Form Bc1040 City of Battle Creek Income Tax Individual

What is the Form BC-1040 City of Battle Creek Income Tax Individual

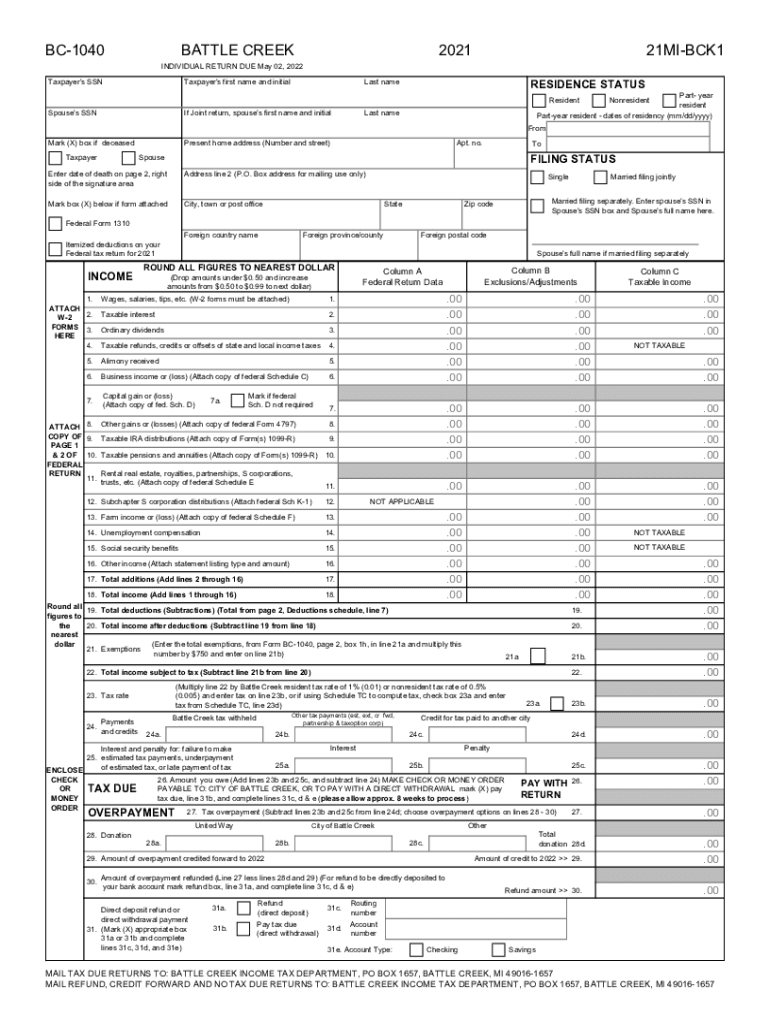

The Form BC-1040 is the official document used for filing individual income taxes in the City of Battle Creek, Michigan. This form is specifically designed for residents who earn income within the city limits and are subject to local income tax regulations. The BC-1040 collects information about the taxpayer's income, deductions, and credits to determine the amount of tax owed or refund due. It is essential for individuals to accurately complete this form to ensure compliance with local tax laws.

How to Obtain the Form BC-1040 City of Battle Creek Income Tax Individual

The Form BC-1040 can be obtained through several convenient methods. Taxpayers can download the form directly from the official City of Battle Creek website. Alternatively, physical copies are often available at local government offices, including the City Clerk's office. Additionally, some tax preparation services may provide access to this form as part of their offerings. It is important to ensure that you are using the most current version of the form to avoid any issues during the filing process.

Steps to Complete the Form BC-1040 City of Battle Creek Income Tax Individual

Completing the Form BC-1040 involves several key steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Report your total income from all sources, including wages, self-employment income, and any other earnings.

- Deduct any allowable expenses or credits that apply to your situation, which can reduce your taxable income.

- Calculate the total tax owed based on the income reported and the applicable tax rates.

- Review the completed form for accuracy before submitting it.

Legal Use of the Form BC-1040 City of Battle Creek Income Tax Individual

The Form BC-1040 is legally recognized as the official means for individuals to report their income to the City of Battle Creek. To ensure the form's legal validity, it must be completed accurately and submitted by the designated deadlines. Compliance with local tax laws is crucial, as failure to file or inaccuracies in the form can lead to penalties and interest on unpaid taxes. Utilizing a reliable method for electronic signatures can further enhance the legal standing of the submitted form.

Filing Deadlines / Important Dates

Taxpayers should be aware of the important deadlines associated with the Form BC-1040. Typically, the filing deadline for individual income tax returns is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check for any updates or changes to deadlines, especially in light of special circumstances that may affect tax filing dates.

Form Submission Methods (Online / Mail / In-Person)

The Form BC-1040 can be submitted through various methods to accommodate taxpayer preferences. Individuals can file their returns online using secure e-filing systems that ensure the protection of personal information. Alternatively, completed forms can be mailed to the appropriate city tax office. For those who prefer face-to-face interaction, in-person submissions may be made at designated government offices during business hours. Each method has its advantages, and taxpayers should choose the one that best suits their needs.

Quick guide on how to complete form bc1040 city of battle creek income tax individual

Prepare Form Bc1040 City Of Battle Creek Income Tax Individual effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Form Bc1040 City Of Battle Creek Income Tax Individual on any platform with airSlate SignNow's Android or iOS applications and simplify any document-centric process today.

How to modify and electronically sign Form Bc1040 City Of Battle Creek Income Tax Individual with ease

- Locate Form Bc1040 City Of Battle Creek Income Tax Individual and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your edits.

- Choose your delivery method for the form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, time-consuming form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Form Bc1040 City Of Battle Creek Income Tax Individual and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the form Battle Creek income tax?

The form Battle Creek income tax is a specific document required for residents and businesses in Battle Creek, Michigan, to report their income tax to the local government. Completing this form accurately is essential to avoid penalties and ensure compliance with local tax laws.

-

How can airSlate SignNow help with the form Battle Creek income tax?

airSlate SignNow streamlines the process of completing and submitting the form Battle Creek income tax by allowing users to fill out, sign, and send documents electronically. With its user-friendly interface, you can complete taxes more efficiently.

-

Is there a cost associated with using airSlate SignNow for the form Battle Creek income tax?

Yes, airSlate SignNow offers various pricing plans to meet different business needs. Users can choose a plan that best suits them, making it a cost-effective solution for managing the form Battle Creek income tax submissions.

-

What features does airSlate SignNow offer for the form Battle Creek income tax?

airSlate SignNow includes features like document editing, secure eSignatures, templates for the form Battle Creek income tax, and cloud storage. These features improve efficiency and ensure that documents are legally binding.

-

Can airSlate SignNow integrate with other tools for tax preparation?

Absolutely! airSlate SignNow offers seamless integrations with various tax preparation software and platforms. This makes it easy to import data directly into the form Battle Creek income tax, streamlining your tax filing process.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents, including the form Battle Creek income tax, provides benefits such as enhanced security, faster processing times, and reduced paperwork. This can lead to a smoother tax preparation experience.

-

How does eSigning the form Battle Creek income tax work?

eSigning the form Battle Creek income tax with airSlate SignNow is simple! After filling out the form, users can invite signers to electronically sign the document, ensuring a quick turnaround and complete compliance with legal requirements.

Get more for Form Bc1040 City Of Battle Creek Income Tax Individual

- Mississippi bill sale form

- Mississippi renunciation and disclaimer of property from will by testate mississippi form

- Quitclaim deed by two individuals to llc mississippi form

- Warranty deed from two individuals to llc mississippi form

- Mississippi partnership form

- Justice court form

- Writ garnishment form

- Ms power form

Find out other Form Bc1040 City Of Battle Creek Income Tax Individual

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now