Form 4419 Rev 9 Revise Existing Transmitter Control Code TCC

What is the Form 4419 Rev 9

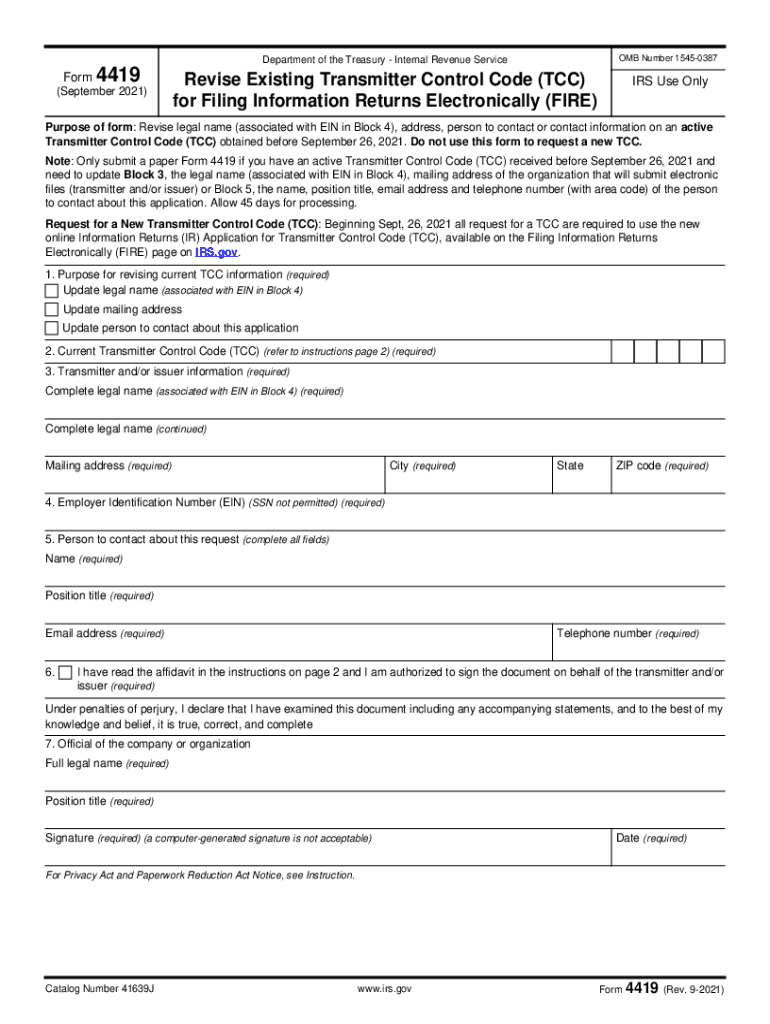

The Form 4419, also known as the Transmitter Control Code (TCC) application, is a crucial document for entities that need to electronically file information returns with the IRS. This form allows businesses to obtain a TCC, which is necessary for submitting forms such as W-2s and 1099s electronically. The Rev 9 version includes updates that reflect the latest IRS requirements and guidelines for electronic filing. Understanding the purpose of this form is essential for compliance and ensuring smooth processing of tax documents.

Steps to complete the Form 4419 Rev 9

Completing the Form 4419 involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your business name, address, and Employer Identification Number (EIN). Next, fill out the form accurately, ensuring that each section is completed as required. Pay special attention to the contact information, as this will be used by the IRS for communication regarding your application. After completing the form, review it for any errors before submitting it electronically or via mail. Following these steps will help facilitate a smooth application process.

How to obtain the Form 4419 Rev 9

The Form 4419 can be obtained directly from the IRS website or through authorized tax software providers. It is important to ensure you are using the most current version, which is Rev 9, to comply with the latest regulations. Once you have the form, you can fill it out electronically, which simplifies the submission process. If you prefer a paper version, you can print it out, complete it by hand, and then submit it via mail. Having the correct form is essential for obtaining your TCC efficiently.

Legal use of the Form 4419 Rev 9

The legal use of the Form 4419 is governed by IRS regulations regarding electronic filing of information returns. When completed accurately, the TCC obtained through this form allows businesses to file their tax documents electronically, which is not only a requirement for many entities but also offers benefits such as faster processing and confirmation of receipt. It is essential to ensure that the information provided is truthful and complete, as inaccuracies can lead to penalties or delays in processing.

Filing Deadlines / Important Dates

Filing deadlines for the Form 4419 are critical for compliance with IRS regulations. Typically, businesses should submit their TCC application well in advance of the filing deadlines for information returns, which usually fall at the end of January for forms like W-2s and 1099s. It is advisable to check the IRS website for specific dates each tax year, as these can vary. Meeting these deadlines ensures that your electronic submissions are processed without delay.

Eligibility Criteria

Eligibility to file the Form 4419 is generally open to all businesses that need to submit information returns electronically. This includes corporations, partnerships, and sole proprietorships. However, entities must have a valid Employer Identification Number (EIN) and should be in good standing with the IRS. Understanding these eligibility criteria is important to ensure that your application is accepted and processed efficiently.

Quick guide on how to complete form 4419 rev 9 2021 revise existing transmitter control code tcc

Complete Form 4419 Rev 9 Revise Existing Transmitter Control Code TCC effortlessly on any device

Online document handling has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage Form 4419 Rev 9 Revise Existing Transmitter Control Code TCC on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to modify and eSign Form 4419 Rev 9 Revise Existing Transmitter Control Code TCC without hassle

- Find Form 4419 Rev 9 Revise Existing Transmitter Control Code TCC and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, laborious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 4419 Rev 9 Revise Existing Transmitter Control Code TCC and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 4419 rev 9 2021 revise existing transmitter control code tcc

The way to create an e-signature for your PDF document online

The way to create an e-signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

How to create an e-signature from your smart phone

The best way to generate an electronic signature for a PDF document on iOS

How to create an e-signature for a PDF file on Android OS

People also ask

-

What is tcc and how does it relate to airSlate SignNow?

Tcc stands for Transactional Communication Collaboration, which is highly relevant for users of airSlate SignNow. It enables businesses to manage the workflow of sending and signing documents efficiently. Using tcc, teams can ensure that all communications regarding document transactions are streamlined.

-

How much does airSlate SignNow cost?

The pricing for airSlate SignNow varies based on the selected plan, offering flexible options designed to fit various business needs. With plans starting at an affordable rate, companies can utilize tcc features without breaking their budget. Be sure to check our website for the latest pricing and promotional offers.

-

What features does airSlate SignNow offer related to tcc?

airSlate SignNow includes features such as customizable workflows, templates, and real-time notifications designed to enhance tcc. These features help teams collaborate effectively, ensuring that all parties are informed during the document signing process. By utilizing these tools, businesses can enhance their transactional communication.

-

How does airSlate SignNow enhance the signing experience?

airSlate SignNow simplifies the signing experience through an intuitive interface and seamless functionality. Users can easily eSign documents from any device, streamlining the tcc process for all involved. This efficiency leads to faster transactions and improved overall satisfaction.

-

What are the benefits of using airSlate SignNow for business contracts?

Using airSlate SignNow for business contracts offers numerous benefits, including increased efficiency and enhanced security. The tcc approach to document management ensures that all transactions are tracked and securely stored, reducing the risk of errors. This allows businesses to focus on their core operations while improving contract turnaround times.

-

Can airSlate SignNow integrate with other applications?

Yes, airSlate SignNow offers extensive integration capabilities with popular apps such as Salesforce, Google Workspace, and more. These integrations bolster the tcc process by allowing seamless communication and document management across platforms. Businesses can enhance their workflow efficiency by utilizing these integrations.

-

Is airSlate SignNow suitable for small businesses?

Absolutely! airSlate SignNow is designed to meet the needs of businesses of all sizes, including small businesses. Its user-friendly interface and cost-effective pricing make it an ideal choice to implement tcc practices, helping small teams manage their signing needs effectively without signNow investment.

Get more for Form 4419 Rev 9 Revise Existing Transmitter Control Code TCC

Find out other Form 4419 Rev 9 Revise Existing Transmitter Control Code TCC

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast