F8606 PDF Form 8606 Nondeductible IRAs Go Department of

What is the F8606 Form 8606 Nondeductible IRAs?

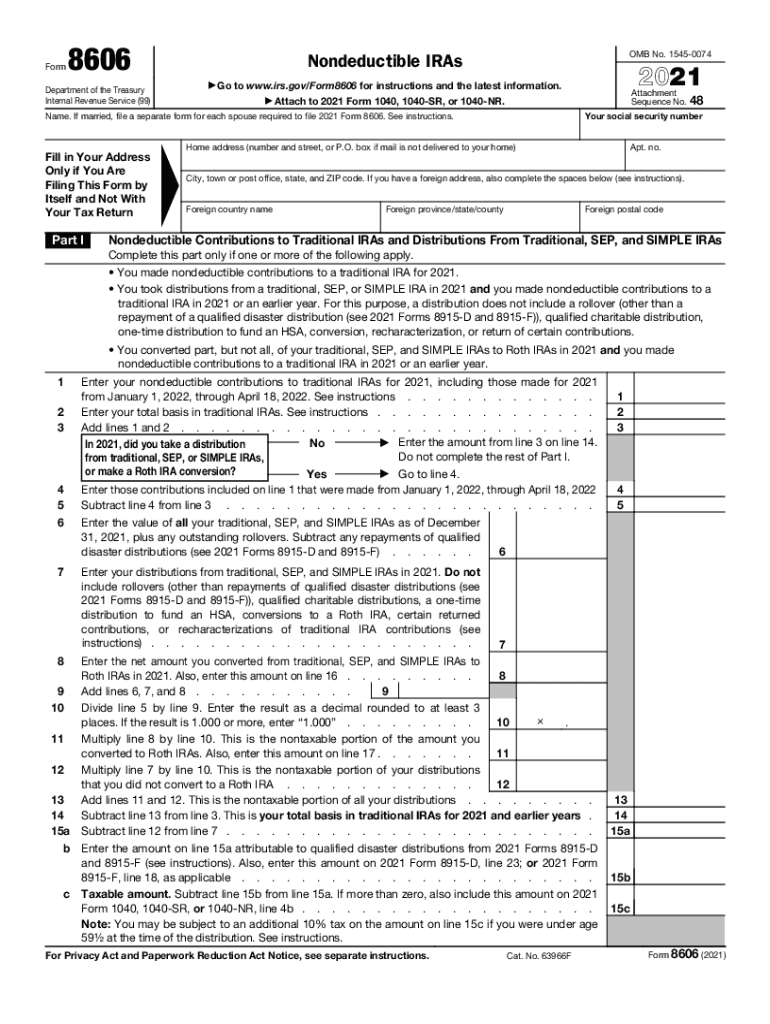

The F8606 Form 8606 is a tax document used to report nondeductible contributions to individual retirement accounts (IRAs) and to track the basis of these contributions. This form is essential for taxpayers who have made contributions to traditional IRAs that are not tax-deductible, as well as for those who have converted traditional IRAs to Roth IRAs. The IRS requires this form to ensure that the non-taxable portion of distributions is accurately reported, preventing double taxation on the same funds.

How to Complete the F8606 Form 8606 Nondeductible IRAs

Completing the F8606 Form 8606 involves several steps. First, gather all necessary information regarding your IRA contributions, including any nondeductible contributions made during the tax year. Next, fill out the form by entering your personal information at the top, followed by details about your contributions. Be sure to accurately report any distributions from your IRAs, as this will affect your tax liability. Finally, review the completed form for accuracy before submitting it with your tax return.

IRS Guidelines for Form 8606

The IRS provides specific guidelines for the use of Form 8606. It is required for any taxpayer who makes nondeductible contributions to a traditional IRA or receives distributions from an IRA that includes nondeductible contributions. Additionally, the form must be filed if you convert a traditional IRA to a Roth IRA. Failure to file this form when required can result in penalties and complications regarding the taxation of distributions. It is important to refer to the latest IRS instructions to ensure compliance with current regulations.

Filing Deadlines for Form 8606

Form 8606 must be filed along with your annual tax return. The typical deadline for filing individual tax returns is April fifteenth of the following year. If you are unable to meet this deadline, you may file for an extension, but be aware that any taxes owed are still due by the original deadline to avoid penalties and interest. It is advisable to complete and submit the form as part of your tax return to ensure accurate reporting of your IRA contributions and distributions.

Required Documents for Form 8606

To complete Form 8606, you will need several documents. These include your tax return for the year, records of any nondeductible contributions made to your traditional IRA, and documentation of any distributions taken from your IRA accounts. It is also helpful to have prior year Form 8606 on hand if applicable, as it can provide context for your current year's contributions and distributions. Keeping organized records will simplify the process of filling out the form.

Penalties for Non-Compliance with Form 8606

Failing to file Form 8606 when required can lead to significant penalties. The IRS imposes a penalty of $50 for each failure to file the form, which can add up if multiple years are involved. Additionally, not reporting nondeductible contributions can result in double taxation on distributions, as the IRS may not recognize the non-taxable portion of your IRA. It is crucial to adhere to filing requirements to avoid these financial consequences.

Quick guide on how to complete f8606pdf form 8606 nondeductible iras go department of

Effortlessly prepare F8606 pdf Form 8606 Nondeductible IRAs Go Department Of on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with everything necessary to create, modify, and electronically sign your documents swiftly without delays. Manage F8606 pdf Form 8606 Nondeductible IRAs Go Department Of on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign F8606 pdf Form 8606 Nondeductible IRAs Go Department Of with ease

- Obtain F8606 pdf Form 8606 Nondeductible IRAs Go Department Of and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize key sections of the documents or conceal sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and hit the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, the hassle of searching for forms, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and electronically sign F8606 pdf Form 8606 Nondeductible IRAs Go Department Of and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the f8606pdf form 8606 nondeductible iras go department of

The way to create an e-signature for your PDF file online

The way to create an e-signature for your PDF file in Google Chrome

The best way to make an e-signature for signing PDFs in Gmail

How to create an e-signature right from your mobile device

The best way to generate an electronic signature for a PDF file on iOS

How to create an e-signature for a PDF on Android devices

People also ask

-

What is the 8606 2021 form and why is it important?

The 8606 2021 form is used to report nondeductible contributions to traditional IRAs and to calculate the taxable portion of distributions. It is essential for individuals who have made contributions that are not tax-deductible, ensuring compliance with IRS regulations and preventing tax penalties.

-

How does airSlate SignNow help with the 8606 2021 form?

airSlate SignNow streamlines the process of filling out the 8606 2021 form by allowing users to easily upload, sign, and send documents electronically. Its user-friendly interface ensures that all necessary information is collected accurately, aiding in avoiding errors during tax filing.

-

What features does airSlate SignNow offer for completing the 8606 2021 form?

airSlate SignNow offers features such as customizable templates, in-app editing, and secure electronic signatures, specifically tailored to simplify the completion of tax forms like the 8606 2021. These tools can save users time and minimize the likelihood of costly mistakes.

-

Is there a cost associated with using airSlate SignNow for the 8606 2021 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans are designed to provide value while enabling seamless processing of documents like the 8606 2021 form at a competitive cost.

-

Can I integrate airSlate SignNow with my accounting software for handling the 8606 2021 form?

Absolutely! airSlate SignNow supports integration with a variety of accounting software, ensuring a smooth workflow for tasks related to the 8606 2021 form. This integration helps streamline document management and improves overall efficiency in tax preparation.

-

What are the benefits of using airSlate SignNow for tax documents like the 8606 2021?

Using airSlate SignNow for tax documents such as the 8606 2021 enhances accuracy, saves time, and improves collaboration. Its electronic signature capabilities allow for quick approvals, reducing delays associated with traditional paper-based methods.

-

How secure is airSlate SignNow when handling sensitive forms like the 8606 2021?

airSlate SignNow prioritizes security with advanced encryption standards and compliance with industry regulations to protect the sensitive information contained in forms such as the 8606 2021. Users can trust that their data remains confidential and secure.

Get more for F8606 pdf Form 8606 Nondeductible IRAs Go Department Of

- Residential rental lease agreement idaho form

- Tenant welcome letter idaho form

- Warning of default on commercial lease idaho form

- Warning of default on residential lease idaho form

- Landlord tenant closing statement to reconcile security deposit idaho form

- Id name change form

- Name change notification form idaho

- Commercial building or space lease idaho form

Find out other F8606 pdf Form 8606 Nondeductible IRAs Go Department Of

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement