Claim for New York City School Tax Credit (NYC-210) Form

What is the Claim for New York City School Tax Credit (NYC-210)

The Claim for New York City School Tax Credit, commonly referred to as NYC-210, is a tax form that allows eligible residents to claim a credit for school taxes paid on their property. This credit is designed to provide financial relief to taxpayers who own or rent property in New York City, helping to offset the cost of local education funding. The NYC-210 form is particularly beneficial for those who may not qualify for other tax credits, ensuring that all taxpayers have access to potential savings.

Steps to complete the Claim for New York City School Tax Credit (NYC-210)

Completing the NYC-210 form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including proof of residency and any relevant tax payment records. Next, fill out the form with accurate personal information, including your name, address, and Social Security number. Be sure to calculate the amount of school tax paid and enter it in the designated section. Finally, review the completed form for any errors before submitting it to the appropriate tax authority.

Eligibility Criteria

To qualify for the NYC-210 tax credit, applicants must meet specific eligibility criteria. Primarily, the claimant must be a resident of New York City and have paid school taxes on their property. Additionally, the income level may impact eligibility, as certain income thresholds must be met to qualify for the credit. It is essential to review the latest guidelines from the New York City Department of Finance to confirm eligibility before applying.

Filing Deadlines / Important Dates

Filing deadlines for the NYC-210 form are crucial for taxpayers to keep in mind. Typically, the form must be submitted by a specific date each year, often aligned with the annual tax filing deadline. It is advisable to check the New York City Department of Finance website for the most current dates and any changes that may occur. Missing the deadline could result in the loss of potential tax credits, so timely submission is essential.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the NYC-210 form. The form can be filed online through the New York City Department of Finance's website, providing a convenient and efficient method for many. Alternatively, individuals can choose to mail the completed form to the designated tax office or submit it in person at a local office. Each submission method has its own guidelines, so it is important to follow the instructions carefully to ensure proper processing.

Key elements of the Claim for New York City School Tax Credit (NYC-210)

The NYC-210 form consists of several key elements that taxpayers must understand. These include personal identification information, details about the property for which the credit is claimed, and the calculation of the school taxes paid. Additionally, the form requires the claimant to provide any supporting documentation that verifies eligibility and tax payments. Understanding these elements is vital for successful completion and submission of the form.

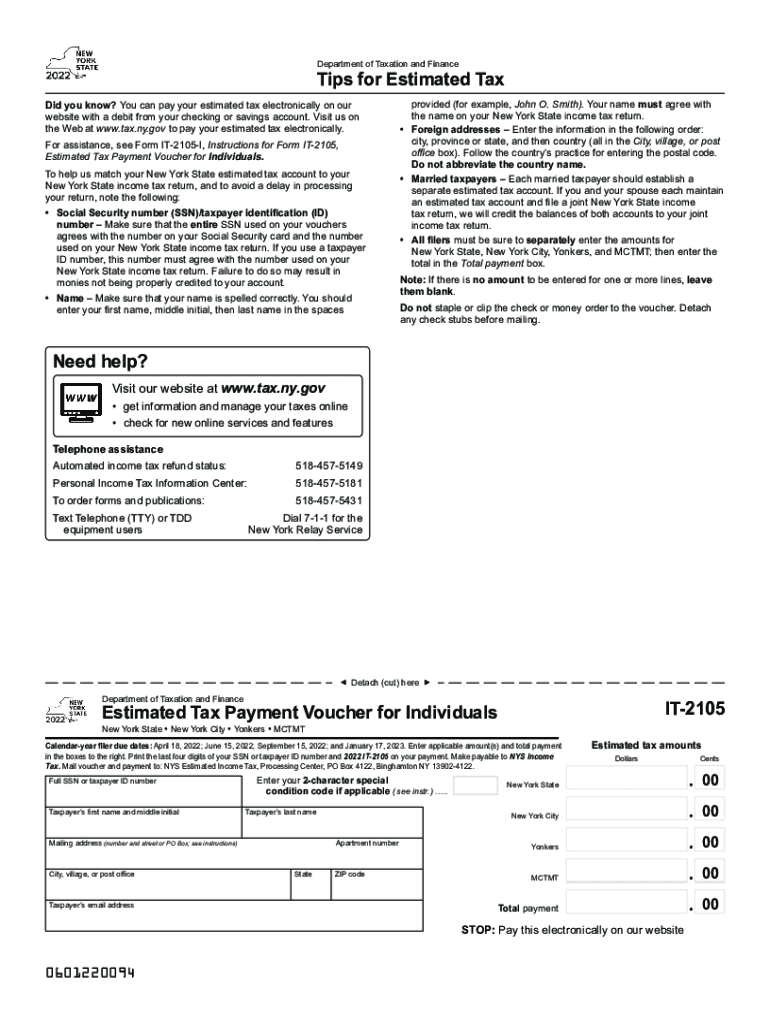

Quick guide on how to complete tips for estimated tax department of taxation and finance

Complete Claim for New York City School Tax Credit (NYC-210) effortlessly on any device

Digital document management has become increasingly popular among both businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to access the correct form and safely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without delays. Handle Claim for New York City School Tax Credit (NYC-210) on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

How to modify and eSign Claim for New York City School Tax Credit (NYC-210) seamlessly

- Obtain Claim for New York City School Tax Credit (NYC-210) and then click Get Form to begin.

- Utilize the features we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or errors that necessitate creating new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Adjust and eSign Claim for New York City School Tax Credit (NYC-210) to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tips for estimated tax department of taxation and finance

The best way to generate an electronic signature for your PDF document online

The best way to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

How to make an electronic signature straight from your smart phone

The way to make an electronic signature for a PDF document on iOS

How to make an electronic signature for a PDF document on Android OS

People also ask

-

What is the significance of 2105 2022 for airSlate SignNow users?

The 2105 2022 update provided several new features for airSlate SignNow users, enhancing document management and eSignature capabilities. This update focused on improving user experience, security, and integration options, making it a cost-effective solution for modern business needs. Staying updated with these changes can greatly benefit organizations looking to optimize their workflow.

-

How does airSlate SignNow pricing compare to other eSignature solutions regarding 2105 2022?

In 2105 2022, airSlate SignNow maintained a competitive pricing model that is often more affordable than many other eSignature solutions. Our flexible pricing tiers cater to various business sizes, ensuring that companies can find a plan that suits their budget without compromising on features. This cost-effectiveness is a core advantage of choosing airSlate SignNow.

-

What features were introduced in the 2105 2022 update?

The 2105 2022 update included new features such as advanced collaboration tools, enhanced templates, and improved integration capabilities. These additions make it easier for teams to work together seamlessly and streamline document workflows. Users can benefit from more customization options to fit their specific business needs.

-

What benefits does airSlate SignNow offer for businesses in 2105 2022?

In 2105 2022, airSlate SignNow offers numerous benefits including increased efficiency, time savings, and enhanced security for document signing. The ability to easily send and eSign documents reduces administrative burden and accelerates business processes. Additionally, features like audit trails provide peace of mind and compliance support.

-

Can airSlate SignNow integrate with other software in 2105 2022?

Yes, airSlate SignNow allows integration with various software platforms as of 2105 2022. This integration capability ensures that users can connect their existing tools with the eSignature solution, streamlining processes across different applications. Popular integrations include CRM systems and cloud storage services, enhancing overall productivity.

-

Is airSlate SignNow suitable for small businesses, especially in 2105 2022?

Absolutely! In 2105 2022, airSlate SignNow is designed to be an ideal solution for small businesses looking for a user-friendly eSigning platform. Our competitive pricing and robust features make it accessible for smaller teams, providing the means to simplify document workflows without substantial investment.

-

How secure is airSlate SignNow in the context of 2105 2022?

Security is a top priority for airSlate SignNow, and in 2105 2022, we have implemented advanced security measures to protect sensitive documents. Features like end-to-end encryption and secure authentication processes ensure that your data remains safe throughout the signing process. Users can trust that their information is handled with the utmost care.

Get more for Claim for New York City School Tax Credit (NYC-210)

- Louisiana petition adoption form

- Supplemental petition edit form

- Reconventional divorce form

- Louisiana interrogatories 497308648 form

- Interrogatories sample make form

- Answers interrogatories form 497308650

- Answers to original first amended and supplemental petition and reconventional demand divorce louisiana form

- La appeal form

Find out other Claim for New York City School Tax Credit (NYC-210)

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template