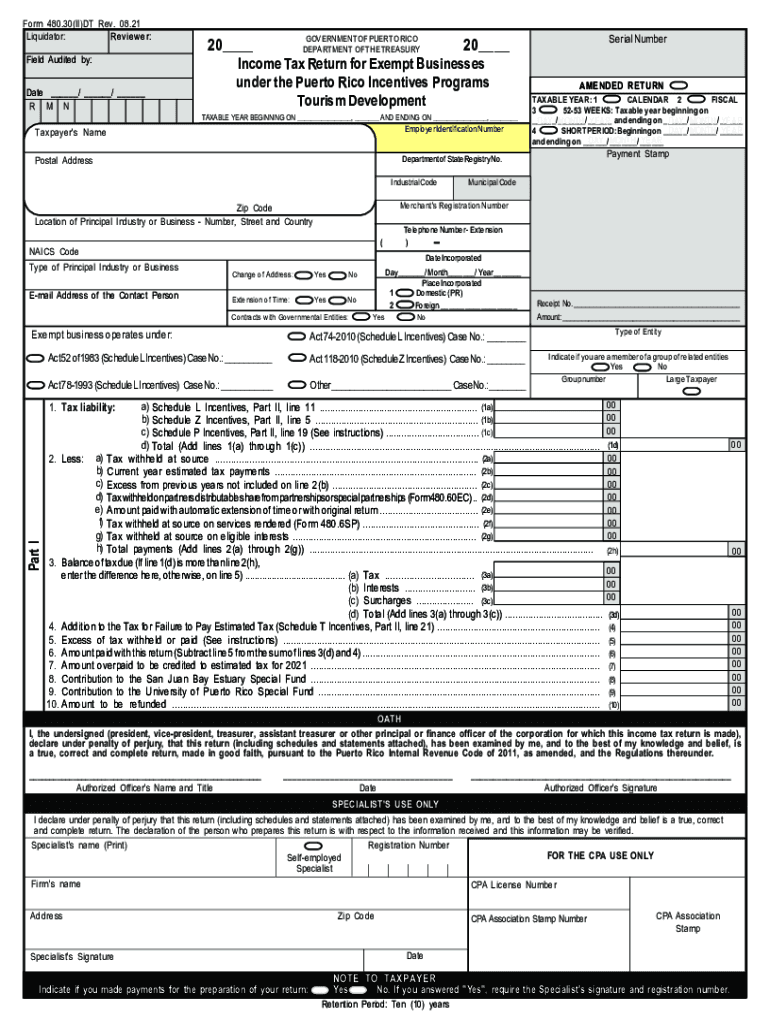

PDF Income Tax Return for Exempt Businesses under the Puerto Rico Form

Understanding the Puerto Rico Tax Form for Exempt Businesses

The Puerto Rico tax form for exempt businesses is specifically designed for entities that qualify for tax exemptions under Puerto Rican law. This form allows eligible businesses to report their income and claim the appropriate exemptions. Understanding the nuances of this form is crucial for compliance and optimal tax management.

Steps to Complete the Puerto Rico Tax Form for Exempt Businesses

Completing the Puerto Rico tax form requires careful attention to detail. Here are the essential steps:

- Gather necessary documentation, including financial statements and proof of exemption eligibility.

- Fill out the form accurately, ensuring all income and deductions are reported.

- Review the completed form for errors or omissions.

- Submit the form by the designated deadline, either electronically or via mail.

Legal Use of the Puerto Rico Tax Form for Exempt Businesses

The legal use of the Puerto Rico tax form is governed by local tax laws. It is essential that businesses adhere to these regulations to maintain their exempt status. This includes properly completing the form and submitting it within the required timeframe to avoid any penalties.

Filing Deadlines and Important Dates

Filing deadlines for the Puerto Rico tax form are critical for compliance. Typically, the form must be submitted annually, with specific due dates that may vary based on the entity type. It is advisable to check the official tax calendar for the most accurate information regarding deadlines.

Required Documents for Filing the Puerto Rico Tax Form

When preparing to file the Puerto Rico tax form, certain documents are necessary to support the information provided. These may include:

- Financial statements for the reporting period.

- Proof of tax-exempt status.

- Documentation of any deductions claimed.

Form Submission Methods for the Puerto Rico Tax Form

Businesses have several options for submitting the Puerto Rico tax form. These methods include:

- Online submission through the official tax portal.

- Mailing a printed copy of the form to the designated tax office.

- In-person submission at local tax offices, if necessary.

Eligibility Criteria for the Puerto Rico Tax Form for Exempt Businesses

To qualify for the Puerto Rico tax form for exempt businesses, entities must meet specific eligibility criteria. Generally, these criteria include being recognized as a tax-exempt organization under Puerto Rican law and maintaining proper documentation to support this status. Understanding these requirements is essential for compliance and to ensure that the business can take advantage of available tax benefits.

Quick guide on how to complete pdf income tax return for exempt businesses under the puerto rico

Accomplish PDF Income Tax Return For Exempt Businesses Under The Puerto Rico seamlessly on any device

Digital document management has become increasingly favored by companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and eSign your documents swiftly without any holdups. Handle PDF Income Tax Return For Exempt Businesses Under The Puerto Rico on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to adjust and eSign PDF Income Tax Return For Exempt Businesses Under The Puerto Rico with ease

- Locate PDF Income Tax Return For Exempt Businesses Under The Puerto Rico and click on Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Forge your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Modify and eSign PDF Income Tax Return For Exempt Businesses Under The Puerto Rico and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pdf income tax return for exempt businesses under the puerto rico

The way to create an e-signature for a PDF document in the online mode

The way to create an e-signature for a PDF document in Chrome

The best way to generate an e-signature for putting it on PDFs in Gmail

How to make an electronic signature straight from your mobile device

The best way to generate an e-signature for a PDF document on iOS devices

How to make an electronic signature for a PDF document on Android devices

People also ask

-

What is the puerto rico tax form, and why is it important?

The puerto rico tax form is a crucial document required for filing tax returns in Puerto Rico. It ensures that residents comply with local tax regulations. Understanding how to properly complete this form can help individuals avoid penalties and ensure accurate reporting of income.

-

How does airSlate SignNow simplify the eSigning process for the puerto rico tax form?

airSlate SignNow streamlines the eSigning process for the puerto rico tax form by providing an intuitive platform where users can easily sign documents electronically. With just a few clicks, users can finalize their tax forms without the hassle of printing or scanning. This efficiency expedites the filing process and makes tax compliance easier.

-

What features does airSlate SignNow offer for managing the puerto rico tax form?

airSlate SignNow includes features such as customizable templates, secure storage, and real-time tracking for the puerto rico tax form. These tools enhance document management and allow users to monitor the status of their tax forms at every stage. This level of organization is essential during tax season.

-

Is airSlate SignNow cost-effective for handling the puerto rico tax form?

Yes, airSlate SignNow offers a cost-effective solution for handling the puerto rico tax form. With various pricing plans available, businesses of all sizes can find an option that fits their budget. By reducing the need for paper forms and postage, users can also save on additional expenses.

-

Can I integrate airSlate SignNow with other tools for the puerto rico tax form?

Absolutely! airSlate SignNow integrates seamlessly with numerous applications to facilitate the processing of the puerto rico tax form. Whether it's accounting software or cloud storage solutions, these integrations enhance workflow and make managing tax documents easier and more efficient.

-

What are the benefits of using airSlate SignNow for the puerto rico tax form?

Using airSlate SignNow for the puerto rico tax form provides numerous benefits, including enhanced security, easy accessibility, and reduced processing times. Users can ensure their sensitive information is protected while also enjoying the convenience of signing documents from anywhere. This combination of features maximizes efficiency.

-

How do I get started with airSlate SignNow for the puerto rico tax form?

Getting started with airSlate SignNow for the puerto rico tax form is quick and straightforward. You can sign up for an account on the airSlate SignNow website, and once registered, you can easily upload your tax forms and access the necessary tools for eSigning. The platform is user-friendly, making it accessible for everyone.

Get more for PDF Income Tax Return For Exempt Businesses Under The Puerto Rico

- Motion intervene form

- Minnesota notice intervention form

- Affidavit of service intervention as a matter of right minnesota form

- Affidavit service motion form

- Guardian ad litem 497312690 form

- Correction statement and agreement minnesota form

- Minnesota closing 497312692 form

- Flood zone statement and authorization minnesota form

Find out other PDF Income Tax Return For Exempt Businesses Under The Puerto Rico

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation