Form NJ 1040 HW "Property Tax Credit Application Wounded 2021

What is the Form NJ 1040 HW "Property Tax Credit Application"?

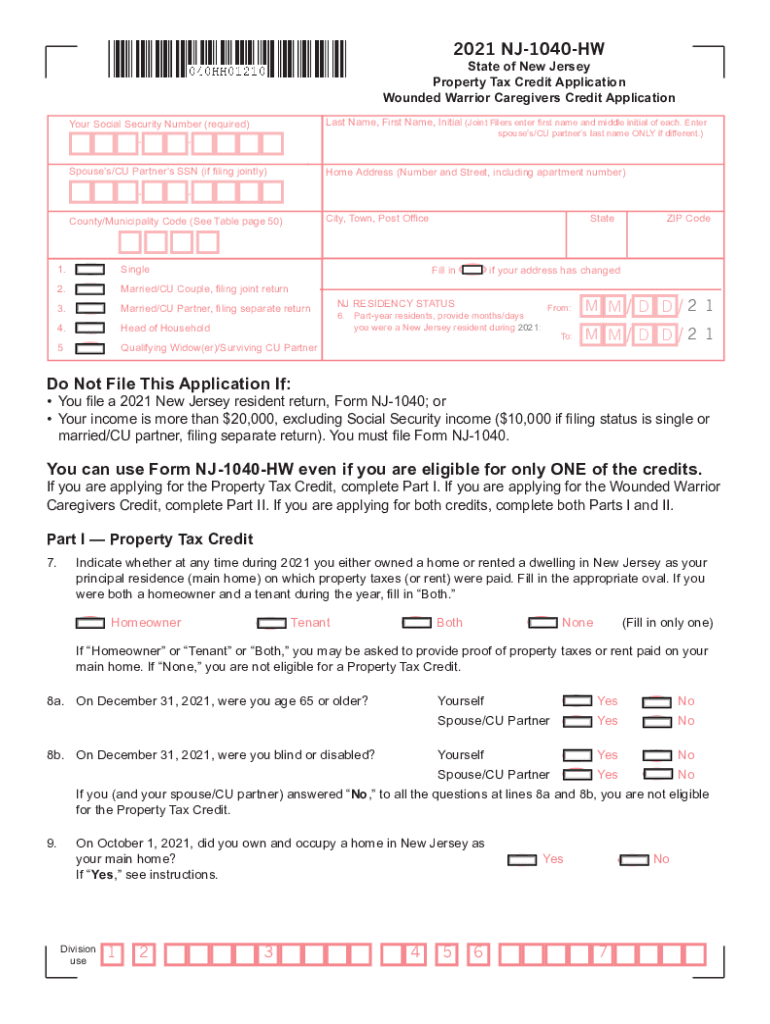

The NJ 1040 HW, known as the Property Tax Credit Application, is a state-specific form used in New Jersey to apply for property tax credits. This form is designed for eligible residents who wish to claim a credit against their property taxes based on certain qualifying criteria. Understanding this form is essential for those looking to reduce their tax burden and ensure compliance with state regulations.

Steps to Complete the Form NJ 1040 HW

Completing the NJ 1040 HW involves several key steps to ensure accuracy and compliance. Begin by gathering necessary documentation, including proof of residency and property ownership. Next, fill out the form with personal information, including your name, address, and Social Security number. Be sure to provide details regarding your property, such as the block and lot number. After completing the form, review all entries for accuracy before submitting it to the appropriate state office.

Eligibility Criteria for the NJ 1040 HW

To qualify for the property tax credit application, applicants must meet specific eligibility criteria. Generally, homeowners must be residents of New Jersey and have paid property taxes on their primary residence. Additional factors may include income limits and age restrictions, particularly for senior citizens or disabled individuals. It is important to review these criteria carefully to ensure that you qualify before submitting your application.

Required Documents for the NJ 1040 HW

When applying for the property tax credit using the NJ 1040 HW, certain documents are required to support your application. These may include:

- Proof of property ownership, such as a deed or tax bill.

- Documentation of residency, like a utility bill or lease agreement.

- Income verification, which could be recent pay stubs or tax returns.

Having these documents ready will streamline the application process and help avoid delays.

Form Submission Methods for the NJ 1040 HW

The NJ 1040 HW can be submitted through various methods to accommodate different preferences. Applicants may choose to file the form online through the New Jersey Division of Taxation's website. Alternatively, you can mail the completed form to the designated state office or deliver it in person. Each method has its own processing times, so consider your needs when deciding how to submit your application.

Legal Use of the Form NJ 1040 HW

The NJ 1040 HW is a legally recognized document that must be completed accurately to ensure compliance with New Jersey tax laws. Submitting false information or failing to provide required documentation can result in penalties or denial of your application. It is essential to understand the legal implications of the form and to ensure that all information provided is truthful and complete.

Filing Deadlines for the NJ 1040 HW

Timely submission of the NJ 1040 HW is crucial for applicants wishing to receive their property tax credits. The filing deadline typically aligns with the state tax return deadlines, so it is advisable to check the New Jersey Division of Taxation’s website for specific dates each year. Missing the deadline may result in the inability to claim the credit for that tax year.

Quick guide on how to complete form nj 1040 hw ampquotproperty tax credit application wounded

Easily Prepare Form NJ 1040 HW "Property Tax Credit Application Wounded on Any Device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and electronically sign your documents promptly without any hold-ups. Manage Form NJ 1040 HW "Property Tax Credit Application Wounded on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The Easiest Way to Modify and Electronically Sign Form NJ 1040 HW "Property Tax Credit Application Wounded

- Find Form NJ 1040 HW "Property Tax Credit Application Wounded and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional hand-signed signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method of submitting your form, whether by email, SMS, or invitation link, or download it directly to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and electronically sign Form NJ 1040 HW "Property Tax Credit Application Wounded and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form nj 1040 hw ampquotproperty tax credit application wounded

Create this form in 5 minutes!

How to create an eSignature for the form nj 1040 hw ampquotproperty tax credit application wounded

How to generate an electronic signature for a PDF file online

How to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The way to generate an e-signature straight from your mobile device

How to make an e-signature for a PDF file on iOS

The way to generate an e-signature for a PDF document on Android devices

People also ask

-

What is a property tax credit application?

A property tax credit application is a formal request for a reduction in property taxes based on qualifying factors, such as income or property usage. Using airSlate SignNow, you can easily prepare, sign, and submit your application electronically, streamlining the process and reducing turnaround time.

-

How can airSlate SignNow help with my property tax credit application?

airSlate SignNow provides an intuitive platform for creating and managing property tax credit applications. With features like electronic signatures and document tracking, you can ensure your application is completed correctly and submitted promptly, improving your chances of approval.

-

Is there a cost associated with using airSlate SignNow for property tax credit applications?

Yes, airSlate SignNow has various pricing plans tailored to your business needs. Investing in our service can save you time and money by simplifying the property tax credit application process, which can often be complicated and time-consuming.

-

What features does airSlate SignNow offer for property tax credit applications?

airSlate SignNow offers features such as template creation, eSignature capabilities, and document status tracking. These features make it easier to manage your property tax credit application, ensuring that everything is in order before submission.

-

Can I integrate airSlate SignNow with other software for my property tax credit application?

Absolutely! airSlate SignNow seamlessly integrates with various third-party applications, including CRMs and accounting software. These integrations facilitate the collection of necessary data for your property tax credit application, enhancing efficiency.

-

How secure is the information I provide in my property tax credit application?

The security of your information is paramount at airSlate SignNow. We utilize advanced encryption protocols and secure cloud storage to protect your data, ensuring that your property tax credit application is safe and confidential.

-

What benefits can I expect from using airSlate SignNow for my applications?

By using airSlate SignNow for your property tax credit application, you can expect faster processing times, reduced paperwork, and increased accuracy. Our platform simplifies the entire process, allowing you to focus on other important tasks.

Get more for Form NJ 1040 HW "Property Tax Credit Application Wounded

- Missouri disclosure form

- Lead paint rental form

- Missouri notice form 497313368

- Sample cover letter for filing of llc articles or certificate with secretary of state missouri form

- Supplemental residential lease forms package missouri

- Missouri landlord tenant form

- Mo name form

- Missouri name change instructions and forms package for a minor missouri

Find out other Form NJ 1040 HW "Property Tax Credit Application Wounded

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form