Tax Declaration Form

What is the Tax Declaration Form

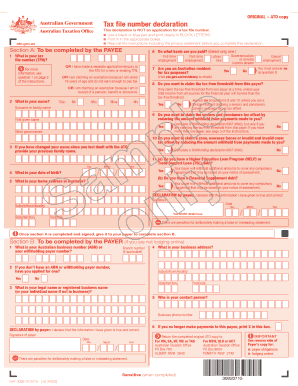

The tax declaration form is an essential document used by individuals and businesses to report their income, expenses, and other relevant financial information to the Internal Revenue Service (IRS). This form serves as a formal declaration of one's tax obligations and is crucial for determining the amount of tax owed or any potential refund. In the United States, various tax declaration forms exist, including the 1040 for individual taxpayers and the W-2 for employees. Each form has specific requirements and is tailored to different taxpayer scenarios.

Steps to Complete the Tax Declaration Form

Completing a tax declaration form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including W-2s, 1099s, and receipts for deductible expenses. Next, choose the appropriate form based on your tax situation. Carefully fill out the form, providing accurate information regarding income, deductions, and credits. After completing the form, review it thoroughly for any errors or omissions. Finally, sign and date the form before submitting it to the IRS by the designated deadline.

Legal Use of the Tax Declaration Form

The legal use of a tax declaration form is governed by IRS regulations and federal tax laws. To be considered valid, the form must be completed accurately and submitted on time. E-signatures are accepted, provided that they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act, ensuring that electronic submissions hold the same legal weight as traditional signatures. It is essential to maintain copies of submitted forms and related documents for record-keeping and potential audits.

Examples of Using the Tax Declaration Form

Tax declaration forms can be utilized in various scenarios, such as individual income tax filings, business tax reporting, and self-employment income declarations. For instance, a self-employed individual may use the IRS Form 1040 along with Schedule C to report business income and expenses. An employee might receive a W-2 form from their employer, which summarizes their earnings and taxes withheld throughout the year. Each example highlights the importance of accurately reporting financial information to meet tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for tax declaration forms are critical to avoid penalties and interest. Generally, individual taxpayers must submit their federal tax returns by April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers can request an extension, allowing them to file by October 15, but any taxes owed must still be paid by the original deadline to avoid penalties. It is important to stay informed about these dates to ensure timely compliance.

Required Documents

When preparing to complete a tax declaration form, several documents are required to support the information provided. Essential documents include W-2 forms from employers, 1099 forms for freelance or contract work, and records of any other income sources. Additionally, receipts for deductible expenses, such as medical costs, mortgage interest, and charitable contributions, should be gathered. Accurate documentation is vital for substantiating claims made on the tax declaration form and for potential audits by the IRS.

Form Submission Methods

Tax declaration forms can be submitted through various methods, including online, by mail, or in person. The IRS offers electronic filing options, which allow taxpayers to submit their forms securely via authorized e-file providers. For those who prefer traditional methods, forms can be printed and mailed to the appropriate IRS address. In-person submissions are also possible at designated IRS offices. Each method has its advantages, and taxpayers should choose the one that best suits their needs and preferences.

Quick guide on how to complete tax declaration form 59155776

Effortlessly prepare Tax Declaration Form on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and electronically sign your documents swiftly and without delays. Manage Tax Declaration Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to edit and electronically sign Tax Declaration Form without hassle

- Obtain Tax Declaration Form and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize signNow sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Choose how you wish to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and electronically sign Tax Declaration Form and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax declaration form 59155776

The best way to create an e-signature for a PDF online

The best way to create an e-signature for a PDF in Google Chrome

The best way to create an e-signature for signing PDFs in Gmail

The way to generate an electronic signature from your smartphone

The way to generate an e-signature for a PDF on iOS

The way to generate an electronic signature for a PDF file on Android

People also ask

-

What is a tax declaration form, and why is it important?

A tax declaration form is a document used to report income, expenses, and other tax-related information to tax authorities. It plays a vital role in ensuring compliance with tax regulations and helps in determining the tax liability of individuals or businesses. Understanding how to properly fill out a tax declaration form can save you time and potential penalties.

-

How does airSlate SignNow simplify the process of filling out a tax declaration form?

airSlate SignNow offers an intuitive platform that allows users to easily create and fill out a tax declaration form electronically. With user-friendly features such as templates, guided prompts, and eSign capabilities, you can efficiently complete your forms and streamline your tax filing process. This not only saves time but also reduces the risk of errors.

-

What are the pricing options for using airSlate SignNow for tax-related documents?

airSlate SignNow provides flexible pricing plans to cater to businesses of all sizes looking to handle tax declaration forms effectively. You can choose from monthly or annual subscriptions with various features included, allowing you to select the plan that best suits your needs. Make sure to check for any promotional discounts that may be available.

-

Are there any specific features of airSlate SignNow tailored for tax declaration forms?

Yes, airSlate SignNow comes with features specifically designed for tax declaration forms, including form templates, automated workflows, and secure eSigning. These features ensure that your documents are completed accurately and submitted on time, providing peace of mind during tax season. Additionally, you can easily track your document's status in real time.

-

Can I integrate airSlate SignNow with my existing accounting software for tax declaration forms?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax software solutions, allowing you to streamline your workflow when preparing tax declaration forms. By integrating these tools, you can easily transfer data and reduce manual entry, enhancing accuracy and efficiency.

-

What benefits does airSlate SignNow offer for businesses handling multiple tax declaration forms?

For businesses managing multiple tax declaration forms, airSlate SignNow provides centralized document management, making it easy to organize and access all necessary paperwork in one place. The platform's collaborative features allow multiple team members to work on forms simultaneously, ensuring that deadlines are met and submissions are accurate. This efficiency can lead to time savings and reduced stress during tax season.

-

Is it safe to use airSlate SignNow for submitting sensitive tax declaration forms?

Yes, airSlate SignNow ensures the highest level of security for all documents, including tax declaration forms. With industry-standard encryption, secure access controls, and compliance with data protection regulations, you can trust that your sensitive information is protected. Our commitment to security helps you feel confident when submitting important tax documents online.

Get more for Tax Declaration Form

- Colorado letter demand 497299850 form

- Letter from tenant to landlord with demand that landlord remove garbage and vermin from premises colorado form

- Letter from tenant to landlord with demand that landlord provide proper outdoor garbage receptacles colorado form

- Letter from tenant to landlord about landlords failure to make repairs colorado form

- Letter landlord repairs form

- Letter from tenant to landlord about landlord using unlawful self help to gain possession colorado form

- Letter from tenant to landlord about illegal entry by landlord colorado form

- Letter from landlord to tenant about time of intent to enter premises colorado form

Find out other Tax Declaration Form

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast