Stackoverflow Comquestions4715050What Does Document Form Mean in Javascript? Stack Overflow

IRS Guidelines for Claiming Deceased Individuals

The IRS has specific guidelines for claiming a deceased individual on tax forms. This process typically involves filing a final tax return for the deceased person. The return must include all income earned up until the date of death. Executors or personal representatives are responsible for ensuring that the final return is filed accurately. If the deceased is owed a refund, the executor can file a claim for the refund on behalf of the estate.

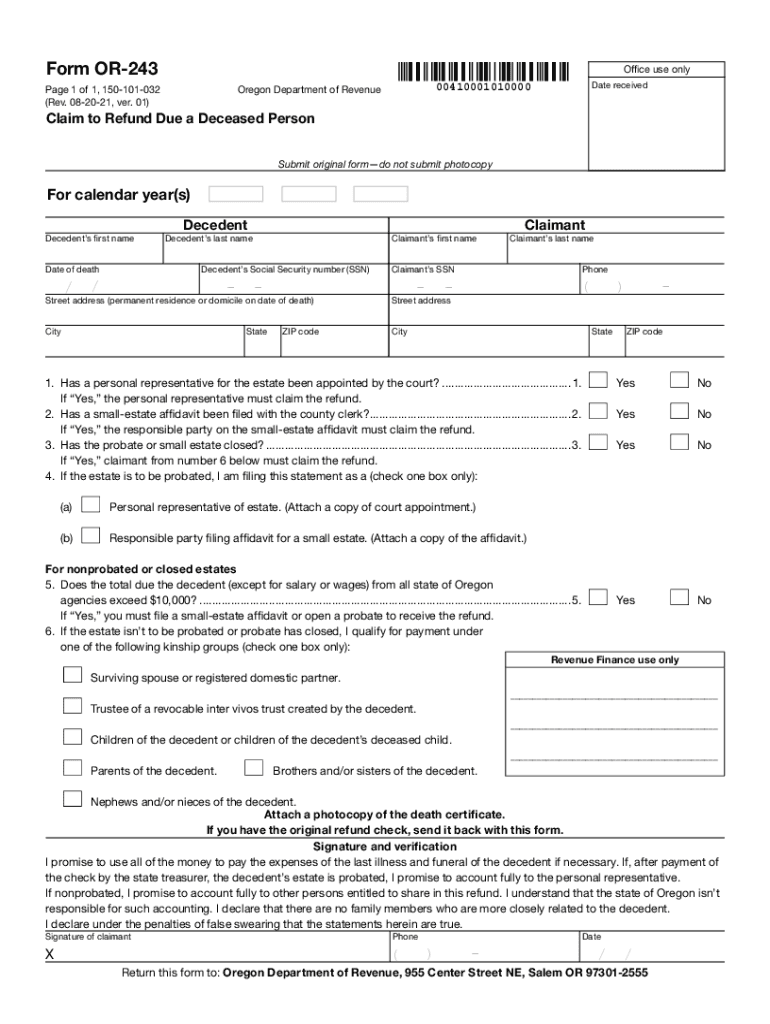

Required Documents for the Oregon Revenue 243 Form

To complete the Oregon Revenue 243 form, certain documents are necessary. This includes the deceased's Social Security number, copies of any relevant tax documents, and proof of the executor's authority to act on behalf of the deceased. Having these documents ready can streamline the filing process and ensure compliance with state requirements.

Filing Deadlines for the Oregon Revenue 243

Filing deadlines for the Oregon Revenue 243 form are crucial to avoid penalties. Generally, the final return must be filed by the due date of the deceased's tax return, which is typically April 15 of the year following the death. If additional time is needed, an extension may be requested, but it is essential to adhere to the state's guidelines to prevent any issues.

Form Submission Methods for Oregon Revenue 243

The Oregon Revenue 243 form can be submitted through various methods, including online filing, mail, or in-person submission at designated state offices. Each method has its own set of requirements and processing times. Online submission is often the quickest way to ensure that the form is received and processed efficiently.

Penalties for Non-Compliance with Oregon Tax Regulations

Failing to comply with Oregon tax regulations regarding the filing of the Revenue 243 form can result in penalties. These may include fines, interest on unpaid taxes, and potential legal action against the estate. It is vital for executors to be aware of these penalties and to ensure that all filings are completed accurately and on time to avoid complications.

Eligibility Criteria for Claiming a Deceased Individual

Eligibility to claim a deceased individual on tax forms requires that the claimant be the executor or a legally appointed representative of the deceased's estate. This ensures that the person filing has the authority to act on behalf of the deceased and can provide necessary documentation to support the claim.

Quick guide on how to complete stackoverflowcomquestions4715050what does documentform mean in javascript stack overflow

Complete Stackoverflow comquestions4715050What Does Document form Mean In Javascript? Stack Overflow effortlessly on any device

Digital document management has become popular with businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Stackoverflow comquestions4715050What Does Document form Mean In Javascript? Stack Overflow on any platform through airSlate SignNow's Android or iOS applications and simplify your document-driven processes today.

The simplest way to alter and electronically sign Stackoverflow comquestions4715050What Does Document form Mean In Javascript? Stack Overflow with ease

- Obtain Stackoverflow comquestions4715050What Does Document form Mean In Javascript? Stack Overflow and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with specialized tools provided by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all entries and click the Done button to save your modifications.

- Choose your preferred method to share your form, whether via email, text message (SMS), invitation link, or download it to your PC.

Eliminate worries about misplaced or lost documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Alter and electronically sign Stackoverflow comquestions4715050What Does Document form Mean In Javascript? Stack Overflow and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the stackoverflowcomquestions4715050what does documentform mean in javascript stack overflow

The best way to generate an electronic signature for a PDF document online

The best way to generate an electronic signature for a PDF document in Google Chrome

The way to generate an e-signature for signing PDFs in Gmail

How to make an electronic signature right from your smart phone

The way to make an e-signature for a PDF document on iOS

How to make an electronic signature for a PDF on Android OS

People also ask

-

What is airSlate SignNow and how can it help me to sign or claim deceased documents?

airSlate SignNow is a powerful eSignature solution that simplifies the signing process for various documents, including those related to estate management. Whether you need to sign or claim deceased documentation, our platform ensures a seamless experience with legally binding signatures, allowing you to focus on more important matters.

-

Is airSlate SignNow cost-effective for handling deceased estate paperwork?

Yes, airSlate SignNow provides a cost-effective solution for managing documents associated with deceased estates. Our pricing plans are designed to cater to businesses and individuals alike, ensuring you get the best value while efficiently signing or claiming deceased documents.

-

What are the key features of airSlate SignNow for signing or claiming deceased documents?

airSlate SignNow offers a variety of features that are particularly useful for signing or claiming deceased documents, including customizable templates, mobile-friendly signing, and real-time tracking. These features enable users to manage documentation efficiently and ensure that all signatures are obtained promptly.

-

Can I integrate airSlate SignNow with other tools to manage deceased estate documents?

Absolutely! airSlate SignNow integrates seamlessly with various platforms such as Google Drive, Salesforce, and more. This integration helps streamline the process for signing or claiming deceased documents, allowing for efficient document management across different applications.

-

How secure is airSlate SignNow for signing or claiming deceased documents?

Security is a top priority at airSlate SignNow. Our platform employs bank-level encryption and secure servers to ensure that your documents, including those to sign or claim deceased, are protected against unauthorized access and data bsignNowes.

-

What types of documents can I sign or claim deceased with airSlate SignNow?

With airSlate SignNow, you can sign or claim a wide range of documents, including wills, estate claims, and legal agreements. Our platform supports various file formats, making it easy to manage all your paperwork related to deceased estates.

-

Is there customer support available for users of airSlate SignNow for deceased documents?

Yes, airSlate SignNow offers comprehensive customer support to assist you whenever you need help, especially with signing or claiming deceased documents. Our support team is available via chat, email, and phone, ensuring that you get the assistance required for any questions or issues.

Get more for Stackoverflow comquestions4715050What Does Document form Mean In Javascript? Stack Overflow

- Letter administration form

- Order granting letters of administration mississippi form

- Mississippi oath form

- Quitclaim deed from husband and wife to husband and wife mississippi form

- Ms warranty deed 497313669 form

- Administrators bond mississippi form

- Mississippi revocation form

- Postnuptial property agreement mississippi mississippi form

Find out other Stackoverflow comquestions4715050What Does Document form Mean In Javascript? Stack Overflow

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple

- eSign Idaho Healthcare / Medical Arbitration Agreement Later

- How To eSign Colorado High Tech Forbearance Agreement

- eSign Illinois Healthcare / Medical Resignation Letter Mobile

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure