California Nonresident State Tax Return Form

What is the California Nonresident State Tax Return Form

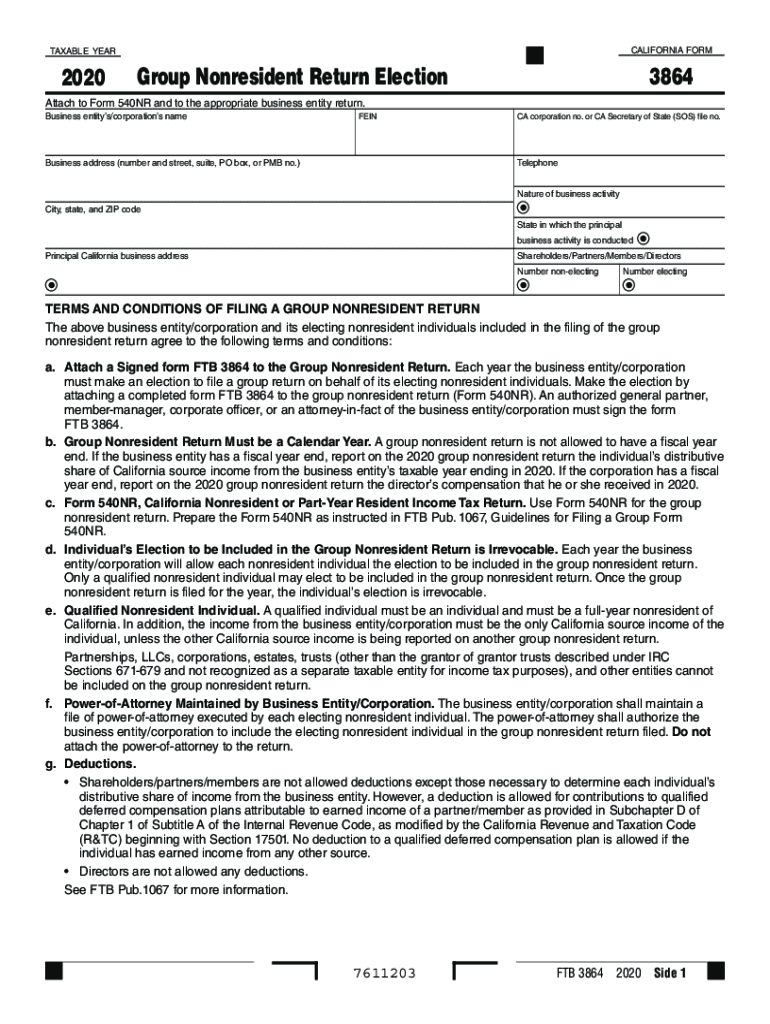

The California Nonresident State Tax Return Form, commonly referred to as the CA 3864, is designed for individuals or entities that earn income in California but are not residents of the state. This form allows nonresidents to report their California-sourced income and calculate their tax liability accordingly. It is essential for ensuring compliance with California tax laws and for accurately determining the amount of tax owed to the state.

How to use the California Nonresident State Tax Return Form

Using the CA 3864 involves gathering all necessary financial information related to your income earned in California. This includes wages, rental income, and any other sources of income that are subject to California tax. Once you have collected this information, you can fill out the form, detailing your income and any applicable deductions. It is crucial to follow the instructions carefully to ensure accurate reporting and compliance with state regulations.

Steps to complete the California Nonresident State Tax Return Form

Completing the CA 3864 involves several key steps:

- Gather all relevant income documents, including W-2s and 1099s.

- Determine your total California-sourced income.

- Fill out the form, providing personal information and income details.

- Calculate your tax liability based on the income reported.

- Review the form for accuracy before submission.

Following these steps will help ensure that your form is completed correctly and submitted on time.

Legal use of the California Nonresident State Tax Return Form

The CA 3864 is legally recognized for reporting income and calculating taxes owed to the state of California. To ensure that your submission is compliant with state laws, it is important to use the most current version of the form and adhere to all filing requirements. This includes providing accurate information and submitting the form by the designated deadlines. Failure to comply with these regulations may result in penalties or additional tax liabilities.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the CA 3864. Typically, the deadline for submitting the California Nonresident State Tax Return Form aligns with the federal tax return deadline, which is usually April 15th. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check the California Franchise Tax Board's website for the most current information regarding deadlines.

Required Documents

When filing the CA 3864, certain documents are required to support your income claims and deductions. These may include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Documentation of any rental income

- Records of any applicable deductions or credits

Having these documents ready will facilitate a smoother filing process and help ensure accuracy.

Quick guide on how to complete california nonresident state tax return form

Effortlessly Create California Nonresident State Tax Return Form on Any Device

The management of online documents has become increasingly favored by both companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the proper format and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents swiftly without any hold-ups. Manage California Nonresident State Tax Return Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The simplest way to modify and eSign California Nonresident State Tax Return Form effortlessly

- Obtain California Nonresident State Tax Return Form and click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize important sections of the documents or obscure confidential details with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which only takes a few moments and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes necessitating the printing of new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Modify and eSign California Nonresident State Tax Return Form and ensure excellent communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the california nonresident state tax return form

The best way to generate an e-signature for your PDF online

The best way to generate an e-signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The best way to create an e-signature straight from your smartphone

How to create an electronic signature for a PDF on iOS

The best way to create an e-signature for a PDF document on Android

People also ask

-

What is CA 3864 and how does it relate to airSlate SignNow?

CA 3864 refers to the specific compliance and functionality standards for electronic signatures. airSlate SignNow fully adheres to these regulations, ensuring that your documents are legally binding and secure. By leveraging CA 3864, businesses can confidently streamline their signing processes.

-

How does airSlate SignNow pricing work for CA 3864 users?

airSlate SignNow offers flexible pricing plans that cater to various business needs, even for those focusing on CA 3864 compliance. You can choose from monthly or annual subscriptions, with options that suit different features required for maintaining CA 3864 standards. This makes it a cost-effective solution for businesses of all sizes.

-

What features does airSlate SignNow offer to comply with CA 3864?

airSlate SignNow provides a range of features that support CA 3864 compliance, including advanced security protocols, customizable workflows, and mobile access. These tools ensure that your eSigning process remains efficient while staying compliant with necessary regulations associated with CA 3864. Thus, your documents are not only signed but also protected.

-

Can airSlate SignNow integrate with other tools to support CA 3864 compliance?

Yes, airSlate SignNow seamlessly integrates with various business applications to enhance your compliance with CA 3864. It can connect with CRMs, cloud storage solutions, and productivity tools to streamline your workflow. These integrations ensure that all your signing processes are efficient and compliant with CA 3864 standards.

-

What benefits can I expect from using airSlate SignNow for CA 3864?

Using airSlate SignNow for CA 3864 provides multiple benefits, including reduced turnaround times on document signing and improved efficiency in managing your paperwork. The platform enhances user experience by simplifying the electronic signature process while ensuring compliance. Additionally, this can help reduce costs associated with traditional paper signing methods.

-

Is airSlate SignNow suitable for small businesses focused on CA 3864?

Absolutely! airSlate SignNow is designed to support businesses of all sizes, including small companies that prioritize CA 3864 compliance. With its user-friendly interface and scalable pricing options, small businesses can effectively manage electronic signatures while staying compliant without breaking the bank.

-

What customer support does airSlate SignNow provide for CA 3864 users?

airSlate SignNow offers robust customer support for all users, including those utilizing CA 3864. You can access support through various channels, including live chat, email, and an extensive knowledge base. This ensures that you can resolve any issues or queries regarding CA 3864 compliance swiftly and effectively.

Get more for California Nonresident State Tax Return Form

- Motion continuance louisiana form

- Motion for continuance due to illness of attorney louisiana form

- Continuance form

- Motion continuance pdf form

- Motion for continuance of motion to reconsider sentence and order louisiana form

- Motion to continue due to attorney being out of town and order louisiana form

- Motion continue 497308715 form

- Louisiana motion hearing form

Find out other California Nonresident State Tax Return Form

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online