Sc Dept of Revenue Form 1065 K 1 2015

What is the SC Dept of Revenue Form 1065 K-1?

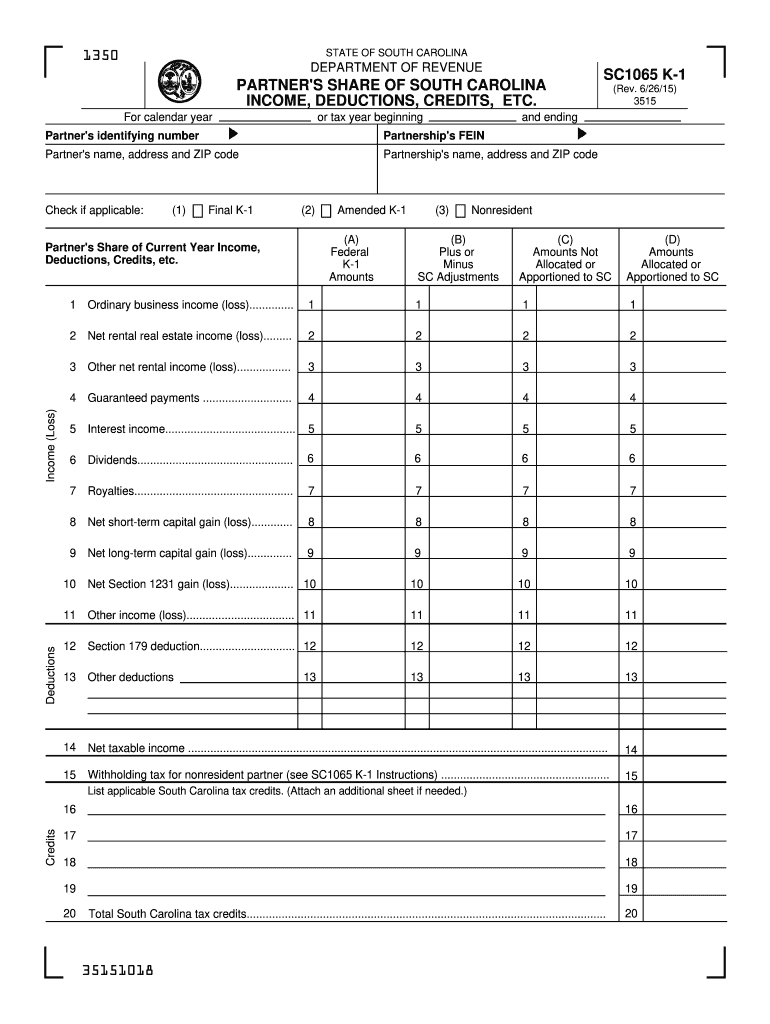

The SC Dept of Revenue Form 1065 K-1 is a tax document used in South Carolina to report income, deductions, and credits from partnerships. This form is essential for partners in a partnership, as it provides the necessary information to accurately report their share of the partnership's income on their individual tax returns. The form includes details such as the partner's share of income, losses, and other tax-related items, ensuring compliance with state tax regulations.

How to use the SC Dept of Revenue Form 1065 K-1

To effectively use the SC Dept of Revenue Form 1065 K-1, partners must first receive the completed form from the partnership. Each partner should review the information provided, ensuring accuracy before reporting it on their personal tax returns. The K-1 form should be attached to the individual tax return, typically the South Carolina Form 1040, and submitted to the SC Department of Revenue. It is important to keep a copy of the K-1 for personal records and future reference.

Steps to complete the SC Dept of Revenue Form 1065 K-1

Completing the SC Dept of Revenue Form 1065 K-1 involves several key steps:

- Gather all necessary financial information related to the partnership.

- Fill in the partner's identifying information, including name, address, and taxpayer identification number.

- Report the partner's share of income, deductions, and credits as provided by the partnership.

- Review the form for accuracy and completeness.

- Distribute copies of the completed K-1 to each partner and retain a copy for the partnership's records.

Key elements of the SC Dept of Revenue Form 1065 K-1

The SC Dept of Revenue Form 1065 K-1 includes several key elements that are crucial for accurate reporting:

- Partner Information: This section includes the partner's name, address, and taxpayer identification number.

- Partnership Information: Details about the partnership, including its name and identification number.

- Income and Deductions: The partner's share of income, losses, and deductions must be clearly reported.

- Credits: Any tax credits applicable to the partner should be included in this section.

Legal use of the SC Dept of Revenue Form 1065 K-1

The SC Dept of Revenue Form 1065 K-1 is legally binding and must be used in accordance with South Carolina tax laws. Partners are required to report the information accurately on their individual tax returns. Failure to do so may result in penalties or audits by the SC Department of Revenue. It is essential for partners to understand their responsibilities regarding the information reported on the K-1 to ensure compliance with state tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the SC Dept of Revenue Form 1065 K-1 align with the partnership's tax return deadlines. Generally, partnerships must file their returns by the fifteenth day of the third month following the end of their tax year. Partners should ensure they receive their K-1 in a timely manner to meet their individual tax filing deadlines, which are typically due on April fifteenth for most taxpayers. It is advisable to keep track of these important dates to avoid any late filing penalties.

Quick guide on how to complete sc1065 2015 online fillable form

Your assistance manual on how to prepare your Sc Dept Of Revenue Form 1065 K 1

If you’re curious about how to finalize and submit your Sc Dept Of Revenue Form 1065 K 1, here are a few brief guidelines to simplify your tax filing.

To start, you simply need to create your airSlate SignNow account to alter how you manage documents online. airSlate SignNow is a user-friendly and powerful document solution that allows you to modify, draft, and complete your tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures, and easily return to edit details as necessary. Streamline your tax management with advanced PDF editing, eSigning, and convenient sharing options.

Complete the steps below to achieve your Sc Dept Of Revenue Form 1065 K 1 in just a few minutes:

- Create your account and begin handling PDFs within minutes.

- Utilize our directory to find any IRS tax form; explore different versions and schedules.

- Select Get form to open your Sc Dept Of Revenue Form 1065 K 1 in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if required).

- Examine your document and correct any mistakes.

- Save changes, print your version, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Keep in mind that filing on paper can increase the likelihood of return errors and delays in reimbursements. Furthermore, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct sc1065 2015 online fillable form

FAQs

-

I'm trying to fill out a free fillable tax form. It won't let me click "done with this form" or "efile" which?

From https://www.irs.gov/pub/irs-utl/... (emphasis mine):DONE WITH THIS FORM — Select this button to save and close the form you are currently viewing and return to your 1040 form. This button is disabled when you are in your 1040 formSo, it appears, and without them mentioning it while you're working on it, that button is for all forms except 1040. Thank you to the other response to this question. I would never have thought of just clicking the Step 2 tab.

-

How do I create a fillable HTML form online that can be downloaded as a PDF? I have made a framework for problem solving and would like to give people access to an online unfilled form that can be filled out and downloaded filled out.

Create PDF Form that will be used for download and convert it to HTML Form for viewing on your website.However there’s a lot of PDF to HTML converters not many can properly convert PDF Form including form fields. If you plan to use some calculations or validations it’s even harder to find one. Try PDFix Form Converter which works fine to me.

-

How do I make a PDF a fillable form?

1. Open it with Foxit PhantomPDF and choose Form > Form Recognition > Run Form Field Recognition . All fillable fields in the document will be recognized and highlighted.2. Add form fields from Form > Form Fields > click a type of form field button and the cursor changes to crosshair . And the Designer Assistant is selected automatically.3. All the corresponding type of form fields will be automatically named with the text near the form fields (Take the text fields for an example as below).4. Click the place you want to add the form field. To edit the form field further, please refer to the properties of different buttons from “Buttons”.

-

Is there a service that will allow me to create a fillable form on a webpage, and then email a PDF copy of each form filled out?

You can use Fill which is has a free forever plan.You can use Fill to turn your PDF document into an online document which can be completed, signed and saved as a PDF, online.You will end up with a online fillable PDF like this:w9 || FillWhich can be embedded in your website should you wish.InstructionsStep 1: Open an account at Fill and clickStep 2: Check that all the form fields are mapped correctly, if not drag on the text fields.Step 3: Save it as a templateStep 4: Goto your templates and find the correct form. Then click on the embed settings to grab your form URL.

-

What is a good program to create fillable, saveable online PDF intake forms?

I have not compared programs, but you cannot go wrong with signNow’s PDF Editor. I would not use anything else. (You also need to consider whom you’re sending it to, and most people would use signNow when opening PDFs.)

-

How do I fill out an Indian passport form online?

You need to be careful while filling up the Passport form online. If is better if you download the Passport form and fill it up offline. You can upload the form again after you completely fill it up. You can check the complete procedure to know : How to Apply for Indian Passport Online ?

Create this form in 5 minutes!

How to create an eSignature for the sc1065 2015 online fillable form

How to create an eSignature for your Sc1065 2015 Online Fillable Form in the online mode

How to create an electronic signature for your Sc1065 2015 Online Fillable Form in Google Chrome

How to generate an electronic signature for signing the Sc1065 2015 Online Fillable Form in Gmail

How to make an electronic signature for the Sc1065 2015 Online Fillable Form straight from your smartphone

How to create an electronic signature for the Sc1065 2015 Online Fillable Form on iOS

How to make an eSignature for the Sc1065 2015 Online Fillable Form on Android

People also ask

-

What is the SC 1065 K 1 2018 form and why is it important?

The SC 1065 K 1 2018 form is a critical document for partnerships to report income, deductions, and credits to their partners. Understanding this form is essential for accurate tax reporting and compliance, ensuring that all partners receive the necessary information for their tax returns.

-

How can airSlate SignNow help with the SC 1065 K 1 2018 form?

airSlate SignNow simplifies the process of sending and electronically signing the SC 1065 K 1 2018 form. With our user-friendly interface, you can quickly prepare and share the form with partners, making tax season hassle-free.

-

What are the pricing options for airSlate SignNow regarding the SC 1065 K 1 2018?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes that need to manage the SC 1065 K 1 2018 form. Our plans are designed to be cost-effective while providing all necessary features to ensure smooth document management and compliance.

-

Are there specific features for managing tax documents like the SC 1065 K 1 2018?

Yes, airSlate SignNow includes features specifically designed for tax documents such as the SC 1065 K 1 2018. These features allow for secure signing, document tracking, and template creation to streamline the entire process, ensuring all parties can easily access and complete their forms.

-

Can I integrate airSlate SignNow with other software for handling SC 1065 K 1 2018?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting and tax software, which helps users manage the SC 1065 K 1 2018 along with their other financial documents. This integration allows for efficient data transfer and reduces the potential for errors.

-

What benefits does airSlate SignNow provide for handling the SC 1065 K 1 2018?

The key benefits of using airSlate SignNow for the SC 1065 K 1 2018 include enhanced efficiency, cost savings, and improved accuracy in document handling. Our electronic signing feature eliminates the need for physical paperwork, allows for quicker turnaround times, and helps ensure compliance with tax regulations.

-

Is eSigning the SC 1065 K 1 2018 legally binding?

Yes, eSigning the SC 1065 K 1 2018 with airSlate SignNow is legally binding and compliant with federal and state regulations. Our platform provides a secure and auditable way to sign documents electronically, making it a reliable option for managing your tax documentation.

Get more for Sc Dept Of Revenue Form 1065 K 1

- California common core data opt out form cuacc

- Formulir klaim asuransi kesehatan cigna indonesia cigna co

- Vacation form

- Visapro form

- Election of method of settlement and statement sun life financial form

- A technical overview of the form

- Terms and conditions easyequities form

- Form 205 collectors annual settlement

Find out other Sc Dept Of Revenue Form 1065 K 1

- How To Sign Georgia Assignment of License

- Sign Arizona Assignment of Lien Simple

- How To Sign Kentucky Assignment of Lien

- How To Sign Arkansas Lease Renewal

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement

- Sign Louisiana Pet Addendum to Lease Agreement Free

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe

- Sign South Carolina Vacation Rental Short Term Lease Agreement Now