Alabama Department of Revenue LSU Form

What is the Alabama Department of Revenue LSU?

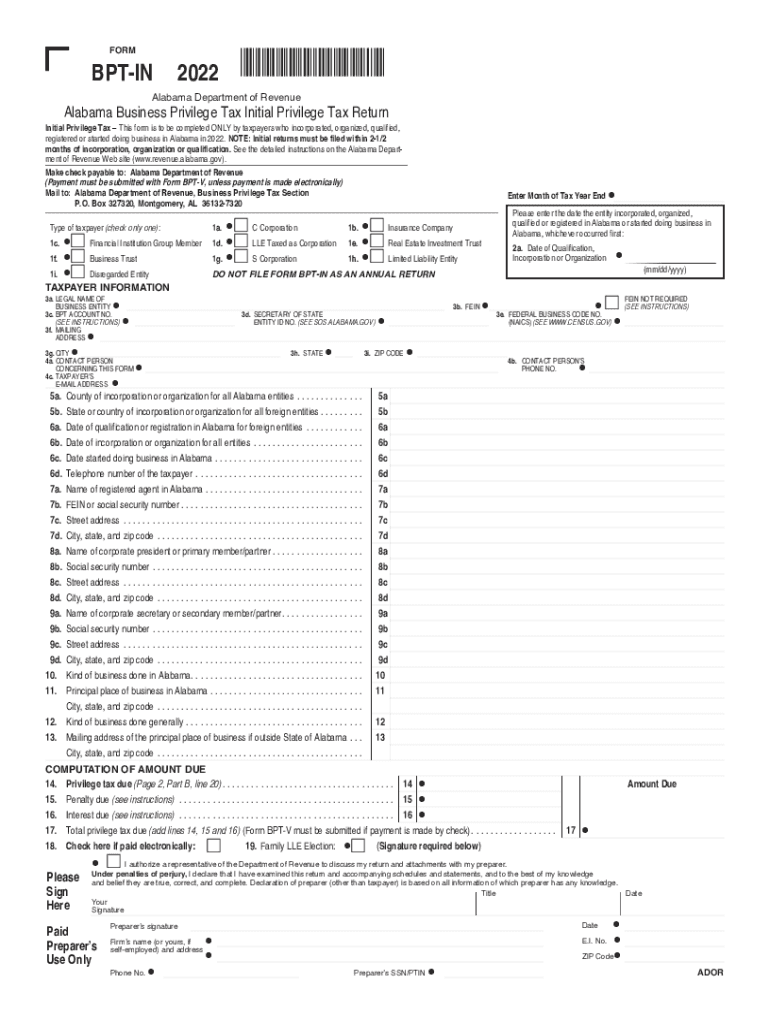

The Alabama Department of Revenue (ADOR) LSU refers to the Local Business Privilege Tax (BPT) form that businesses must file to comply with state tax regulations. This form is essential for businesses operating within Alabama, as it helps the state assess and collect taxes based on business activities. The LSU is particularly relevant for entities such as corporations, partnerships, and limited liability companies (LLCs) engaged in business operations in Alabama.

Steps to Complete the Alabama Department of Revenue LSU

Completing the Alabama form BPT in 2022 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and balance sheets. Next, access the form through the Alabama Department of Revenue website or a trusted digital platform. Fill out the required sections, which typically include business identification details, income calculations, and applicable deductions. After completing the form, review it for any errors before submitting it electronically or by mail.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Alabama form BPT in 2022 is crucial for compliance. Typically, the initial return is due on the fifteenth day of the third month following the close of the business's fiscal year. For businesses operating on a calendar year, this means the form must be filed by March 15. Late submissions may incur penalties, so it is advisable to mark these dates on your calendar and prepare in advance.

Required Documents

When preparing to file the Alabama form BPT in 2022, certain documents are required to substantiate the information provided. These documents generally include:

- Federal tax returns for the business

- Financial statements, including profit and loss statements

- Records of any business deductions claimed

- Identification details for the business entity

Having these documents ready will streamline the filing process and help ensure accuracy.

Form Submission Methods

The Alabama form BPT in 2022 can be submitted through various methods to accommodate different preferences. Businesses can file the form online through the Alabama Department of Revenue's e-filing system, which is often the most efficient option. Alternatively, the form can be mailed to the appropriate address or submitted in person at designated revenue offices. Each method has its own processing times, so businesses should choose the one that best fits their needs.

Penalties for Non-Compliance

Failure to file the Alabama form BPT in 2022 by the deadline can result in significant penalties. These may include monetary fines based on the amount of tax owed and interest on late payments. Additionally, non-compliance can lead to further legal consequences, such as liens against business assets or restrictions on future business operations. It is essential for businesses to adhere to filing requirements to avoid these repercussions.

Quick guide on how to complete alabama department of revenue lsu

Complete Alabama Department Of Revenue LSU effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and eSign your documents quickly without delays. Manage Alabama Department Of Revenue LSU on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

How to edit and eSign Alabama Department Of Revenue LSU seamlessly

- Find Alabama Department Of Revenue LSU and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Alabama Department Of Revenue LSU and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the alabama department of revenue lsu

The best way to create an electronic signature for your PDF document online

The best way to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

The best way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is the al form bpt in instructions?

The al form bpt in instructions refers to guidelines for completing the BPT form, which helps businesses manage their tax obligations more efficiently. By understanding this form, you can ensure compliance and avoid potential penalties.

-

How can airSlate SignNow help with the al form bpt in instructions?

airSlate SignNow streamlines the process of filling out the al form bpt in instructions by providing easy-to-use templates and eSignature capabilities. This allows businesses to complete and sign their documents quickly and securely, saving them time and reducing errors.

-

Are there any costs associated with using airSlate SignNow for al form bpt in instructions?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Whether you are a small startup or a large enterprise, you can find a cost-effective solution that simplifies the completion of the al form bpt in instructions.

-

What features does airSlate SignNow offer for managing al form bpt in instructions?

AirSlate SignNow includes features such as customizable templates, advanced integrations, and secure cloud storage that are ideal for handling the al form bpt in instructions. These features enhance efficiency and provide a seamless experience for users.

-

Is there customer support available for queries on al form bpt in instructions?

Absolutely! AirSlate SignNow provides dedicated customer support to assist users with any questions regarding the al form bpt in instructions. Our support team is available through various channels to ensure you receive timely and effective help.

-

Can I integrate airSlate SignNow with other tools for my al form bpt in instructions?

Yes, airSlate SignNow offers numerous integrations with popular business tools, making it easy to manage your al form bpt in instructions alongside your existing workflows. This ensures a seamless experience when handling documents across different platforms.

-

What benefits can I expect from using airSlate SignNow for al form bpt in instructions?

Using airSlate SignNow for the al form bpt in instructions provides quicker turnaround times, improved compliance, and enhanced document security. It allows businesses to focus on their core operations while automating the paperwork process effectively.

Get more for Alabama Department Of Revenue LSU

- Maryland divorce form

- Md wife 497310217 form

- Warranty deed from husband and wife to llc maryland form

- Maryland judgment form

- Letter tenant notice 497310221 form

- Md landlord tenant notice form

- Letter from tenant to landlord containing notice that premises in uninhabitable in violation of law and demand immediate repair 497310223 form

- Tenant notice repair template form

Find out other Alabama Department Of Revenue LSU

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist