MO PTC Property Tax Credit Claim Form

What is the MO PTC Property Tax Credit Claim

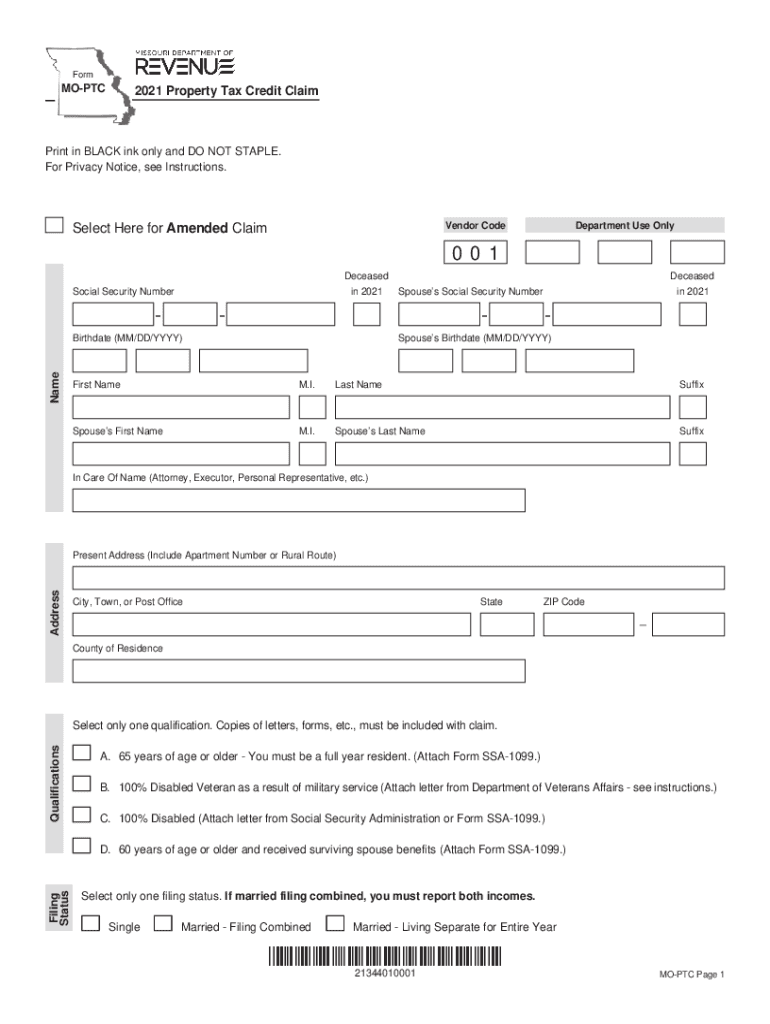

The Missouri Property Tax Credit (MO PTC) Claim is a tax benefit designed to assist eligible residents of Missouri in reducing their property tax burden. This claim is specifically aimed at individuals who meet certain criteria, including age, disability status, and income limitations. By filing the MO PTC, eligible taxpayers can receive a credit that directly reduces the amount of property tax they owe, making homeownership more affordable for those who qualify.

How to use the MO PTC Property Tax Credit Claim

To utilize the MO PTC Property Tax Credit Claim effectively, taxpayers must first determine their eligibility based on specific criteria, such as age and income. Once eligibility is confirmed, individuals can obtain the necessary form, which is typically available through the Missouri Department of Revenue. After filling out the form accurately, it should be submitted to the appropriate state office, either online, by mail, or in person, depending on the preferred submission method.

Steps to complete the MO PTC Property Tax Credit Claim

Completing the MO PTC Property Tax Credit Claim involves several key steps:

- Determine Eligibility: Review the eligibility requirements to ensure you qualify for the credit.

- Obtain the Form: Access the MO PTC form from the Missouri Department of Revenue website or local offices.

- Fill Out the Form: Provide accurate information, including personal details and property tax information.

- Attach Required Documents: Include any necessary documentation that supports your claim, such as proof of income or age.

- Submit the Form: Send your completed form to the appropriate state office via your chosen method.

Eligibility Criteria

Eligibility for the MO PTC Property Tax Credit Claim is primarily determined by factors such as age, disability status, and income level. Generally, applicants must be at least sixty-five years old, or be a veteran or permanently disabled individual. Additionally, there are income limits that vary based on filing status. It is crucial to review the most current eligibility guidelines provided by the Missouri Department of Revenue to ensure compliance and maximize the potential credit amount.

Required Documents

When filing the MO PTC Property Tax Credit Claim, certain documents are required to substantiate your eligibility and claim amount. These documents may include:

- Proof of age or disability, such as a birth certificate or disability award letter.

- Income verification documents, including tax returns or W-2 forms.

- Property tax statements to confirm the amount of tax paid.

Having these documents ready can streamline the filing process and help avoid delays in claim processing.

Form Submission Methods

The MO PTC Property Tax Credit Claim can be submitted through various methods to accommodate taxpayer preferences. These methods include:

- Online Submission: Many taxpayers prefer to submit their claims electronically through the Missouri Department of Revenue's online portal.

- Mail: Completed forms can be mailed to the designated state office for processing.

- In-Person: Taxpayers may also choose to submit their claims in person at local Department of Revenue offices.

Each submission method has its own processing times, so it is advisable to choose the one that best fits your needs.

Quick guide on how to complete mo ptc 2021 property tax credit claim

Effortlessly prepare MO PTC Property Tax Credit Claim on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a sustainable alternative to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage MO PTC Property Tax Credit Claim on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

How to modify and eSign MO PTC Property Tax Credit Claim with ease

- Obtain MO PTC Property Tax Credit Claim and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of the documents or conceal sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details carefully and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign MO PTC Property Tax Credit Claim and maintain excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mo ptc 2021 property tax credit claim

The way to create an e-signature for your PDF document online

The way to create an e-signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to create an e-signature from your smart phone

The best way to generate an electronic signature for a PDF document on iOS

The best way to create an e-signature for a PDF file on Android OS

People also ask

-

What is the 2021 mo ptc and how does it relate to airSlate SignNow?

The 2021 mo ptc refers to the Missouri Personal Tax Credit for the year 2021. While airSlate SignNow primarily focuses on document signing and management, understanding forms related to the 2021 mo ptc can help streamline your tax-related document processes.

-

How can airSlate SignNow assist with tax document management for the 2021 mo ptc?

AirSlate SignNow makes it easy to share, edit, and eSign documents related to the 2021 mo ptc. With its user-friendly interface, businesses can manage tax forms efficiently, ensuring that all necessary documents are quickly signed and submitted.

-

What are the pricing options available for airSlate SignNow in 2021?

In 2021, airSlate SignNow offers a range of pricing plans to suit various business needs. Whether you're looking for a basic plan for individual use or a comprehensive solution for an organization handling many 2021 mo ptc forms, there’s an option available that ensures affordability and value.

-

What features does airSlate SignNow provide for managing the 2021 mo ptc documents?

AirSlate SignNow offers features like customizable templates, real-time document tracking, and secure eSigning, making it ideal for managing the 2021 mo ptc documents. These tools facilitate compliance and streamline the signing process, ensuring that all parties are well-informed.

-

Are there any integrations available with airSlate SignNow for handling 2021 mo ptc?

Yes, airSlate SignNow integrates with a variety of applications that can be useful for managing 2021 mo ptc documents. This includes popular productivity tools like Google Drive and Dropbox, enabling seamless workflows for tax document preparation and submission.

-

What benefits does using airSlate SignNow offer for the 2021 mo ptc process?

Using airSlate SignNow for the 2021 mo ptc process includes enhanced productivity, reduced turnaround time, and improved document security. The ability to eSign and store documents electronically ensures compliance and accessibility at all times.

-

Can airSlate SignNow handle bulk signing for 2021 mo ptc related forms?

Absolutely! AirSlate SignNow allows for bulk signing, which is incredibly beneficial for businesses handling multiple 2021 mo ptc related forms. This feature simplifies the process, allowing you to send documents to multiple recipients at once.

Get more for MO PTC Property Tax Credit Claim

- Living trust for individual who is single divorced or widow or widower with no children minnesota form

- Minnesota living trust form

- Living trust for husband and wife with one child minnesota form

- Living trust for husband and wife with minor and or adult children minnesota form

- Amendment to living trust minnesota form

- Living trust property record minnesota form

- Financial account transfer to living trust minnesota form

- Mn assignment form

Find out other MO PTC Property Tax Credit Claim

- Sign Banking Presentation Oregon Fast

- Sign Banking Document Pennsylvania Fast

- How To Sign Oregon Banking Last Will And Testament

- How To Sign Oregon Banking Profit And Loss Statement

- Sign Pennsylvania Banking Contract Easy

- Sign Pennsylvania Banking RFP Fast

- How Do I Sign Oklahoma Banking Warranty Deed

- Sign Oregon Banking Limited Power Of Attorney Easy

- Sign South Dakota Banking Limited Power Of Attorney Mobile

- How Do I Sign Texas Banking Memorandum Of Understanding

- Sign Virginia Banking Profit And Loss Statement Mobile

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed