Instructions for Form NYC 202 Unincorporated Business Tax

What is the Instructions For Form NYC 202 Unincorporated Business Tax

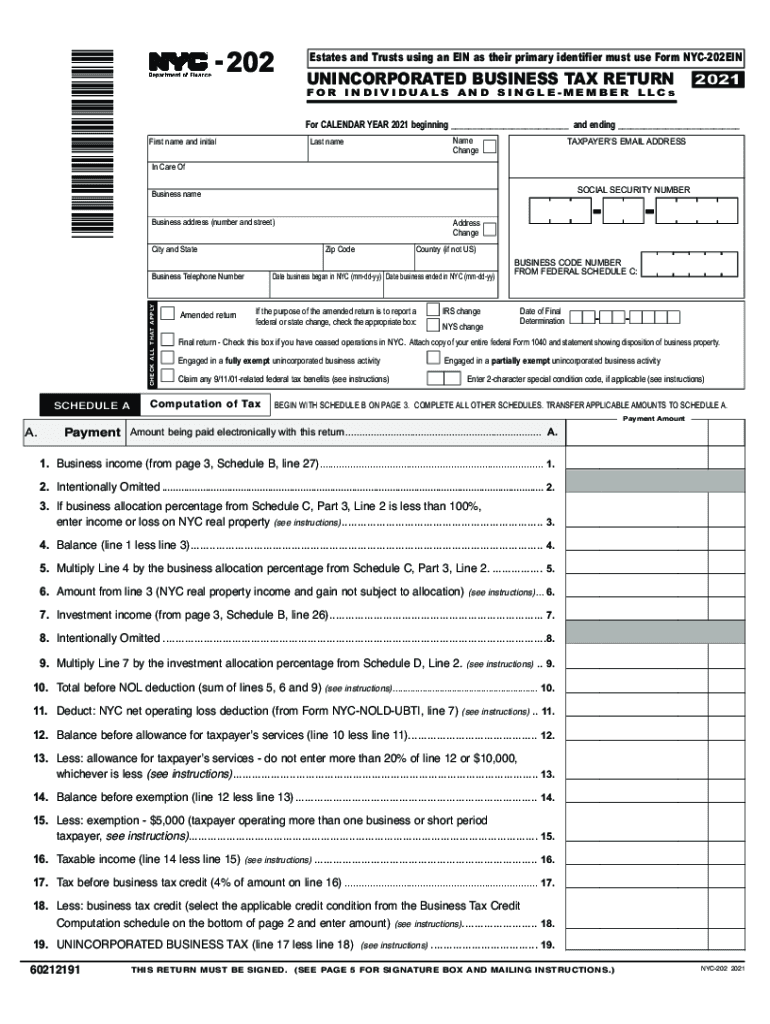

The Instructions for Form NYC 202 provide essential guidelines for businesses operating as unincorporated entities in New York City. This form is specifically designed for reporting income, expenses, and tax liabilities associated with unincorporated business activities. It is crucial for individuals and partnerships who do not operate as corporations to accurately complete this form to comply with local tax regulations.

Understanding the specific requirements outlined in the instructions helps ensure that all necessary information is included, which is vital for the proper assessment of tax obligations. The form addresses various aspects of unincorporated business taxation, including allowable deductions, credits, and the overall calculation of tax due.

Steps to Complete the Instructions For Form NYC 202 Unincorporated Business Tax

Completing the Instructions for Form NYC 202 involves several key steps to ensure accuracy and compliance. First, gather all relevant financial documents, including income statements, expense records, and any previous tax filings. Next, carefully read through the instructions to understand the specific sections of the form, such as income reporting and allowable deductions.

Once familiar with the requirements, begin filling out the form by entering your business information, including the name, address, and tax identification number. Follow the instructions for reporting income and expenses, ensuring that all figures are accurate and supported by documentation. After completing the form, review it thoroughly for any errors or omissions before submission.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for Form NYC 202 to avoid penalties and interest on unpaid taxes. Generally, the form is due on the 15th day of the fourth month following the end of the tax year. For businesses operating on a calendar year, this typically means the form is due by April 15. However, if the due date falls on a weekend or holiday, the deadline may be extended to the next business day.

Additionally, keeping track of any changes in tax regulations or deadlines announced by the New York City Department of Finance is important, as these can affect your filing schedule.

Required Documents

To successfully complete Form NYC 202, several key documents are required. These include:

- Income statements detailing all sources of revenue.

- Expense records, including receipts and invoices for business-related costs.

- Previous tax returns, if applicable, to provide context for current filings.

- Any supporting documentation for deductions claimed, such as proof of business expenses.

Having these documents organized and readily available will streamline the completion process and ensure compliance with tax regulations.

Legal Use of the Instructions For Form NYC 202 Unincorporated Business Tax

The legal use of the Instructions for Form NYC 202 is critical for ensuring compliance with New York City tax laws. The form serves as an official document for reporting income and taxes owed by unincorporated businesses, making it essential for legal and financial accountability.

Accurate completion of the form, in accordance with the provided instructions, helps prevent potential legal issues, such as audits or penalties for misreporting income. It is also important to retain copies of the submitted form and any supporting documents for future reference and compliance verification.

Quick guide on how to complete instructions for form nyc 202 unincorporated business tax

Complete Instructions For Form NYC 202 Unincorporated Business Tax effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed papers, as you can obtain the proper form and securely save it online. airSlate SignNow equips you with all the necessary tools to generate, adjust, and eSign your documents swiftly without hurdles. Manage Instructions For Form NYC 202 Unincorporated Business Tax on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

The easiest way to adjust and eSign Instructions For Form NYC 202 Unincorporated Business Tax with ease

- Locate Instructions For Form NYC 202 Unincorporated Business Tax and click on Get Form to begin.

- Utilize the resources we provide to complete your form.

- Emphasize essential sections of your documents or obscure sensitive information with tools that airSlate SignNow offers for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and select the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Adjust and eSign Instructions For Form NYC 202 Unincorporated Business Tax while ensuring outstanding communication throughout the form preparation stage with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions for form nyc 202 unincorporated business tax

The way to create an electronic signature for a PDF document in the online mode

The way to create an electronic signature for a PDF document in Chrome

How to generate an e-signature for putting it on PDFs in Gmail

The best way to make an e-signature from your mobile device

The best way to create an e-signature for a PDF document on iOS devices

The best way to make an e-signature for a PDF file on Android devices

People also ask

-

What are the key features of airSlate SignNow for 202 2021?

In 202 2021, airSlate SignNow offers a robust suite of features including electronic signatures, document templates, and real-time collaboration. These tools streamline the signing process, making it efficient and hassle-free. Users can also track document status to ensure that all necessary signatures are obtained promptly.

-

How much does airSlate SignNow cost in 202 2021?

In 202 2021, airSlate SignNow offers various pricing plans to fit different business needs. The plans are competitively priced and tailored to provide value, ensuring you're getting an eSigning solution that suits your budget. You can take advantage of a free trial to explore all features before making a commitment.

-

Is airSlate SignNow compliant with legal requirements in 202 2021?

Yes, airSlate SignNow is fully compliant with the legal standards for electronic signatures in 202 2021, including eIDAS and the ESIGN Act. This ensures that your electronically signed documents hold the same legal weight as traditional handwritten signatures. Trust airSlate SignNow for your secure eSignature needs.

-

What integrations does airSlate SignNow offer in 202 2021?

In 202 2021, airSlate SignNow integrates seamlessly with commonly used applications like Google Drive, Salesforce, and Microsoft Office. These integrations enhance productivity by allowing users to manage documents without leaving their preferred platforms. This versatility makes airSlate SignNow a powerful tool for any business.

-

How does airSlate SignNow improve workflow efficiency in 202 2021?

By utilizing airSlate SignNow in 202 2021, businesses can signNowly enhance workflow efficiency. The platform automates the document signing process, reducing time spent on manual tasks and paperwork. This means faster turnaround times for contracts and agreements, allowing you to focus on what matters most.

-

Can airSlate SignNow be used on mobile devices in 202 2021?

Absolutely! In 202 2021, airSlate SignNow is fully compatible with mobile devices, allowing users to send, sign, and manage documents on-the-go. The user-friendly mobile app ensures that you have access to essential signing features wherever you are, helping you maintain productivity anytime, anywhere.

-

What customer support options are available with airSlate SignNow in 202 2021?

In 202 2021, airSlate SignNow provides an array of customer support options including live chat, email support, and an extensive knowledge base. The support team is dedicated to assisting users with any questions or issues they may encounter. This ensures that you always have the help you need to maximize your experience.

Get more for Instructions For Form NYC 202 Unincorporated Business Tax

Find out other Instructions For Form NYC 202 Unincorporated Business Tax

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe