Form 8995Department of the Treasury Internal Revenue Serv

What is the Form 8995?

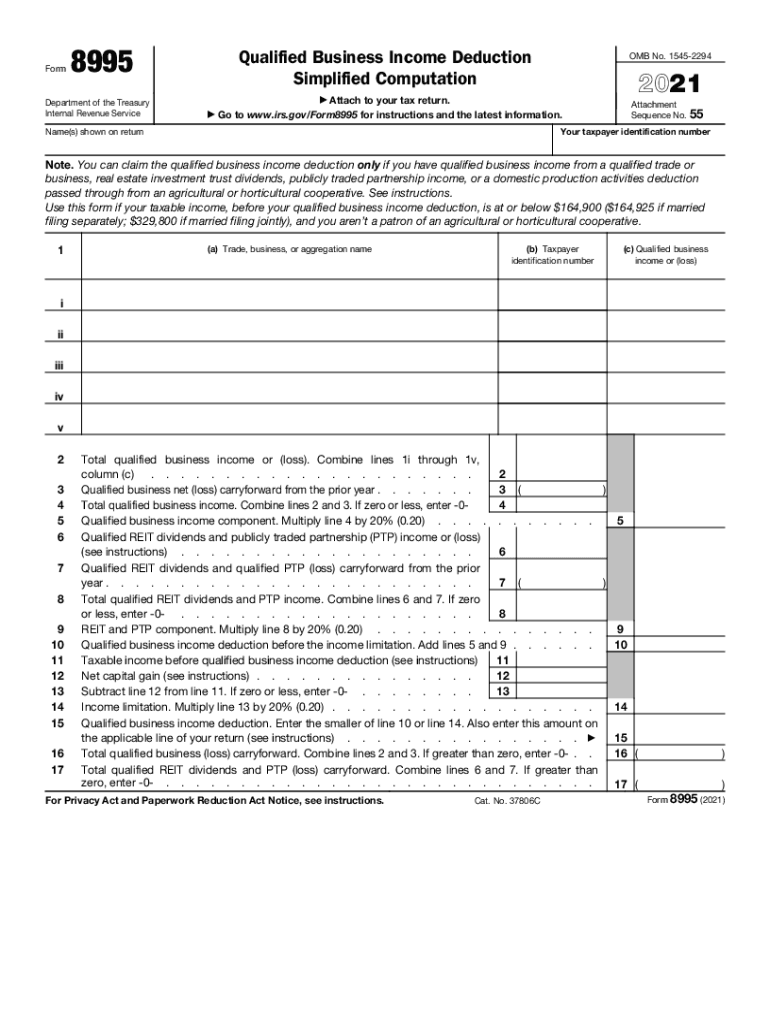

The Form 8995 is a tax form used by individuals and businesses to claim the Qualified Business Income (QBI) deduction. This deduction allows eligible taxpayers to reduce their taxable income by a percentage of their qualified business income. The form is part of the Internal Revenue Service (IRS) guidelines and is specifically designed for taxpayers who meet certain criteria, including those operating as sole proprietors, partnerships, or S corporations. By using this form, taxpayers can simplify the process of calculating their QBI deduction, making it easier to take advantage of this tax benefit.

How to obtain the Form 8995

To obtain the Form 8995, taxpayers can visit the official IRS website, where the form is available for download in PDF format. The IRS provides the form along with instructions, which detail how to fill it out correctly. Additionally, taxpayers can request a physical copy of the form by contacting the IRS directly or by visiting local IRS offices. It is important to ensure that you are using the correct version of the form for the tax year, as updates may occur annually.

Steps to complete the Form 8995

Completing the Form 8995 involves several key steps:

- Begin by entering your personal information, including your name and Social Security number.

- Calculate your qualified business income by determining the total income from your business activities.

- Apply any necessary adjustments to your income, such as deductions or losses, to arrive at your QBI.

- Calculate the QBI deduction by applying the appropriate percentage to your qualified business income.

- Transfer the calculated deduction to your main tax return, typically Form 1040.

It is advisable to refer to the IRS instructions for detailed guidance on each step to ensure accuracy and compliance.

Legal use of the Form 8995

The legal use of the Form 8995 is governed by IRS regulations. Taxpayers must ensure that they meet the eligibility criteria for claiming the QBI deduction, as improper use of the form can lead to penalties or audits. The form must be filled out accurately and submitted with the taxpayer's annual tax return. It is essential to maintain proper documentation to support the claims made on the form, as the IRS may request this information during an audit.

Eligibility Criteria

To be eligible to use the Form 8995, taxpayers must meet specific criteria:

- Taxpayers must have qualified business income from a qualified trade or business.

- The taxpayer's taxable income must be below certain thresholds, which may vary each tax year.

- Taxpayers engaged in specified service trades or businesses may face additional limitations based on income levels.

It is important to review the IRS guidelines to confirm eligibility before completing the form.

Filing Deadlines / Important Dates

The filing deadline for the Form 8995 typically aligns with the annual tax return deadline, which is usually April 15 for individual taxpayers. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. Taxpayers should also be aware of any extensions they may file and the corresponding deadlines. Staying informed about these dates is crucial to avoid late filing penalties.

Quick guide on how to complete form 8995department of the treasury internal revenue serv

Accomplish Form 8995Department Of The Treasury Internal Revenue Serv effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed materials, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Handle Form 8995Department Of The Treasury Internal Revenue Serv on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

How to edit and electronically sign Form 8995Department Of The Treasury Internal Revenue Serv easily

- Obtain Form 8995Department Of The Treasury Internal Revenue Serv and then click Get Form to commence.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to store your changes.

- Select how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tiring form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Form 8995Department Of The Treasury Internal Revenue Serv and ensure effective communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8995department of the treasury internal revenue serv

How to create an e-signature for a PDF document in the online mode

How to create an e-signature for a PDF document in Chrome

The best way to generate an e-signature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your mobile device

How to generate an e-signature for a PDF document on iOS devices

The way to create an electronic signature for a PDF document on Android devices

People also ask

-

What is form 8995 2021 and who needs to use it?

Form 8995 2021 is a tax form used to calculate the Qualified Business Income Deduction for eligible taxpayers. Businesses and self-employed individuals with qualifying income should use this form to ensure they maximize their deductions and reduce their tax liabilities.

-

How can airSlate SignNow help with using form 8995 2021?

airSlate SignNow allows you to streamline the process of sending and signing documents related to your form 8995 2021. With our platform, you can easily collect signatures, manage your form submissions, and ensure compliance with tax regulations in a secure and efficient manner.

-

Is there a cost associated with using airSlate SignNow for form 8995 2021?

Yes, airSlate SignNow offers several pricing plans to cater to different business needs. These plans provide cost-effective solutions for managing documents, including those related to form 8995 2021, ensuring that you receive the best value for your eSigning needs.

-

What features does airSlate SignNow offer for document management related to form 8995 2021?

airSlate SignNow offers features such as customizable templates, secure cloud storage, and real-time tracking to facilitate document management for form 8995 2021. Additionally, our platform includes options for bulk sending documents and automated reminders for signers to enhance your workflow.

-

Can I integrate airSlate SignNow with other tools when managing form 8995 2021?

Absolutely! airSlate SignNow integrates seamlessly with numerous third-party applications, enabling you to manage your workflows related to form 8995 2021 effectively. Whether you're using accounting software or project management tools, our integrations ensure a smooth flow of information.

-

What are the benefits of using airSlate SignNow for submitting form 8995 2021?

Using airSlate SignNow provides signNow benefits for submitting form 8995 2021, including enhanced security, reduced turnaround time, and improved collaboration. Our easy-to-use platform not only simplifies the signing process but also increases efficiency, allowing you to focus on your business.

-

Is it safe to use airSlate SignNow for sensitive documents like form 8995 2021?

Yes, airSlate SignNow prioritizes security and compliance, utilizing industry-standard encryption protocols to protect your sensitive information such as form 8995 2021. Our solution is designed to keep your documents secure while ensuring that your eSigning experience is trustworthy and reliable.

Get more for Form 8995Department Of The Treasury Internal Revenue Serv

- Ky landlord tenant 497307951 form

- Kentucky keep form

- Ky failure 497307953 form

- Letter from landlord to tenant as notice to tenant of tenants disturbance of neighbors peaceful enjoyment to remedy or lease 497307954 form

- Letter tenant notice template form

- Plaintiff medical history kentucky kentucky form

- Kentucky about law form

- Kentucky ordinance form

Find out other Form 8995Department Of The Treasury Internal Revenue Serv

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe