Irs Form 1065 Fillable

What is the IRS Form 1065 Fillable

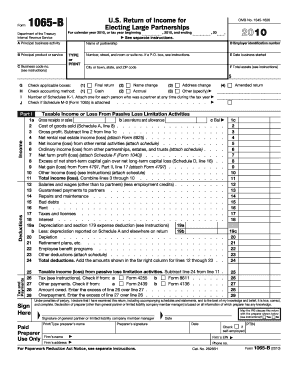

The IRS Form 1065 is a tax document used by partnerships to report income, deductions, gains, and losses from the partnership's operations. It is essential for partnerships to file this form to inform the IRS about the financial activities of the business. The fillable version allows for easy online completion, enabling users to enter information directly into the form fields. This digital format simplifies the process and ensures that all necessary details are captured accurately.

How to Use the IRS Form 1065 Fillable

Using the IRS Form 1065 fillable version is straightforward. Start by downloading the form from a reliable source. Once you have the form open, carefully enter the required information, including the partnership's name, address, and Employer Identification Number (EIN). Make sure to provide accurate financial data, such as income and expenses. After filling out the form, review it for completeness and accuracy before submitting it to the IRS.

Steps to Complete the IRS Form 1065 Fillable

Completing the IRS Form 1065 involves several key steps:

- Gather necessary information, including financial records and partner details.

- Open the fillable form and enter the partnership's basic information.

- Input income and deductions in the appropriate sections.

- Calculate totals and ensure all figures align with supporting documents.

- Review the form for accuracy.

- Submit the form electronically or print it for mailing.

Legal Use of the IRS Form 1065 Fillable

The IRS Form 1065 fillable version is legally valid when completed according to IRS guidelines. It must be signed by an authorized partner to certify that the information provided is true and accurate. Electronic signatures are acceptable, provided they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act. This ensures that the form holds the same legal weight as a traditional paper submission.

Filing Deadlines / Important Dates

Partnerships must file the IRS Form 1065 by the 15th day of the third month after the end of their tax year. For partnerships operating on a calendar year, this means the deadline is typically March 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. It is crucial to adhere to these deadlines to avoid penalties and interest on any unpaid taxes.

Required Documents

To complete the IRS Form 1065, several documents are necessary:

- Financial statements, including income statements and balance sheets.

- Partner information, including names, addresses, and Social Security Numbers or EINs.

- Records of income and expenses related to the partnership's operations.

- Supporting documentation for any deductions claimed.

Form Submission Methods

The IRS Form 1065 can be submitted in various ways. Partnerships may choose to file electronically using IRS-approved software, which often simplifies the process. Alternatively, the form can be printed and mailed to the appropriate IRS address. It is essential to ensure that the form is sent to the correct location to avoid processing delays.

Quick guide on how to complete irs form 1065 fillable

Complete Irs Form 1065 Fillable effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly and without issues. Manage Irs Form 1065 Fillable on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to modify and electronically sign Irs Form 1065 Fillable without hassle

- Locate Irs Form 1065 Fillable and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or conceal sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether via email, SMS, invite link, or download it to your computer.

Eliminate concerns regarding lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and electronically sign Irs Form 1065 Fillable while ensuring exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 1065 fillable

The way to make an electronic signature for your PDF online

The way to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The way to make an e-signature right from your smartphone

The way to generate an electronic signature for a PDF on iOS

The way to make an e-signature for a PDF on Android

People also ask

-

What is form 1065 and why is it important for my business?

Form 1065 is a tax document that partnerships use to report income, deductions, gains, and losses. It's crucial for accurate tax reporting and compliance with IRS regulations. Utilizing airSlate SignNow to gather signatures on your form 1065 can streamline this process and ensure timely submissions.

-

How can airSlate SignNow help me manage form 1065?

airSlate SignNow simplifies the management of form 1065 by allowing users to easily create, edit, and send the document for signatures. Our platform provides templates specifically for the form 1065, enhancing efficiency and reducing administrative burden in tax preparation.

-

What features does airSlate SignNow offer for electronically signing form 1065?

With airSlate SignNow, you can electronically sign form 1065 securely and efficiently. Features include customizable templates, in-platform signing, and mobile access, ensuring that everyone involved can sign the document from anywhere at any time.

-

Is airSlate SignNow cost-effective for completing form 1065?

Yes, airSlate SignNow offers a cost-effective solution for completing form 1065, helping businesses save time and money. By reducing the need for physical paperwork and enabling electronic signatures, our platform minimizes costs related to printing and postage.

-

What integrations does airSlate SignNow support for form 1065?

airSlate SignNow integrates with various platforms like Google Drive, Dropbox, and CRM systems. These integrations allow you to manage your form 1065 and related documents seamlessly, ensuring a smooth workflow and easy access to your files.

-

Can I track the status of my form 1065 with airSlate SignNow?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of your form 1065 in real-time. You'll receive notifications as your document is viewed, signed, or completed, ensuring you stay updated throughout the signing process.

-

How does airSlate SignNow ensure the security of my form 1065?

Security is a top priority at airSlate SignNow. We utilize advanced encryption protocols and multi-factor authentication to protect your form 1065 and any sensitive information. Our commitment to data security helps ensure that your documents remain confidential and compliant with regulations.

Get more for Irs Form 1065 Fillable

- Medical waiver kentucky form

- Tenant landlord rent 497307964 form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory decrease in services kentucky form

- Temporary lease agreement to prospective buyer of residence prior to closing kentucky form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory threats to evict or retaliatory eviction 497307967 form

- Letter from landlord to tenant returning security deposit less deductions kentucky form

- Letter from tenant to landlord containing notice of failure to return security deposit and demand for return kentucky form

- Letter from tenant to landlord containing notice of wrongful deductions from security deposit and demand for return kentucky form

Find out other Irs Form 1065 Fillable

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed