PDF Form 3M Income Tax Return for Clubs and Other Organizations Not

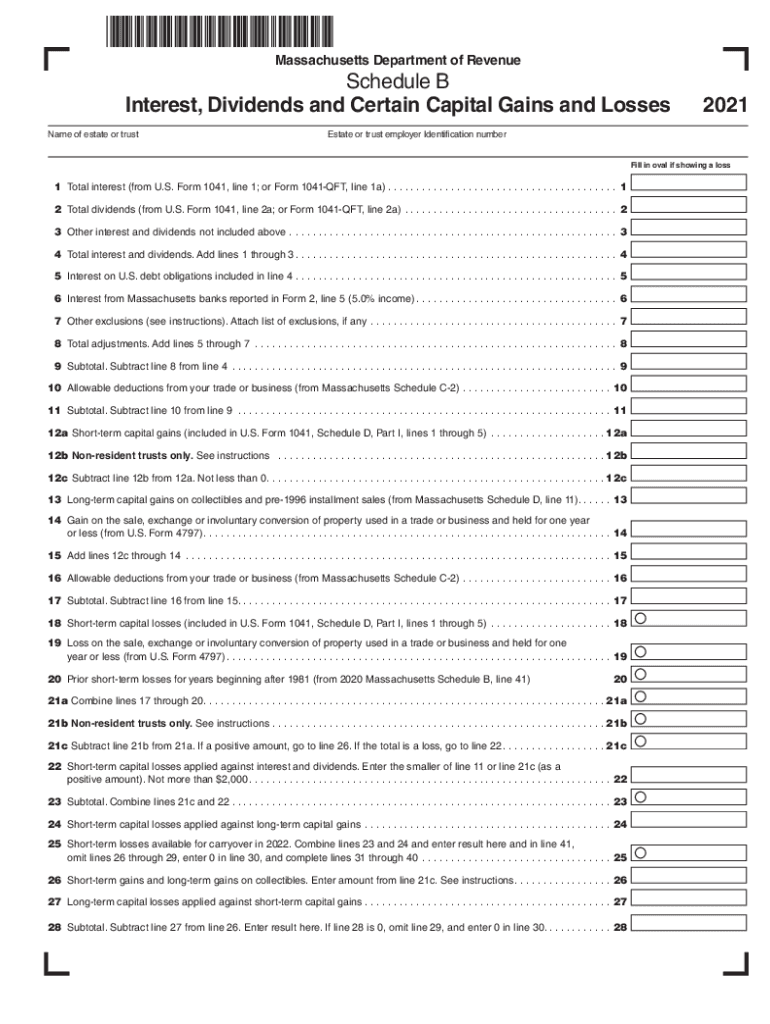

What is the DOR Schedule B?

The DOR Schedule B is a specific form used in the context of income tax reporting for certain organizations in Massachusetts. This form is designed for clubs and other organizations that are not classified as traditional businesses. It provides a structured way to report income, deductions, and other financial information required by the Massachusetts Department of Revenue. Understanding the purpose of this form is crucial for compliance with state tax regulations.

Steps to Complete the DOR Schedule B

Completing the DOR Schedule B involves several important steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense reports. Next, carefully fill out each section of the form, ensuring that all income sources and deductions are accurately reported. It is essential to double-check calculations to avoid errors. Once completed, the form should be reviewed for completeness before submission.

Filing Deadlines / Important Dates

Filing deadlines for the DOR Schedule B are critical to avoid penalties. Typically, the form must be submitted by the due date for the organization's tax return. For most organizations, this date aligns with the standard tax filing deadline, which is usually April fifteenth. However, organizations should verify specific dates each year, as they may vary or be extended under certain circumstances.

Legal Use of the DOR Schedule B

The DOR Schedule B must be filled out accurately to ensure legal compliance with Massachusetts tax laws. This form serves as an official record of income and expenses, and failure to report correctly can lead to penalties or audits. Organizations should maintain thorough records to support the information provided on the form, as this can be crucial in the event of a review by the Massachusetts Department of Revenue.

Required Documents

To complete the DOR Schedule B, specific documents are required. These typically include financial statements, detailed income reports, and records of any deductions claimed. Organizations should also have their previous tax returns on hand, as they may provide useful context and data for the current filing. Ensuring that all necessary documentation is prepared in advance can streamline the completion process.

Who Issues the DOR Schedule B

The DOR Schedule B is issued by the Massachusetts Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among organizations operating within Massachusetts. The form is part of the broader framework of tax reporting required for non-profit entities and other organizations not classified as standard businesses.

Penalties for Non-Compliance

Failure to comply with the filing requirements associated with the DOR Schedule B can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential for organizations to understand their obligations and ensure timely and accurate submissions to avoid these consequences. Regular consultations with tax professionals can help mitigate risks associated with non-compliance.

Quick guide on how to complete pdf form 3m income tax return for clubs and other organizations not

Facilitate PDF Form 3M Income Tax Return For Clubs And Other Organizations Not effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally-friendly substitute for conventional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and electronically sign your documents swiftly without interruptions. Handle PDF Form 3M Income Tax Return For Clubs And Other Organizations Not on any device using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to modify and eSign PDF Form 3M Income Tax Return For Clubs And Other Organizations Not with ease

- Find PDF Form 3M Income Tax Return For Clubs And Other Organizations Not and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misfiled documents, tedious form navigation, or errors that require the printing of new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign PDF Form 3M Income Tax Return For Clubs And Other Organizations Not and ensure seamless communication at any stage of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pdf form 3m income tax return for clubs and other organizations not

How to make an e-signature for a PDF file online

How to make an e-signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The best way to create an e-signature straight from your mobile device

The best way to make an e-signature for a PDF file on iOS

The best way to create an e-signature for a PDF document on Android devices

People also ask

-

What is the dor schedule b and why is it important?

The dor schedule b is a tax document that provides detailed information about a taxpayer's foreign financial assets. It is crucial for compliance with U.S. tax laws and avoiding penalties. Understanding the dor schedule b will help businesses effectively manage their financial reporting.

-

How can airSlate SignNow streamline the process of filling out dor schedule b?

airSlate SignNow simplifies the process of completing the dor schedule b by allowing users to fill out and sign the document digitally. This not only saves time but also reduces errors associated with manual entries. Additionally, our solution ensures secure storage of your completed forms.

-

What pricing options are available for using airSlate SignNow to handle dor schedule b?

airSlate SignNow offers flexible pricing plans designed for businesses of all sizes. Customers can choose from monthly or annual subscriptions, with features tailored to meet the needs of those dealing with documents like the dor schedule b. Visit our pricing page for more details.

-

Are there integrations available with airSlate SignNow for managing dor schedule b?

Yes, airSlate SignNow integrates seamlessly with a variety of business applications, enhancing your workflow for managing the dor schedule b. This includes integrations with major software tools like CRM systems and project management platforms. Streamlining these processes can signNowly improve your efficiency.

-

How does airSlate SignNow ensure the security of my dor schedule b documents?

The security of your dor schedule b documents is a top priority for airSlate SignNow. We implement advanced encryption methods and robust access controls to protect your data. This ensures that your sensitive financial information remains confidential and secure during transmission and storage.

-

Can I access my completed dor schedule b documents after signing?

Absolutely! With airSlate SignNow, you can easily access your completed dor schedule b documents at any time. Our cloud-based system allows for secure storage and retrieval, ensuring you can revisit your signed documents whenever necessary.

-

Does airSlate SignNow offer support for users completing a dor schedule b?

Yes, airSlate SignNow provides dedicated customer support to assist users with any questions related to completing the dor schedule b. Our support team is available via chat, email, or phone to ensure you have all the resources you need for a smooth experience.

Get more for PDF Form 3M Income Tax Return For Clubs And Other Organizations Not

- Consent change name form

- Change name person form

- Maryland name change order form

- Name change minor maryland form

- Md change file form

- Md service process form

- No fault uncontested agreed divorce package for dissolution of marriage with adult children and with or without property and 497310053 form

- Bill of sale of automobile and odometer statement maryland form

Find out other PDF Form 3M Income Tax Return For Clubs And Other Organizations Not

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template