Form 5329, Additional Taxes on Qualified Plans Including

What is the Form 5329, Additional Taxes On Qualified Plans

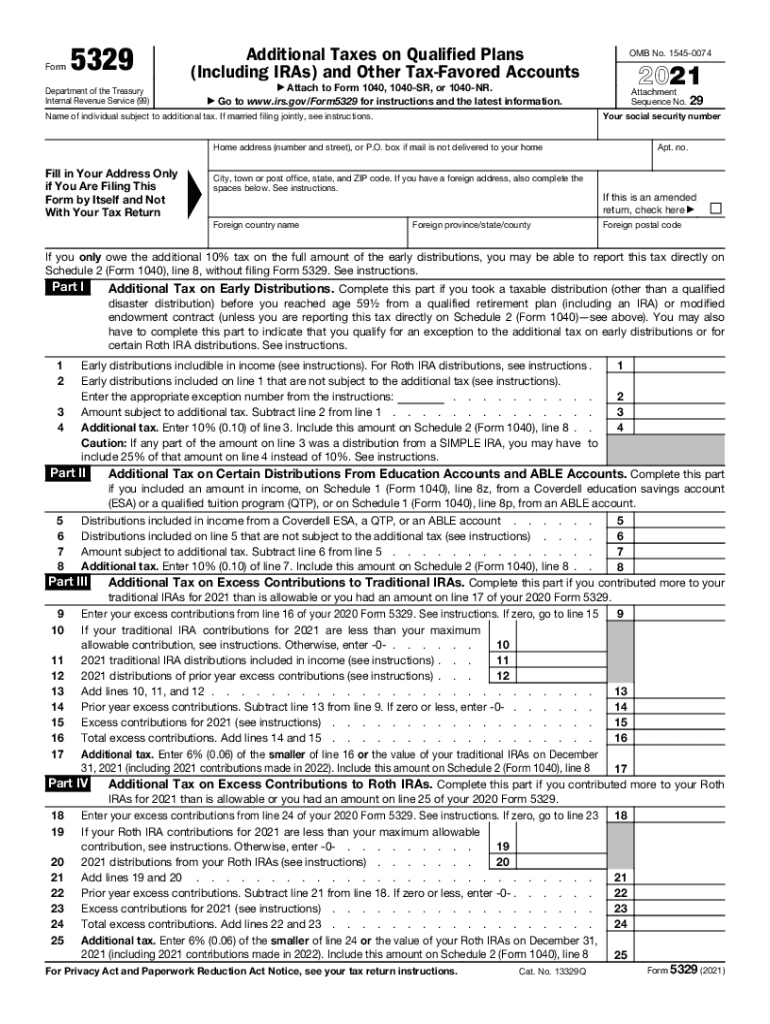

The Form 5329 is a tax document used by individuals to report additional taxes on qualified retirement plans and other tax-favored accounts. This form is particularly relevant for taxpayers who have taken early distributions from their retirement accounts or who have failed to meet required minimum distribution (RMD) rules. The 5329 tax form helps the IRS ensure compliance with tax laws regarding retirement accounts, including IRAs and 401(k)s.

This form is essential for accurately calculating any additional taxes owed, which can include penalties for early withdrawals or missed distributions. Understanding the purpose of the Form 5329 is crucial for taxpayers to avoid unexpected tax liabilities.

How to use the Form 5329, Additional Taxes On Qualified Plans

Using the Form 5329 involves several steps to ensure accurate reporting of additional taxes. First, taxpayers need to determine if they are required to file this form based on their retirement account activity. If you have taken early distributions or failed to take the required minimum distributions, you will need to complete the 5329.

Once you establish the need to file, gather necessary information such as the amounts withdrawn, the type of account, and any exceptions that may apply. The form includes sections to report these details, along with calculations for any penalties. After completing the form, it should be attached to your tax return when filing with the IRS.

Steps to complete the Form 5329, Additional Taxes On Qualified Plans

Completing the Form 5329 requires careful attention to detail. Here are the steps to follow:

- Identify your filing requirement: Determine if you need to file based on early distributions or missed RMDs.

- Gather relevant information: Collect details about your retirement accounts, including distribution amounts and dates.

- Complete the form: Fill out the appropriate sections, including any applicable exceptions to penalties.

- Calculate additional taxes: Use the provided instructions to determine any penalties owed.

- Attach the form: Include the completed Form 5329 with your tax return when submitting to the IRS.

IRS Guidelines for the Form 5329

The IRS provides specific guidelines for completing and filing the Form 5329. These guidelines outline the various scenarios in which the form must be filed, including early withdrawals and missed RMDs. It is essential to refer to the IRS instructions for the 5329 to understand the requirements fully.

Additionally, the IRS specifies the types of exceptions that may apply, which can reduce or eliminate penalties. Familiarizing yourself with these guidelines can help ensure compliance and avoid unnecessary penalties.

Penalties for Non-Compliance with Form 5329

Failure to file the Form 5329 when required can result in significant penalties. The IRS imposes a penalty of ten percent on early distributions from retirement accounts unless an exception applies. Similarly, failing to take required minimum distributions can lead to a penalty of fifty percent on the amount that should have been withdrawn.

These penalties can add up quickly, making it crucial for taxpayers to understand their obligations regarding the Form 5329. Timely and accurate filing can help avoid these costly penalties and ensure compliance with tax regulations.

Eligibility Criteria for Filing Form 5329

Eligibility to file the Form 5329 is determined by specific criteria related to retirement account activity. Taxpayers must file this form if they have taken early distributions from their qualified plans or if they have failed to meet the required minimum distribution rules.

Additionally, certain exceptions may apply that could exempt individuals from penalties, such as disability or substantial medical expenses. Understanding these eligibility criteria is essential for accurately determining the need to file and the potential penalties involved.

Quick guide on how to complete form 5329 additional taxes on qualified plans including

Finalize Form 5329, Additional Taxes On Qualified Plans including effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 5329, Additional Taxes On Qualified Plans including on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Form 5329, Additional Taxes On Qualified Plans including effortlessly

- Find Form 5329, Additional Taxes On Qualified Plans including and click Get Form to commence.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your updates.

- Choose how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about missing or lost documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your needs in document management within a few clicks from any device of your choice. Modify and eSign Form 5329, Additional Taxes On Qualified Plans including and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 5329 additional taxes on qualified plans including

The way to create an e-signature for a PDF file online

The way to create an e-signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The way to make an electronic signature from your mobile device

The best way to generate an e-signature for a PDF file on iOS

The way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is the 2021 Form 5329 and why might I need it?

The 2021 Form 5329 is a tax form used to report additional tax on qualified plans and accounts. Individuals may need this form if they owe additional taxes related to early distributions from IRAs or if they need to calculate excess contributions to retirement accounts. Understanding how to use the 2021 Form 5329 can help you avoid penalties.

-

How can airSlate SignNow assist me with the 2021 Form 5329?

airSlate SignNow provides an easy-to-use platform to electronically sign and send your 2021 Form 5329. With our document management features, you can streamline the process of completing and filing this form, ensuring that all signatures are collected efficiently. Simplifying this workflow can save you time and reduce paperwork errors.

-

What pricing plans does airSlate SignNow offer for handling documents like the 2021 Form 5329?

airSlate SignNow offers multiple pricing plans that cater to different business needs, from basic to advanced options. Each plan allows you to manage documents such as the 2021 Form 5329, with features designed to enhance efficiency while keeping costs low. This means you can choose a plan that fits your budget while ensuring you have all the necessary tools.

-

Are there any integrations available with airSlate SignNow for filing the 2021 Form 5329?

Yes, airSlate SignNow integrates seamlessly with popular software applications that can support your filing needs. These integrations can help you directly access your financial data or other relevant documents while preparing your 2021 Form 5329. Connecting with your existing tools makes the document preparation process even smoother.

-

What features does airSlate SignNow offer to help complete my 2021 Form 5329?

airSlate SignNow offers features such as document templates, electronic signatures, and real-time collaboration to assist you in completing your 2021 Form 5329. These tools make it easy to ensure that your form is accurate and completed on time. Plus, the platform provides secure storage for your sensitive information.

-

Can I use airSlate SignNow to store my completed 2021 Form 5329 securely?

Absolutely! airSlate SignNow provides secure cloud storage for all your documents, including your completed 2021 Form 5329. This ensures that your important tax documents are easily accessible whenever needed while maintaining the privacy and security of your information.

-

Is it easy to share my completed 2021 Form 5329 with my accountant?

Yes, sharing your completed 2021 Form 5329 with your accountant is straightforward with airSlate SignNow. You can send the document via email right from the platform, or share a secure link for viewing and downloading. This ensures your accountant has the latest version of your form conveniently.

Get more for Form 5329, Additional Taxes On Qualified Plans including

- Individual credit application idaho form

- Interrogatories to plaintiff for motor vehicle occurrence idaho form

- Interrogatories to defendant for motor vehicle accident idaho form

- Llc notices resolutions and other operations forms package idaho

- Idaho disclosure form

- Idaho notice form

- Idaho certificate of trust by individual idaho form

- Id trust form

Find out other Form 5329, Additional Taxes On Qualified Plans including

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer