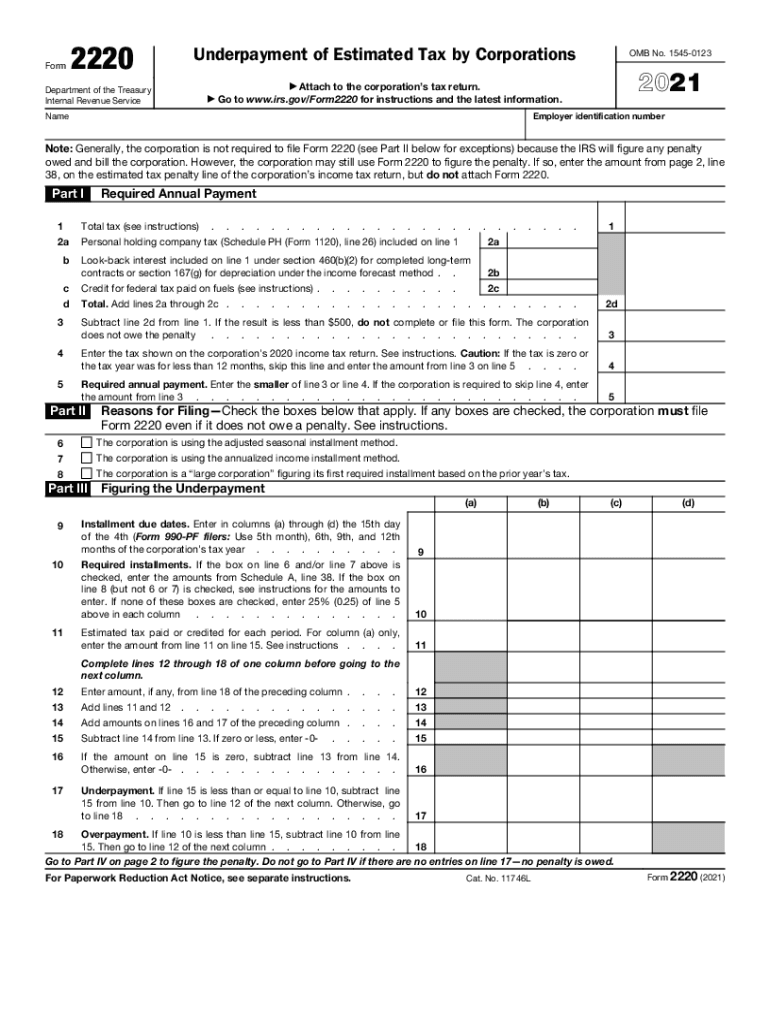

Instructions for Form 2220 Internal Revenue Service2020 Instructions for Form 2220 IRS Tax FormsInstructions for Form 2220 Inter

Understanding IRS Form 2210 Instructions for 2021

IRS Form 2210 is used to determine if you owe a penalty for underpaying your estimated tax. The instructions for this form provide detailed guidance on how to calculate your tax liability and assess whether you meet the safe harbor provisions that may exempt you from penalties. Familiarizing yourself with these instructions is crucial for accurate tax reporting and compliance.

Steps to Complete IRS Form 2210

Completing IRS Form 2210 involves several key steps:

- Gather your financial documents, including income statements and previous tax returns.

- Calculate your total tax liability for the year.

- Determine your total payments made through withholding and estimated tax payments.

- Use the worksheet provided in the instructions to calculate any potential underpayment penalty.

- Review the safe harbor provisions to see if you qualify for an exemption.

- Complete the form accurately, ensuring all calculations are correct.

Filing Deadlines and Important Dates

It is essential to be aware of the filing deadlines associated with IRS Form 2210 to avoid penalties. Generally, the form should be filed with your annual tax return by the tax deadline, which is typically April 15. If you are unable to file by this date, consider applying for an extension, but remember that any taxes owed are still due by the original deadline.

Required Documents for IRS Form 2210

When filling out IRS Form 2210, you will need several documents to ensure accuracy:

- Your previous year's tax return for reference.

- Income statements such as W-2s or 1099s.

- Records of estimated tax payments made throughout the year.

- Any other relevant financial documents that reflect your income and tax situation.

Penalties for Non-Compliance

Failing to file IRS Form 2210 when required can result in significant penalties. The IRS may impose an underpayment penalty if you do not meet the required payment thresholds. This penalty is calculated based on the amount of underpayment and the period of time the payment was late. Understanding these penalties can help you avoid unnecessary costs.

Digital vs. Paper Version of IRS Form 2210

Filing IRS Form 2210 can be done digitally or via paper. The digital version allows for easier calculations and faster submission. Many tax software programs can assist in completing the form electronically, ensuring compliance with the latest IRS regulations. The paper version requires careful manual calculations and mailing, which can delay processing.

Quick guide on how to complete instructions for form 2220 2020internal revenue service2020 instructions for form 2220 irs tax formsinstructions for form 2220

Complete Instructions For Form 2220 Internal Revenue Service2020 Instructions For Form 2220 IRS Tax FormsInstructions For Form 2220 Inter effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the features required to create, edit, and electronically sign your documents swiftly and without delay. Manage Instructions For Form 2220 Internal Revenue Service2020 Instructions For Form 2220 IRS Tax FormsInstructions For Form 2220 Inter on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and electronically sign Instructions For Form 2220 Internal Revenue Service2020 Instructions For Form 2220 IRS Tax FormsInstructions For Form 2220 Inter with ease

- Find Instructions For Form 2220 Internal Revenue Service2020 Instructions For Form 2220 IRS Tax FormsInstructions For Form 2220 Inter and click on Get Form to begin.

- Make use of the tools we offer to finalize your document.

- Emphasize relevant sections of the documents or obscure sensitive details using tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to store your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Instructions For Form 2220 Internal Revenue Service2020 Instructions For Form 2220 IRS Tax FormsInstructions For Form 2220 Inter and maintain effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 2220 2020internal revenue service2020 instructions for form 2220 irs tax formsinstructions for form 2220

How to make an e-signature for your PDF document in the online mode

How to make an e-signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature straight from your mobile device

The best way to make an electronic signature for a PDF document on iOS devices

How to create an electronic signature for a PDF document on Android devices

People also ask

-

What is the IRS Form 2210 for 2021?

The IRS Form 2210 for 2021 is used to determine if you owe a penalty for underpayment of estimated tax. It helps taxpayers calculate whether they paid enough tax throughout the year to avoid penalties. Understanding this form is crucial for managing your tax responsibilities effectively.

-

How can airSlate SignNow assist with IRS Form 2210 for 2021?

airSlate SignNow helps streamline the signing process for IRS Form 2210 for 2021 by providing an intuitive eSigning platform. With its easy-to-use features, you can quickly send, sign, and manage documents related to your tax forms. This saves you time and ensures compliance with IRS requirements.

-

What are the pricing options for using airSlate SignNow with IRS Form 2210 for 2021?

airSlate SignNow offers various pricing plans tailored to meet different business needs when dealing with IRS Form 2210 for 2021. You can choose from basic to advanced plans, ensuring you get the features that fit your requirements without overspending. Explore our website for detailed pricing information.

-

What features does airSlate SignNow offer for managing IRS Form 2210 for 2021?

airSlate SignNow provides features like secure eSigning, document templates, and automated reminders to simplify the management of IRS Form 2210 for 2021. These tools enhance efficiency, allowing you to focus on your business while ensuring that your tax forms are handled properly and securely.

-

Is airSlate SignNow compliant with IRS regulations for documents like Form 2210 for 2021?

Yes, airSlate SignNow is fully compliant with IRS regulations, ensuring that documents such as IRS Form 2210 for 2021 are processed securely and legally. Our platform uses encryption and strong authentication methods to protect sensitive information, providing peace of mind while you manage your tax documents.

-

Can airSlate SignNow integrate with other tools for filing IRS Form 2210 for 2021?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software, making it easier to manage IRS Form 2210 for 2021 and related documents. These integrations streamline your workflow, allowing seamless data transfer and reducing the chances of manual errors.

-

What are the benefits of using airSlate SignNow for IRS Form 2210 for 2021?

Using airSlate SignNow for IRS Form 2210 for 2021 offers numerous benefits, including time-saving features, enhanced security, and easy access from any device. The ability to manage and sign your tax documents electronically means you can handle your responsibilities efficiently without being tied to paper documents.

Get more for Instructions For Form 2220 Internal Revenue Service2020 Instructions For Form 2220 IRS Tax FormsInstructions For Form 2220 Inter

- Single member limited liability company llc operating agreement louisiana form

- Liability company form

- Louisiana notice contract form

- Quitclaim deed from individual to husband and wife louisiana form

- Warranty deed from individual to husband and wife louisiana form

- Louisiana estate form

- Quitclaim deed from corporation to husband and wife louisiana form

- Warranty deed from corporation to husband and wife louisiana form

Find out other Instructions For Form 2220 Internal Revenue Service2020 Instructions For Form 2220 IRS Tax FormsInstructions For Form 2220 Inter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document