482 0C COMPOSITE PARTNER RETURN Rev 06 Pr Form

What is the 482 0C COMPOSITE PARTNER RETURN Rev 06 Pr

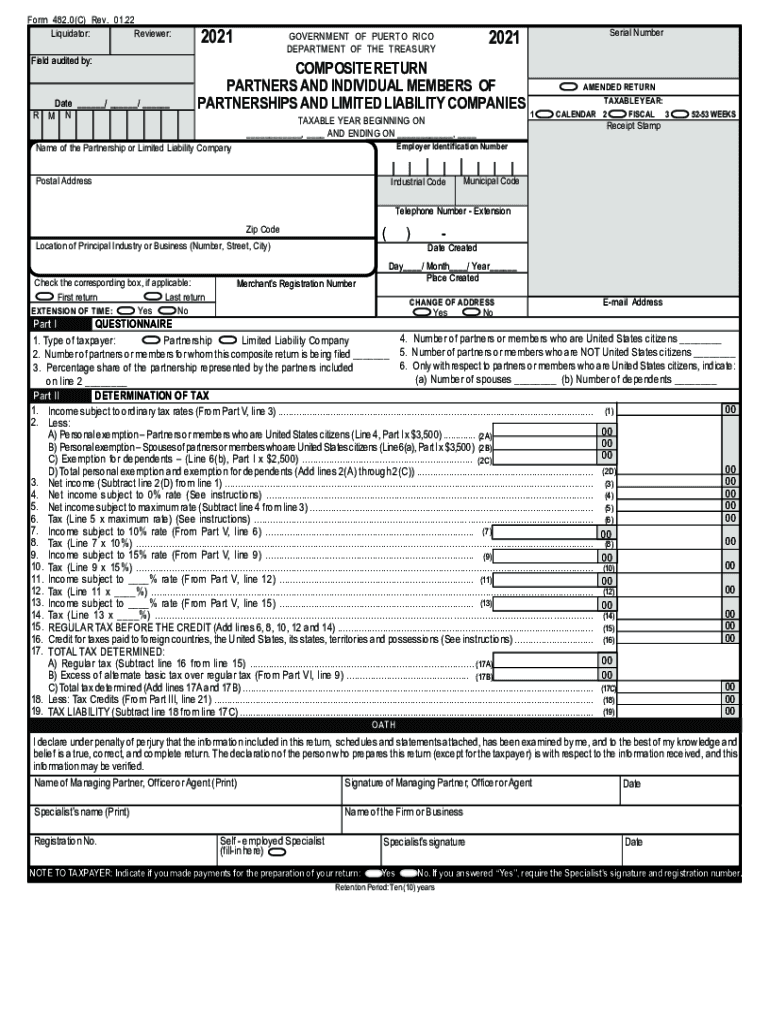

The 482 0C COMPOSITE PARTNER RETURN Rev 06 Pr is a tax form used by partnerships to report income, deductions, and credits. This form allows partners to collectively report their earnings and tax obligations to the Internal Revenue Service (IRS). It is essential for ensuring that all partners are compliant with federal tax regulations and accurately represent their financial activities. The form is particularly relevant for partnerships that operate in multiple states or have complex income structures.

Steps to complete the 482 0C COMPOSITE PARTNER RETURN Rev 06 Pr

Completing the 482 0C COMPOSITE PARTNER RETURN Rev 06 Pr involves several key steps:

- Gather necessary financial documents, including income statements and expense reports.

- Identify all partners and their respective ownership percentages.

- Fill out the form accurately, ensuring all income, deductions, and credits are reported.

- Review the completed form for accuracy and compliance with IRS guidelines.

- Submit the form by the designated filing deadline, either electronically or via mail.

Legal use of the 482 0C COMPOSITE PARTNER RETURN Rev 06 Pr

The legal use of the 482 0C COMPOSITE PARTNER RETURN Rev 06 Pr is crucial for partnerships. This form must be completed in accordance with IRS regulations to ensure that all partners fulfill their tax obligations. An accurate and timely submission helps avoid penalties and legal issues related to tax compliance. It is essential for partnerships to maintain proper records and documentation to support the information reported on the form.

Filing Deadlines / Important Dates

Filing deadlines for the 482 0C COMPOSITE PARTNER RETURN Rev 06 Pr are typically aligned with the federal tax return deadlines. Generally, partnerships must file their returns by March 15 of the following year. If additional time is needed, partnerships may apply for an extension, which can provide an additional six months to file. It is important for partners to be aware of these dates to avoid late fees and penalties.

Required Documents

To complete the 482 0C COMPOSITE PARTNER RETURN Rev 06 Pr, several documents are required:

- Income statements for the partnership.

- Expense reports detailing operational costs.

- Partner agreements outlining ownership percentages.

- Previous tax returns for reference and consistency.

Form Submission Methods (Online / Mail / In-Person)

The 482 0C COMPOSITE PARTNER RETURN Rev 06 Pr can be submitted in various ways. Partnerships may choose to file electronically using authorized e-file providers, which can expedite processing times. Alternatively, the form can be mailed directly to the IRS at the address specified in the form instructions. In-person submission is generally not an option for this form, as it is primarily processed through electronic or mail channels.

Quick guide on how to complete 4820c composite partner return rev 06 pr

Effortlessly prepare 482 0C COMPOSITE PARTNER RETURN Rev 06 Pr on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and eSign your documents quickly and without hold-ups. Handle 482 0C COMPOSITE PARTNER RETURN Rev 06 Pr on any platform with the airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The easiest way to modify and eSign 482 0C COMPOSITE PARTNER RETURN Rev 06 Pr with ease

- Find 482 0C COMPOSITE PARTNER RETURN Rev 06 Pr and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize signNow sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a standard handwritten signature.

- Review the details and click on the Done button to finalize your changes.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign 482 0C COMPOSITE PARTNER RETURN Rev 06 Pr and ensure excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 4820c composite partner return rev 06 pr

The way to create an e-signature for your PDF online

The way to create an e-signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The best way to create an e-signature right from your smartphone

The best way to generate an electronic signature for a PDF on iOS

The best way to create an e-signature for a PDF on Android

People also ask

-

What is the 482 0C COMPOSITE PARTNER RETURN Rev 06 Pr. document?

The 482 0C COMPOSITE PARTNER RETURN Rev 06 Pr. document is a critical form used by businesses to report and file composite partner returns. This return simplifies the tax process for partners and ensures compliance with state regulations. Understanding its structure and requirements is essential for accurate submissions.

-

How can airSlate SignNow assist with the 482 0C COMPOSITE PARTNER RETURN Rev 06 Pr.?

airSlate SignNow streamlines the process of preparing and sending the 482 0C COMPOSITE PARTNER RETURN Rev 06 Pr. document by allowing users to eSign and share it securely. Our platform ensures that all required fields are completed correctly, reducing the likelihood of submission errors. This efficiency ultimately saves time during tax season.

-

What are the key features of airSlate SignNow for handling the 482 0C COMPOSITE PARTNER RETURN Rev 06 Pr.?

Key features of airSlate SignNow include eSigning capabilities, document templates, and secure cloud storage for the 482 0C COMPOSITE PARTNER RETURN Rev 06 Pr. These tools help you manage your documents efficiently while ensuring compliance and security. Plus, our user-friendly interface makes the process seamless.

-

Is there a pricing plan for using airSlate SignNow for the 482 0C COMPOSITE PARTNER RETURN Rev 06 Pr.?

Yes, airSlate SignNow offers flexible pricing plans that cater to different business needs while providing access to the tools necessary for managing the 482 0C COMPOSITE PARTNER RETURN Rev 06 Pr. document. Whether you are a small business or an enterprise, our pricing options are designed to fit your budget without compromising on features.

-

What are the benefits of using airSlate SignNow for the 482 0C COMPOSITE PARTNER RETURN Rev 06 Pr.?

Using airSlate SignNow for your 482 0C COMPOSITE PARTNER RETURN Rev 06 Pr. can enhance efficiency, reduce paper waste, and speed up the eSigning process. Our solution makes it easy to track progress and ensure that all parties complete their signing tasks on time. Additionally, you can access your documents anytime, anywhere, boosting productivity.

-

Can I integrate airSlate SignNow with other software for the 482 0C COMPOSITE PARTNER RETURN Rev 06 Pr.?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to streamline your workflows when managing the 482 0C COMPOSITE PARTNER RETURN Rev 06 Pr. document. This integration helps centralize your documentation process and enhances collaboration across your teams, making it simpler to manage financial documents.

-

What is the process for eSigning the 482 0C COMPOSITE PARTNER RETURN Rev 06 Pr. with airSlate SignNow?

The process for eSigning the 482 0C COMPOSITE PARTNER RETURN Rev 06 Pr. with airSlate SignNow is straightforward. Simply upload your document, add signers, and assign the necessary fields for signatures. Once all parties have signed, you receive a completed document securely stored in your account.

Get more for 482 0C COMPOSITE PARTNER RETURN Rev 06 Pr

Find out other 482 0C COMPOSITE PARTNER RETURN Rev 06 Pr

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document

- Help Me With Sign New Mexico Banking Word

- Help Me With Sign New Mexico Banking Document