Form CT 3001216Mandatory First Installment MFI of

What is the new york ct 300 form?

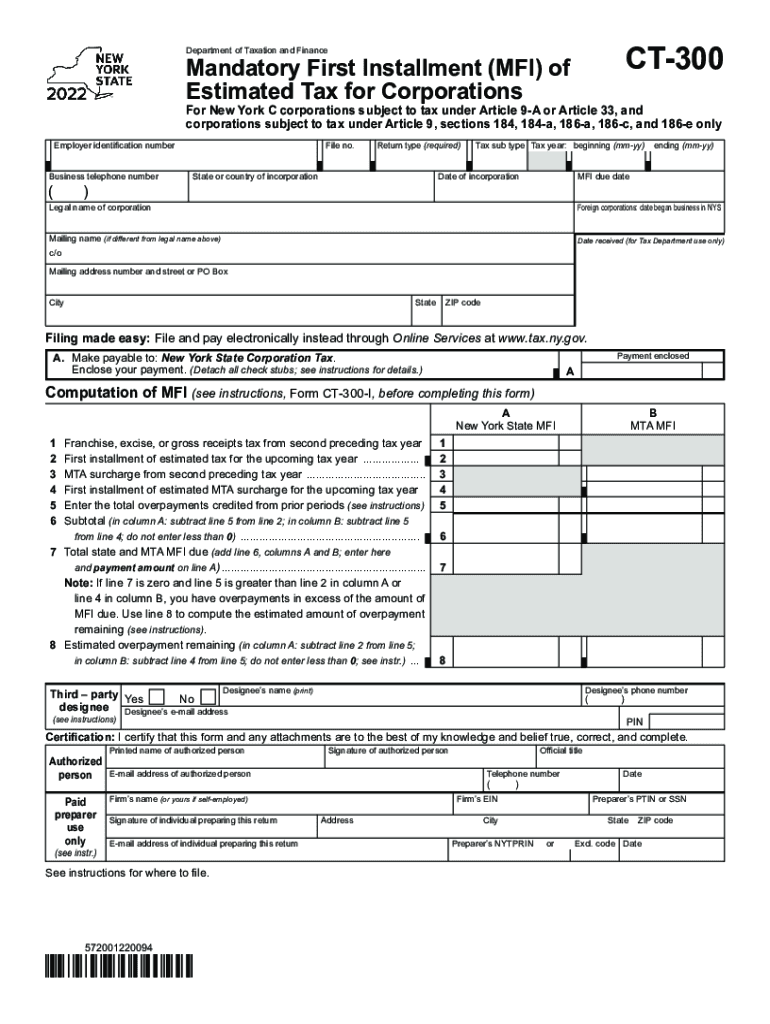

The new york ct 300 form, also known as the Mandatory First Installment (MFI) form, is a tax document used by businesses in New York to report their estimated tax payments. This form is particularly relevant for corporations and partnerships that are required to make estimated tax payments for the current tax year. The CT 300 form helps ensure compliance with state tax regulations and assists in the accurate calculation of tax liabilities.

Steps to complete the new york ct 300 form

Completing the new york ct 300 form involves several key steps:

- Gather necessary information: Collect your business's financial records, including income statements and previous tax returns.

- Calculate estimated tax liability: Use your projected income to estimate your tax obligations for the year.

- Fill out the form: Enter the required information, including your business name, address, and estimated tax amounts.

- Review for accuracy: Double-check all entries to ensure there are no errors that could lead to penalties.

- Submit the form: Choose your preferred submission method, either electronically or via mail.

Legal use of the new york ct 300 form

The new york ct 300 form is legally binding when completed and submitted according to New York state tax laws. It is essential for businesses to adhere to the guidelines set forth by the New York State Department of Taxation and Finance. Proper use of this form ensures that businesses fulfill their tax obligations and avoid potential legal issues or penalties associated with non-compliance.

Filing deadlines for the new york ct 300 form

Filing the new york ct 300 form on time is crucial to avoid penalties. The deadlines for submitting this form typically align with the estimated tax payment schedule set by the New York State Department of Taxation and Finance. Generally, businesses must submit their first installment by the 15th day of the fourth month of their tax year. It is advisable to check the latest guidelines for specific dates and any changes that may occur annually.

Form submission methods for the new york ct 300 form

Businesses have several options for submitting the new york ct 300 form:

- Online submission: Many businesses prefer to file electronically through the New York State Department of Taxation and Finance website.

- Mail submission: The form can be printed and mailed to the appropriate tax office.

- In-person submission: Some businesses may choose to deliver the form directly to a local tax office, ensuring immediate receipt.

Key elements of the new york ct 300 form

The new york ct 300 form contains several key elements that are essential for accurate completion:

- Business identification: This includes the legal name, address, and employer identification number (EIN) of the business.

- Estimated tax calculation: A section for entering the estimated tax amounts based on projected income.

- Payment information: Details regarding payment methods and amounts due.

- Signature line: A space for an authorized representative to sign and date the form, confirming its accuracy.

Quick guide on how to complete form ct 3001216mandatory first installment mfi of

Effortlessly Prepare Form CT 3001216Mandatory First Installment MFI Of on Any Device

Managing documents online has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, enabling you to locate the correct form and secure it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents quickly without delays. Handle Form CT 3001216Mandatory First Installment MFI Of on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Edit and eSign Form CT 3001216Mandatory First Installment MFI Of with Ease

- Find Form CT 3001216Mandatory First Installment MFI Of and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Mark important sections of your documents or conceal confidential information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign tool, which takes moments and holds the same legal significance as a traditional handwritten signature.

- Review all details and click on the Done button to save your changes.

- Choose how you want to submit your form, via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require reprinting. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form CT 3001216Mandatory First Installment MFI Of and ensure smooth communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ct 3001216mandatory first installment mfi of

The way to generate an electronic signature for a PDF document online

The way to generate an electronic signature for a PDF document in Google Chrome

The way to generate an e-signature for signing PDFs in Gmail

The way to create an electronic signature right from your smart phone

The best way to make an e-signature for a PDF document on iOS

The way to create an electronic signature for a PDF on Android OS

People also ask

-

What is the New York CT 300 form?

The New York CT 300 form is a tax form used by corporations in New York to report and pay their franchise taxes. It is essential for businesses seeking compliance with New York State tax regulations. Using airSlate SignNow, you can easily eSign and send the CT 300 form electronically, streamlining your submission process.

-

How can I fill out the New York CT 300 form electronically?

You can fill out the New York CT 300 form electronically by using airSlate SignNow. Our platform offers user-friendly tools that allow you to complete the form digitally, ensuring accuracy while saving time. Once completed, you can conveniently send it for eSignature, making the process hassle-free.

-

Is there a cost associated with using airSlate SignNow for the New York CT 300 form?

Yes, there is a cost associated with using airSlate SignNow, but the pricing is competitive and designed to be cost-effective. By investing in airSlate SignNow, you gain access to features that simplify the completion and signing of the New York CT 300 form, which can ultimately save your business time and resources.

-

What are the key features of airSlate SignNow for managing the New York CT 300 form?

airSlate SignNow offers key features such as document editing, eSigning, and real-time tracking, making it an excellent choice for managing the New York CT 300 form. These features ensure that you can complete your tax forms accurately and promptly while maintaining a clear record of all transactions. This enhances your efficiency and compliance.

-

How does airSlate SignNow ensure the security of my New York CT 300 form?

airSlate SignNow prioritizes security with advanced encryption methods that protect documents, including your New York CT 300 form, during transmission and storage. This means that your sensitive corporate information is secure, giving you peace of mind as you eSign and share important tax documents.

-

Can I integrate airSlate SignNow with other tools while filing the New York CT 300 form?

Yes, airSlate SignNow can integrate seamlessly with a range of third-party applications, enhancing your workflow when filing the New York CT 300 form. This includes tools such as CRM and accounting software, allowing for a more efficient data exchange and improved overall productivity.

-

What benefits does using airSlate SignNow provide for filing the New York CT 300 form?

Using airSlate SignNow to file the New York CT 300 form provides numerous benefits, including increased efficiency, reduced paperwork, and faster processing times. The ability to eSign and send documents electronically means you can manage your tax responsibilities with ease, ensuring compliance and saving valuable time for your business.

Get more for Form CT 3001216Mandatory First Installment MFI Of

- Rule show cause 497309174 form

- Judgment of divorce for people with no children louisiana form

- Commercial sublease louisiana form

- Petition for divorce la cc art 102 with adult children louisiana form

- Louisiana lease 497309178 form

- Louisiana 103 form

- Louisiana property settlement 497309180 form

- Notice to lessor exercising option to purchase louisiana form

Find out other Form CT 3001216Mandatory First Installment MFI Of

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document