Department of Taxation and Finance Certificate of Form

What is the Department of Taxation and Finance Certificate Of?

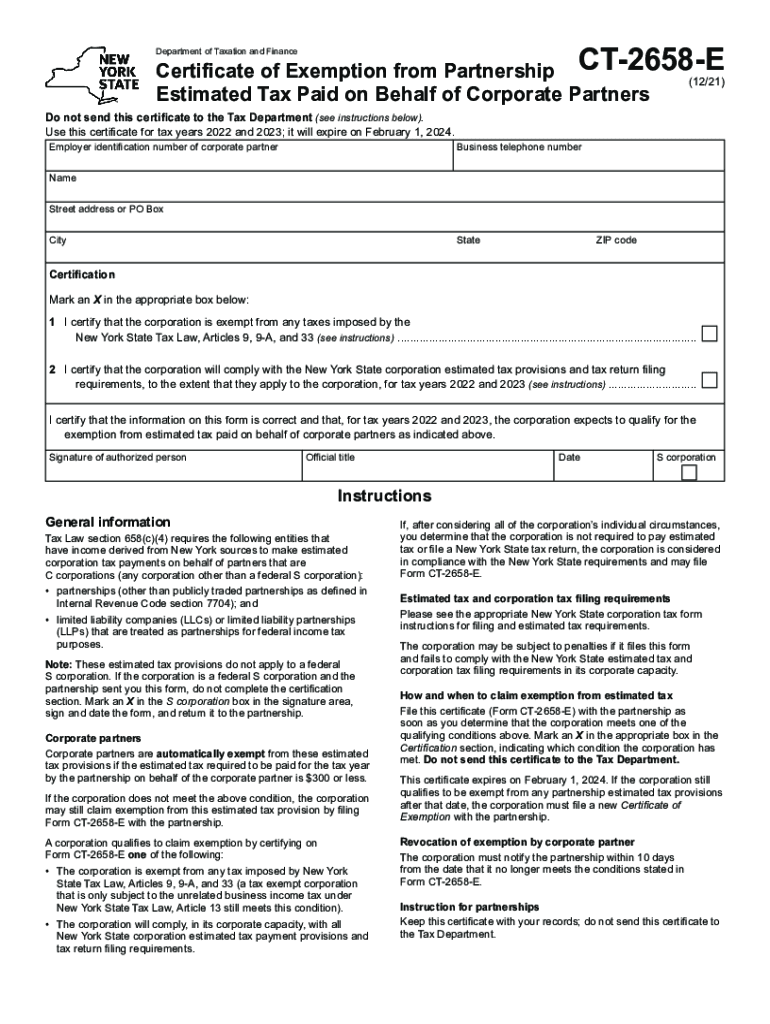

The Department of Taxation and Finance Certificate Of is a crucial document used in various tax-related processes. This certificate serves as proof of tax exemption for certain entities, such as non-profit organizations or government agencies. It is essential for businesses that qualify for tax exemptions to ensure compliance with state regulations. The certificate outlines the specific tax exemptions applicable to the entity and is often required when making purchases or applying for various tax benefits.

Key Elements of the Department of Taxation and Finance Certificate Of

Understanding the key elements of the Department of Taxation and Finance Certificate Of is vital for accurate completion. The certificate typically includes:

- Entity Information: Name, address, and type of organization.

- Tax Identification Number: The unique number assigned to the entity for tax purposes.

- Exemption Details: Specific taxes from which the entity is exempt.

- Signature: Authorized signature of the individual completing the certificate.

These elements ensure that the certificate is valid and can be used effectively in transactions requiring tax exemption.

Steps to Complete the Department of Taxation and Finance Certificate Of

Completing the Department of Taxation and Finance Certificate Of involves several straightforward steps:

- Gather Required Information: Collect all necessary details about the entity, including its tax identification number and exemption status.

- Fill Out the Certificate: Accurately complete each section of the certificate, ensuring all information is correct.

- Review for Accuracy: Double-check all entries to avoid errors that could lead to complications.

- Obtain Signature: Ensure that the certificate is signed by an authorized representative of the entity.

- Submit the Certificate: Provide the completed certificate to the relevant parties, such as vendors or tax authorities.

Following these steps will help ensure that the certificate is completed correctly and is ready for use.

Legal Use of the Department of Taxation and Finance Certificate Of

The legal use of the Department of Taxation and Finance Certificate Of is essential for maintaining compliance with tax laws. This certificate must be presented when making tax-exempt purchases or when applying for certain tax benefits. It is legally binding and can be subject to audits, so it is important to ensure that the information provided is accurate and truthful. Misuse of the certificate can lead to penalties and legal repercussions.

Filing Deadlines / Important Dates

Being aware of filing deadlines related to the Department of Taxation and Finance Certificate Of is crucial for compliance. While the certificate itself does not typically have a specific filing deadline, it is important to submit it timely when required by vendors or tax authorities. Additionally, businesses should be aware of annual tax filing deadlines to ensure that all tax-related documents, including the certificate, are up to date.

Who Issues the Form

The Department of Taxation and Finance is responsible for issuing the Certificate Of. This state agency oversees tax regulations and ensures that entities comply with tax laws. Businesses seeking the certificate must apply through the appropriate channels within the department to obtain their tax exemption status officially.

Eligibility Criteria

Eligibility for the Department of Taxation and Finance Certificate Of varies based on the type of entity. Generally, non-profit organizations, government agencies, and certain educational institutions may qualify for tax exemptions. To be eligible, entities must demonstrate their status and provide necessary documentation supporting their exemption claims. It is advisable to consult the Department of Taxation and Finance for specific eligibility requirements applicable to each entity type.

Quick guide on how to complete department of taxation and finance certificate of

Complete Department Of Taxation And Finance Certificate Of effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Administer Department Of Taxation And Finance Certificate Of on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused activity today.

The easiest way to modify and eSign Department Of Taxation And Finance Certificate Of without hassle

- Locate Department Of Taxation And Finance Certificate Of and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight key sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Craft your eSignature using the Sign tool, which takes seconds and carries the same legal weight as a conventional wet signature.

- Review the details and then click the Done button to save your modifications.

- Choose how you would like to share your form, by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow manages all your document management needs with just a few clicks from a device of your preference. Adjust and eSign Department Of Taxation And Finance Certificate Of and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the department of taxation and finance certificate of

The best way to make an e-signature for a PDF online

The best way to make an e-signature for a PDF in Google Chrome

The way to create an e-signature for signing PDFs in Gmail

The best way to generate an e-signature straight from your smartphone

How to make an e-signature for a PDF on iOS

The best way to generate an e-signature for a PDF document on Android

People also ask

-

What is the 2658 e template and how can it benefit my business?

The 2658 e template is a customizable document template designed to streamline your eSigning processes. By using this template, businesses can save time and increase efficiency by standardizing document workflows. It allows for quick adjustments and ensures that all necessary fields are properly filled out.

-

How much does the 2658 e template cost?

The pricing for the 2658 e template can vary depending on the subscription plan you choose with airSlate SignNow. Typically, they offer flexible pricing tiers based on the number of users and features included. It’s best to visit their pricing page to see the most current offerings and find a plan that suits your needs.

-

Can I customize the 2658 e template for different use cases?

Yes, the 2658 e template is highly customizable to fit various use cases. Users can modify fields, add branding elements, and tailor the content to meet specific business requirements. This ensures that the template aligns with your unique operational needs.

-

What features does the 2658 e template offer?

The 2658 e template includes features like easy document editing, real-time collaboration, and secure eSigning capabilities. Additionally, it supports automated workflows and integrates with other tools, making it a comprehensive solution for managing document processes effectively.

-

Is the 2658 e template secure for sensitive information?

Absolutely! The 2658 e template utilizes advanced security measures, including encryption and secure access controls, to protect sensitive information. airSlate SignNow is compliant with industry regulations, ensuring your documents remain confidential and secure during the eSigning process.

-

Can the 2658 e template integrate with other software?

Yes, the 2658 e template seamlessly integrates with various third-party applications and software. This allows you to enhance your existing workflows by connecting tools like CRM systems, cloud storage, and productivity apps. Integration helps centralize your document management processes.

-

How can I get support while using the 2658 e template?

Support for the 2658 e template is readily available through airSlate SignNow's customer service channels. Users can access resources such as tutorials, FAQs, and live chat support to get assistance with any issues or questions they may have while using the template.

Get more for Department Of Taxation And Finance Certificate Of

- Judgment for temporary custody to plaintiff louisiana form

- Judgment of divorce with no children no community property louisiana form

- Judgment of divorce with community property no children louisiana form

- Louisiana community property form

- Judgment of divorce with community property with children restraining orders louisiana form

- Motion traverse form

- Judgment default form

- La child support 497308860 form

Find out other Department Of Taxation And Finance Certificate Of

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service