Border States Uniform Sale for Resale Certificate 2003-2026

What is the Border States Uniform Sale for Resale Certificate

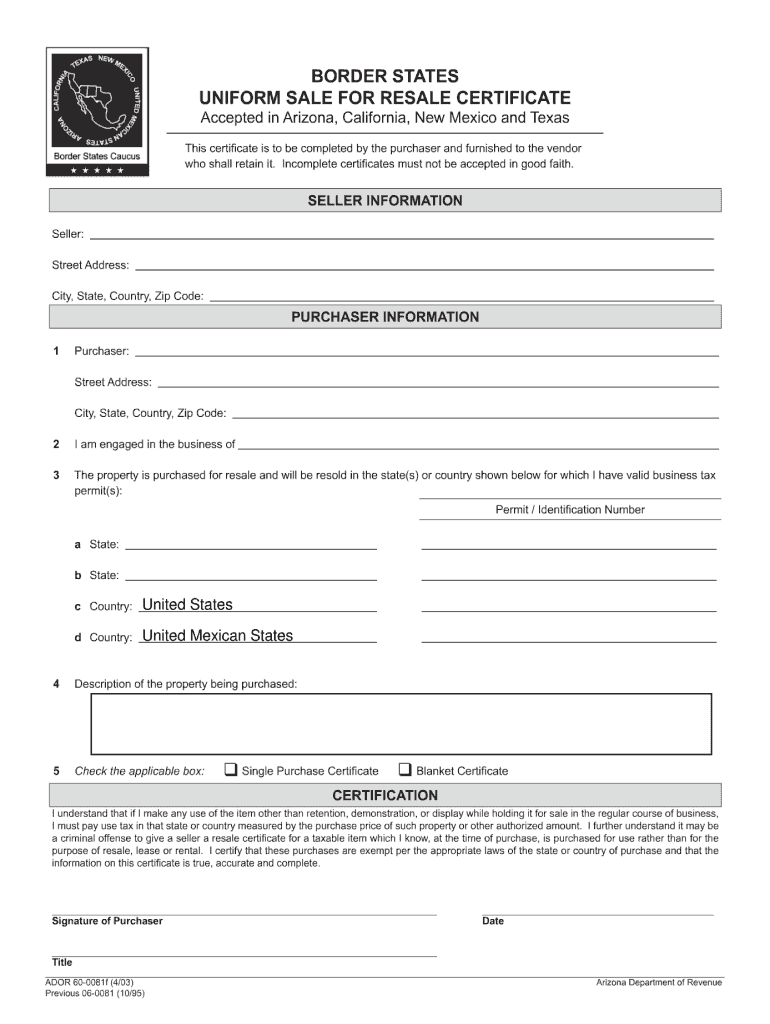

The Border States Uniform Sale for Resale Certificate is a legal document that allows businesses to purchase goods without paying sales tax, provided those goods are intended for resale. This certificate is recognized across several states, streamlining the resale process for businesses operating in border regions. By using this certificate, businesses can ensure compliance with state tax regulations while minimizing costs associated with sales tax on inventory purchases.

How to Use the Border States Uniform Sale for Resale Certificate

To effectively use the Border States Uniform Sale for Resale Certificate, businesses must present the certificate to their suppliers at the time of purchase. The supplier will retain the certificate for their records, ensuring that sales tax is not applied to the transaction. It is essential for businesses to keep a copy of the certificate for their own records as well, as it may be required for tax audits or compliance checks.

Steps to Complete the Border States Uniform Sale for Resale Certificate

Completing the Border States Uniform Sale for Resale Certificate involves several key steps:

- Obtain the official form from your state’s tax authority or a trusted source.

- Fill in your business information, including the name, address, and tax identification number.

- Specify the type of goods being purchased for resale.

- Sign and date the certificate to validate it.

Ensure that all information is accurate to avoid any issues during transactions or audits.

Legal Use of the Border States Uniform Sale for Resale Certificate

The legal use of the Border States Uniform Sale for Resale Certificate is governed by state tax laws. Businesses must ensure that they only use the certificate for purchases intended for resale. Misuse of the certificate, such as using it for personal purchases or items not intended for resale, can lead to penalties, including fines and back taxes owed to the state.

Key Elements of the Border States Uniform Sale for Resale Certificate

Key elements of the Border States Uniform Sale for Resale Certificate include:

- Business Identification: The name and address of the business using the certificate.

- Tax Identification Number: The unique number assigned to the business for tax purposes.

- Description of Goods: A clear description of the items being purchased for resale.

- Signature: The authorized signature of the business representative.

These elements ensure the certificate is valid and can be used effectively during transactions.

State-Specific Rules for the Border States Uniform Sale for Resale Certificate

Each state may have specific rules governing the use of the Border States Uniform Sale for Resale Certificate. It is important for businesses to familiarize themselves with the regulations in their respective states, including any requirements for renewal or specific documentation that may be needed. Compliance with these state-specific rules helps businesses avoid legal issues and ensures smooth operations.

Quick guide on how to complete border states uniform sale for resale certificate

Manage Border States Uniform Sale For Resale Certificate anytime, anywhere

Your daily business operations may require additional focus when handling state-specific forms. Regain your office hours and minimize the expenses linked to document-driven processes with airSlate SignNow. airSlate SignNow offers you an extensive range of pre-built business forms, including Border States Uniform Sale For Resale Certificate, which you can utilize and share with your associates. Manage your Border States Uniform Sale For Resale Certificate seamlessly with robust editing and eSignature features, delivering it right to your recipients.

How to obtain Border States Uniform Sale For Resale Certificate in a few clicks:

- Choose a form pertinent to your state.

- Simply click Learn More to open the document and verify its accuracy.

- Click on Get Form to begin managing it.

- Border States Uniform Sale For Resale Certificate will instantly open in the editor. No further actions are needed.

- Utilize airSlate SignNow’s advanced editing features to complete or modify the form.

- Locate the Sign tool to create your signature and eSign your document.

- When you're ready, click on Done, save changes, and access your document.

- Distribute the form via email or text, or use a link-to-fill option with your partners or allow them to download the file.

airSlate SignNow signNowly reduces your time spent managing Border States Uniform Sale For Resale Certificate and allows you to find necessary documents in one location. A comprehensive library of forms is organized and designed to address essential business operations needed for your company. The sophisticated editor minimizes error potential, enabling you to easily correct mistakes and review your documents on any device before sending them out. Begin your free trial today to explore all the advantages of airSlate SignNow for daily business workflows.

Create this form in 5 minutes or less

FAQs

-

When employees work in a different state than they live, do they need to fill out state withholding certificates for both states?

Ohio borders on 5 states (MI, IN, KY, WV, PA). With each state there is an agreement that provides cross border employees are only taxed in one state. This makes it simpler for both employees and employers.I don’t know that this is true with all states but if Ohio and Michigan can get along on this, the other states have no excuse.

-

How can I create an online certificate for membership? I want to send a link for members to just fill out and download.

ClassMarker will enable you to do exactly what you are wanting to achieve.With ClassMarker, you can create fully customized certificates.Options include:Portrait & Landscape CertificatesA4 & Letter sizesMultiple Font styles and sizesDrag and Drop Text and ImagesAdd extra Text fields and ImagesSelect different date display formatsAbility to create wallet sized certificatesYou can also now have Unique IDs, Serial Numbers, Course numbers and more included on your ClassMarker Certificates.If you choose for users to add their names, you can select for these to be automatically added to their certificates.Creating customized certificatesTo do as you have mentioned, you could create questionnaires/forms that you are wanting users to fill out (this can be done with a variety of different question types). You can ask for information such as name and/or email and additional ‘extra information’ questions that you can choose to make mandatory. If you like, you can choose to include these on the certificates as well.You will also be able to choose what your users see when they have finished completing their questionnaire. You can choose to not show any questions and answers but instead some customized feedback to thank your users for taking the time to fill out your questionnaire and any additional details you require, along with redirecting them elsewhere.Users will then click on the ‘certificate download’ button on their results page on-screen and/or have the results emailed to them which will also include the certificate download link so that they can download their certificate at a time that is convenient for them!You had mentioned you want to send a link to members - you can do this in ClassMarker by assigning your questionnaire to a link, in which you can then embed this directly into a page on your website or email them the link.You can check out ClassMarker’s video demo here:Online Testing Video Demonstrations

-

If an online retailer doesn't expect to come close to meeting the minimum sales threshold in a state (i.e. $100,000+), is there any reason it should obtain a resale certificate from that state, or any state for that matter?

Yes, after working with Amazon as a seller and having to get like 16 different sales tax licences from all of the states that they have their warehouses in, I found that in online retail a business owner is expected to have all of their tax licenses set up within the first month of business regardless of the amount sold. If your selling in their state you need to have a sales tax license.I would imagine if you're selling less than the threshold it's a good idea to call the local tax office and ask them about the threshold. With questions like “When do I need a resale certificate in the state of such and such for a online retail business?” or “Why does the state have a threshold, and what does it mean exactly?”.Although, this is my opinion as I am not a CPA, so what I say is not legal advice it's just me expressing my opinion based on experience.Hope this gives you some ideas and sends you down the right path.

-

I am 2015 passed out CSE student, I am preparing for GATE2016 from a coaching, due to some reasons I do not have my provisional certificate, am I still eligible to fill application form? How?

Yes you are eligible. There is still time, application closes on October 1 this year. So if you get the provisional certificate in time you can just wait or if you know that you won't get it in time, just mail GATE organising institute at helpdesk@gate.iisc.ernet.in mentioning your problem. Hope it helps.

-

How do I fill out the N-600 certificate of citizenship application if you already received a US passport from the state department and returned your Greencard as the questions seem to assume one is still on immigrant status?

In order to file N-600 to apply for a Certificate of Citizenship, you must already be a US citizen beforehand. (The same is true to apply for a US passport — you must already be a US citizen beforehand.) Whether you applied for a passport already is irrelevant; it is normal for a US citizen to apply for a US passport; applying for a passport never affects your immigration status, as you must already have been a US citizen before you applied for a passport.The form’s questions are indeed worded poorly. Just interpret the question to be asking about your status before you became a citizen, because otherwise the question would make no sense, as an applicant of N-600 must already be a US citizen at the time of filing the application.(By the way, why are you wasting more than a thousand dollars to apply for a Certificate of Citizenship anyway? It basically doesn’t serve any proof of citizenship purposes that a US passport doesn’t already serve as.)

Create this form in 5 minutes!

How to create an eSignature for the border states uniform sale for resale certificate

How to create an electronic signature for the Border States Uniform Sale For Resale Certificate in the online mode

How to generate an electronic signature for the Border States Uniform Sale For Resale Certificate in Google Chrome

How to generate an eSignature for signing the Border States Uniform Sale For Resale Certificate in Gmail

How to generate an electronic signature for the Border States Uniform Sale For Resale Certificate straight from your smartphone

How to generate an electronic signature for the Border States Uniform Sale For Resale Certificate on iOS

How to make an eSignature for the Border States Uniform Sale For Resale Certificate on Android

People also ask

-

What is a border states uniform sale for resale certificate?

A border states uniform sale for resale certificate is a legal document that allows businesses to purchase goods without paying sales tax, as long as those goods are intended for resale. This certificate is essential for sellers to comply with tax regulations while optimizing their purchasing strategies for border state transactions.

-

How do I apply for a border states uniform sale for resale certificate?

To apply for a border states uniform sale for resale certificate, businesses typically need to fill out a specific application form and provide relevant documentation that proves their resale status and tax-exempt activity. The application process may vary by state, so always check the local regulations to ensure compliance.

-

Are there fees associated with obtaining a border states uniform sale for resale certificate?

In most cases, there are no direct fees for obtaining a border states uniform sale for resale certificate. However, certain states may impose administrative fees, so it's important to verify with your local tax authority. Overall, having this certificate can help businesses save considerably on resale purchases.

-

What are the benefits of using a border states uniform sale for resale certificate?

The primary benefit of using a border states uniform sale for resale certificate is the ability to make tax-exempt purchases on items meant for resale, which can signNowly lower costs. Additionally, it enhances compliance with local tax laws, providing peace of mind while conducting business across state lines.

-

Can a border states uniform sale for resale certificate be used for online purchases?

Yes, a border states uniform sale for resale certificate can generally be used for online purchases, provided the seller accepts it as valid documentation. It's crucial to confirm with the online vendor if they require specific procedures to submit the certificate during the transaction process.

-

What documents should be kept on file when using a border states uniform sale for resale certificate?

When using a border states uniform sale for resale certificate, businesses should keep copies of the certificate itself, invoices related to the purchases made with the certificate, and any correspondence or confirmations from vendors regarding the tax-exempt status. This documentation is vital for being audit-ready and ensuring compliance with tax regulations.

-

How does airSlate SignNow facilitate the management of border states uniform sale for resale certificates?

airSlate SignNow provides a user-friendly platform to easily create, send, and eSign documents, including border states uniform sale for resale certificates. This cost-effective solution offers streamlined workflows that help businesses manage their documentation efficiently, ensuring compliance while saving time in the process.

Get more for Border States Uniform Sale For Resale Certificate

Find out other Border States Uniform Sale For Resale Certificate

- Sign South Carolina Insurance Lease Agreement Template Computer

- Sign Missouri Legal Last Will And Testament Online

- Sign Montana Legal Resignation Letter Easy

- How Do I Sign Montana Legal IOU

- How Do I Sign Montana Legal Quitclaim Deed

- Sign Missouri Legal Separation Agreement Myself

- How Do I Sign Nevada Legal Contract

- Sign New Jersey Legal Memorandum Of Understanding Online

- How To Sign New Jersey Legal Stock Certificate

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online