Electronic Filing of Form 1065, U S Partnership Return of

What is the electronic filing of Form 1065?

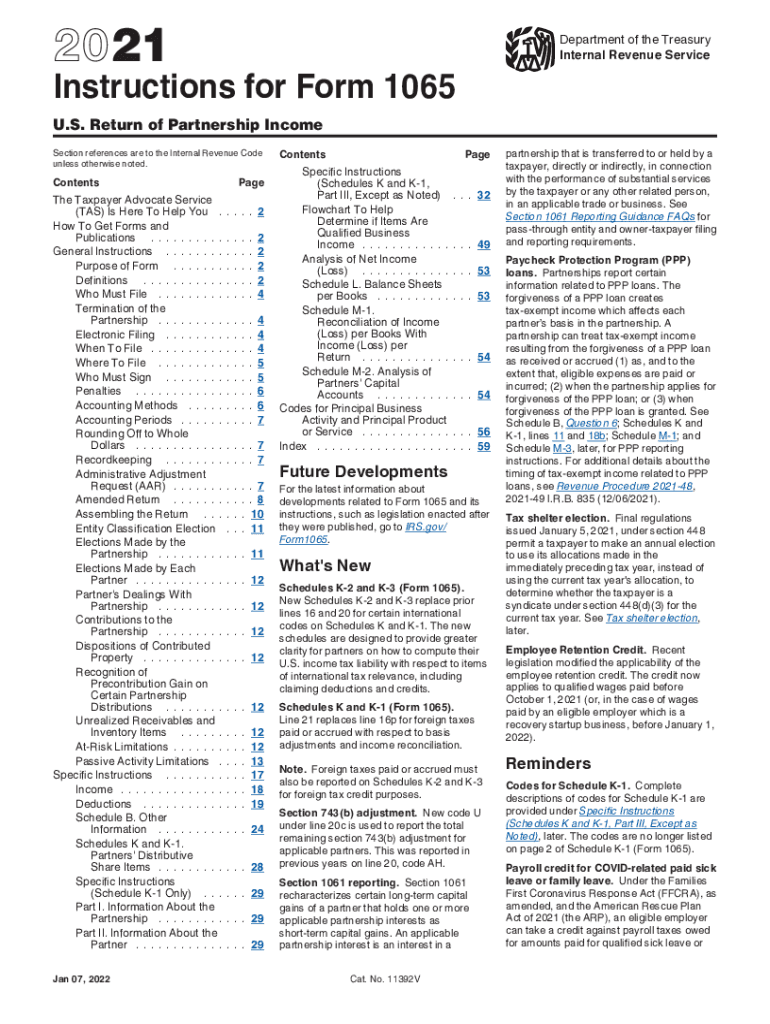

The electronic filing of Form 1065 refers to the digital submission process for the U.S. Partnership Return of Income. This form is essential for partnerships to report their income, deductions, gains, and losses to the Internal Revenue Service (IRS). By utilizing electronic filing, partnerships can efficiently submit their returns while ensuring compliance with IRS requirements. This method streamlines the filing process, reduces the likelihood of errors, and facilitates faster processing times compared to traditional paper submissions.

Steps to complete the electronic filing of Form 1065

Completing the electronic filing of Form 1065 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, balance sheets, and prior year returns. Next, access a compatible e-filing software or platform that supports Form 1065. Input the required information into the software, ensuring that all fields are filled out correctly. Review the completed form for any discrepancies or missing information. Once verified, submit the form electronically through the software. After submission, retain a copy of the confirmation and any supporting documentation for your records.

IRS guidelines for Form 1065

The IRS provides specific guidelines for completing and filing Form 1065. These include instructions on eligibility, required information, and deadlines. Partnerships must ensure that all partners are accurately reported, including their share of income, deductions, and credits. It is crucial to follow the IRS instructions closely to avoid penalties and ensure that the return is processed smoothly. Additionally, partnerships should be aware of any updates to IRS regulations that may affect their filing requirements.

Filing deadlines for Form 1065

Partnerships must adhere to specific filing deadlines for Form 1065 to avoid penalties. Generally, the due date for filing is the fifteenth day of the third month following the end of the partnership's tax year. For partnerships operating on a calendar year, this typically falls on March 15. If additional time is needed, partnerships can file for an extension, which grants an automatic six-month extension to file the return. However, it is important to note that this extension does not extend the time for payment of any taxes owed.

Required documents for Form 1065

To complete Form 1065 accurately, partnerships need to gather several essential documents. These typically include financial statements, such as income statements and balance sheets, as well as records of all income and expenses incurred during the tax year. Additionally, partnerships should have documentation for any deductions and credits claimed, including receipts and invoices. Having these documents organized and readily available will facilitate a smoother filing process and help ensure compliance with IRS regulations.

Legal use of electronic filing for Form 1065

The legal use of electronic filing for Form 1065 is governed by various regulations that ensure the validity and security of electronic submissions. The IRS recognizes e-filed returns as legally binding, provided that they meet specific criteria. This includes compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant laws. By using a reliable e-filing platform, partnerships can ensure that their submissions are secure and legally recognized, thereby reducing the risk of disputes or penalties.

Quick guide on how to complete electronic filing of form 1065 us partnership return of

Complete Electronic Filing Of Form 1065, U S Partnership Return Of seamlessly on any device

Digital document management has gained popularity among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides you with all the resources needed to create, edit, and eSign your documents swiftly without delays. Handle Electronic Filing Of Form 1065, U S Partnership Return Of on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and eSign Electronic Filing Of Form 1065, U S Partnership Return Of effortlessly

- Find Electronic Filing Of Form 1065, U S Partnership Return Of and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal weight as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and eSign Electronic Filing Of Form 1065, U S Partnership Return Of and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the electronic filing of form 1065 us partnership return of

How to make an electronic signature for your PDF document in the online mode

How to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

How to create an e-signature from your mobile device

The best way to generate an electronic signature for a PDF document on iOS devices

How to create an e-signature for a PDF file on Android devices

People also ask

-

What are the key features of airSlate SignNow for completing 2021 1065 instruction?

airSlate SignNow offers robust features that streamline the eSigning process for 2021 1065 instruction. Users can easily prepare, send, and sign documents using customizable templates and workflows, ensuring a smooth experience. The platform also features advanced security options to protect sensitive tax information.

-

How does airSlate SignNow integrate with other applications for 2021 1065 instruction?

airSlate SignNow seamlessly integrates with various business applications, facilitating effective management of 2021 1065 instruction documents. Whether you're using cloud storage solutions or accounting software, SignNow can enhance your workflow by connecting critical tools. These integrations help ensure that your documents are always accessible and ready for signature.

-

Is airSlate SignNow a cost-effective solution for handling 2021 1065 instruction?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses managing 2021 1065 instruction. With competitive pricing plans, you can choose a package that fits your needs without compromising on functionality. Many businesses find that the time saved through efficient document handling offsets the costs of the service.

-

What benefits does airSlate SignNow provide for managing 2021 1065 instruction?

Managing 2021 1065 instruction with airSlate SignNow offers numerous benefits, including enhanced efficiency and reduced processing time. The platform allows for quick document preparation, signing, and tracking, which saves valuable time. Additionally, real-time notifications keep both senders and recipients updated throughout the signing process.

-

Can airSlate SignNow help me stay compliant while completing my 2021 1065 instruction?

Absolutely, airSlate SignNow is designed to help users maintain compliance while managing their 2021 1065 instruction documents. The platform meets the necessary legal standards for electronic signatures, ensuring that your signed documents are valid and enforceable. Moreover, the audit trail feature allows you to track all activities related to your documents, further supporting compliance efforts.

-

How user-friendly is airSlate SignNow for those unfamiliar with 2021 1065 instruction?

airSlate SignNow is exceptionally user-friendly, making it accessible even for those unfamiliar with 2021 1065 instruction. The intuitive interface and straightforward navigation guide users through the process of preparing and signing documents. Additionally, resources such as tutorials and customer support ensure that users can find help when needed.

-

Is there a mobile version of airSlate SignNow for managing 2021 1065 instruction on the go?

Yes, airSlate SignNow offers a mobile application that allows you to manage your 2021 1065 instruction documents from anywhere. This mobile solution ensures that you can send and sign documents on the go, enhancing flexibility and convenience. With the app, you won’t miss important signatures or deadlines, no matter where you are.

Get more for Electronic Filing Of Form 1065, U S Partnership Return Of

- Petition for appointment of co conservator mississippi form

- Conservators bond mississippi form

- Mississippi pre incorporation agreement shareholders agreement and confidentiality agreement mississippi form

- Corporation form

- Corporate records maintenance package for existing corporations mississippi form

- Mississippi limited form

- Ms company form

- Disclaimer life insurance form

Find out other Electronic Filing Of Form 1065, U S Partnership Return Of

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will