Emergencies SC Department of Revenue Form

Understanding the SC Department of Revenue Form PT 401 1

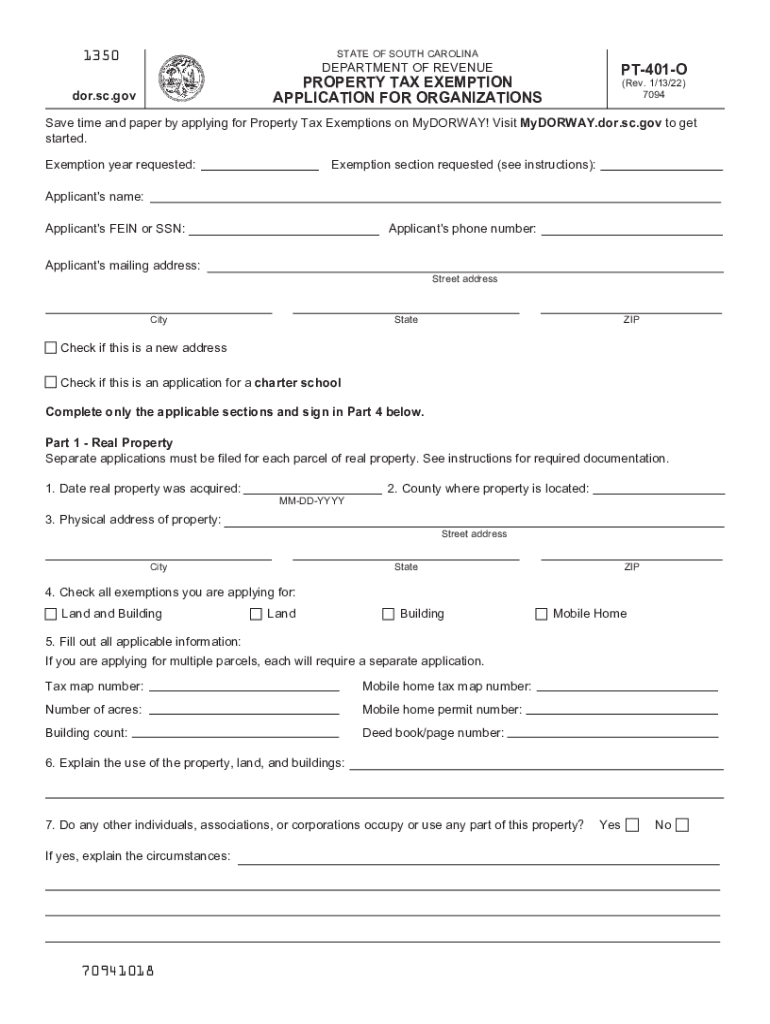

The SC Department of Revenue Form PT 401 1 is essential for individuals and organizations seeking property tax exemptions in South Carolina. This form, also known as the PT401 revenue application, is specifically designed to assist property owners in claiming exemptions that can significantly reduce their tax liabilities. Understanding the purpose and requirements of this form is crucial for ensuring compliance and maximizing potential savings.

Steps to Complete the SC Department of Revenue Form PT 401 1

Completing the SC PT 401 1 form involves several important steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, such as proof of ownership and any relevant financial information. Next, carefully fill out each section of the form, providing accurate details about the property and the exemption being claimed. It is vital to review the completed form for any errors before submission. Finally, submit the form according to the specified guidelines, ensuring it is sent to the correct department within the appropriate timeframe.

Eligibility Criteria for the SC PT 401 1 Form

To qualify for the exemptions available through the SC Department of Revenue Form PT 401 1, applicants must meet specific eligibility criteria. Generally, property owners must demonstrate that their property is used for exempt purposes, such as charitable, educational, or religious activities. Additionally, organizations must be recognized as tax-exempt under state or federal law. It is advisable to review the detailed eligibility requirements outlined by the SC Department of Revenue to ensure compliance.

Form Submission Methods for the SC PT 401 1

The SC Department of Revenue Form PT 401 1 can be submitted through various methods, including online submission, mail, or in-person delivery. For online submissions, users can utilize the department's electronic filing system, which streamlines the process and provides immediate confirmation. If opting for mail, ensure that the form is sent to the correct address and consider using a tracking method for peace of mind. In-person submissions can be made at designated department offices, allowing for direct interaction with staff for any questions or clarifications.

Key Elements of the SC PT 401 1 Form

Several key elements must be included in the SC Department of Revenue Form PT 401 1 for it to be considered complete. These elements typically include the applicant's name, contact information, property details, and the specific exemption being sought. Additionally, supporting documentation must be attached to validate the claims made on the form. Ensuring that all required information is accurately provided will facilitate a smoother review process by the SC Department of Revenue.

Penalties for Non-Compliance with the SC PT 401 1 Form

Failure to comply with the requirements associated with the SC Department of Revenue Form PT 401 1 can result in penalties. These may include the denial of the exemption claim, retroactive tax assessments, and potential fines. It is essential for applicants to adhere strictly to the guidelines and deadlines established by the SC Department of Revenue to avoid any negative consequences related to their property tax exemptions.

Quick guide on how to complete emergencies sc department of revenue

Effortlessly Prepare Emergencies SC Department Of Revenue on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to secure the necessary form and keep it safely online. airSlate SignNow equips you with all the resources needed to create, edit, and electronically sign your documents swiftly and without hassle. Manage Emergencies SC Department Of Revenue on any platform using airSlate SignNow's Android or iOS applications and simplify your document tasks today.

How to Edit and Electronically Sign Emergencies SC Department Of Revenue with Ease

- Locate Emergencies SC Department Of Revenue and click Get Form to initiate the process.

- Use the features we provide to complete your document.

- Emphasize key sections of the documents or obscure sensitive details with the tools airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal standing as a conventional handwritten signature.

- Review all entered information and click on the Done button to save your changes.

- Choose your preferred method of sending your form—via email, SMS, a link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, monotonous form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you select. Edit and electronically sign Emergencies SC Department Of Revenue to ensure outstanding communication throughout every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the emergencies sc department of revenue

The best way to generate an e-signature for your PDF file in the online mode

The best way to generate an e-signature for your PDF file in Chrome

How to make an e-signature for putting it on PDFs in Gmail

The way to create an electronic signature right from your smartphone

How to create an electronic signature for a PDF file on iOS devices

The way to create an electronic signature for a PDF on Android

People also ask

-

What is the sc department of revenue form pt 401 1?

The sc department of revenue form pt 401 1 is a critical form used by businesses in South Carolina to report property taxes. Understanding how to accurately complete this form can help ensure compliance and avoid penalties.

-

How can airSlate SignNow help with the sc department of revenue form pt 401 1?

AirSlate SignNow offers a user-friendly platform that simplifies the process of completing and eSigning the sc department of revenue form pt 401 1. With our solution, you can easily upload, edit, and send the form to relevant parties within minutes.

-

Is there a cost associated with using airSlate SignNow for the sc department of revenue form pt 401 1?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. You can choose a plan that best fits your requirements and enjoy the efficient handling of documents like the sc department of revenue form pt 401 1 without breaking the bank.

-

Are there any integrations available for airSlate SignNow when managing the sc department of revenue form pt 401 1?

AirSlate SignNow seamlessly integrates with various business applications and CRM systems. This means you can easily manage the sc department of revenue form pt 401 1 alongside your other business documents, improving workflow efficiency.

-

What are the benefits of using airSlate SignNow for the sc department of revenue form pt 401 1?

By using airSlate SignNow for the sc department of revenue form pt 401 1, businesses can ensure faster document turnaround times and improved compliance. The electronic signature feature also streamlines approvals, making it easier to manage important tax documents.

-

Can I access my sc department of revenue form pt 401 1 from any device?

Absolutely! AirSlate SignNow is cloud-based, allowing you to access your sc department of revenue form pt 401 1 from any device with internet connectivity. Whether you’re on a computer, tablet, or smartphone, your documents are always at your fingertips.

-

How secure is my data when using airSlate SignNow for the sc department of revenue form pt 401 1?

Security is a top priority for airSlate SignNow. When handling the sc department of revenue form pt 401 1, your data is protected with advanced encryption and compliance measures to ensure that all information remains confidential and secure.

Get more for Emergencies SC Department Of Revenue

- Md statutory form

- Power of attorney forms package maryland

- Revised uniform anatomical gift act donation maryland

- Employment hiring process package maryland form

- Revocation of anatomical gift donation maryland form

- Employment or job termination package maryland form

- Newly widowed individuals package maryland form

- Employment interview package maryland form

Find out other Emergencies SC Department Of Revenue

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement