About Form 1040 V, Payment VoucherInternal Revenue Service2020 Form 1040 V IRS Tax Forms2020 Form 1040 V IRS Tax Forms2020 Form

Understanding the RI 1040V Form

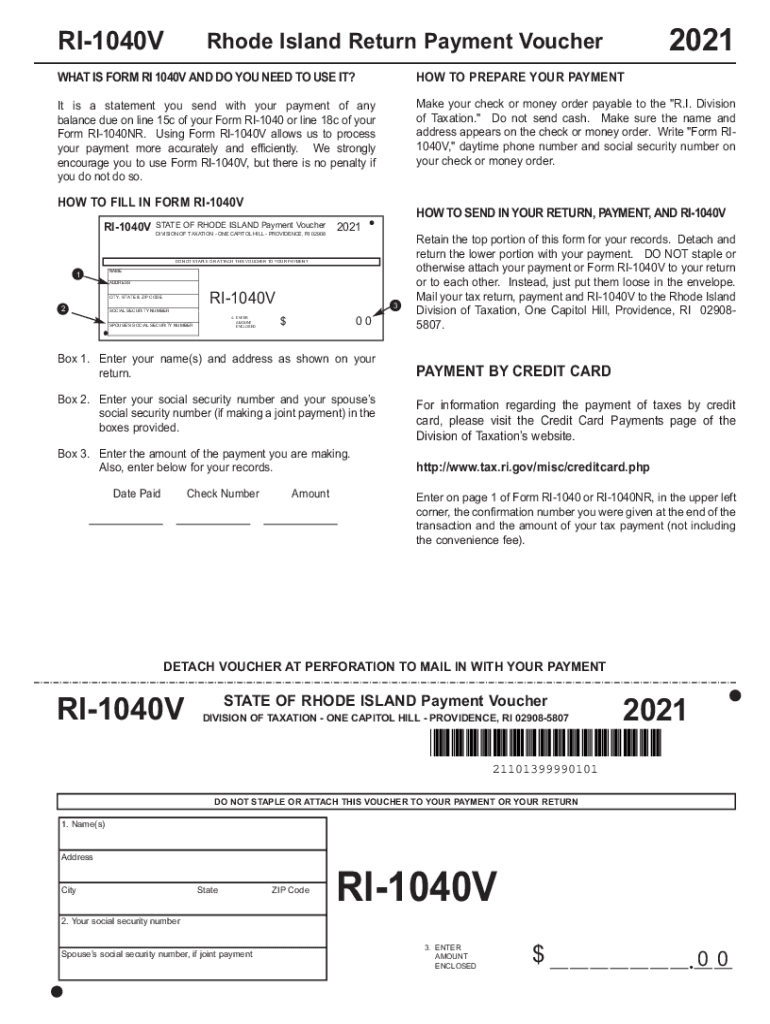

The RI 1040V form, also known as the Rhode Island Payment Voucher, is a crucial document for taxpayers in Rhode Island who are submitting their state income tax payments. This form helps ensure that payments are correctly applied to the taxpayer's account with the Rhode Island Division of Taxation. It is essential to complete this form accurately to avoid any delays in processing your payment.

Steps to Complete the RI 1040V Form

Filling out the RI 1040V form involves several straightforward steps:

- Obtain the Form: You can download the RI 1040V form from the Rhode Island Division of Taxation website or request a paper copy.

- Fill Out Your Information: Enter your name, address, and Social Security number on the form. Ensure that all information is accurate to prevent issues with your payment.

- Enter Payment Amount: Specify the amount you are paying with this voucher. This should match the amount due on your tax return.

- Sign and Date: Sign and date the form to validate your payment. An unsigned form may lead to processing delays.

Legal Use of the RI 1040V Form

The RI 1040V form serves as a legal document that confirms your intent to pay state taxes. When submitted correctly, it ensures compliance with Rhode Island tax laws. The form must be used in conjunction with your RI 1040 tax return to facilitate the proper application of your payment. It is important to keep a copy of the completed form for your records as proof of payment.

Filing Deadlines for the RI 1040V Form

Timely submission of the RI 1040V form is essential to avoid penalties. The due date for filing this form typically aligns with the state income tax return deadline, which is usually April 15. If you are unable to meet this deadline, consider filing for an extension to avoid late fees.

Common Mistakes to Avoid

When completing the RI 1040V form, taxpayers should be mindful of common errors that can lead to complications:

- Failing to sign the form, which can result in rejection.

- Entering incorrect payment amounts, leading to potential underpayment or overpayment.

- Not including the form with your tax return, which can delay processing.

Where to Submit the RI 1040V Form

The completed RI 1040V form should be submitted along with your tax return. You can file your tax return electronically or by mail. If mailing, ensure that you send it to the appropriate address provided by the Rhode Island Division of Taxation to ensure timely processing.

Quick guide on how to complete about form 1040 v payment voucherinternal revenue service2020 form 1040 v irs tax forms2020 form 1040 v irs tax forms2020 form

Complete About Form 1040 V, Payment VoucherInternal Revenue Service2020 Form 1040 V IRS Tax Forms2020 Form 1040 V IRS Tax Forms2020 Form effortlessly on any device

Online document administration has gained increased popularity among businesses and individuals. It offers an excellent eco-conscious substitute for conventional printed and signed paperwork, as you can obtain the right form and safely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without any delays. Manage About Form 1040 V, Payment VoucherInternal Revenue Service2020 Form 1040 V IRS Tax Forms2020 Form 1040 V IRS Tax Forms2020 Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest method to modify and eSign About Form 1040 V, Payment VoucherInternal Revenue Service2020 Form 1040 V IRS Tax Forms2020 Form 1040 V IRS Tax Forms2020 Form smoothly

- Obtain About Form 1040 V, Payment VoucherInternal Revenue Service2020 Form 1040 V IRS Tax Forms2020 Form 1040 V IRS Tax Forms2020 Form and click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method to send the form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing fresh document copies. airSlate SignNow meets your document management needs in a few clicks from any device of your choice. Edit and eSign About Form 1040 V, Payment VoucherInternal Revenue Service2020 Form 1040 V IRS Tax Forms2020 Form 1040 V IRS Tax Forms2020 Form and ensure exceptional communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the about form 1040 v payment voucherinternal revenue service2020 form 1040 v irs tax forms2020 form 1040 v irs tax forms2020 form

The way to create an e-signature for a PDF document in the online mode

The way to create an e-signature for a PDF document in Chrome

The best way to generate an e-signature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your mobile device

The best way to generate an e-signature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is an ri number and why is it important for eSigning documents?

An ri number is a unique identifier that helps track and manage electronic signatures in the airSlate SignNow platform. It is crucial for ensuring that each signed document is easily retrievable and linked to the correct transaction, providing clarity and accountability in your eSigning process.

-

How can I obtain my ri number when using airSlate SignNow?

You can obtain your ri number by creating an account and initiating the document signing process on airSlate SignNow. Once a document is prepared for eSignature, an ri number will automatically be generated, allowing you to monitor the signing progress.

-

What features does airSlate SignNow offer that utilize the ri number?

airSlate SignNow integrates advanced features that leverage the ri number for tracking document status, ensuring compliance, and maintaining an audit trail. From real-time notifications to detailed reporting, the ri number plays a pivotal role in enhancing user experience and document management.

-

Are there any costs associated with obtaining an ri number through airSlate SignNow?

Obtaining an ri number is included with your subscription to airSlate SignNow, which offers various pricing plans to fit your business needs. The cost-effective solutions ensure that businesses can easily access this essential functionality without any additional fees.

-

Can I integrate the ri number with other software applications?

Yes, airSlate SignNow allows for seamless integration with various third-party applications, enabling you to synchronize data, including ri numbers. This integration enhances workflow efficiency and ensures that your eSigning and document management processes are streamlined across platforms.

-

What benefits does the ri number provide in tracking signed documents?

The ri number provides signNow benefits in tracking signed documents, allowing businesses to quickly retrieve signed agreements and maintain effective record-keeping. This functionality ensures that you have a clear audit trail and can easily verify the integrity and authenticity of each signature.

-

How does airSlate SignNow ensure the security of my ri number?

airSlate SignNow prioritizes security by employing robust encryption protocols that protect your ri number and all document transactions. With features like multi-factor authentication and compliance with industry regulations, you can be confident that your information is safeguarded.

Get more for About Form 1040 V, Payment VoucherInternal Revenue Service2020 Form 1040 V IRS Tax Forms2020 Form 1040 V IRS Tax Forms2020 Form

- Answer and counterclaim mississippi form

- Judgment notice form

- Opposition summary judgment form

- Plaintiffs response to defendants motion for partial summary judgment mississippi form

- Plaintiffs response to defendants motion to amend mississippi form

- Answer to counterclaimants counterclaim mississippi form

- Dismiss jurisdiction form

- Necessary parties form

Find out other About Form 1040 V, Payment VoucherInternal Revenue Service2020 Form 1040 V IRS Tax Forms2020 Form 1040 V IRS Tax Forms2020 Form

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF