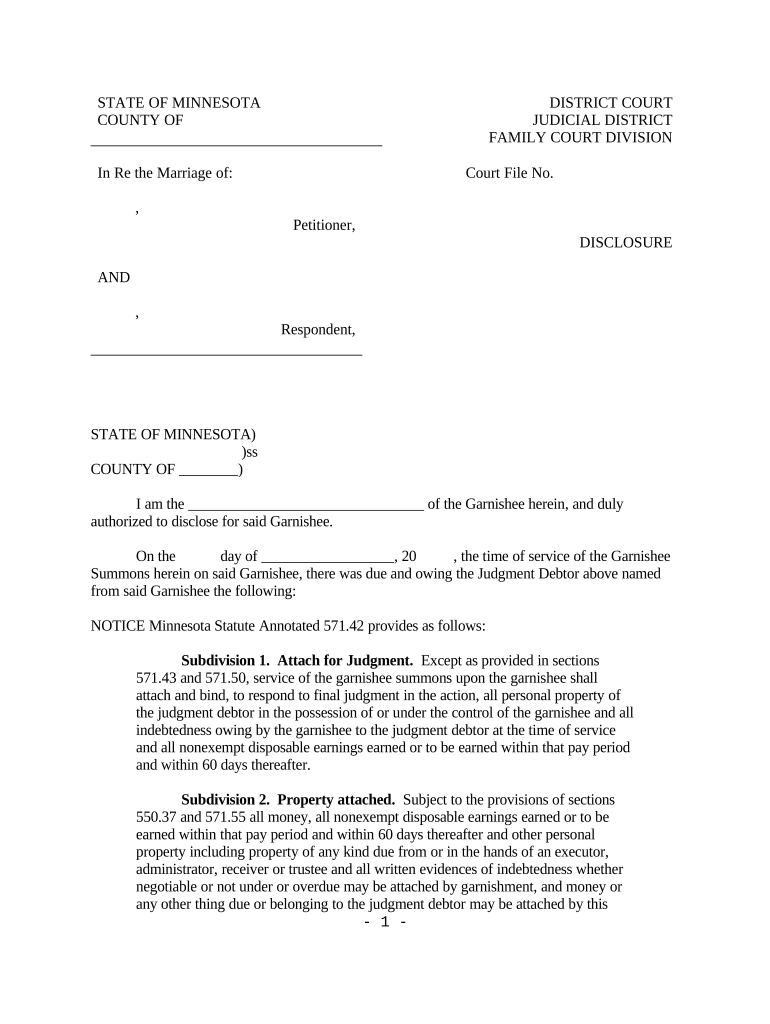

Garnishment Disclosure Minnesota Form

What is the Garnishment Disclosure Minnesota

The Garnishment Disclosure Minnesota form is a legal document that outlines the details of wage garnishment in the state of Minnesota. This form is typically used by creditors to inform debtors about the garnishment process, including the amount being garnished from their wages and the legal basis for the garnishment. It serves as a crucial communication tool between the creditor, the debtor, and the employer, ensuring that all parties are aware of their rights and obligations under Minnesota law.

How to use the Garnishment Disclosure Minnesota

Using the Garnishment Disclosure Minnesota form involves several steps to ensure compliance with legal requirements. First, the creditor must fill out the form accurately, providing necessary details such as the debtor's name, the amount owed, and the reason for garnishment. Once completed, the form should be served to the debtor and the employer. The debtor has the right to contest the garnishment, and the form serves as a notification of the garnishment process, allowing them to understand their rights and options.

Steps to complete the Garnishment Disclosure Minnesota

Completing the Garnishment Disclosure Minnesota form requires careful attention to detail. Follow these steps:

- Gather necessary information about the debtor, including their full name, address, and Social Security number.

- Determine the amount to be garnished based on the outstanding debt.

- Complete the form, ensuring all fields are filled out accurately.

- Review the form for any errors or omissions before submission.

- Serve the completed form to the debtor and their employer, following legal service requirements.

Legal use of the Garnishment Disclosure Minnesota

The legal use of the Garnishment Disclosure Minnesota form is governed by state laws that dictate the garnishment process. This form must be used in accordance with Minnesota Statutes, which outline the rights of debtors and creditors. Proper use of the form ensures that creditors comply with legal standards while providing debtors with the necessary information regarding their garnishment. Failure to adhere to these legal requirements can result in penalties or dismissal of the garnishment.

Key elements of the Garnishment Disclosure Minnesota

Several key elements must be included in the Garnishment Disclosure Minnesota form to ensure its validity:

- The creditor's name and contact information.

- The debtor's name, address, and Social Security number.

- The total amount owed and the specific amount to be garnished.

- The legal basis for the garnishment, such as a court judgment.

- Instructions for the debtor on how to respond or contest the garnishment.

State-specific rules for the Garnishment Disclosure Minnesota

In Minnesota, specific rules govern the garnishment process, including the use of the Garnishment Disclosure form. These rules dictate the maximum amount that can be garnished from a debtor's wages, the timeframe for serving the form, and the debtor's rights to challenge the garnishment. Understanding these state-specific regulations is essential for both creditors and debtors to navigate the garnishment process effectively.

Quick guide on how to complete garnishment disclosure minnesota

Easily Prepare Garnishment Disclosure Minnesota on Any Device

Digital document management has become increasingly favored among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents quickly and without delays. Manage Garnishment Disclosure Minnesota on any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to Edit and Electronically Sign Garnishment Disclosure Minnesota Effortlessly

- Locate Garnishment Disclosure Minnesota and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form searches, or mistakes that require printing additional copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Garnishment Disclosure Minnesota and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Garnishment Disclosure in Minnesota?

A Garnishment Disclosure in Minnesota is a legal notice that informs a debtor about the garnishment of their wages or bank accounts. It outlines the specific details regarding the amount being garnished, the creditor involved, and the legal basis for the garnishment. Understanding this disclosure is vital for individuals facing wage garnishment to protect their rights.

-

How can airSlate SignNow help with Garnishment Disclosure in Minnesota?

AirSlate SignNow offers a streamlined solution for managing PDF documents, including Garnishment Disclosures in Minnesota. Our platform allows you to easily create, sign, and send these documents securely. This simplifies the process and ensures that all legal requirements are met efficiently.

-

Is airSlate SignNow compliant with Minnesota laws regarding Garnishment Disclosure?

Yes, airSlate SignNow is designed to comply with state and federal regulations, including those pertaining to Garnishment Disclosure in Minnesota. Our platform implements the necessary security measures and document management practices to adhere to legal standards. This ensures that your documents are processed correctly and lawfully.

-

What features does airSlate SignNow offer for managing documents related to Garnishment Disclosure in Minnesota?

AirSlate SignNow provides features such as electronic signatures, document templates, and customizable workflows specifically for managing Garnishment Disclosures in Minnesota. You can easily track the status of your documents and receive notifications once they are signed. This functionality helps streamline your workflow and enhance document efficiency.

-

Are there any pricing options for using airSlate SignNow for Garnishment Disclosure in Minnesota?

Yes, airSlate SignNow offers various pricing plans designed to fit different business needs, making it a cost-effective solution for managing Garnishment Disclosures in Minnesota. You can choose from basic to advanced plans based on your document volume and required features. This flexibility ensures you only pay for what you need.

-

Can I integrate airSlate SignNow with other applications for Garnishment Disclosure in Minnesota?

Absolutely! AirSlate SignNow supports integrations with various applications, allowing you to streamline your processes for Garnishment Disclosure in Minnesota. This means you can connect it to your CRM, accounting software, or other tools to automate workflows and enhance operational efficiency.

-

How can I ensure that my Garnishment Disclosure in Minnesota is legally binding?

Using airSlate SignNow enhances the legal standing of your Garnishment Disclosure in Minnesota by utilizing secure electronic signatures. Our platform adheres to the Electronic Signatures in Global and National Commerce (ESIGN) Act and UETA, ensuring that your documents are legally binding and compliant. This provides peace of mind when sending important legal documents.

Get more for Garnishment Disclosure Minnesota

- Cigna form lm 600829i

- Prepaid card offer certificate tailbase form

- Employment application educational grimmway farms form

- Copyright transfer form template

- Chapter 4 roles of child health care providers cdc form

- Quarter form 941me 99 2106200 maine revenue 771843123

- Company agreement template form

- Company buyout agreement template form

Find out other Garnishment Disclosure Minnesota

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure