PDF Instructions for Form 6385 Tax Attributes Carryovers

What is the PDF Instructions for Form 6385 Tax Attributes Carryovers

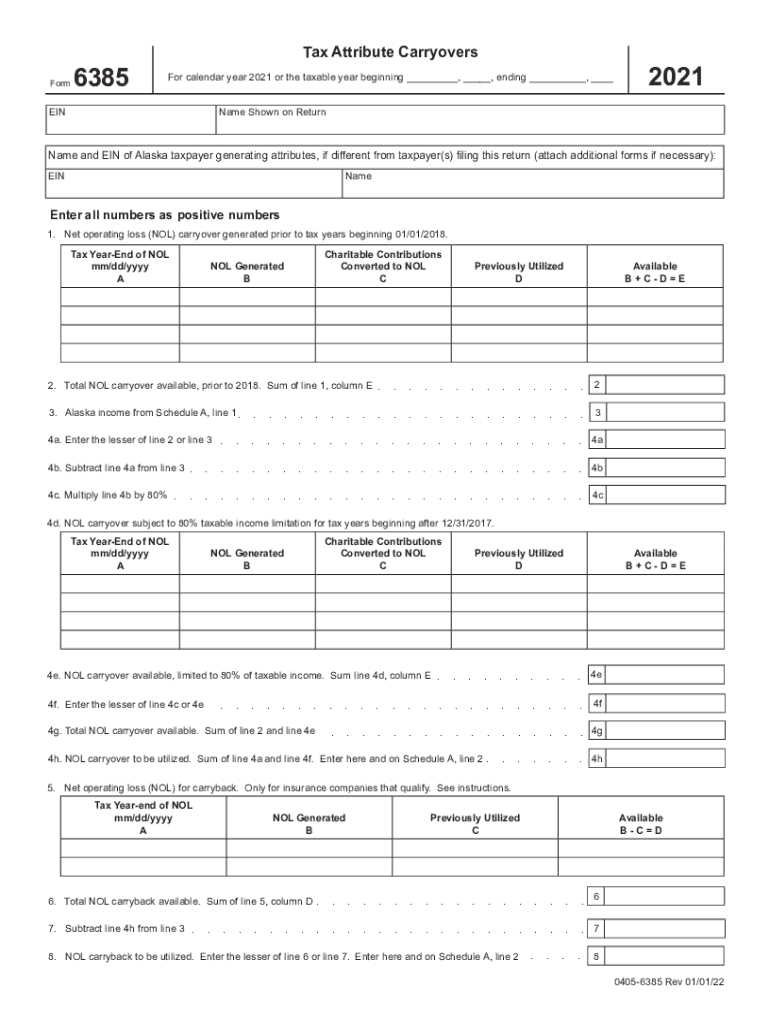

The PDF instructions for Form 6385 provide essential guidance on how to report tax attributes carryovers. This form is critical for taxpayers who need to carry forward certain tax attributes from previous years, such as net operating losses or credits. Understanding these instructions ensures compliance with IRS regulations and helps avoid potential issues during tax filing. The document outlines the necessary steps, definitions, and examples to clarify the process of reporting these carryovers accurately.

Steps to Complete the PDF Instructions for Form 6385 Tax Attributes Carryovers

Completing the PDF instructions for Form 6385 involves several key steps:

- Review the eligibility criteria to ensure you qualify for carryovers.

- Gather all necessary documentation, including previous tax returns and relevant financial statements.

- Follow the detailed instructions in the PDF to fill out each section of the form accurately.

- Ensure that all calculations are correct, particularly for any carryover amounts.

- Sign and date the form as required, ensuring compliance with eSignature regulations if submitting electronically.

Legal Use of the PDF Instructions for Form 6385 Tax Attributes Carryovers

The legal use of the PDF instructions for Form 6385 is paramount for ensuring that taxpayers adhere to IRS guidelines. These instructions are designed to help individuals and businesses understand their rights and obligations regarding tax attributes carryovers. Proper use of the form can protect taxpayers from penalties and ensure that they receive any eligible tax benefits. It is important to follow the instructions closely to maintain compliance with federal tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the PDF instructions for Form 6385 are crucial to adhere to in order to avoid penalties. Typically, the form must be submitted by the due date of your tax return, including any extensions. For most taxpayers, this is April 15 of the following year. However, specific deadlines may vary based on individual circumstances, such as business structure or special tax situations. Keeping track of these dates helps ensure timely submission and compliance with IRS requirements.

Required Documents

To complete the PDF instructions for Form 6385, several documents are required:

- Previous tax returns that detail the tax attributes being carried over.

- Financial statements that support the reported carryover amounts.

- Any relevant IRS notices or correspondence regarding prior year tax filings.

Having these documents ready will facilitate a smoother completion process and ensure accurate reporting of carryover amounts.

Examples of Using the PDF Instructions for Form 6385 Tax Attributes Carryovers

Examples of using the PDF instructions for Form 6385 can help clarify how to apply the guidelines in practical scenarios. For instance, a business that incurred a net operating loss in the previous year can use the form to carry that loss forward to offset future taxable income. Similarly, individuals who have unused tax credits from prior years can report these credits using the guidelines provided in the PDF instructions. These examples illustrate the importance of understanding how to navigate the form effectively.

Quick guide on how to complete pdf instructions for form 6385 tax attributes carryovers

Effortlessly prepare PDF Instructions For Form 6385 Tax Attributes Carryovers on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage PDF Instructions For Form 6385 Tax Attributes Carryovers on any platform using airSlate SignNow's Android or iOS applications and simplify your document-based tasks today.

How to edit and eSign PDF Instructions For Form 6385 Tax Attributes Carryovers with ease

- Obtain PDF Instructions For Form 6385 Tax Attributes Carryovers and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate the hassle of lost or misplaced files, frustrating form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign PDF Instructions For Form 6385 Tax Attributes Carryovers and guarantee seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pdf instructions for form 6385 tax attributes carryovers

The best way to create an electronic signature for a PDF file online

The best way to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The best way to generate an e-signature right from your mobile device

The way to create an e-signature for a PDF file on iOS

The best way to generate an e-signature for a PDF on Android devices

People also ask

-

What are AK carryovers in airSlate SignNow?

AK carryovers in airSlate SignNow refer to the ability to carry over data and signatures across multiple documents seamlessly. This feature ensures that users can maintain continuity and efficiency when dealing with extensive documentation. By utilizing AK carryovers, businesses can enhance their workflow and save valuable time.

-

How does airSlate SignNow handle pricing for AK carryovers?

Pricing for AK carryovers in airSlate SignNow is structured to provide flexibility based on your business needs. We offer various subscription tiers that allow you to choose the most cost-effective solution for utilizing AK carryovers. Each tier comes with features that scale according to the volume of documents you handle.

-

Can I integrate AK carryovers with other software?

Yes, airSlate SignNow supports integrations with a variety of software that can enhance your experience with AK carryovers. You can connect seamlessly with platforms such as CRM systems, project management tools, and cloud storage services. This allows for smooth data transfer and improved document management across different applications.

-

What benefits does airSlate SignNow provide with AK carryovers?

The primary benefit of using AK carryovers in airSlate SignNow is increased efficiency in document management. By allowing users to carry over signatures and data, it simplifies the signing process and reduces the need for repetitive data entry. This leads to faster turnaround times and a more streamlined workflow.

-

Is there a limit to the number of AK carryovers I can use?

There is no strict limit on the number of AK carryovers you can use, but this may vary depending on your subscription plan. Each tier offers flexibility in how many documents and signatures can be processed simultaneously. Contacting our support can provide more specific details tailored to your needs.

-

What types of documents benefit the most from AK carryovers?

Documents that require repetitive information, such as contracts, agreements, and forms are the ones that benefit the most from AK carryovers. By carrying over essential data and signatures, you can ensure accuracy and consistency across similar documents. This greatly enhances the efficiency of document workflows.

-

How does airSlate SignNow ensure security with AK carryovers?

AirSlate SignNow prioritizes security for all features, including AK carryovers. We implement advanced encryption protocols and secure data storage to protect your sensitive information. With robust security measures, businesses can confidently utilize AK carryovers without compromising their data integrity.

Get more for PDF Instructions For Form 6385 Tax Attributes Carryovers

- Quitclaim deed from husband and wife to husband and wife maryland form

- Md wife form

- Md revocation form

- Maryland property form

- Md postnuptial agreement form

- Quitclaim deed from husband and wife to an individual maryland form

- Warranty deed from husband and wife to an individual maryland form

- Maryland garnishment 497310151 form

Find out other PDF Instructions For Form 6385 Tax Attributes Carryovers

- How Can I eSign Minnesota Partnership agreements

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now

- eSign Georgia Rental lease agreement template Simple

- Can I eSign Wyoming Rental lease agreement forms

- eSign New Hampshire Rental lease agreement template Online

- eSign Utah Rental lease contract Free