, fill in necessary financial data, and send them securely for signatures. This ensures a fast and efficient workflow for your financial documentation.

-

Is airSlate SignNow cost-effective for generating Hawaii income expense statements?

Yes, airSlate SignNow offers a cost-effective solution for generating Hawaii income expense statements. With various pricing plans tailored to fit different business sizes, you can choose a plan that meets your needs without compromising on features. Investing in this tool can save your business both time and money in document management.

-

What features does airSlate SignNow offer for Hawaii income expense statement management?

airSlate SignNow provides several features for managing Hawaii income expense statements, including customizable templates, secure eSigning, and real-time collaboration. Additionally, the platform allows you to track document statuses, ensuring you’re always informed. These features streamline the creation and management of essential financial documents.

-

Can airSlate SignNow integrate with accounting software for managing Hawaii income expense statements?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting software, making it easier for businesses to manage Hawaii income expense statements. This integration allows for automated data transfer, reducing manual entry errors and increasing efficiency. Connect the tools you already use to enhance your financial workflow.

-

How secure is the information in my Hawaii income expense statement with airSlate SignNow?

airSlate SignNow prioritizes the security of your information, utilizing advanced encryption and secure cloud storage for your Hawaii income expense statements. This ensures that sensitive financial data is protected against unauthorized access. You can confidently manage your documents, knowing your information is safely stored.

-

What are the benefits of using airSlate SignNow for Hawaii income expense statements?

Using airSlate SignNow for your Hawaii income expense statements brings numerous benefits, such as enhanced efficiency, reduced paperwork, and improved compliance. The user-friendly interface and eSigning capabilities facilitate a faster document turnaround. Additionally, you gain access to tools that make financial management easier and more transparent.

Get more for Hawaii Income Expense Statement

Find out other Hawaii Income Expense Statement

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template