Individual Payroll Record Form

What is the Individual Payroll Record

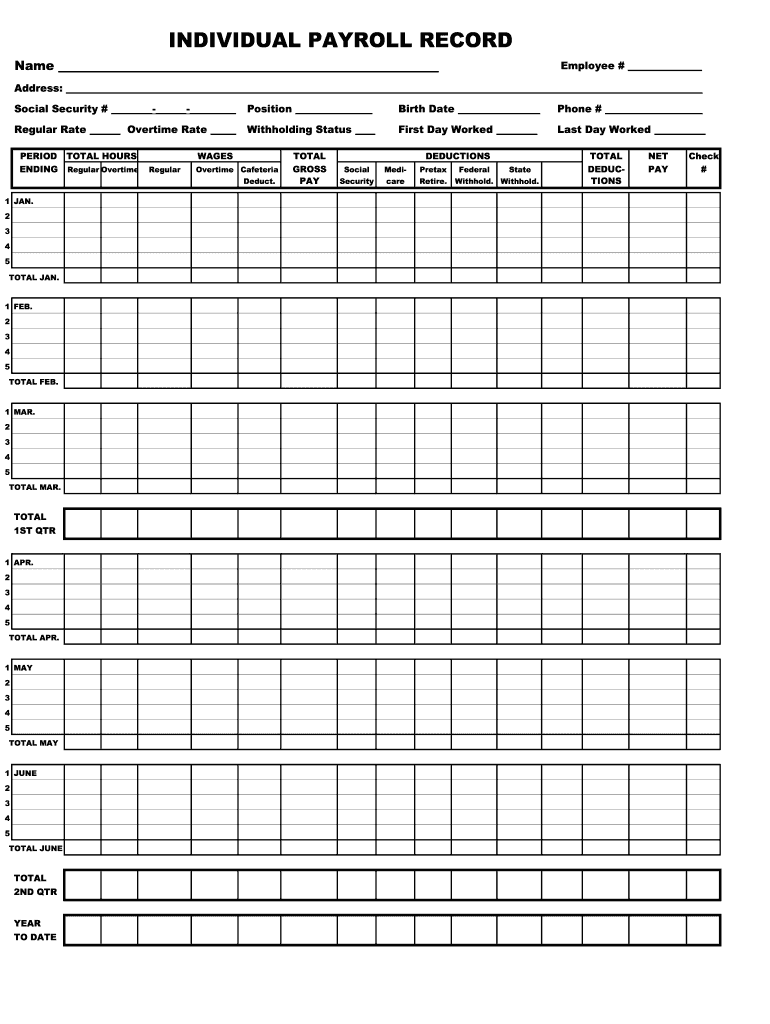

The individual payroll record is a comprehensive document that details an employee's earnings, deductions, and net pay over a specified period. This record serves as an essential tool for both employees and employers, ensuring accurate tracking of compensation and compliance with tax regulations. It typically includes information such as the employee's name, Social Security number, pay period dates, gross pay, withholdings for federal and state taxes, and any other deductions like health insurance or retirement contributions. Understanding the components of this record is crucial for maintaining accurate payroll practices.

How to Use the Individual Payroll Record

Using the individual payroll record effectively involves several steps. First, employers should ensure that all payroll data is accurately entered into the record, reflecting the correct hours worked, pay rates, and deductions. Employees can use this record to verify their earnings and ensure that all deductions are appropriate. It is advisable for employees to keep a copy of their payroll records for personal reference and to assist in tax preparation. Regularly reviewing this document can help identify any discrepancies that may need to be addressed with the payroll department.

Steps to Complete the Individual Payroll Record

Completing the individual payroll record requires careful attention to detail. Here are the steps involved:

- Gather necessary employee information, including name, Social Security number, and employment details.

- Record the pay period dates to ensure accurate tracking of earnings.

- Calculate gross pay based on hours worked and pay rates.

- Deduct federal and state taxes, along with any additional withholdings.

- Calculate net pay by subtracting total deductions from gross pay.

- Review the completed record for accuracy before distribution.

Legal Use of the Individual Payroll Record

The individual payroll record must be maintained in compliance with federal and state labor laws. This includes ensuring that the record accurately reflects all earnings and deductions, as inaccuracies can lead to legal issues or penalties. Employers are required to keep payroll records for a specific duration, typically at least three years, to comply with the Fair Labor Standards Act (FLSA). Proper documentation is vital for audits and can provide protection against potential disputes regarding employee compensation.

Key Elements of the Individual Payroll Record

Understanding the key elements of the individual payroll record is essential for both employers and employees. The main components include:

- Employee Information: Name, Social Security number, and job title.

- Pay Period: Start and end dates of the pay period.

- Hours Worked: Total hours worked during the pay period.

- Gross Pay: Total earnings before deductions.

- Deductions: Itemized list of all deductions including taxes and benefits.

- Net Pay: Amount received by the employee after deductions.

Examples of Using the Individual Payroll Record

There are various scenarios in which the individual payroll record can be utilized. For instance, employees may refer to their payroll records when preparing their taxes to ensure that all income and deductions are accurately reported. Employers might use these records during audits to demonstrate compliance with labor laws. Additionally, if an employee disputes their pay, the payroll record serves as a critical piece of evidence to resolve the issue. Keeping accurate payroll records is essential for maintaining trust and transparency in the employer-employee relationship.

Quick guide on how to complete individual payroll record

Complete Individual Payroll Record effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers a great eco-friendly substitute for traditional printed and signed papers, as you can locate the appropriate form and safely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Handle Individual Payroll Record on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Individual Payroll Record with ease

- Obtain Individual Payroll Record and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important parts of your documents or obscure sensitive information with tools provided specifically for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets all your needs in document management with just a few clicks from a device of your choice. Modify and eSign Individual Payroll Record and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the individual payroll record

The way to create an e-signature for your PDF document online

The way to create an e-signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to create an e-signature from your smart phone

The best way to generate an electronic signature for a PDF document on iOS

The best way to create an e-signature for a PDF file on Android OS

People also ask

-

What is a payroll record form, and why is it important?

A payroll record form is a critical document used to track employee earnings, taxes, and deductions. It helps businesses maintain accurate financial records and ensures compliance with tax regulations. Using a payroll record form simplifies payroll processing and enhances organization in employee records.

-

How can airSlate SignNow help with payroll record forms?

airSlate SignNow offers a user-friendly platform to create, send, and eSign payroll record forms seamlessly. Our solution streamlines the workflow for managing payroll documents, making it easier for HR departments to keep records up-to-date. This not only saves time but also minimizes the risk of errors in record-keeping.

-

Is there a free trial available for using airSlate SignNow for payroll record forms?

Yes, airSlate SignNow provides a free trial that allows you to explore the features and capabilities related to payroll record forms. This trial is an excellent way to assess how our platform can meet your specific payroll needs without any financial commitment. Sign up today to experience the benefits firsthand!

-

What features does airSlate SignNow offer for payroll record forms?

airSlate SignNow includes multiple features for payroll record forms, such as customizable templates, eSignature capabilities, and automated alerts. You can easily track the status of your documents and receive notifications when they are signed. These features greatly enhance the efficiency of managing payroll records.

-

Are payroll record forms secure when using airSlate SignNow?

Absolutely! Security is a top priority for airSlate SignNow. All payroll record forms are protected with advanced encryption and compliance measures, ensuring that sensitive employee information is secure during transmission and storage. You can confidently manage payroll records without worrying about data bsignNowes.

-

Can airSlate SignNow integrate with accounting software for payroll record forms?

Yes, airSlate SignNow offers integrations with popular accounting software that can streamline the process of managing payroll record forms. These integrations facilitate automatic updates and data transfer between platforms, simplifying payroll management. This connectivity helps you maintain accurate and up-to-date records.

-

What are the pricing options for using airSlate SignNow for payroll record forms?

airSlate SignNow offers flexible pricing plans that cater to various business sizes and needs related to payroll record forms. You can choose from several tiers, each designed to provide scalable features to fit your budget. Explore our pricing page for more details on the best plan for your payroll needs.

Get more for Individual Payroll Record

- Revocation of durable power of attorney for health care indiana form

- Aging parent package indiana form

- Sale of a business package indiana form

- Legal documents for the guardian of a minor package indiana form

- New state resident package indiana form

- Declaration of mental health care treatment indiana form

- Commercial property sales package indiana form

- Revocation of declaration of mental health care treatment indiana form

Find out other Individual Payroll Record

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word

- How Can I Send Sign Word

- Send Sign Document Online

- Send Sign Document Computer

- Send Sign Document Myself

- Send Sign Document Secure

- Send Sign Document iOS

- Send Sign Document iPad

- How To Send Sign Document

- Fax Sign PDF Online