IA 1120S Schedule K 1 42 008 Iowa Department of Revenue 2021-2026

Understanding the rent reimbursement application

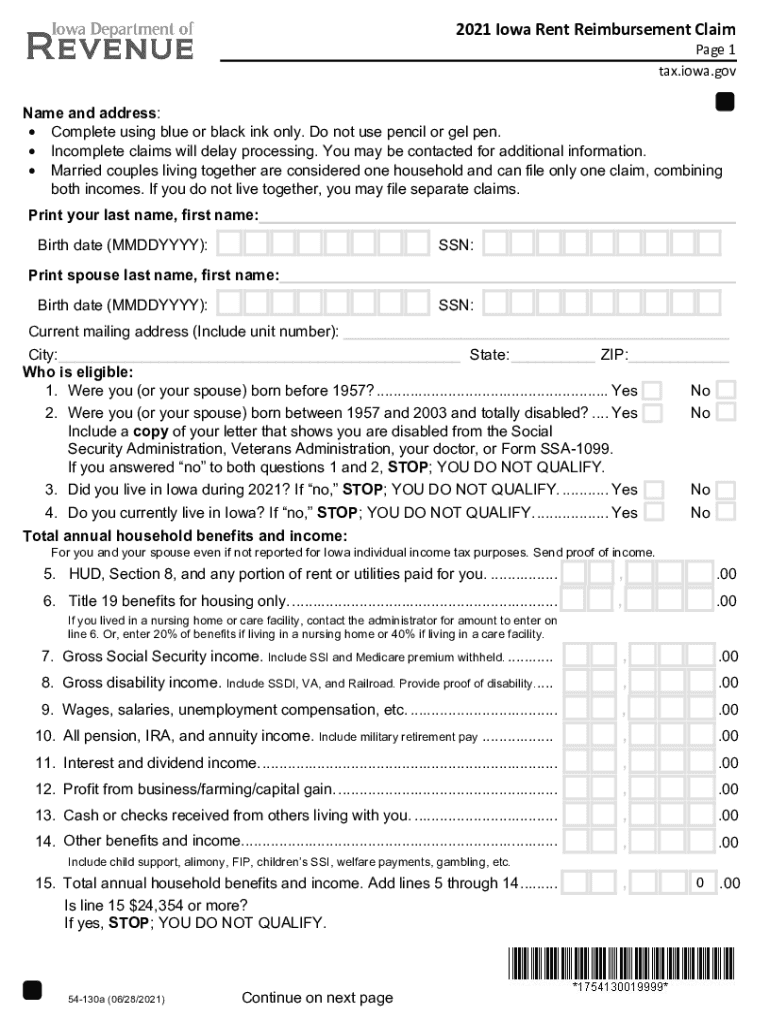

The rent reimbursement application is a crucial document for individuals seeking financial assistance for their housing expenses. This application allows eligible residents to claim a portion of their rent back, providing much-needed support. The process typically involves providing personal information, details about your rental agreement, and proof of income. Understanding the specifics of this application can help ensure that you complete it accurately and efficiently.

Eligibility criteria for the rent reimbursement application

To qualify for the rent reimbursement application, applicants must meet certain eligibility criteria. Generally, these may include:

- Residency in the state where the application is submitted.

- Meeting income limits set by the local housing authority.

- Proof of rental payments, such as receipts or bank statements.

- Age or disability requirements, depending on state regulations.

It is essential to review the specific requirements for your state to ensure compliance before submitting your application.

Steps to complete the rent reimbursement application

Completing the rent reimbursement application involves several key steps to ensure it is filled out correctly:

- Gather necessary documents, including proof of income and rental agreements.

- Fill out the application form with accurate personal and financial information.

- Attach required documentation to support your claims.

- Review the application for any errors or missing information.

- Submit the application either online or via mail, as per the guidelines provided by your local housing authority.

Following these steps can help streamline the process and increase the likelihood of approval.

Form submission methods for the rent reimbursement application

There are various methods available for submitting the rent reimbursement application. Depending on your local regulations, you may have the option to:

- Submit the application online through the designated state portal.

- Mail a hard copy of the application to the appropriate housing authority.

- Deliver the application in person at local offices.

Choosing the right submission method can depend on your preferences and the specific requirements of your state.

Required documents for the rent reimbursement application

When applying for rent reimbursement, certain documents are typically required to support your application. Commonly needed documents include:

- Proof of income, such as pay stubs or tax returns.

- A copy of your lease or rental agreement.

- Receipts or bank statements showing rent payments.

- Identification documents, such as a driver's license or social security card.

Ensuring you have all necessary documents ready can facilitate a smoother application process.

Important deadlines for the rent reimbursement application

Filing deadlines for the rent reimbursement application can vary by state and program. It is essential to be aware of these deadlines to avoid missing out on potential benefits. Key dates to keep in mind include:

- The start and end dates for the application period.

- Deadlines for submitting supporting documents.

- Notification dates for application status updates.

Staying informed about these dates can help ensure timely submissions and approvals.

Quick guide on how to complete ia 1120s schedule k 1 42 008 iowa department of revenue

Effortlessly prepare IA 1120S Schedule K 1 42 008 Iowa Department Of Revenue on any device

Online document management has become increasingly common among businesses and individuals. It offers a perfect eco-friendly substitute to traditional printed and signed paperwork, as you can easily find the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents quickly without delays. Manage IA 1120S Schedule K 1 42 008 Iowa Department Of Revenue on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

Easily modify and eSign IA 1120S Schedule K 1 42 008 Iowa Department Of Revenue with minimal effort

- Find IA 1120S Schedule K 1 42 008 Iowa Department Of Revenue and select Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal significance as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form: via email, SMS, an invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign IA 1120S Schedule K 1 42 008 Iowa Department Of Revenue and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ia 1120s schedule k 1 42 008 iowa department of revenue

Create this form in 5 minutes!

How to create an eSignature for the ia 1120s schedule k 1 42 008 iowa department of revenue

The way to generate an e-signature for a PDF document online

The way to generate an e-signature for a PDF document in Google Chrome

How to generate an e-signature for signing PDFs in Gmail

The way to generate an e-signature from your smart phone

The way to create an e-signature for a PDF document on iOS

The way to generate an e-signature for a PDF file on Android OS

People also ask

-

What is a rent reimbursement application?

A rent reimbursement application is a document that allows tenants to seek financial reimbursement from their employer for rental expenses. By using airSlate SignNow, you can easily create, send, and eSign this application, streamlining the process.

-

How does airSlate SignNow simplify the rent reimbursement application process?

airSlate SignNow simplifies the rent reimbursement application process by providing an intuitive interface for document creation and eSigning. Users can track application status in real-time and quickly obtain necessary signatures, making it efficient and hassle-free.

-

What features does airSlate SignNow offer for the rent reimbursement application?

airSlate SignNow offers features such as custom document templates, real-time collaboration, and secure storage for rent reimbursement applications. Additionally, users can automate reminders for signers to ensure timely completion.

-

Is there a cost associated with using airSlate SignNow for a rent reimbursement application?

Yes, airSlate SignNow offers various pricing plans depending on your needs, which include the features necessary for processing rent reimbursement applications. You can choose a plan that fits your budget and scale as your requirements grow.

-

Can I integrate airSlate SignNow with other applications for my rent reimbursement application?

Absolutely! airSlate SignNow integrates seamlessly with a variety of applications, making it easy to manage your rent reimbursement application alongside other business tools. This integration ensures that all your documents are centralized and easily accessible.

-

How does airSlate SignNow ensure the security of my rent reimbursement application?

airSlate SignNow prioritizes the security of your rent reimbursement application by employing bank-level encryption and secure data storage protocols. Our platform is designed to keep your sensitive information safe and confidential throughout the entire process.

-

Can multiple people review and sign my rent reimbursement application?

Yes, airSlate SignNow allows multiple users to review and sign your rent reimbursement application. You can easily add recipients, set signing orders, and track who has completed their part of the application for better collaboration.

Get more for IA 1120S Schedule K 1 42 008 Iowa Department Of Revenue

Find out other IA 1120S Schedule K 1 42 008 Iowa Department Of Revenue

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed