OTE* N Due to Issues Displaying the State of Iowa Taxes Form

Key elements of the Iowa Form 06191

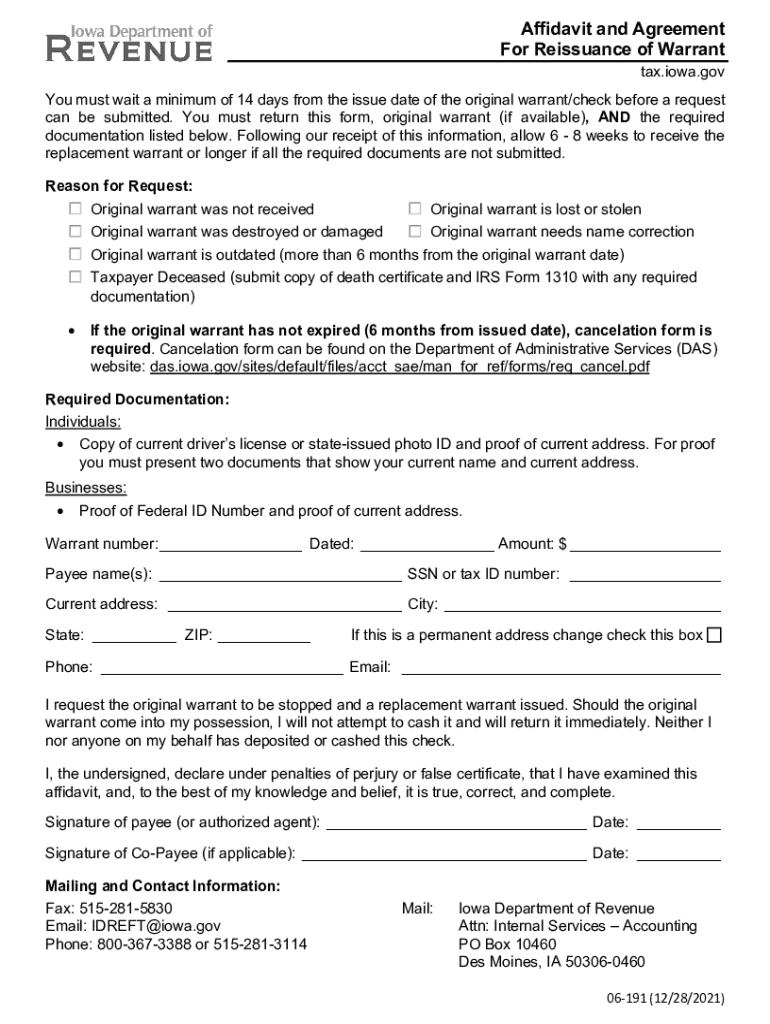

The Iowa Form 06191, commonly referred to as the 06 191 form, is essential for taxpayers needing to report specific information related to their state taxes. This form captures critical data, including taxpayer identification details, income sources, and applicable deductions. Understanding its components is vital for accurate completion and compliance with state regulations.

Key elements of the form include:

- Taxpayer Identification: This section requires the taxpayer's name, address, and Social Security number or Employer Identification Number.

- Income Reporting: Taxpayers must report all sources of income, including wages, dividends, and any other earnings.

- Deductions and Credits: The form allows taxpayers to claim deductions and credits, which can significantly reduce their tax liability.

- Signature Section: A valid signature is necessary to affirm the accuracy of the information provided.

Steps to complete the Iowa Form 06191

Completing the Iowa Form 06191 requires careful attention to detail to ensure accuracy and compliance. Here are the steps to follow:

- Gather Necessary Information: Collect all relevant documents, such as W-2s, 1099s, and records of any deductions you plan to claim.

- Fill Out Taxpayer Information: Enter your name, address, and identification number in the designated sections of the form.

- Report Income: Accurately report all income sources, ensuring that amounts match your supporting documents.

- Claim Deductions: Identify and claim any deductions or credits applicable to your situation.

- Review the Form: Double-check all entries for accuracy and completeness before signing.

- Sign and Date: Ensure you sign and date the form to validate it.

Legal use of the Iowa Form 06191

The Iowa Form 06191 is legally binding when completed correctly and submitted on time. It is essential for taxpayers to understand the legal implications of the information they provide. Misrepresentation or errors can lead to penalties or audits by the Iowa Department of Revenue.

To ensure legal compliance:

- Provide accurate and truthful information.

- Submit the form by the specified deadline to avoid late fees.

- Keep copies of all submitted forms and supporting documents for your records.

Filing Deadlines / Important Dates

Filing deadlines for the Iowa Form 06191 are crucial for taxpayers to meet to avoid penalties. Typically, the deadline for submitting the form aligns with the federal tax filing deadline, which is usually April 15 each year. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day.

It is advisable to mark your calendar with important dates, such as:

- Initial filing deadline: April 15

- Extended filing deadline (if applicable): October 15

Form Submission Methods

Taxpayers have several options for submitting the Iowa Form 06191. Understanding these methods can enhance the filing experience:

- Online Submission: Many taxpayers opt for electronic filing through authorized e-filing platforms, which can expedite processing times.

- Mail Submission: The form can be printed and mailed to the Iowa Department of Revenue. Ensure proper postage and address the envelope correctly.

- In-Person Submission: Taxpayers may also choose to deliver their forms directly to local tax offices, which can provide immediate confirmation of receipt.

Examples of using the Iowa Form 06191

The Iowa Form 06191 is utilized in various scenarios, reflecting the diverse needs of taxpayers. Here are some examples:

- Individual Tax Filers: A single taxpayer reporting income from employment and freelance work would use the form to detail their earnings and claim deductions.

- Small Business Owners: A sole proprietor may utilize the form to report business income and expenses, ensuring they receive appropriate tax credits.

- Students: A student with part-time employment can use the form to report income and claim education-related deductions.

Quick guide on how to complete ote n due to issues displaying the state of iowa taxes

Complete OTE* N Due To Issues Displaying The State Of Iowa Taxes effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without delays. Manage OTE* N Due To Issues Displaying The State Of Iowa Taxes on any platform with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to edit and eSign OTE* N Due To Issues Displaying The State Of Iowa Taxes seamlessly

- Obtain OTE* N Due To Issues Displaying The State Of Iowa Taxes and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Produce your eSignature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Decide how you want to deliver your form, whether by email, SMS, or invite link, or download it to your computer.

No more worrying about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow manages all your requirements in document management with just a few clicks from your chosen device. Modify and eSign OTE* N Due To Issues Displaying The State Of Iowa Taxes and ensure superior communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ote n due to issues displaying the state of iowa taxes

The way to generate an e-signature for a PDF in the online mode

The way to generate an e-signature for a PDF in Chrome

How to create an e-signature for putting it on PDFs in Gmail

The way to generate an e-signature right from your smart phone

The way to create an e-signature for a PDF on iOS devices

The way to generate an e-signature for a PDF on Android OS

People also ask

-

What is Iowa Form 06191?

Iowa Form 06191 is a document used for specific administrative purposes within the state of Iowa. It is commonly required for various legal and governmental processes. Understanding how to correctly fill out and utilize Iowa Form 06191 is essential for compliance.

-

How does airSlate SignNow help with Iowa Form 06191?

airSlate SignNow simplifies the process of sending and eSigning Iowa Form 06191. With our platform, users can quickly upload, complete, and securely share the form online. This streamlines workflows and ensures that all necessary signatures are captured efficiently.

-

Is there a cost to using airSlate SignNow for Iowa Form 06191?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs, including those for managing Iowa Form 06191. Each plan includes a range of features designed to enhance document management. You can choose the subscription that best fits your budget and requirements.

-

What features does airSlate SignNow offer for Iowa Form 06191?

airSlate SignNow provides a user-friendly interface, real-time editing capabilities, and secure storage for Iowa Form 06191. Additionally, features such as reminders and status tracking help ensure that all parties complete their obligations timely. These tools improve efficiency and compliance with your documents.

-

Can airSlate SignNow integrate with other software when handling Iowa Form 06191?

Absolutely! airSlate SignNow supports integrations with various software solutions, making it easy to incorporate Iowa Form 06191 into your existing workflows. Whether through CRM, cloud storage, or productivity tools, our platform ensures seamless connectivity to enhance your document processes.

-

What are the benefits of using airSlate SignNow for Iowa Form 06191?

Using airSlate SignNow for Iowa Form 06191 offers numerous benefits, including increased efficiency, reduced turnaround times, and enhanced security. The platform allows for quick document retrieval and real-time collaboration, allowing businesses to focus on their core tasks without delays.

-

How secure is my data when using airSlate SignNow for Iowa Form 06191?

airSlate SignNow prioritizes the security of your data when handling Iowa Form 06191. We employ industry-standard encryption and robust authentication methods to protect documents and sensitive information. You can confidently manage your forms knowing that your data is safeguarded.

Get more for OTE* N Due To Issues Displaying The State Of Iowa Taxes

- Order correcting final judgment mississippi form

- Complaint mississippi 497314712 form

- Name affidavit mississippi form

- Name affidavit for persons with multiple aliases mississippi form

- Agreement for donation of land to city mississippi form

- Due diligence audit questionnaire mississippi form

- Ministry of finance tax administration p pdv form

- Hollywood casino columbus passenger manifest for charter form

Find out other OTE* N Due To Issues Displaying The State Of Iowa Taxes

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement