Nonresident Withholding Tax Department of Revenue Kentucky Form

What is the Nonresident Withholding Tax in Kentucky?

The Nonresident Withholding Tax in Kentucky is a tax imposed on income earned by nonresidents working or conducting business within the state. This tax ensures that nonresidents contribute to state revenue based on their earnings sourced from Kentucky. The Kentucky Department of Revenue oversees the administration of this tax, which includes the collection and processing of withholding amounts from payments made to nonresident individuals and entities.

Steps to Complete the Nonresident Withholding Tax Forms

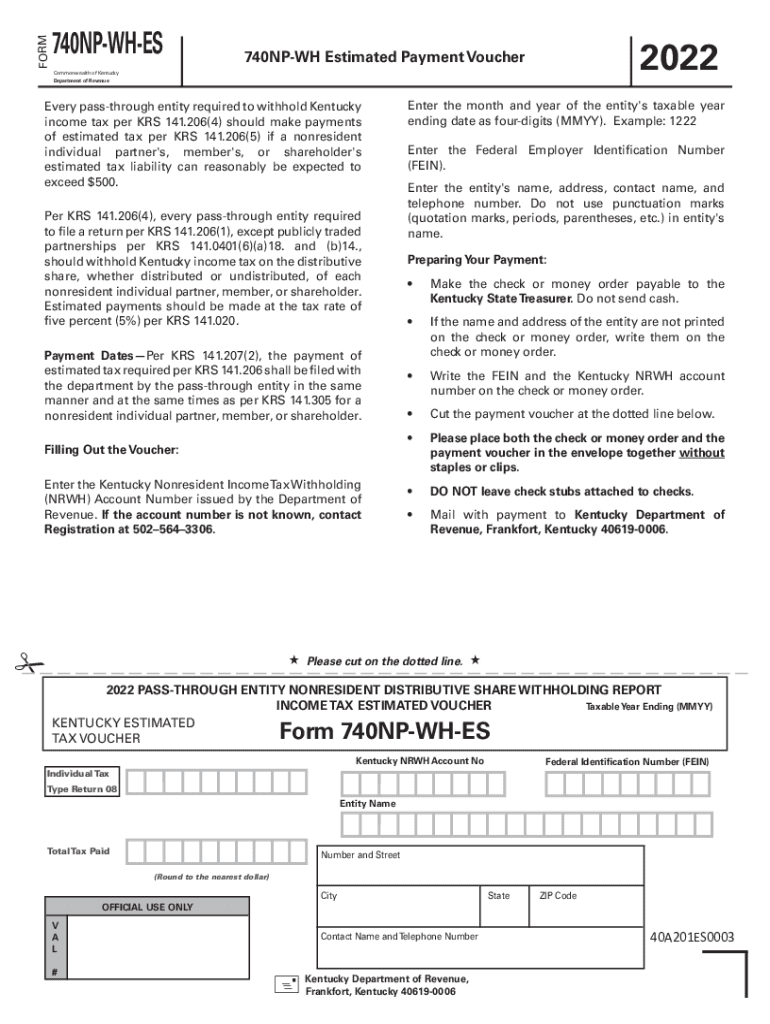

Completing the Nonresident Withholding Tax forms involves several key steps to ensure compliance with Kentucky tax regulations. First, gather all necessary documentation, including income statements and any relevant tax identification numbers. Next, fill out the Kentucky Form 740NP WH, which is specifically designed for nonresident withholding. Ensure that all information is accurate and complete. After completing the form, review it for any errors before submitting it to the Kentucky Department of Revenue. Finally, retain a copy of the submitted form for your records.

Required Documents for Nonresident Withholding Tax

To successfully complete the Nonresident Withholding Tax process, certain documents are required. These typically include:

- Income statements, such as W-2s or 1099s, detailing earnings from Kentucky sources.

- Completed Kentucky Form 740NP WH, which outlines the withholding tax obligations.

- Any prior tax returns that may be relevant for establishing tax liability.

- Proof of residency in another state, if applicable.

Filing Deadlines and Important Dates

It is crucial to adhere to specific deadlines when filing the Nonresident Withholding Tax. Generally, forms must be submitted by the due date of the income tax return for the year in which the income was earned. Additionally, quarterly estimated payments may be required, with deadlines typically falling on the 15th of April, June, September, and January. Keeping track of these dates helps avoid penalties and interest on unpaid taxes.

Penalties for Non-Compliance

Failure to comply with the Nonresident Withholding Tax requirements can lead to significant penalties. These may include monetary fines based on the amount of tax owed, interest on late payments, and potential legal action for persistent non-compliance. It is essential for nonresidents to understand their obligations and ensure timely filing to avoid these consequences.

Eligibility Criteria for Nonresident Withholding Tax

Eligibility for the Nonresident Withholding Tax applies to individuals and businesses that earn income from Kentucky sources but are not residents of the state. This includes nonresident employees, independent contractors, and businesses that operate in Kentucky but are registered in another state. Understanding eligibility is vital to ensure proper tax withholding and compliance with state regulations.

Quick guide on how to complete nonresident withholding tax department of revenue kentucky

Complete Nonresident Withholding Tax Department Of Revenue Kentucky effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without any holdups. Manage Nonresident Withholding Tax Department Of Revenue Kentucky on any device using airSlate SignNow's Android or iOS apps and enhance any document-related process today.

The easiest way to modify and eSign Nonresident Withholding Tax Department Of Revenue Kentucky without hassle

- Obtain Nonresident Withholding Tax Department Of Revenue Kentucky and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important parts of your documents or obscure sensitive information using tools specifically designed for that by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to finalize your changes.

- Choose your preferred delivery method for your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting documents. airSlate SignNow caters to your document management needs in just a few clicks from any device of your choice. Modify and eSign Nonresident Withholding Tax Department Of Revenue Kentucky and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Kentucky nonresident income tax withholding instructions packet?

The Kentucky nonresident income tax withholding instructions packet provides essential guidance for nonresidents on how to comply with Kentucky's income tax withholding requirements. It outlines the forms and steps necessary for proper tax withholding, ensuring that businesses and individuals can navigate their tax obligations effectively.

-

How can I obtain the Kentucky nonresident income tax withholding instructions packet?

You can easily obtain the Kentucky nonresident income tax withholding instructions packet from the Kentucky Department of Revenue's website. Additionally, it may also be included in tax preparation resources and platforms that offer compliance assistance for nonresident taxpayers.

-

What features are included in the Kentucky nonresident income tax withholding instructions packet?

The Kentucky nonresident income tax withholding instructions packet includes forms, detailed instructions, and guidelines regarding withholding rates and filing procedures. It is designed to simplify the tax process for businesses, ensuring they have all the necessary information for accurate compliance.

-

How does the Kentucky nonresident income tax withholding instructions packet benefit businesses?

Utilizing the Kentucky nonresident income tax withholding instructions packet helps businesses avoid penalties and legal issues related to incorrect withholding. By following the guidelines provided in the packet, businesses can ensure that they are deducting the correct amount of taxes from their employees’ paychecks.

-

Are there any costs associated with the Kentucky nonresident income tax withholding instructions packet?

The Kentucky nonresident income tax withholding instructions packet is available for free download from the Kentucky Department of Revenue. However, businesses may incur costs from tax preparation services or software that assist with implementing the instructions provided in the packet.

-

Can I integrate the Kentucky nonresident income tax withholding instructions packet with existing payroll software?

Yes, many payroll software solutions allow you to incorporate the guidelines from the Kentucky nonresident income tax withholding instructions packet. This integration helps automate the withholding process, ensuring compliance while minimizing the potential for errors in tax calculations.

-

What steps should I take if I have questions about the Kentucky nonresident income tax withholding instructions packet?

If you have questions about the Kentucky nonresident income tax withholding instructions packet, you can contact the Kentucky Department of Revenue directly for assistance. Additionally, consulting with a tax professional can provide clarity on specific scenarios and compliance requirements.

Get more for Nonresident Withholding Tax Department Of Revenue Kentucky

- Confirm title form

- Plaintiffs first set of interrogatories requests for production of documents and things and requests for admissions mississippi form

- Answer to counterclaim mississippi form

- First set interrogatories 497314061 form

- Mississippi documents form

- Requests for admissions mississippi form

- Judgment mississippi form

- Warranty deed from couple mississippi form

Find out other Nonresident Withholding Tax Department Of Revenue Kentucky

- eSign Iowa Car Dealer Agreement Free

- eSign Iowa Car Dealer Limited Power Of Attorney Free

- eSign Iowa Car Dealer Limited Power Of Attorney Fast

- eSign Iowa Car Dealer Limited Power Of Attorney Safe

- How Can I eSign Iowa Car Dealer Limited Power Of Attorney

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free