Download ILovePDF Latest Version Form

Understanding the Arizona Form 830

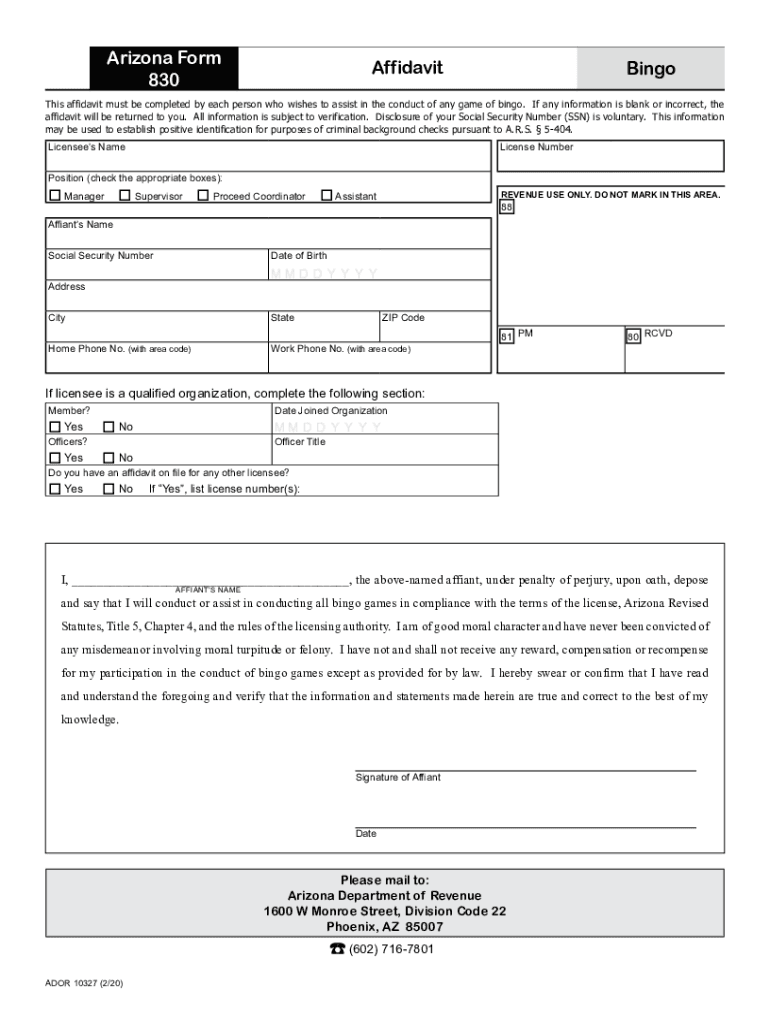

The Arizona Form 830, also known as the Arizona Revenue 10327, is a crucial document for businesses and individuals in the state. This form is primarily used for reporting various tax-related information to the Arizona Department of Revenue. It is essential for maintaining compliance with state tax laws and ensuring accurate reporting of income and deductions. Understanding the purpose and requirements of this form is vital for anyone who needs to file it.

Steps to Complete the Arizona Form 830

Completing the Arizona Form 830 involves several key steps to ensure accuracy and compliance. Here’s a straightforward process to follow:

- Gather necessary documents, including income statements and previous tax returns.

- Download the Arizona 830 PDF from the official state website or a trusted source.

- Fill out the form, ensuring all required fields are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the form either online, by mail, or in person, depending on your preference and the specific instructions provided.

Legal Use of the Arizona Form 830

The Arizona Form 830 must be used in accordance with state tax regulations. It is legally binding when completed accurately and submitted on time. Failure to comply with the requirements can result in penalties or delays in processing your tax return. It is important to ensure that all information provided is truthful and complete to avoid any legal issues.

Filing Deadlines for the Arizona Form 830

Timely filing of the Arizona Form 830 is crucial to avoid penalties. The typical deadline for submitting this form aligns with the federal tax filing deadline, which is usually April 15. However, it is advisable to check for any state-specific extensions or changes that may apply. Keeping track of these deadlines can help ensure compliance and avoid unnecessary fees.

Form Submission Methods for the Arizona Form 830

There are several methods available for submitting the Arizona Form 830. You can choose to file it online through the Arizona Department of Revenue's e-filing system, which is often the quickest option. Alternatively, you can print the completed form and mail it to the appropriate address or deliver it in person to a local revenue office. Each method has its own advantages, so selecting the one that best fits your needs is important.

Required Documents for the Arizona Form 830

When completing the Arizona Form 830, certain documents are necessary to support your claims and ensure accurate reporting. Commonly required documents include:

- Income statements, such as W-2s or 1099s.

- Previous year’s tax returns for reference.

- Documentation for any deductions or credits you plan to claim.

- Identification information, including your Social Security number or Employer Identification Number (EIN).

Penalties for Non-Compliance with the Arizona Form 830

Failure to file the Arizona Form 830 on time or providing inaccurate information can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. To avoid these consequences, it is crucial to complete the form accurately and submit it by the designated deadline. Understanding the implications of non-compliance can help motivate timely and correct filings.

Quick guide on how to complete download ilovepdf free latest version

Effortlessly Prepare Download ILovePDF Latest Version on Any Device

Managing documents online has gained popularity among companies and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without interruptions. Manage Download ILovePDF Latest Version on any device using the airSlate SignNow applications for Android or iOS and enhance any document-related task today.

The Easiest Way to Edit and eSign Download ILovePDF Latest Version Seamlessly

- Find Download ILovePDF Latest Version and click Get Form to initiate the process.

- Utilize the tools we provide to fill out your form.

- Emphasize key sections of your documents or obscure sensitive details using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign feature, which takes just moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to deliver your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced files, the hassle of searching for forms, or the need to print new document copies due to errors. airSlate SignNow meets your document management needs with just a few clicks from your preferred device. Modify and eSign Download ILovePDF Latest Version while ensuring outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the download ilovepdf free latest version

How to generate an e-signature for a PDF online

How to generate an e-signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

The way to make an e-signature right from your smartphone

The best way to create an e-signature for a PDF on iOS

The way to make an e-signature for a PDF on Android

People also ask

-

What is the Arizona Form 830?

The Arizona Form 830 is a document used to report various financial information to the state of Arizona. It is commonly utilized by businesses and individuals to ensure compliance with state tax regulations. Understanding how to correctly fill out the form is crucial to avoid any potential penalties.

-

How can airSlate SignNow help with the Arizona Form 830?

airSlate SignNow streamlines the process of completing and electronically signing the Arizona Form 830. Our platform allows users to fill out the document, collaborate with others, and eSign it securely from anywhere. This enhances efficiency and ensures that your submission is timely and accurate.

-

Is there a cost associated with using airSlate SignNow for Arizona Form 830 submissions?

Yes, airSlate SignNow offers various pricing plans tailored to the needs of businesses. While there is a cost to utilize our eSigning services, the investment in our platform provides signNow time and resource savings when preparing the Arizona Form 830 and other documents.

-

What features does airSlate SignNow offer for the Arizona Form 830?

The key features of airSlate SignNow for the Arizona Form 830 include customizable templates, secure eSigning, and real-time collaboration tools. Users can easily save, share, and track the status of their documents to ensure efficient completion and submission.

-

Can I integrate airSlate SignNow with my existing software for Arizona Form 830 management?

Absolutely! airSlate SignNow provides seamless integrations with a wide range of popular business applications, allowing you to manage the Arizona Form 830 alongside your other workflows. This integration enhances productivity and ensures a smoother document handling experience.

-

What benefits does airSlate SignNow offer for filing the Arizona Form 830?

Using airSlate SignNow for the Arizona Form 830 offers several benefits, including reduced processing time, enhanced security, and improved accuracy. The ability to eSign and store documents electronically simplifies record-keeping and ensures you meet all compliance requirements.

-

Is airSlate SignNow secure for signing the Arizona Form 830?

Yes, airSlate SignNow employs advanced security measures to protect your documents. From encryption to authentication features, we ensure that your Arizona Form 830 and other sensitive documents are safeguarded against unauthorized access.

Get more for Download ILovePDF Latest Version

- Bill of sale for automobile or vehicle including odometer statement and promissory note indiana form

- Promissory note in connection with sale of vehicle or automobile indiana form

- Bill of sale for watercraft or boat indiana form

- Bill of sale of automobile and odometer statement for as is sale indiana form

- Construction contract cost plus or fixed fee indiana form

- Painting contract for contractor indiana form

- Trim carpenter 497306631 form

- Fencing contract for contractor indiana form

Find out other Download ILovePDF Latest Version

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document