State of Rhode Island Division of Taxation Form RI 2210PT 2021

What is the State Of Rhode Island Division Of Taxation Form RI 2210PT

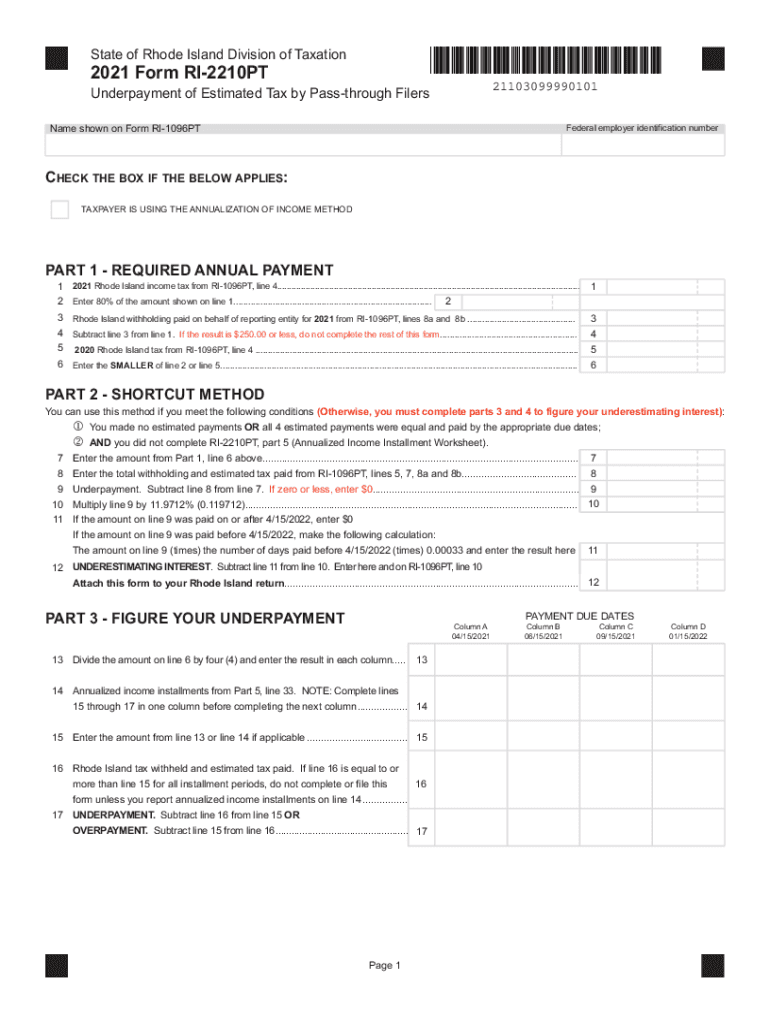

The State Of Rhode Island Division Of Taxation Form RI 2210PT is a tax form used by individuals who need to apply for a penalty waiver due to underpayment of estimated tax. This form is specifically designed for taxpayers who may not have met the required payment thresholds and wish to demonstrate reasonable cause for their underpayment. By submitting this form, taxpayers can potentially avoid penalties associated with late or insufficient tax payments.

How to use the State Of Rhode Island Division Of Taxation Form RI 2210PT

To effectively use the State Of Rhode Island Division Of Taxation Form RI 2210PT, taxpayers should first ensure they meet the eligibility criteria for a penalty waiver. After confirming eligibility, the next step involves accurately filling out the form, providing necessary financial details, and explaining the circumstances that led to the underpayment. Once completed, the form should be submitted to the appropriate tax authority as specified in the instructions.

Steps to complete the State Of Rhode Island Division Of Taxation Form RI 2210PT

Completing the State Of Rhode Island Division Of Taxation Form RI 2210PT involves several key steps:

- Gather relevant financial documents, including income statements and previous tax returns.

- Review the eligibility criteria to ensure you qualify for a penalty waiver.

- Fill out the form with accurate personal and financial information.

- Provide a detailed explanation of the reasons for underpayment.

- Double-check all entries for accuracy before submission.

- Submit the completed form to the designated tax office.

Legal use of the State Of Rhode Island Division Of Taxation Form RI 2210PT

The legal use of the State Of Rhode Island Division Of Taxation Form RI 2210PT is governed by state tax laws. To be considered valid, the form must be completed accurately and submitted within the specified time frame. It is important for taxpayers to understand that submitting this form does not guarantee a penalty waiver; approval is subject to review by the tax authority based on the provided information and justification.

Key elements of the State Of Rhode Island Division Of Taxation Form RI 2210PT

Key elements of the State Of Rhode Island Division Of Taxation Form RI 2210PT include:

- Taxpayer identification information, such as name and Social Security number.

- Details of income and tax payments made during the tax year.

- Explanation of circumstances leading to underpayment.

- Signature and date to certify the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the State Of Rhode Island Division Of Taxation Form RI 2210PT typically align with the state tax return deadlines. Taxpayers should be aware of important dates, including the due date for submitting the form and any associated tax returns. It is advisable to check the Rhode Island Division of Taxation website or consult a tax professional for the most current deadlines to ensure timely submission.

Quick guide on how to complete state of rhode island division of taxation 2020 form ri 2210pt

Complete State Of Rhode Island Division Of Taxation Form RI 2210PT effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute to conventional printed and signed papers, as you can access the proper format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without interruptions. Manage State Of Rhode Island Division Of Taxation Form RI 2210PT on any device using airSlate SignNow’s Android or iOS applications and enhance any document-centric procedure today.

The simplest method to modify and eSign State Of Rhode Island Division Of Taxation Form RI 2210PT without hassle

- Find State Of Rhode Island Division Of Taxation Form RI 2210PT and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to store your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing out new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign State Of Rhode Island Division Of Taxation Form RI 2210PT and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct state of rhode island division of taxation 2020 form ri 2210pt

Create this form in 5 minutes!

How to create an eSignature for the state of rhode island division of taxation 2020 form ri 2210pt

The way to generate an electronic signature for a PDF document online

The way to generate an electronic signature for a PDF document in Google Chrome

The way to generate an e-signature for signing PDFs in Gmail

The way to create an electronic signature right from your smart phone

The best way to make an e-signature for a PDF document on iOS

The way to create an electronic signature for a PDF on Android OS

People also ask

-

What is the State Of Rhode Island Division Of Taxation Form RI 2210PT?

The State Of Rhode Island Division Of Taxation Form RI 2210PT is a form used by businesses and individuals to report underpayment of estimated tax. This form helps ensure that taxpayers comply with Rhode Island tax regulations and avoid potential penalties. Utilizing tools like airSlate SignNow can streamline the completion and submission of this form.

-

How can airSlate SignNow assist with the State Of Rhode Island Division Of Taxation Form RI 2210PT?

airSlate SignNow allows you to electronically sign and send the State Of Rhode Island Division Of Taxation Form RI 2210PT with ease. The platform ensures that all documents are securely stored and easily accessible, making the tax filing process much smoother for users. Additionally, its user-friendly interface simplifies document management.

-

Is there a cost associated with using airSlate SignNow for forms like the State Of Rhode Island Division Of Taxation Form RI 2210PT?

Yes, airSlate SignNow operates on a subscription-based pricing model. However, the cost is competitive and provides excellent value for businesses looking to simplify document signing processes. Users can choose from various plans depending on their needs, ensuring they only pay for the features required.

-

Can I integrate airSlate SignNow with other applications for managing the State Of Rhode Island Division Of Taxation Form RI 2210PT?

Absolutely! airSlate SignNow offers seamless integrations with numerous applications, enhancing your workflow for managing the State Of Rhode Island Division Of Taxation Form RI 2210PT. You can connect it with CRMs, cloud storage solutions, and other tools to streamline your documentation processes effectively.

-

What are the benefits of using airSlate SignNow for the State Of Rhode Island Division Of Taxation Form RI 2210PT?

Using airSlate SignNow for the State Of Rhode Island Division Of Taxation Form RI 2210PT streamlines the signing process and reduces the chances of errors or omissions. It enhances compliance by providing a secure platform for document handling. Additionally, it saves time and improves overall productivity.

-

How does airSlate SignNow ensure the security of the State Of Rhode Island Division Of Taxation Form RI 2210PT?

airSlate SignNow employs advanced encryption and security protocols to protect documents like the State Of Rhode Island Division Of Taxation Form RI 2210PT. This ensures that all sensitive information remains confidential and secure during the signing process. Users can trust that their data is protected.

-

Can I access the State Of Rhode Island Division Of Taxation Form RI 2210PT from multiple devices using airSlate SignNow?

Yes, airSlate SignNow is accessible from any device with internet connectivity, allowing users to manage the State Of Rhode Island Division Of Taxation Form RI 2210PT on-the-go. This flexibility ensures that you can sign and submit documents whenever and wherever is most convenient for you.

Get more for State Of Rhode Island Division Of Taxation Form RI 2210PT

- Order and notice of reference to family master mississippi form

- Affidavit of blood testing results mississippi form

- Agreed order dismissal form

- Ms determination custody form

- Mississippi family 497314639 form

- Ms paternity 497314640 form

- Mississippi paternity 497314641 form

- Stipulated agreement 497314642 form

Find out other State Of Rhode Island Division Of Taxation Form RI 2210PT

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free