NYS 45 Quarterly ReportingDepartment of Labor Form

What is the NYS 45 Quarterly Reporting

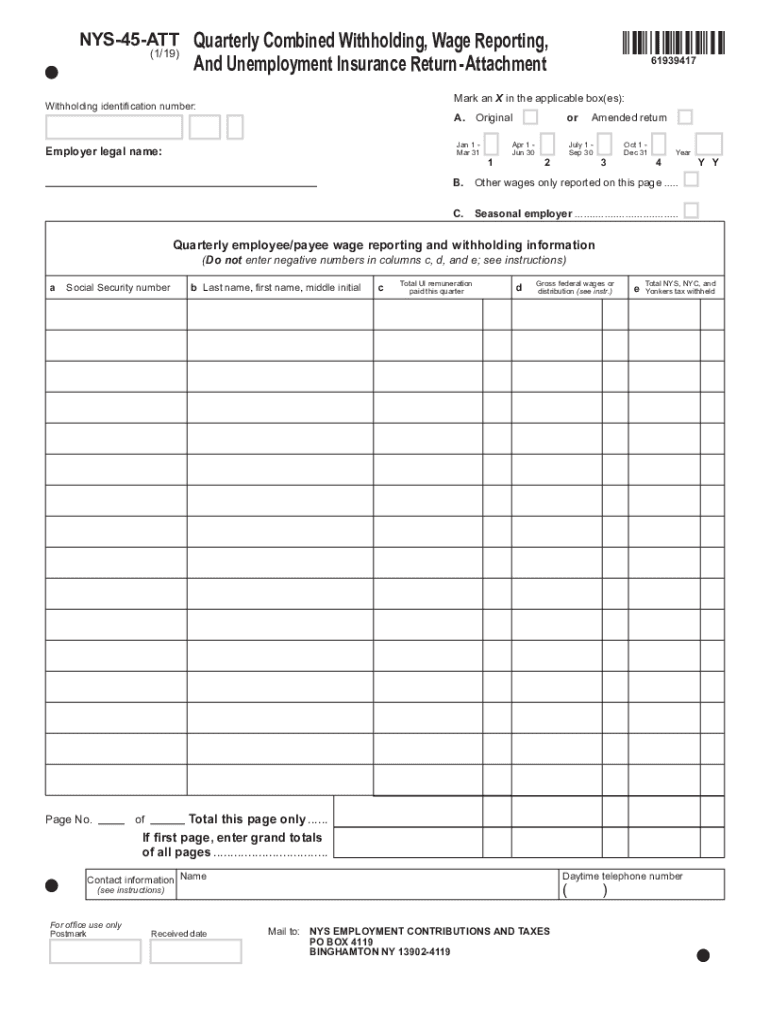

The NYS 45 form, also known as the New York State Quarterly Combined Withholding, Wage Reporting, and Unemployment Insurance Return, is a crucial document for employers in New York. This form is used to report wages paid to employees and the corresponding taxes withheld during a specific quarter. It serves as a comprehensive report to the New York State Department of Labor, ensuring compliance with state employment and tax regulations.

Steps to complete the NYS 45 Quarterly Reporting

Completing the NYS 45 form involves several key steps:

- Gather employee information: Collect details such as names, Social Security numbers, and wages paid during the quarter.

- Calculate total wages: Sum all wages paid to employees for the reporting period.

- Determine tax withheld: Calculate the total amount of state and federal taxes withheld from employee wages.

- Complete the form: Fill out the NYS 45 form with the gathered data, ensuring accuracy in all entries.

- Submit the form: File the completed NYS 45 electronically through the NYS Department of Labor's website or by mail.

Legal use of the NYS 45 Quarterly Reporting

The NYS 45 form is legally binding and must be filed accurately and on time to avoid penalties. Employers are required to submit this form quarterly, and failure to do so can result in fines or legal consequences. It is essential to maintain proper records and documentation to support the information reported on the form, as this may be subject to audits by the state.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines for filing the NYS 45 form. The due dates are typically as follows:

- For the first quarter (January to March): Due by April 30.

- For the second quarter (April to June): Due by July 31.

- For the third quarter (July to September): Due by October 31.

- For the fourth quarter (October to December): Due by January 31 of the following year.

Form Submission Methods

The NYS 45 form can be submitted through various methods:

- Online: Employers can file the form electronically via the New York State Department of Labor's online portal.

- Mail: The completed form can be printed and mailed to the appropriate address provided by the Department of Labor.

- In-Person: Employers may also choose to deliver the form in person at designated state offices.

Penalties for Non-Compliance

Failure to file the NYS 45 form on time or inaccuracies in reporting can lead to significant penalties. Employers may face fines, interest on unpaid taxes, and potential legal action. It is crucial to ensure timely and accurate submissions to avoid these consequences.

Quick guide on how to complete nys 45 quarterly reportingdepartment of labor

Finalize NYS 45 Quarterly ReportingDepartment Of Labor effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers a superb eco-conscious alternative to conventional printed and signed documentation, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle NYS 45 Quarterly ReportingDepartment Of Labor on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

Effortless ways to modify and eSign NYS 45 Quarterly ReportingDepartment Of Labor

- Obtain NYS 45 Quarterly ReportingDepartment Of Labor and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you wish to distribute your form, via email, text message (SMS), or invitation link, or download it to your computer.

Put aside worries about lost or misplaced files, tedious document searching, or errors that necessitate printing new copies. airSlate SignNow manages your needs in document handling with just a few clicks from any device you prefer. Edit and eSign NYS 45 Quarterly ReportingDepartment Of Labor to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nys 45 quarterly reportingdepartment of labor

The way to generate an electronic signature for your PDF document online

The way to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The way to create an electronic signature straight from your smart phone

The best way to make an electronic signature for a PDF document on iOS

The way to create an electronic signature for a PDF document on Android OS

People also ask

-

What is the pricing structure for 45 att mn?

The pricing for 45 att mn is competitive and designed to suit businesses of all sizes. airSlate SignNow offers various plans, including monthly and annual subscriptions, ensuring you can choose the best option for your needs. You can visit our pricing page to find detailed information on the features included in each plan.

-

What features does airSlate SignNow offer for 45 att mn?

airSlate SignNow provides a comprehensive set of features for 45 att mn, such as document uploading, eSigning, and real-time collaboration. Additionally, it includes templates and automation tools to streamline your workflow. These features are designed to enhance productivity and simplify document management.

-

How does 45 att mn benefit businesses?

45 att mn empowers businesses by facilitating faster document signing and improving overall efficiency. With airSlate SignNow, organizations can reduce turnaround times and eliminate the hassle of paper documents. This leads to improved customer satisfaction and increased productivity.

-

Are there integrations available for 45 att mn?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing the functionality of 45 att mn. Popular integrations include Google Drive, Salesforce, and Dropbox, allowing users to sync their documents easily. These integrations help streamline processes and ensure a smoother workflow.

-

Is 45 att mn user-friendly?

Absolutely! airSlate SignNow is known for its intuitive interface, making 45 att mn easy to use for individuals and businesses alike. Even those with minimal technical skills can quickly navigate the platform and execute eSignatures effortlessly.

-

What types of documents can be signed with 45 att mn?

With 45 att mn, users can sign a wide range of documents, including contracts, agreements, and forms. airSlate SignNow supports various file formats, ensuring that you can handle all your document signing needs. This versatility is crucial for businesses dealing with different types of paperwork.

-

Is customer support available for 45 att mn users?

Yes, airSlate SignNow offers dedicated customer support for all users of 45 att mn. Our support team is available via phone, email, and live chat, ready to assist with any questions or issues. We are committed to ensuring your experience with our platform is smooth and satisfactory.

Get more for NYS 45 Quarterly ReportingDepartment Of Labor

- Landlord tenant closing statement to reconcile security deposit louisiana form

- Name change notification package for brides court ordered name change divorced marriage for louisiana louisiana form

- Name change notification form louisiana

- Commercial building or space lease louisiana form

- Louisiana relative caretaker legal documents package louisiana form

- Louisiana standby temporary guardian legal documents package louisiana form

- Louisiana bankruptcy forms

- Louisiana chapter 13 form

Find out other NYS 45 Quarterly ReportingDepartment Of Labor

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word

- How Can I Send Sign Word

- Send Sign Document Online

- Send Sign Document Computer

- Send Sign Document Myself

- Send Sign Document Secure

- Send Sign Document iOS

- Send Sign Document iPad