Demand Repayment Form

What is the Demand Repayment

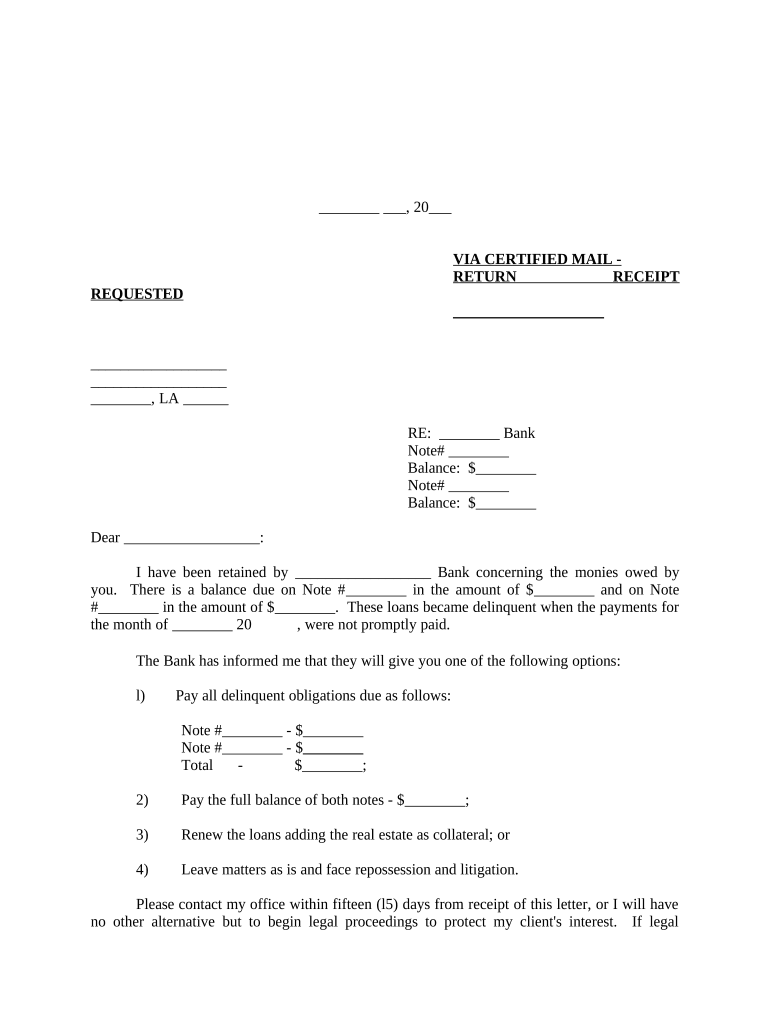

A Louisiana demand letter is a formal document used to request repayment of a debt or obligation. It serves as a notice to the debtor, outlining the amount owed and the reason for the demand. This letter is an essential step in the debt collection process, as it provides the debtor with an opportunity to settle the matter before further legal action is pursued. The demand letter typically includes details such as the original agreement, payment terms, and a deadline for repayment.

Key elements of the Demand Repayment

When drafting a Louisiana demand letter, it is crucial to include several key elements to ensure its effectiveness. These elements typically consist of:

- Identification of parties: Clearly state the names and addresses of both the creditor and debtor.

- Details of the debt: Specify the amount owed, the original agreement, and any relevant dates.

- Payment terms: Outline the terms under which the debt should be repaid, including acceptable payment methods.

- Deadline for payment: Provide a specific date by which the debtor must respond or settle the debt.

- Consequences of non-payment: Mention potential legal actions that may follow if the debt remains unpaid.

Steps to complete the Demand Repayment

Completing a Louisiana demand letter involves several important steps. To ensure clarity and effectiveness, follow these guidelines:

- Gather information: Collect all relevant details about the debt, including contracts, invoices, and communication records.

- Draft the letter: Use clear and concise language to outline the debt, payment terms, and consequences of non-payment.

- Review for accuracy: Double-check all information for accuracy and completeness before finalizing the letter.

- Send the letter: Deliver the demand letter via a method that provides proof of receipt, such as certified mail.

- Follow up: If no response is received by the deadline, consider your next steps, which may include legal action.

Legal use of the Demand Repayment

The legal use of a Louisiana demand letter is significant in the debt collection process. It serves as a formal request for repayment and can be used as evidence in court if the matter escalates. To ensure the letter is legally sound, it should comply with local laws and regulations regarding debt collection practices. This includes adhering to the Fair Debt Collection Practices Act (FDCPA) and any state-specific laws that govern such communications.

State-specific rules for the Demand Repayment

In Louisiana, there are specific rules and regulations that govern the use of demand letters. It is essential to understand these rules to ensure compliance. For instance, the letter must clearly state the amount owed and the basis for the claim. Additionally, Louisiana law may require that certain disclosures be included in the letter, especially if the debt is related to a consumer transaction. Familiarizing yourself with these state-specific requirements can help prevent potential legal issues.

How to use the Demand Repayment

Using a Louisiana demand letter effectively involves understanding its purpose and the appropriate context for its use. It is typically employed when a debtor has failed to make payments as agreed. The letter serves as a formal reminder and a request for repayment. It can also be used as a precursor to legal action, demonstrating that the creditor has made a reasonable effort to resolve the matter amicably. Properly utilizing this document can facilitate communication and potentially lead to a resolution without further escalation.

Quick guide on how to complete demand repayment

Effortlessly Prepare Demand Repayment on Any Device

Digital document management has gained traction among companies and individuals alike. It offers a brilliant eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the tools you need to design, modify, and eSign your documents swiftly without interruptions. Manage Demand Repayment on any platform with the airSlate SignNow apps for Android or iOS and enhance any document-centric workflow today.

The easiest method to modify and eSign Demand Repayment without hassle

- Find Demand Repayment and click Get Form to initiate.

- Leverage the tools provided to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow specially offers for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow attends to your document management needs in just a few clicks from any device you prefer. Modify and eSign Demand Repayment and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Louisiana demand letter?

A Louisiana demand letter is a formal document that requests payment or action from a debtor. It outlines the amount owed and provides a specific timeframe for resolution. Creating a well-structured Louisiana demand letter can help initiate the collections process and demonstrate your seriousness in pursuing the claim.

-

How does airSlate SignNow help with Louisiana demand letters?

airSlate SignNow simplifies the process of creating and sending Louisiana demand letters by providing customizable templates that ensure your document adheres to state laws. Our platform allows you to eSign and send documents quickly, ensuring that you can efficiently manage your collections. This streamlines your communication with debtors while keeping everything legally compliant.

-

What are the costs associated with using airSlate SignNow for Louisiana demand letters?

airSlate SignNow offers a range of pricing plans tailored to fit various business needs. Each plan provides access to features that make drafting and sending Louisiana demand letters easy and cost-effective. We recommend checking our website for the latest pricing details and any promotional offers currently available.

-

Can I track the status of my Louisiana demand letters with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your Louisiana demand letters in real-time. You’ll receive notifications when your document is opened, viewed, and signed, giving you complete visibility over the process. This feature is essential for ensuring timely follow-up on outstanding debts.

-

What features does airSlate SignNow offer for drafting Louisiana demand letters?

airSlate SignNow includes features such as customizable templates, easy eSigning options, and secure document storage. You can efficiently create Louisiana demand letters that meet all necessary legal requirements with our user-friendly interface. Additionally, our platform ensures that your documents are stored securely for future reference.

-

Are there integrations available for airSlate SignNow that can enhance the use of Louisiana demand letters?

Absolutely! airSlate SignNow offers integrations with various CRM platforms and productivity tools, enhancing the efficiency of managing your Louisiana demand letters. These integrations allow for seamless data transfer and document management, making it easier to track interactions with clients and debtors throughout the process.

-

How long does it take to create a Louisiana demand letter using airSlate SignNow?

Creating a Louisiana demand letter with airSlate SignNow typically takes just minutes. Our intuitive platform provides templates and guided steps to quickly input your necessary information, allowing you to generate a professional-looking demand letter swiftly. This ensures you can address your collections needs promptly.

Get more for Demand Repayment

Find out other Demand Repayment

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form