PERSONAL PROPERTY TAX FORMS and INSTRUCTIONS

Understanding the 2022 Personal Property Tax Forms

The 2022 Kentucky 62A500 form is essential for reporting personal property taxes in Kentucky. This form is specifically designed for individuals and businesses to declare personal property owned as of January first of the tax year. Understanding the purpose of this form is crucial for compliance with state tax regulations. The information provided on the 62A500 helps local governments assess property taxes accurately, ensuring that taxpayers fulfill their obligations while contributing to community funding.

Steps to Complete the 2022 Kentucky 62A500 Form

Filling out the 2022 Kentucky 62A500 form requires careful attention to detail. Here are the steps to ensure accurate completion:

- Gather all necessary documents related to your personal property, including purchase receipts and previous tax assessments.

- Begin filling out the form by entering your personal information, such as name, address, and contact details.

- List all personal property owned, including vehicles, machinery, and equipment, along with their respective values.

- Ensure that you provide accurate descriptions and classifications for each item to avoid discrepancies.

- Review the completed form for accuracy before submission, as errors can lead to penalties or delays.

Legal Use of the 2022 Kentucky 62A500 Form

The 2022 Kentucky 62A500 form holds legal significance as it serves as the official declaration of personal property for taxation purposes. Proper execution of this form ensures compliance with Kentucky tax laws. It is important to note that submitting an incomplete or inaccurate form can result in legal repercussions, including fines or additional tax assessments. Utilizing a reliable eSignature solution can enhance the legitimacy of your submission, providing a digital certificate that verifies your identity and compliance with legal standards.

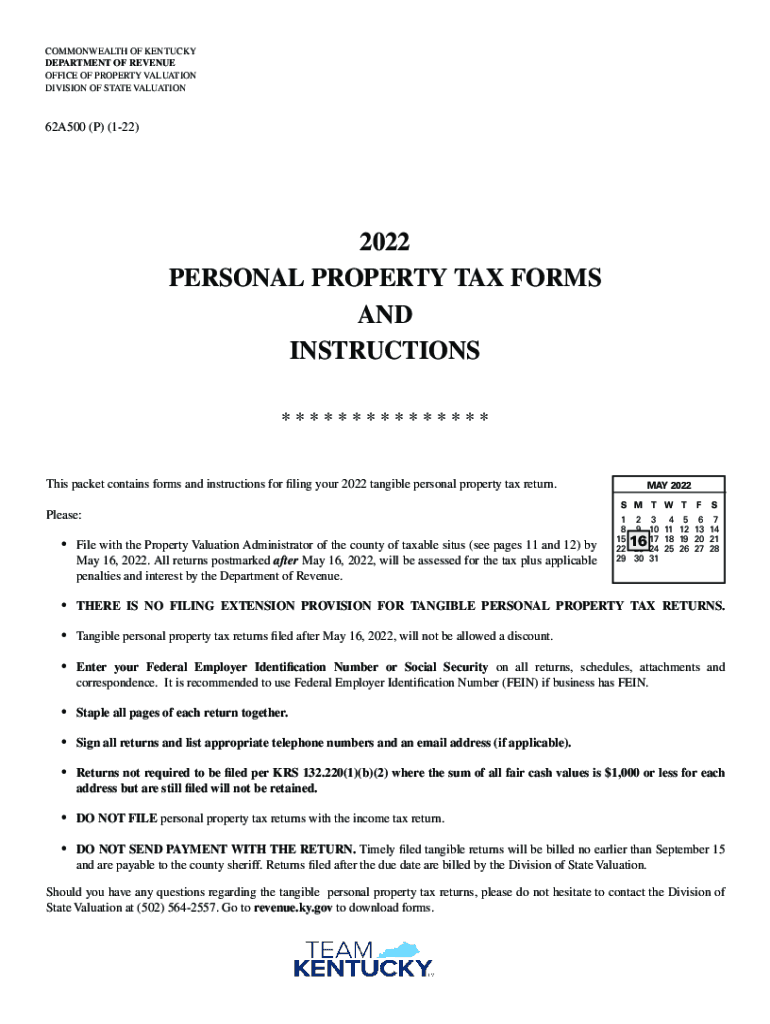

Filing Deadlines for the 2022 Kentucky 62A500 Form

Timely submission of the 2022 Kentucky 62A500 form is essential to avoid penalties. The deadline for filing this form is typically April fifteenth of the tax year. It is advisable to check for any specific local regulations or extensions that may apply. Missing the deadline can result in late fees or additional interest on owed taxes, making it crucial to stay informed about filing dates.

Form Submission Methods for the 2022 Kentucky 62A500

The 2022 Kentucky 62A500 form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Many counties allow electronic filing through their official websites, streamlining the process.

- Mail: Completed forms can be mailed to the appropriate local tax office. Ensure to send it via certified mail to confirm receipt.

- In-Person: Taxpayers may also choose to submit the form in person at their local tax office, allowing for immediate confirmation of submission.

Key Elements of the 2022 Kentucky 62A500 Form

Understanding the key elements of the 2022 Kentucky 62A500 form is vital for accurate completion. The form typically includes:

- Taxpayer Information: Personal details of the individual or business filing the form.

- Property Listings: Detailed descriptions and values of all personal property owned as of January first.

- Signature Section: A declaration that the information provided is true and correct, requiring the taxpayer's signature.

- Additional Notes: Any specific instructions or additional information relevant to the filing process.

Quick guide on how to complete 2022 personal property tax forms and instructions

Complete PERSONAL PROPERTY TAX FORMS AND INSTRUCTIONS effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage PERSONAL PROPERTY TAX FORMS AND INSTRUCTIONS on any gadget using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to alter and eSign PERSONAL PROPERTY TAX FORMS AND INSTRUCTIONS effortlessly

- Find PERSONAL PROPERTY TAX FORMS AND INSTRUCTIONS and then click Get Form to commence.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Verify all the details and then click on the Done button to store your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Put aside concerns about lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your requirements in document management in just a few clicks from any device you prefer. Modify and eSign PERSONAL PROPERTY TAX FORMS AND INSTRUCTIONS and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the 2022 ky 62a500 form?

The 2022 ky 62a500 form is an essential document used for various administrative purposes in Kentucky. It provides necessary information that is often required for legal and business transactions. Understanding the specifics of the 2022 ky 62a500 can help streamline your processes efficiently.

-

How can airSlate SignNow simplify the completion of the 2022 ky 62a500?

airSlate SignNow simplifies the completion of the 2022 ky 62a500 by offering a user-friendly interface for eSigning and document management. With features like customizable templates and secure storage, users can fill out and sign the form quickly. This not only saves time but also enhances accuracy in submission.

-

What pricing plans are available for using airSlate SignNow for the 2022 ky 62a500?

airSlate SignNow offers several flexible pricing plans to suit different business needs for managing the 2022 ky 62a500 form. These plans range from basic to premium, allowing you to select the level of features you require. Investing in airSlate SignNow is cost-effective, especially when handling multiple documents.

-

Are there any key features in airSlate SignNow related to the 2022 ky 62a500?

Yes, airSlate SignNow provides various key features that enhance the handling of the 2022 ky 62a500. These features include real-time collaboration, document tracking, and mobile compatibility, which make managing your forms easier and more efficient. The platform ensures that you have all the tools necessary for seamless document transactions.

-

What are the benefits of using airSlate SignNow for the 2022 ky 62a500?

Using airSlate SignNow for the 2022 ky 62a500 offers several benefits, including improved efficiency and enhanced security. The platform allows you to send, sign, and manage documents with ease, reducing the time spent on manual processes. Additionally, the electronic signature feature ensures that all transactions are legally binding and secure.

-

Can I integrate airSlate SignNow with other software for handling the 2022 ky 62a500?

Absolutely! airSlate SignNow provides integration capabilities with various software solutions that cater to document management for the 2022 ky 62a500. These integrations allow for smoother workflows and a centralized location for all your documents, enhancing productivity and efficiency in your operations.

-

Is airSlate SignNow compliant with regulations related to the 2022 ky 62a500?

Yes, airSlate SignNow is fully compliant with regulations pertaining to electronic signatures and document management, including those relevant to the 2022 ky 62a500. The platform meets industry standards for security and compliance, giving you confidence in handling sensitive information. This compliance is crucial for maintaining the integrity of your documents.

Get more for PERSONAL PROPERTY TAX FORMS AND INSTRUCTIONS

- Demand to produce copy of will from heir to executor or person in possession of will indiana form

- Secured promissory note with monthly installment payments kansas form

- Kansas estate contract form

- Commercial mortgage and security agreement kansas form

- Bill of sale of automobile and odometer statement kansas form

- Bill of sale for automobile or vehicle including odometer statement and promissory note kansas form

- Promissory note in connection with sale of vehicle or automobile kansas form

- Bill of sale for watercraft or boat kansas form

Find out other PERSONAL PROPERTY TAX FORMS AND INSTRUCTIONS

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service