COMMERCIAL LOAN APPLICATION Self Help Credit Union Self Help Form

Understanding the Commercial Loan Application

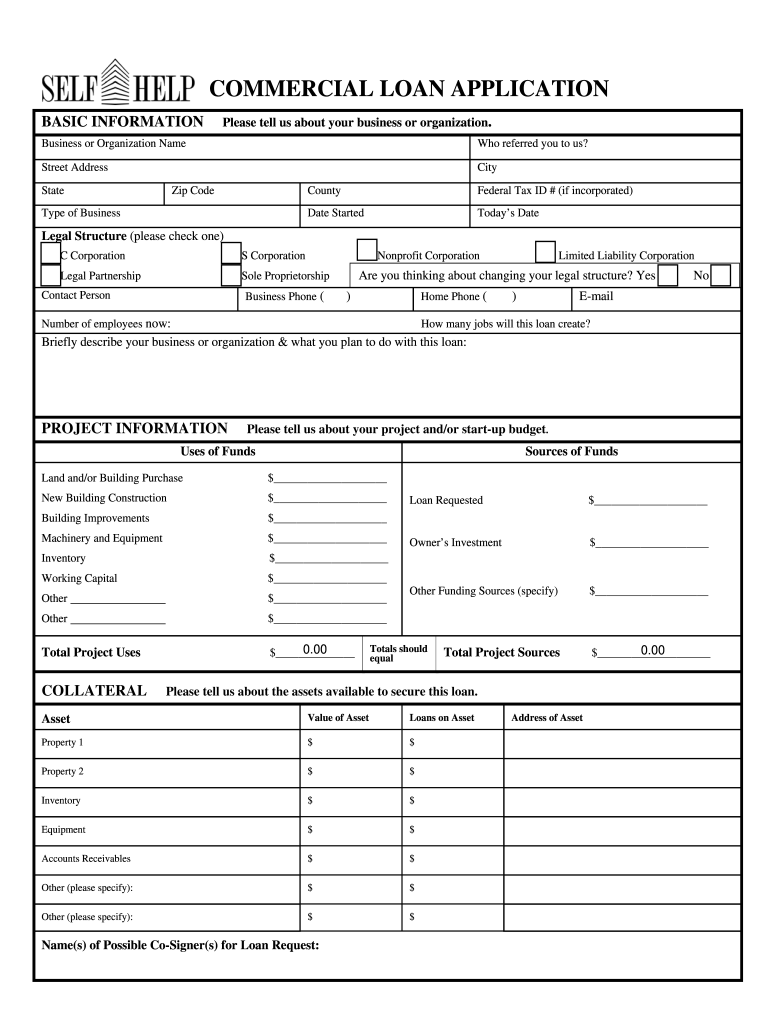

The commercial loan application is a crucial document used by businesses seeking financing from a self credit union. This application typically requires detailed information about the business, including its financial history, purpose for the loan, and projected revenue. It serves as a tool for the credit union to assess the creditworthiness of the applicant and determine the terms of the loan. Understanding the components of this application can help businesses prepare effectively and increase their chances of approval.

Steps to Complete the Commercial Loan Application

Completing the commercial loan application involves several key steps:

- Gather necessary documentation, such as financial statements, tax returns, and business plans.

- Fill out the application form accurately, providing all required information about the business and its owners.

- Review the application for completeness and accuracy before submission.

- Submit the application through the preferred method, whether online, by mail, or in person.

Each step is essential to ensure that the application is processed smoothly and efficiently.

Key Elements of the Commercial Loan Application

When filling out the commercial loan application, certain key elements must be included:

- Business Information: Name, address, and type of business.

- Loan Amount Requested: Specify the amount needed for the intended purpose.

- Financial Statements: Recent balance sheets, income statements, and cash flow statements.

- Personal Guarantees: Information about the owners' personal financial status may be required.

These elements are critical for the credit union to evaluate the application effectively.

Eligibility Criteria for the Commercial Loan Application

Eligibility for a commercial loan from a self credit union generally includes several criteria:

- The business must be legally registered and operational.

- Applicants should have a solid credit history and demonstrate the ability to repay the loan.

- The purpose of the loan must align with the credit union's lending policies.

Meeting these criteria is essential for a successful application process.

Legal Use of the Commercial Loan Application

The commercial loan application must comply with various legal requirements to ensure its validity. This includes adherence to federal and state regulations governing lending practices. The application process should also respect privacy laws regarding the handling of sensitive financial information. Using a reliable platform for submission can help maintain compliance and security.

Examples of Using the Commercial Loan Application

Businesses may use the commercial loan application for various purposes, including:

- Expanding operations or opening new locations.

- Purchasing equipment or inventory.

- Refinancing existing debt to improve cash flow.

These examples illustrate the versatility of the application in supporting diverse business needs.

Quick guide on how to complete commercial loan application self help credit union self help

Complete COMMERCIAL LOAN APPLICATION Self Help Credit Union Self help easily on any device

Digital document management has become favored by businesses and individuals alike. It offers a perfect environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents promptly without delays. Manage COMMERCIAL LOAN APPLICATION Self Help Credit Union Self help on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign COMMERCIAL LOAN APPLICATION Self Help Credit Union Self help effortlessly

- Obtain COMMERCIAL LOAN APPLICATION Self Help Credit Union Self help and then click Get Form to initiate.

- Use the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional ink signature.

- Verify all details and then click the Done button to preserve your changes.

- Select your preferred method for sending your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Modify and eSign COMMERCIAL LOAN APPLICATION Self Help Credit Union Self help and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How would you form a single German word meaning "to read a newspaper's self-help columns just to assure yourself that your problems are better than the people who write to self-help columns"?

I don't think you really would. That is extremely specific. Perhaps the old favorite "Schadenfreude" can apply here instead. ;-)

-

How can people get the most out of the self-help books they read?

First of all, by selecting carefully which books to read. Not all self-help books are worth reading, and not all are for you in particular. Use the resources relevant / applicable / available for you to select the books really worth the time and money.Once you read such a book, make notes and list your action points to be executed. And please don’t say that something will not work: try first, second, third and many times before stating that it does not work for you.

-

Do I need to fill out the self-declaration form in the NEET 2018 application form since I have a domicile of J&K?

since you’re a domicile of J&K & are eligible for J&K counselling process - you’re not required to put self declaration.self declaration is for the students who’re not domicile of J&K but presently are there & unable to avail the domicile benefit .source- http://cbseneet.nic.in

-

How do I read self-help books to get the most of them?

Source: How to read self help books? I was reading ‘Talk Like TED’ book from a week. That book is amazing and I am loving it. The ideas in it are so inspiring. They make you want to do something.Generally we get that fire in us when we read such inspiring things. That’s called fire-to-do-shit fire. But, does that last long? If yes, how long? I was experiencing the same. It does not last for much time.But hang on. I have found out a solution kind of thing. Its writing things down. I might be on your phone or laptop or on a paper or anywhere. By this you are taming that fire and making it glow for long. Our brains remember things which we write. That’s why teachers ask us to take notes.Writing may not be copying the whole chapter or the whole book down. It could be the main point, followed by your thoughts on it. That ‘Aha, I never thought of this!’ moments are precious. Never let them go without noting it. I experienced that when you come back search that aha moment, I couldn’t find. I don’t whether it happens with everyone, but this technique will be helpful.Sometimes a brand new hits up the mind which exists no where. Not in the book nor you heard it somewhere. That might be a derivation of ideas you read. Or you might have applied that idea you read in some other area to solve a different problem.I read some books long back. When I look back, I remember the learning only those which I have implemented or adapted in my life. I don’t remember the complete book. The idea of reading a book isn’t memorizing it though. Its to learn and get new ideas and ways to solve problemsYes, it will take some extra time to complete the book. But its worth your time.This way of noting down this can be applied in many areas. Like when we listen to talks at conference or somewhere online or a TED talk and so on. Preserve those ‘I didn’t know this before moments’.This way you build a huge knowledge base. It opens the doors to many possibilities. With your experiences and knowledge added, you can teach the world, the same things in a new way and a new perspective or understanding.You can write blogs, make videos or make podcast shows with the precious knowledge base that you have. You can teach a lot and create your business around it.Take Care,Happy Reading!This is a part of challenge I took to post one every alternate day on my blog! Keep visiting.Connect DeeperI run HackLetter for people like you interested in doing crazy stuff. Subscribe so that I can send you many more thoughts like these weekly.

-

I need help filling out this IRA form to withdraw money. How do I fill this out?

I am confused on the highlighted part.

-

What are some ways towards finding out how to get real self-help?

From my perspective religions are not the path to help. Tens of BILLIONS of people have tried religions for thousands of years and you can count on 1 hand the number of enlightened souls. You have much better changes of winning a billion dollar lotto than getting true self-help from religion. They want you dependant on them.I searched for decades for an answer to your question and found that you must be clear what your goal is and give up your agendas, core beliefs, opinions, conclusions & interpretations that do not align with your goals to signNow them. These are all made up and can be changed to what serves you.Another key element was realizing that you can not get, find or have feelings and emotions. By definition, to have, is to possess. You can only possess tangibles such as cars, houses, food, etc. All emotions and feelings are intangible such as love, sad, happy, courage, patience, etc. You can not have, get or find intangibles as they only exit in our thoughts & words. When people try to have, get or find love, happiness, courage and patience they often fail. Sometimes they show up and we erroneous conclude they were had, gotten or found.If I feel upset, the upset was created by my attachment to an outcome, not the situation. If I am upset you didn't return my call the upset was created out of my expections you should have called. If there was no agenda, opinion, core belief you SHOULD CALL, then there is NO emotional response. It's fine you didn't call.Emotions and feelings are perceived ways of being and as such can be accessed at any moment, anywhere for any duration. I feel unconditional love for people when I am BEING unconditional. I am BEING happy when I want to. I can BE courageous when my voice aligns with my heart. Circumstances don't dictate my emotions, what I think & say about them do. Align your thoughts and words with desired actions and goals.Create a life you love your way.

-

How do I read self-help books to take the maximum out of them?

Self help books are not the kind of books to read in one go. These type of books are like food for your brain. So they must be read in daily installments.And I suggest to read such books during night while you try to fall asleep or in the morning when you wake up. These are the times when your subconscious mind can consume the most and make a most of it.This was just out of my experience.Suggestions are always invited. :)

Create this form in 5 minutes!

How to create an eSignature for the commercial loan application self help credit union self help

How to generate an eSignature for the Commercial Loan Application Self Help Credit Union Self Help in the online mode

How to make an electronic signature for the Commercial Loan Application Self Help Credit Union Self Help in Google Chrome

How to create an electronic signature for signing the Commercial Loan Application Self Help Credit Union Self Help in Gmail

How to generate an electronic signature for the Commercial Loan Application Self Help Credit Union Self Help straight from your mobile device

How to create an electronic signature for the Commercial Loan Application Self Help Credit Union Self Help on iOS

How to generate an electronic signature for the Commercial Loan Application Self Help Credit Union Self Help on Android OS

People also ask

-

What is the COMMERCIAL LOAN APPLICATION Self Help Credit Union Self Help process?

The COMMERCIAL LOAN APPLICATION Self Help Credit Union Self Help process allows businesses to apply for loans quickly and efficiently. With airSlate SignNow, you can eSign documents and submit your application online, streamlining the entire process. This user-friendly approach ensures that you can focus on your business while we handle the paperwork.

-

How does airSlate SignNow improve the COMMERCIAL LOAN APPLICATION Self Help Credit Union Self Help experience?

airSlate SignNow enhances the COMMERCIAL LOAN APPLICATION Self Help Credit Union Self Help experience by providing a seamless eSigning solution. Our platform allows you to fill out and sign your documents anytime, anywhere, ensuring that your application is submitted without delays. This means faster approval times and more time for you to manage your business.

-

What are the costs associated with the COMMERCIAL LOAN APPLICATION Self Help Credit Union Self Help?

The costs associated with the COMMERCIAL LOAN APPLICATION Self Help Credit Union Self Help can vary based on the loan amount and terms. Using airSlate SignNow, there are no hidden fees for eSigning your application, making it a cost-effective solution. We recommend checking with the Self Help Credit Union for specific loan pricing and terms.

-

Are there specific features for the COMMERCIAL LOAN APPLICATION Self Help Credit Union Self Help on airSlate SignNow?

Yes, airSlate SignNow offers several features specifically for the COMMERCIAL LOAN APPLICATION Self Help Credit Union Self Help. These include customizable templates, secure eSigning, and the ability to track document status in real-time. These features ensure that your application process is efficient and organized.

-

What benefits does airSlate SignNow offer for businesses applying for a COMMERCIAL LOAN APPLICATION Self Help Credit Union Self Help?

The benefits of using airSlate SignNow for your COMMERCIAL LOAN APPLICATION Self Help Credit Union Self Help include increased efficiency, reduced paperwork, and enhanced security. Our platform allows for quick document turnaround, minimizing delays in your loan application. Additionally, eSigning offers a secure way to handle sensitive information.

-

Can I integrate airSlate SignNow with other tools for my COMMERCIAL LOAN APPLICATION Self Help Credit Union Self Help needs?

Absolutely! airSlate SignNow can be integrated with various tools and platforms to support your COMMERCIAL LOAN APPLICATION Self Help Credit Union Self Help needs. This includes CRM systems, cloud storage services, and project management tools, allowing for a more comprehensive workflow that enhances productivity and convenience.

-

Is technical support available for the COMMERCIAL LOAN APPLICATION Self Help Credit Union Self Help process?

Yes, airSlate SignNow provides technical support for users navigating the COMMERCIAL LOAN APPLICATION Self Help Credit Union Self Help process. Our dedicated support team is available to assist you with any questions or issues you may encounter while using our platform. We’re here to ensure your experience is as smooth as possible.

Get more for COMMERCIAL LOAN APPLICATION Self Help Credit Union Self help

- Vanity amp personalized university of notre dame cyberdrive illinois form

- Application driveway chicago form

- Office of the secretary of state commercial driver training school division safety inspection form

- Illinois service facility form

- Professional sports teams motorcycle cyberdrive illinois form

- Request form illinois secretary of state 6966905

- State form 44606

- Indiana report vehicle form

Find out other COMMERCIAL LOAN APPLICATION Self Help Credit Union Self help

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online