Fillable Online Dfa Arkansas Sales and Use Tax Forms 2022-2026

Understanding the 2012 Arkansas Excise Form

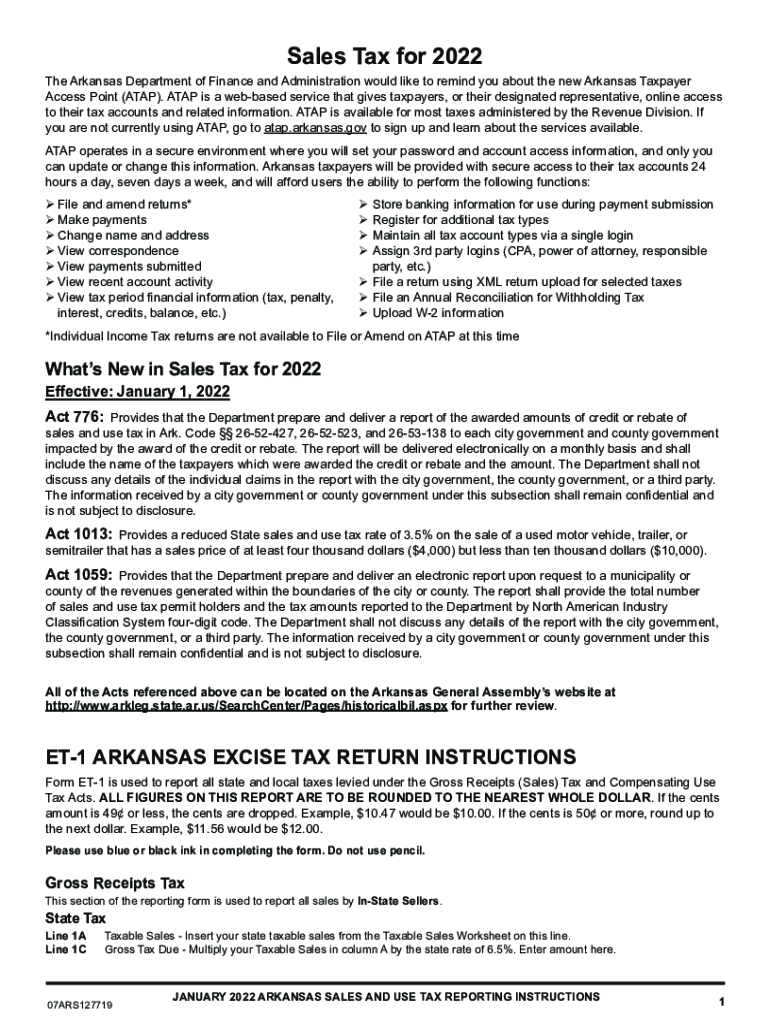

The 2012 Arkansas excise form, also known as the Arkansas ET-1 form, is essential for businesses operating within the state. This form is primarily used for reporting sales and use tax obligations. It is crucial for ensuring compliance with Arkansas tax laws and regulations. The form requires accurate reporting of sales, purchases, and applicable taxes to avoid penalties and ensure proper tax remittance.

Steps to Complete the 2012 Arkansas ET-1 Form

Completing the 2012 Arkansas ET-1 form involves several key steps:

- Gather necessary documentation, including sales records and purchase invoices.

- Fill in your business information, including name, address, and tax identification number.

- Report total sales and exempt sales accurately in the designated sections.

- Calculate the total tax due based on the reported figures.

- Review the form for accuracy before submission.

Legal Use of the 2012 Arkansas Excise Form

The 2012 Arkansas excise form is legally binding when completed and submitted in accordance with state regulations. It must be signed by an authorized representative of the business, ensuring accountability. Compliance with the submission deadlines is also critical to avoid any legal repercussions.

Filing Deadlines for the 2012 Arkansas ET-1 Form

Filing deadlines for the 2012 Arkansas ET-1 form are typically set quarterly. Businesses must submit their forms by the 20th of the month following the end of each quarter. For example, the deadline for the first quarter would be April 20. Missing these deadlines can result in penalties and interest on unpaid taxes.

Required Documents for the 2012 Arkansas Excise Form

To complete the 2012 Arkansas ET-1 form, businesses need to have several key documents on hand:

- Sales records detailing all transactions made during the reporting period.

- Invoices for any purchases that may be exempt from sales tax.

- Previous tax returns for reference and accuracy.

Form Submission Methods for the 2012 Arkansas ET-1

The 2012 Arkansas ET-1 form can be submitted through various methods to accommodate different business needs. Options include:

- Online submission via the Arkansas Department of Finance and Administration's website.

- Mailing a printed copy of the form to the appropriate tax office.

- In-person delivery at designated tax offices.

Penalties for Non-Compliance with the 2012 Arkansas ET-1 Form

Failure to comply with the requirements of the 2012 Arkansas ET-1 form can lead to significant penalties. These may include:

- Monetary fines based on the amount of tax owed.

- Interest charges on late payments.

- Potential legal action for continued non-compliance.

Quick guide on how to complete fillable online dfa arkansas sales and use tax forms

Complete Fillable Online Dfa Arkansas Sales And Use Tax Forms seamlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed forms, allowing you to locate the necessary document and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage Fillable Online Dfa Arkansas Sales And Use Tax Forms on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and electronically sign Fillable Online Dfa Arkansas Sales And Use Tax Forms effortlessly

- Locate Fillable Online Dfa Arkansas Sales And Use Tax Forms and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, and mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Fillable Online Dfa Arkansas Sales And Use Tax Forms and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online dfa arkansas sales and use tax forms

Create this form in 5 minutes!

How to create an eSignature for the fillable online dfa arkansas sales and use tax forms

The way to make an electronic signature for a PDF file online

The way to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature from your mobile device

The way to generate an e-signature for a PDF file on iOS

The way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is the 2012 AR excise document and why is it important?

The 2012 AR excise document is essential for businesses operating in Arkansas to comply with state tax regulations. It outlines the necessary excise tax obligations and reporting requirements. Without accurate submission of the 2012 AR excise form, businesses risk penalties or fines from state authorities.

-

How can airSlate SignNow help with the 2012 AR excise filing process?

airSlate SignNow streamlines the 2012 AR excise filing process by allowing businesses to easily send and sign documents electronically. This eliminates the hassles of paper documents, reduces processing time, and ensures secure storage of signed forms. With features like templates and reminders, staying compliant with the 2012 AR excise requirements has never been easier.

-

What features does airSlate SignNow offer for managing the 2012 AR excise documents?

airSlate SignNow includes features such as electronic signatures, document templates, and real-time tracking to efficiently manage 2012 AR excise documents. Users can create reusable templates tailored to their business needs, simplifying repetitive tasks. The intuitive user interface ensures that even those unfamiliar with e-signatures can navigate the process effortlessly.

-

What are the pricing options for using airSlate SignNow for 2012 AR excise documents?

airSlate SignNow offers flexible pricing plans to suit businesses of all sizes, with features tailored for handling 2012 AR excise documents. Plans vary based on the number of users and features needed, ensuring cost-effectiveness for every budget. A free trial is available to explore how the platform can optimize your 2012 AR excise filing process.

-

Is airSlate SignNow compliant with regulations for the 2012 AR excise?

Yes, airSlate SignNow is designed to comply with state and federal regulations regarding electronic signatures and document submissions, including for the 2012 AR excise forms. The platform adheres to strict security measures to protect sensitive information, ensuring businesses meet compliance standards while managing their excise documents.

-

Can airSlate SignNow integrate with other software to enhance the 2012 AR excise management?

Absolutely! airSlate SignNow integrates seamlessly with a variety of software solutions, including accounting and tax preparation tools, to enhance the management of 2012 AR excise documents. This integration allows for streamlined workflows and reduces the chances of errors in data entry, making the entire process more efficient.

-

How user-friendly is airSlate SignNow for handling 2012 AR excise documents?

airSlate SignNow is highly user-friendly, designed for both tech-savvy individuals and those less familiar with digital tools. The platform's intuitive interface makes it easy to manage 2012 AR excise documents, with straightforward navigation and clear instructions. Users can quickly send, sign, and store documents without extensive training.

Get more for Fillable Online Dfa Arkansas Sales And Use Tax Forms

- Foundation contractor package louisiana form

- Plumbing contractor package louisiana form

- Brick mason contractor package louisiana form

- Roofing contractor package louisiana form

- Electrical contractor package louisiana form

- Sheetrock drywall contractor package louisiana form

- Flooring contractor package louisiana form

- Trim carpentry contractor package louisiana form

Find out other Fillable Online Dfa Arkansas Sales And Use Tax Forms

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors