Individual Income Tax Declaration for Internet or Electronic Filing Dor Mo Form

What is the Individual Income Tax Declaration For Internet Or Electronic Filing Dor Mo

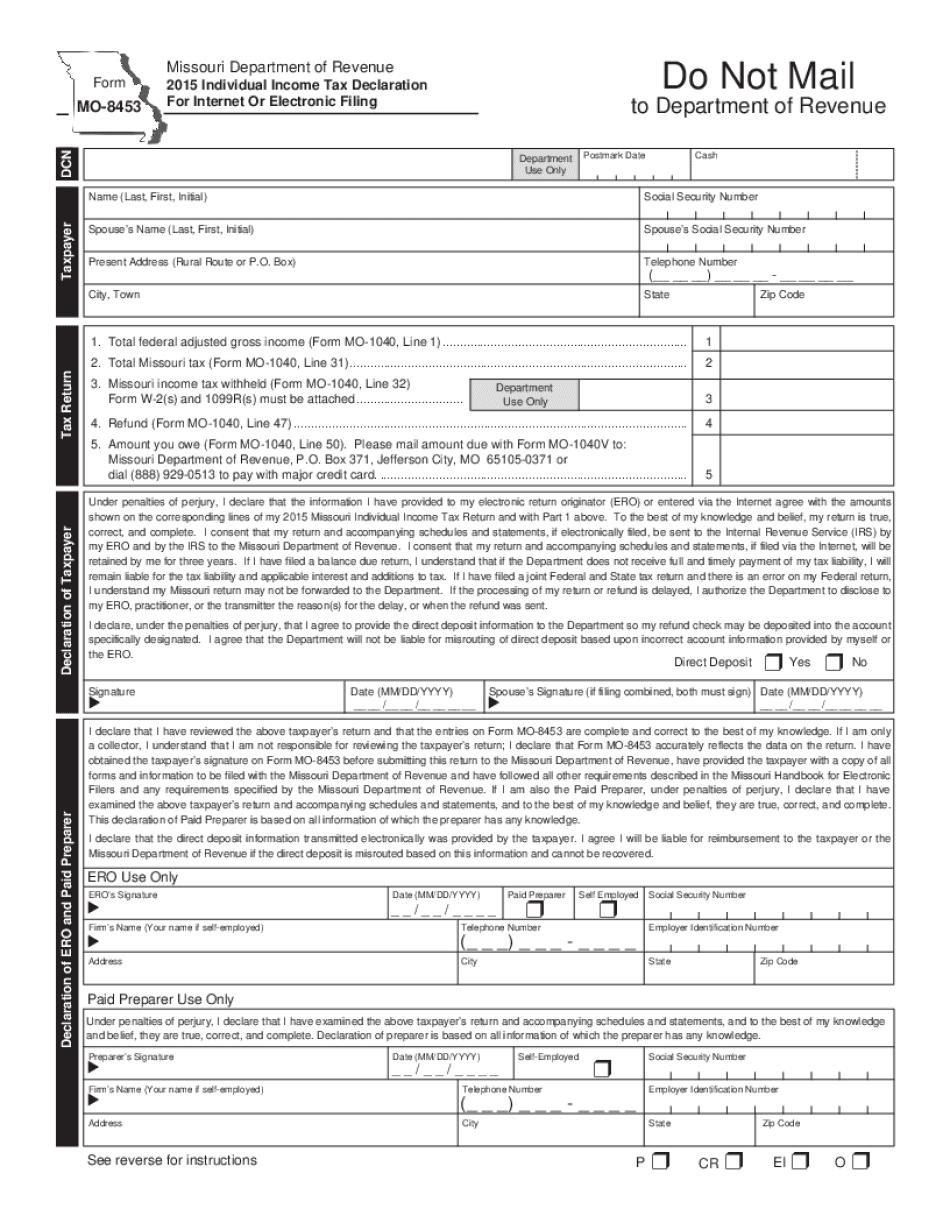

The Individual Income Tax Declaration for Internet or Electronic Filing Dor Mo is a specific form used by residents of Missouri to file their state income taxes electronically. This form is designed to facilitate the submission of tax information through online platforms, ensuring a streamlined process for taxpayers. It serves as a declaration of income and tax liability, allowing individuals to report their earnings and claim any applicable deductions or credits. The electronic filing option is particularly beneficial as it reduces the need for paper forms and speeds up the processing time for refunds.

Steps to Complete the Individual Income Tax Declaration For Internet Or Electronic Filing Dor Mo

Completing the Individual Income Tax Declaration for Internet or Electronic Filing Dor Mo involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Access the electronic filing system through an approved platform.

- Input personal information, including your Social Security number, address, and filing status.

- Enter income details and any deductions or credits you are eligible for.

- Review all information for accuracy before submission.

- Submit the form electronically and retain a copy for your records.

Legal Use of the Individual Income Tax Declaration For Internet Or Electronic Filing Dor Mo

The Individual Income Tax Declaration for Internet or Electronic Filing Dor Mo is legally binding when completed and submitted in accordance with state regulations. To ensure its validity, it must be signed electronically using a compliant eSignature solution. This form adheres to the legal frameworks established by the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA), which recognize electronic signatures as legally equivalent to handwritten signatures. Proper completion and submission of this form can help avoid penalties and ensure compliance with state tax laws.

IRS Guidelines

While the Individual Income Tax Declaration for Internet or Electronic Filing Dor Mo is a state-specific form, it is essential to follow IRS guidelines for federal tax filing as well. Taxpayers should ensure that their reported income on this form aligns with their federal tax return. The IRS provides comprehensive resources and instructions for filing federal taxes, which can help taxpayers understand their obligations and ensure accurate reporting. Familiarity with both state and federal guidelines is crucial for avoiding discrepancies and potential audits.

Filing Deadlines / Important Dates

Filing deadlines for the Individual Income Tax Declaration for Internet or Electronic Filing Dor Mo typically align with federal tax deadlines. For most taxpayers, the deadline to file is April 15th of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to be aware of any changes to these dates, as well as any extensions that may be available for specific circumstances, such as natural disasters or other emergencies.

Required Documents

To successfully complete the Individual Income Tax Declaration for Internet or Electronic Filing Dor Mo, taxpayers need to gather several key documents:

- W-2 forms from employers detailing annual earnings.

- 1099 forms for any freelance or contract work.

- Documentation of other income sources, such as rental or investment income.

- Receipts for deductible expenses, including medical costs and charitable contributions.

- Any relevant tax credits or previous year’s tax returns for reference.

Quick guide on how to complete 2015 individual income tax declaration for internet or electronic filing dor mo

Complete Individual Income Tax Declaration For Internet Or Electronic Filing Dor Mo effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary for you to create, edit, and electronically sign your documents swiftly without delays. Manage Individual Income Tax Declaration For Internet Or Electronic Filing Dor Mo on any platform using airSlate SignNow apps for Android or iOS and simplify any document-related process today.

The easiest method to modify and eSign Individual Income Tax Declaration For Internet Or Electronic Filing Dor Mo without hassle

- Obtain Individual Income Tax Declaration For Internet Or Electronic Filing Dor Mo and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal weight as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form hunting, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Individual Income Tax Declaration For Internet Or Electronic Filing Dor Mo and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2015 individual income tax declaration for internet or electronic filing dor mo

The way to create an e-signature for your PDF in the online mode

The way to create an e-signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to create an e-signature right from your smart phone

The best way to generate an electronic signature for a PDF on iOS devices

The best way to create an e-signature for a PDF on Android OS

People also ask

-

What is MO 8453 and how does it relate to airSlate SignNow?

MO 8453 is a form used for electronic signatures in relation to tax documents. With airSlate SignNow, you can easily complete and eSign the MO 8453, ensuring a smooth and compliant submission process. Our platform offers an intuitive interface for handling such specific documents.

-

How does airSlate SignNow enhance the signing process for MO 8453?

airSlate SignNow enhances the signing process for MO 8453 by providing a user-friendly platform that simplifies document management. Users can seamlessly send, sign, and store MO 8453 forms, eliminating the hassle of physical paperwork. Our solution improves efficiency and accuracy in document handling.

-

What are the pricing plans for using airSlate SignNow with MO 8453?

Our pricing plans for airSlate SignNow are designed to be cost-effective, starting with a free trial to explore features related to MO 8453. We offer various subscription options that cater to different business sizes and needs, ensuring you get value for your investment in electronic signature capabilities. Contact our sales team for specific pricing details.

-

Can I integrate airSlate SignNow with other software when working with MO 8453?

Yes, airSlate SignNow offers integrations with various software applications that can enhance your workflow for handling MO 8453. Whether you use CRM systems, cloud storage, or other document management tools, our platform ensures compatibility and smooth data transfer. This flexibility allows you to streamline your operations effectively.

-

What features does airSlate SignNow offer specifically for MO 8453?

airSlate SignNow provides essential features like customizable templates, secure electronic signatures, and real-time tracking for MO 8453. Additionally, our platform supports multiple formats and ensures compliance with legal standards. These features make it a comprehensive solution for managing tax forms digitally.

-

Are there security measures in place for signing MO 8453 with airSlate SignNow?

Yes, airSlate SignNow prioritizes security, especially when handling sensitive documents like MO 8453. Our platform employs advanced encryption, access controls, and audit trails to protect your data. Users can sign and store their forms confidently, knowing that their information is secure.

-

How can I get help with using airSlate SignNow for MO 8453?

For assistance with using airSlate SignNow for MO 8453, we provide extensive resources, including tutorials and customer support. Our help center contains guides specifically designed for common questions and issues. Additionally, our support team is available to help with any challenges you might encounter.

Get more for Individual Income Tax Declaration For Internet Or Electronic Filing Dor Mo

Find out other Individual Income Tax Declaration For Internet Or Electronic Filing Dor Mo

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document