THIS is NOT a TAX BILL L 4400 Origin Sl Michigan Gov Form

Key elements of the Michigan assessment taxable valuation property

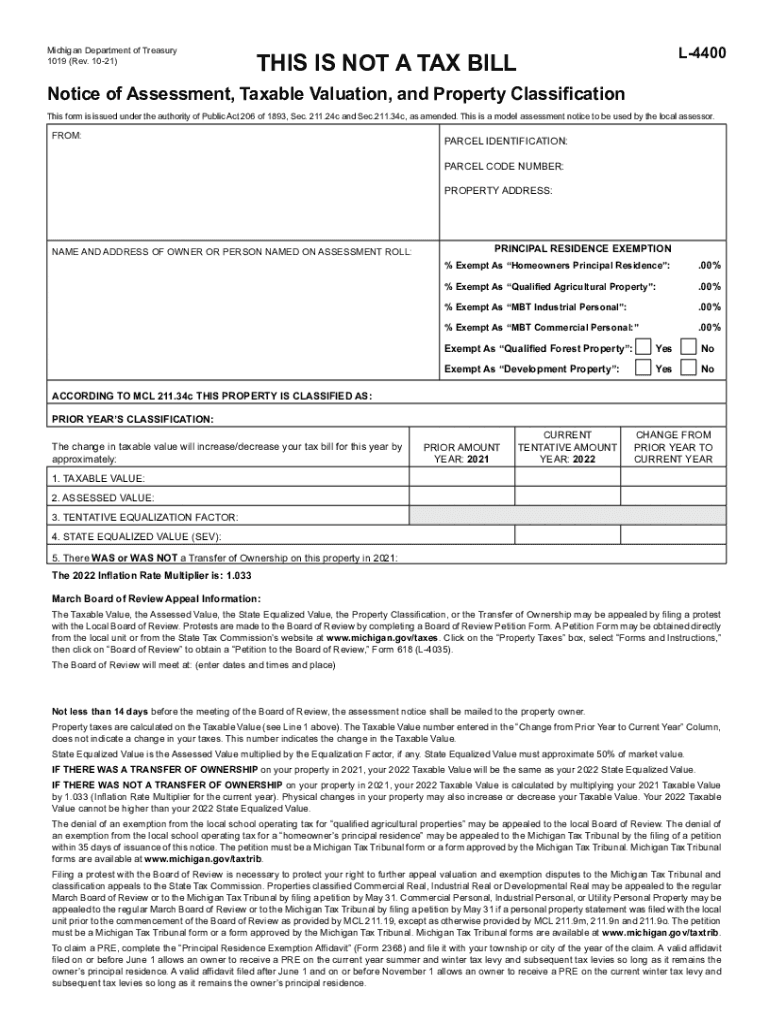

The Michigan assessment taxable valuation property form is essential for property owners to understand their property tax obligations. Key elements of this form include the property identification number, the assessed value of the property, and the taxable value. The assessed value is determined by local assessors based on property characteristics and market conditions. The taxable value is capped by state law, ensuring that property taxes do not increase excessively year over year. Understanding these elements helps property owners ensure that their assessments are accurate and that they are not overpaying on taxes.

Steps to complete the Michigan assessment taxable valuation property

Completing the Michigan assessment taxable valuation property form involves several straightforward steps. First, gather all necessary information, including the property identification number and any previous assessment documents. Next, accurately fill out the form, ensuring that all details match official records. Pay special attention to the assessed value and any exemptions you may qualify for. After completing the form, review it for accuracy before submitting it to your local assessor's office. Keeping a copy for your records is also advisable.

Legal use of the Michigan assessment taxable valuation property

The Michigan assessment taxable valuation property form serves a legal purpose in determining property taxes. It is used by local governments to assess the value of properties for taxation purposes. Accurate completion of this form is crucial, as it can affect the amount of tax owed. Additionally, the form may be used in legal disputes regarding property assessments, making it important for property owners to keep it up to date and accurate. Understanding the legal implications of this form can help property owners navigate tax obligations effectively.

Form submission methods for the Michigan assessment taxable valuation property

Property owners in Michigan can submit the assessment taxable valuation property form through various methods. The most common method is by mail, where completed forms can be sent directly to the local assessor's office. Some municipalities may offer online submission options, allowing for quicker processing. In-person submissions are also an option, where property owners can hand-deliver their forms and receive immediate confirmation of receipt. It is essential to check with the local assessor's office for specific submission guidelines and options available in your area.

Filing deadlines for the Michigan assessment taxable valuation property

Filing deadlines for the Michigan assessment taxable valuation property form are crucial for property owners to note. Generally, the form must be submitted by a specific date each year, often around the first of the year, to ensure that the property is assessed for the upcoming tax year. Missing this deadline can result in penalties or missed opportunities for tax exemptions. Property owners should consult their local assessor's office for the exact deadlines and any changes that may occur each year.

Examples of using the Michigan assessment taxable valuation property

Understanding practical examples of using the Michigan assessment taxable valuation property form can clarify its importance. For instance, a homeowner may use the form to contest an increase in their property’s assessed value, arguing that it exceeds market value. Additionally, a property owner may complete the form to apply for a tax exemption, such as the Principal Residence Exemption, which can significantly reduce their taxable value. These examples highlight the form's role in managing property tax obligations effectively.

Quick guide on how to complete this is not a tax bill l 4400 origin slmichigangov

Effortlessly Prepare THIS IS NOT A TAX BILL L 4400 Origin sl michigan gov on Any Device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage THIS IS NOT A TAX BILL L 4400 Origin sl michigan gov on any device with airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to Edit and eSign THIS IS NOT A TAX BILL L 4400 Origin sl michigan gov with Ease

- Obtain THIS IS NOT A TAX BILL L 4400 Origin sl michigan gov and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal authority as a traditional handwritten signature.

- Review the information carefully and click on the Done button to save your modifications.

- Choose how you would like to send your form—via email, SMS, or invite link—or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from your chosen device. Edit and eSign THIS IS NOT A TAX BILL L 4400 Origin sl michigan gov and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a notice taxable property classification?

A notice taxable property classification is a formal document that identifies the classification of a property for tax purposes. This classification determines the tax rates applicable to the property. Understanding your property's classification can help you manage tax responsibilities more effectively.

-

How can airSlate SignNow assist with handling notice taxable property classification?

airSlate SignNow provides an efficient way to send and eSign documents related to your notice taxable property classification. Our solution simplifies the process of managing property tax-related documents, ensuring that you can handle paperwork seamlessly and securely.

-

What features does airSlate SignNow offer for property classification documentation?

airSlate SignNow offers features such as customizable templates and automated workflows specifically designed for documents related to notice taxable property classification. These features streamline the preparation and signing process, making it quick and hassle-free.

-

Is airSlate SignNow cost-effective for managing notice taxable property classification?

Yes, airSlate SignNow is a cost-effective solution for managing notice taxable property classification. Our pricing plans are designed to fit the budgets of businesses of all sizes, allowing you to manage property documents without overspending.

-

Can airSlate SignNow integrate with other tools for managing property classification?

Absolutely! airSlate SignNow can integrate with various third-party applications that help manage your notice taxable property classification. This integration allows you to streamline your workflows, saving time and enhancing productivity.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for managing notice taxable property classification offers numerous benefits. It enhances document security, provides real-time tracking of signatures, and reduces the time spent on paperwork, allowing you to focus on core business activities.

-

How secure is airSlate SignNow for handling sensitive tax documents?

airSlate SignNow employs industry-leading security measures to ensure that all documents, including those related to notice taxable property classification, are protected. We utilize encryption, secure sign-in methods, and compliance with data protection regulations to keep your information safe.

Get more for THIS IS NOT A TAX BILL L 4400 Origin sl michigan gov

- Mississippi approving accounting order form

- Mississippi contract sale form

- Mississippi renunciation and disclaimer of joint tenant or tenancy interest mississippi form

- Quitclaim deed from individual to llc mississippi form

- Warranty deed from individual to llc mississippi form

- Partial release from deed of trust mississippi form

- Sample legal opinion re loan modification mississippi form

- Change deed trust form

Find out other THIS IS NOT A TAX BILL L 4400 Origin sl michigan gov

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now